DeFi Rate - This Week In DeFi – November 4

This Week In DeFi – November 4This week, Meta officially integrates Polygon, Solana and Arweave for NFTs, Alameda Research worries some with its financials, and GALA has a $2B hack-scare.To the DeFi community, This week, Meta has officially integrated the Polygon and Solana blockchains, as well as decentralized data storage platform Arweave into its Instagram NFT features. Users will soon be able to create digital collectibles on the social media platform, as well as purchase and sell them – all directly within instagram. The feature will begin with a small group of US testers, with expansion to other countries also on the way. Arweave’s token surged 60% on the news, while Polygon also outperformed much of the market.  📣 Major announcement: @Meta is now using Arweave to permanently store digital collectables from @instagram.

Instagram users are now able to issue digital collectables for their posts, stored on Arweave.

Some thoughts 👇 Crypto trading firm Alameda Research has revealed details of its balance sheet, showing extremely close ties to crypto exchange FTX and somewhat illiquid assets. Most notably, a significant proportion of Alameda’s holdings are made up of billions of dollars worth of FTT, FTX’s exchange token – much of which is locked up as collateral. Another $900 million or so is made up of locked or collateralized Solana tokens, as well as other tokens such as SRM, MAPS, OXY and FIDA. The details have drawn concern about the $7.4 billion in loans Alameda has taken out against very low-liquidity assets, as well as its incestuous relationship with FTX.  WOW

Per CoinDesk, Alameda research has $14.6 billion of assets, against $8b of liabilities.

For assets: $3.66b FTT, $2.16b “FTT collateral”, $3.37b crypto ($292m SOL, $863m “locked SOL”), $134m USD & $2b “equity securities.

Most net equity tied in completely illiquid altcoins. Web3 gaming platform Gala Games caused some panic among the community yesterday as $2 billion worth of GALA tokens were minted out of thin air. The project later claimed that it “attacked” itself in an effort to prevent bad actors from making away with funds from a potential exploit. The problem arose from a “misconfiguration” of a bridge from the multi-chain protocol, pNetwork. Only GALA tokens on BNB Chain were affected.  Before you panic about $GALA, please read this thread from @pNetworkDeFi.

TLDR: Everything is fine. The activity you have been seeing on @PancakeSwap is pNetwork working to drain the liquidity pool. GALA on ETH is completely unaffected.

