Why the Poor Stay Poor in America - Debt and Inequality

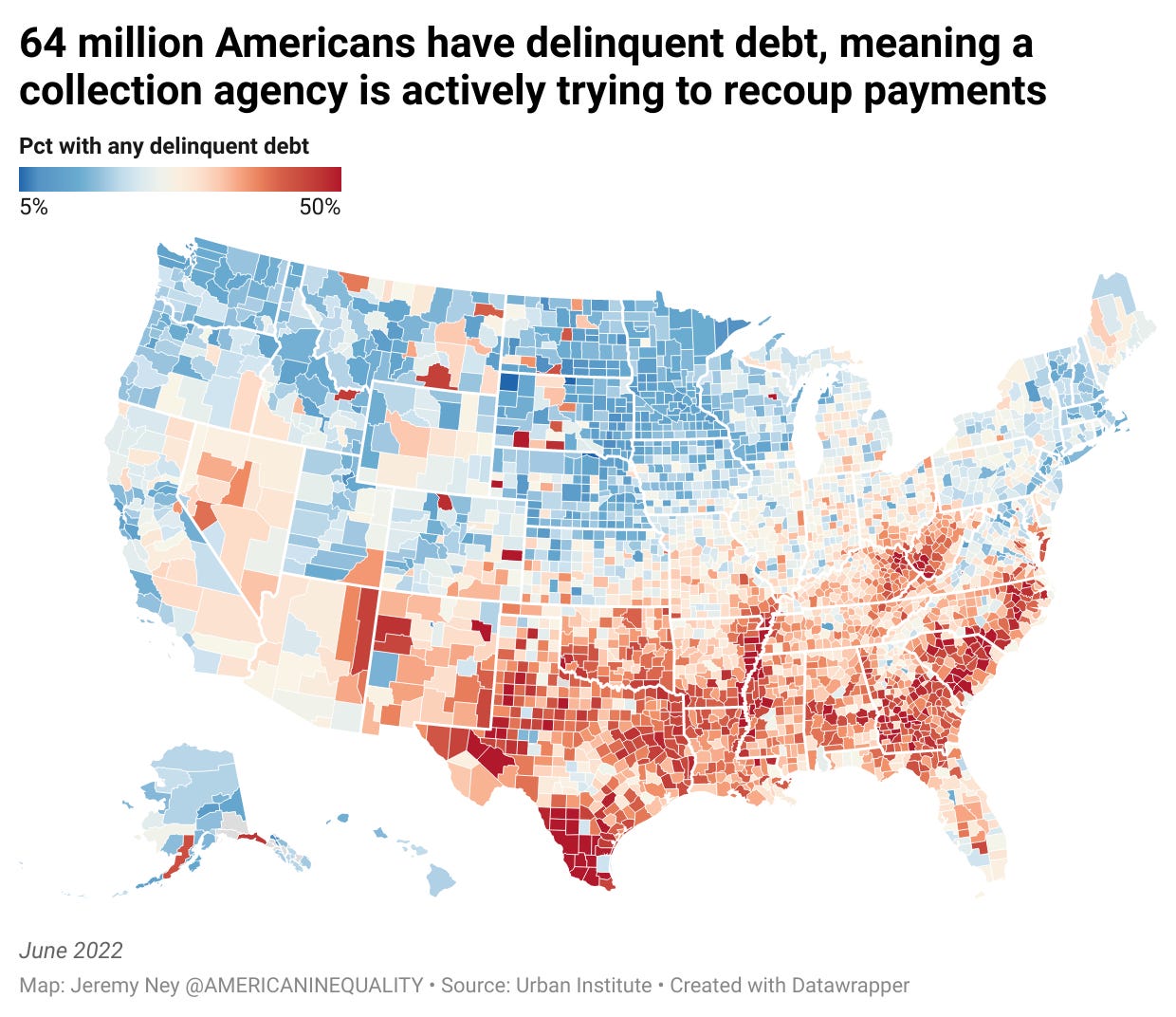

Debt can help you buy a home. Debt can help you start a business Debt can help you go to school. But debt can be crippling for millions of Americans. 64 million Americans are overdue on debt and are struggling to pay it back. 📈 As interest rates rise, the cost of education increases, and it becomes more expensive to own a home, debt is keeping more and more households in cycles of poverty. Texas has the most indebted counties

📍Texas is home to 7 of the 10 counties with the highest percent of residents in debt. The other 3 in the top 10 are in South Carolina. Duval County in south central Texas is the most debt-ridden county in America, where 2 in 3 residents there are delinquent on their debt payments. Duval has almost double the national poverty rate and 90% of the population is Latinx. “Death Valley” for migrants, or Brooks County, has the next highest rate of debt delinquency in Texas. It’s one of the busiest points for illegal immigrant crossing and it has the highest rate of immigrant deaths of anywhere in the country. For the 90% Latinx population who lives in Brooks, many cannot provide for immigrants traveling through there who may knock on their doors because they themselves are so in debt. Looking after others or extending resources isn’t possible when the population is already struggling under such intense weight.

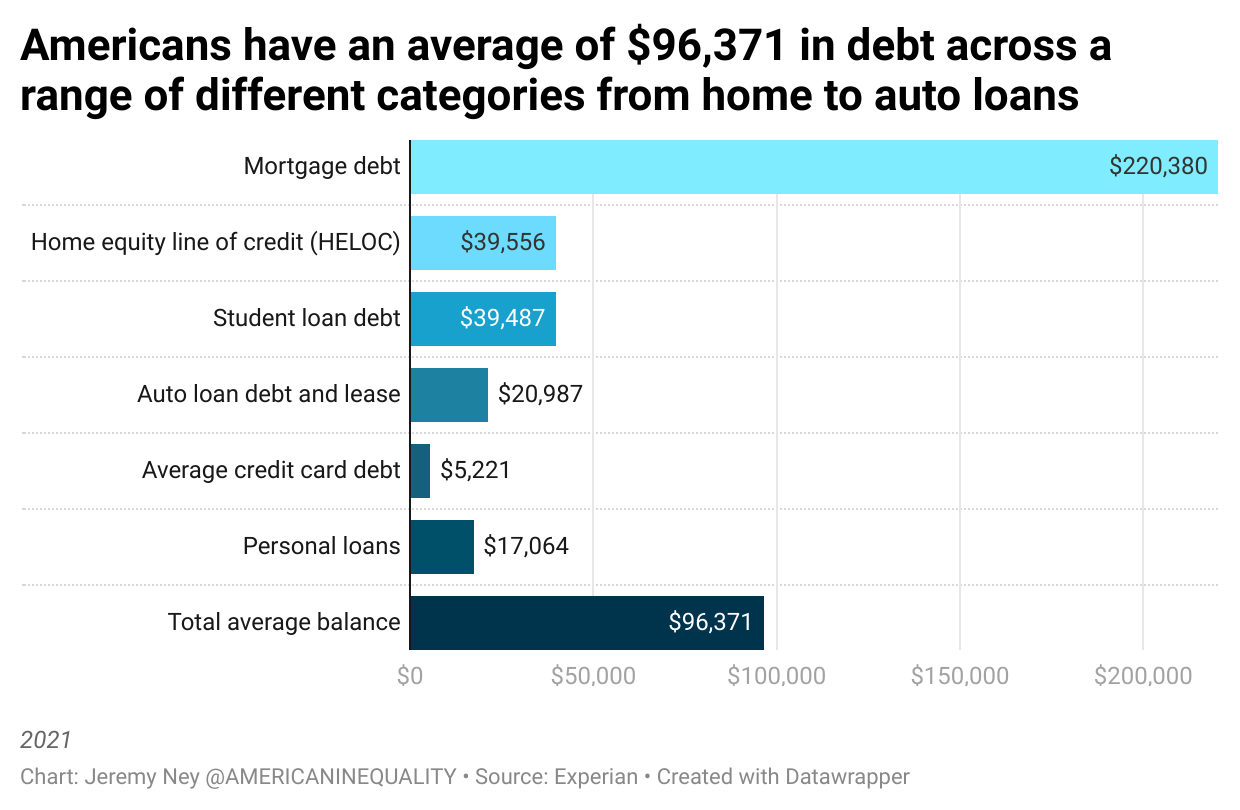

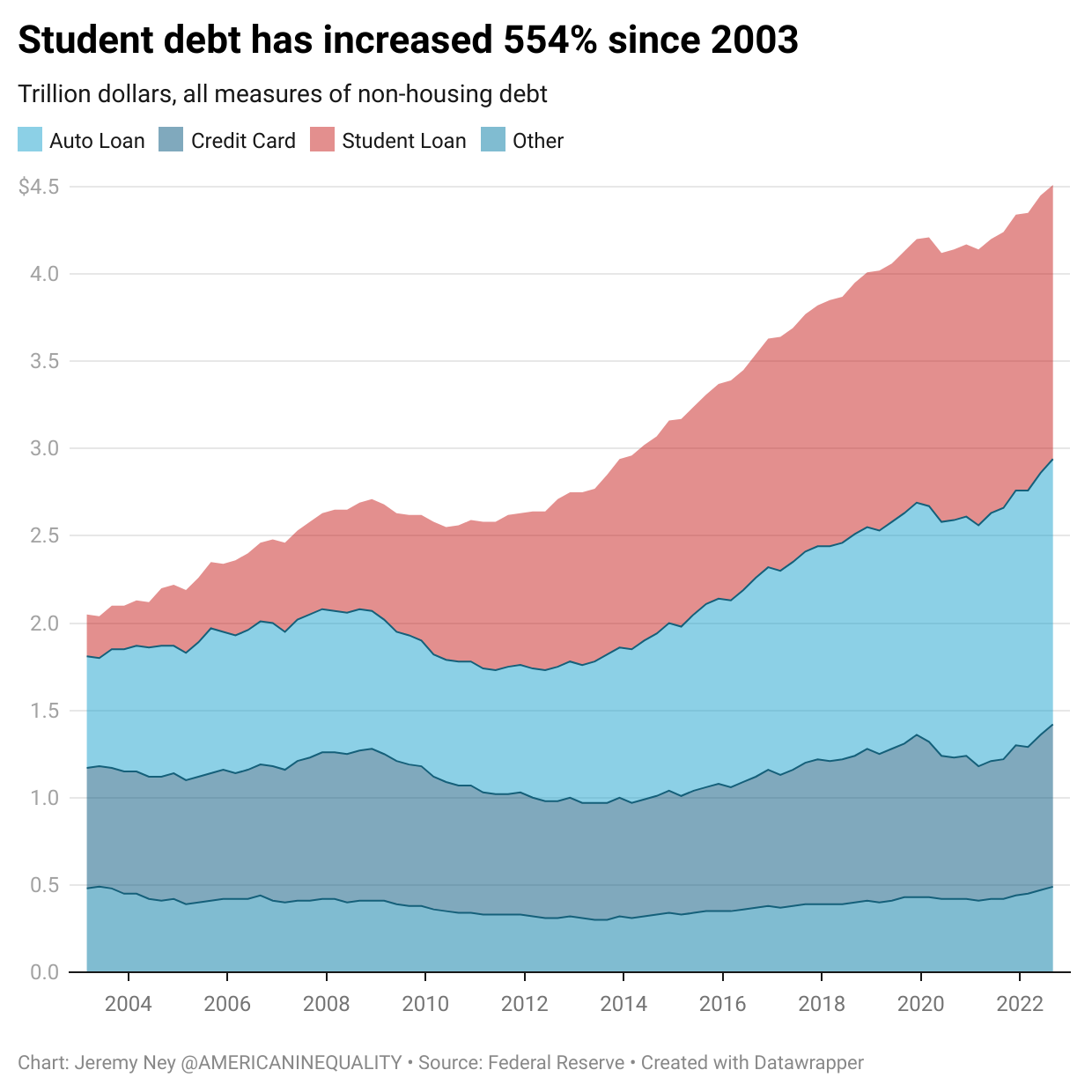

⛺️ Simone Cifuentes knows how crippling debt can be. Simone lives in a tent on her own property in Vermont while she rents out her house to save money. She has $332,000, which is largely split between her mortgage and student loans. She tries to cover debt payments for her father too and largely focuses on paying off the debt that has accruing interest since she knows how those spirals can get out of control. At the beginning of 2014, she had $10,000 in debt, but this grew to $27,000 by the end of the year. That same year she lost her job a week before her birthday. “I’m hoping to go back to teaching full time with no more ‘bad’ debt so I can finally afford to live in my own house” she says. Good debt vs. Bad debt can mean the difference between opportunity and povertyDebt becomes a problem when households can’t pay it back. In 2016, Donald Trump declared himself “The King of Debt”. He argued that he has been successfully using debt his whole life to fund his businesses. While this is possible, bad debt and an inability to pay off that debt will make it very hard to become king. 💳 Credit card debt - Credit card debt has now reached its highest levels ever, far surpassing levels seen before the 2008 financial crisis. New data just released from the Federal Reserve shows that credit card debt is now at $930 billion, up from $870 billion in 2008. Delinquency rates are also rising. While inflation explains part of this (and prices rising faster than wages), the other side is that money has become tighter as interest rates rise and markets slow down, and so households are extending themselves further on credit cards. 📚 Student debt - 45 million people have $1.5 trillion in student debt (average of $33K each). The issue of student debt has dramatically increased over the past 40 years. College tuition has risen at 4x the rate of inflation and 8x that of household income. More on this below. 🩺 Medical debt - More than half of all overdue debt that Americans owe is related to medical expenses. People living in rural areas and in parts of American that did not expand Medicaid under the Affordable Care Act were more likely to have high medical debt. 