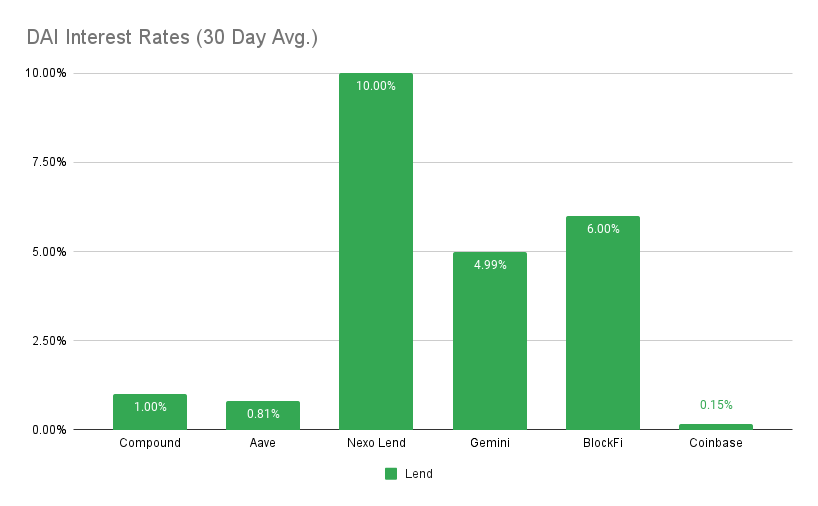

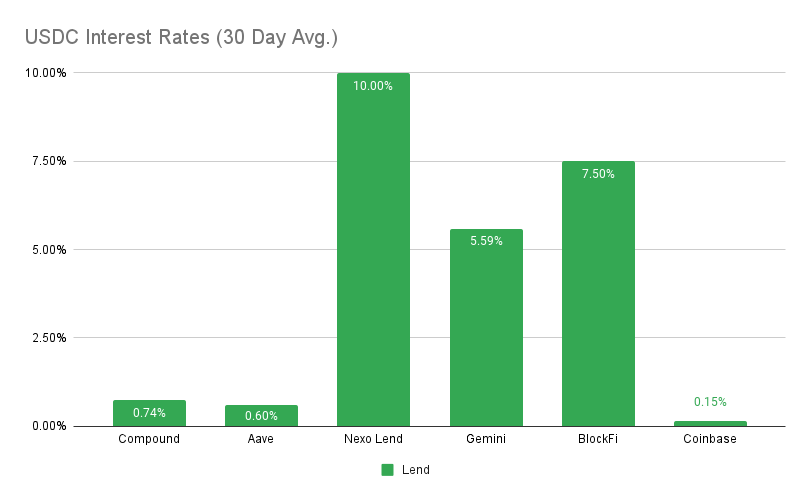

Do not buy $pGALA on PancakeSwap for now  pNetwork 🦜 @pNetworkDeFi Huobi’s HUSD stablecoin has plummeted to just a third of its target value, not long after its delisting from the Huobi exchange. The exchange announced that it would convert users’ assets to Tether (USDT), in a 1:1 ratio. Alameda Research is giving the DeFi community traumatic flashbacks to 3 Arrows Capital insolvency, as worrying details arise around the nature of the company’s finances. Of particular worry is the apparent illiquidity of a majority of the firm’s holdings, against which it has borrowed several billion dollars’ worth of assets. The nature of Alameda’s holdings has also raised questions about the ethics and possibly the legality of its business dealings, given its proximity to major exchange FTX. Most of Alameda’s holdings are directly related to FTX-affiliated assets, pointing to some questionable dealings. At the center of it all once again is Sam Bankman-Fried, who came under fire recently for his proposed regulations on the DeFi sector. Moving on from Bankman-Fried’s behavior, we have mixed treatment of DeFi and crypto by financial institutions this week; Santander is restricting how much of their own money UK customers are “allowed” to spend on crypto, while Fidelity opens the floodgates to retail crypto investment with commission-free trading. JP Morgan and its peers have also run some interesting tests on a modified version on Aave on Polygon – showing some potential use-cases for the meshing of traditional finance and DeFi Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesJP Morgan, DBS, SBI Digital Asset complete DeFi tokenization trials on public blockchainSantander imposes limits on UK crypto exchange transactionsFidelity turns its attention to retail investors with new crypto offeringFederal Reserve raises interest rates by 75 basis points for fourth time in a rowStat BoxTotal Value Locked: $54.89B (up 1.5% since last week) DeFi Market Cap: $48.00B (up 4.9%) DEX Weekly Volume: $11B (up 10%) Bonus Reads[Kari McMahon – The Block] – Crypto exchange Kraken's NFT marketplace goes live in beta [Aleksandar Gilbert – The Defiant] – Cronje Rejoins Fantom and DeFi After Posting Essay on Crypto Winter [Aleksandar Gilbert – The Defiant] – DeFi 2.0 makes a comeback with “Chicken Bonds” [Jeremy Nation – The Block] – dYdX introduces proposal for autonomous subDAO-based infrastructure If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – October 28

Friday, October 28, 2022

This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.

This Week In DeFi – October 14

Friday, October 21, 2022

This week, Aptos goes live and airdrops 20M APT, Frax Finance announces liquid staking, Edge Capital Management raises $67M for DeFi funds and Ripple plans an EVM sidechain.

This Week In DeFi – October 14

Friday, October 14, 2022

This week, Uniswap raises $165M in Series B funding, Solana's Mango Markets is exploited for $100M and ETH becomes deflationary.

This Week In DeFi – October 7

Friday, October 7, 2022

This week in DeFi, Bitwise launches a Web3 ETF, Binance Smart Chain is halted after a hack and Ribbon Finance launches unsecured lending for institutions.

This Week In DeFi – September 30

Friday, September 30, 2022

This week, USDC plans expansion to 5 more networks, Chainlink partners with SWIFT and launches a growth program, and Robinhood launches its own Web3 wallet.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