🏠 Housing debt - The Federal Housing Association (FHA) guidelines permit a total mortgage payment and any recurring monthly obligations ratio as high as 43% for borrowers. So that means if you’ve got a monthly income of $5,835 (US median) you shouldn’t be spending more than $2,500 on debt repayments each month. ⚖️ Racial divides for debt - 27% of Black households are delinquent on paying back their debts, while only 15% of White households are delinquent on their debt. On top of this, White households actually have more debt (median $73.8K, compared to median $30.8K for Black households), which is largely due to the much higher rates of White homeownership in America. So Black Americans are struggling to pay back their debts, but often because they are saddled with payday loans and low-income jobs that make it harder to get back above water. What’s been happening with student debt?President Biden recently canceled up to $20,000 in student debt for Pell Grant recipients and $10,000 for other borrowers. Student debt is a special challenge because it’s much harder to resolve your student debt through personal bankruptcy than it is for credit card or mortgage debt. Biden’s goal was to support low-income borrowers and resolve debt for Black borrowers as well. There are many arguments for and against Biden’s plan, but if he is able to achieve his goals, this would be a huge step forward for reducing debt and inequality. The reason student debt is particularly important is because of 🎭 debt-to-income ratios. High debt is less problematic if those debt holders have higher incomes and can afford to pay back what they owe. Students, however, generally have lower incomes at the beginning of their careers and have higher debts because they are recent graduates (i.e. high debt-to-income ratios, often $2 in debt for every $1 in income). High debt-to-income ratios usually results in higher interest rates, because they are a higher risk to a lender, which can exacerbate debt traps. The Biden proposal tries to target students in this position. 🏛 Last week, the Supreme Court agreed to hear the case on whether the Biden administration had overstepped its authority in canceling billions of dollars in student debt. The trial has been fast-tracked as states are arguing the executive action could wipe out future tax revenues for them. The nonpartisan Congressional Budget Office estimates the plan will cost $400 billion. The Path ForwardPredatory practices perpetuate debt cycles. Payday lenders and loan sharks charge such high interest rates that it can be impossible to pay off those debts. Debt management plans can help households navigate the debt that they do already have. And bankruptcy can help Americans emerge from debt.

Households have an average of $96,371 in debt. With rising interest rates and a struggling economy, Americans may face more hurdles ahead. However, we can help reduce debt and inequality by focusing on the regions most in need. like Texas and South Carolina, while also recognizing the types of debts that make it harder to achieve opportunity.

|

Older messages

Medical Debt Is Crushing Millions of Americans

Saturday, December 3, 2022

Listen now (11 min) | And With Overwhelming Debt Comes Ruined Lives

Holiday Reading: Why We Need Other Animals

Thursday, November 24, 2022

And Why They May...Or May Not Need Us

Urban Sprawl With Little Regulation

Thursday, November 17, 2022

Listen now (8 min) | Is This What the Middle Class Really Wants?

There's Still Time...

Tuesday, November 8, 2022

Listen now (4 min) | To Make Your Voice Heard!

Are Secret Algorithms Responsible For Your Rent Hike?

Sunday, November 6, 2022

Listen now (7 min) | And Other Sundry Issues Affecting Our Housing Market

You Might Also Like

Katie Holmes Has Been Wearing These Ballet Flats Since The ‘90s

Friday, January 10, 2025

A timeless staple. The Zoe Report Daily The Zoe Report 1.9.2025 katie holmes best y2k looks (Celebrity) Katie Holmes Has Been Wearing These Ballet Flats Since The '90s A timeless staple. Read More

3x3: January 9, 2025

Friday, January 10, 2025

What's next? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How to Stop Google Personalizing Your Search Results

Thursday, January 9, 2025

Medical Debt Won't Hurt Your Credit Score Anymore. The best way to escape the filter bubble. Not displaying correctly? View this newsletter online. TODAY'S FEATURED STORY You Can Stop Google

The Ukrainian Mom Who Gave Birth to Premature Twins As Russia Invaded

Thursday, January 9, 2025

Today in style, self, culture, and power. The Cut January 9, 2025 HOW I GOT THIS BABY The Ukrainian Mom Who Gave Birth to Premature Twins As Russia Invaded “My mom and I left with one bag. We didn'

Kendall Jenner Channeled Princess Diana's Iconic Off-Duty Look

Thursday, January 9, 2025

Plus, Anne Hathaway freed the nip, Lisa Kudrow talks Matthew Perry, your daily horoscope, and more. Jan. 9, 2025 Bustle Daily I quit Instagram but I still think about my parasocial relationships. LIFE

The quest to find an actually attractive air fryer

Thursday, January 9, 2025

Every pizza lover needs this reusable pizza box

Announcing Our New Chancellors

Thursday, January 9, 2025

January 9, 2025 announcing new chancellors We are honored to announce the election of Ada Limón and Eleanor Wilner to our fifteen-member Board of Chancellors, an honorary group of esteemed poets who

A Story About a Front Door

Thursday, January 9, 2025

And Life. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Halloween

Thursday, January 9, 2025

Forwarded this email? Subscribe here for more Halloween Edith Zimmerman Jan 9 READ IN APP Archive | Etsy | About me Like Comment Restack © 2025 Edith Zimmerman New York State Unsubscribe Get the app

The Overworld

Thursday, January 9, 2025

Videogames aren't escapism as much as an analogy for living ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