MicroAngel State of the Fund: November 2022

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: November 2022Sideways MRR action but cashflow slump. Designing MicroAngel LP + MicroAngel playbook as an investment. 30-day Revenue: $31kGood morning and evening to you! It’s time for the state of the fund to take a look at progress this past month. I feel a period of transition starting to happen, as my mind regularly drifts away from the portfolio towards other projects, my wife’s business, and my interest continues to grow to move on to the next great adventure. As of today though, Fund 1 performance breakdown goes as follows:

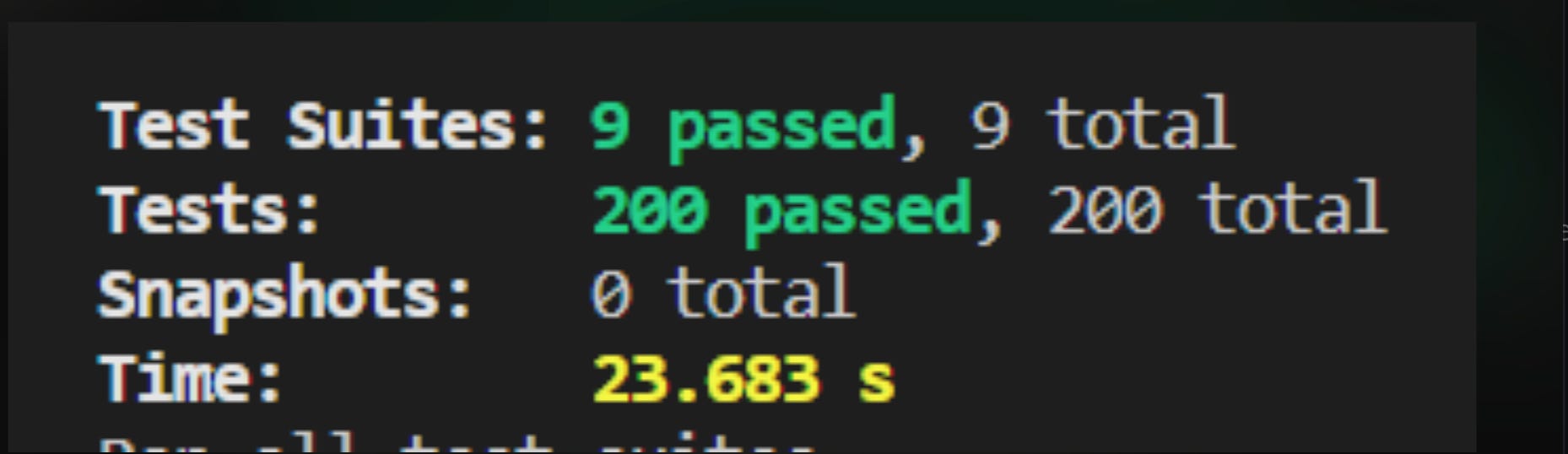

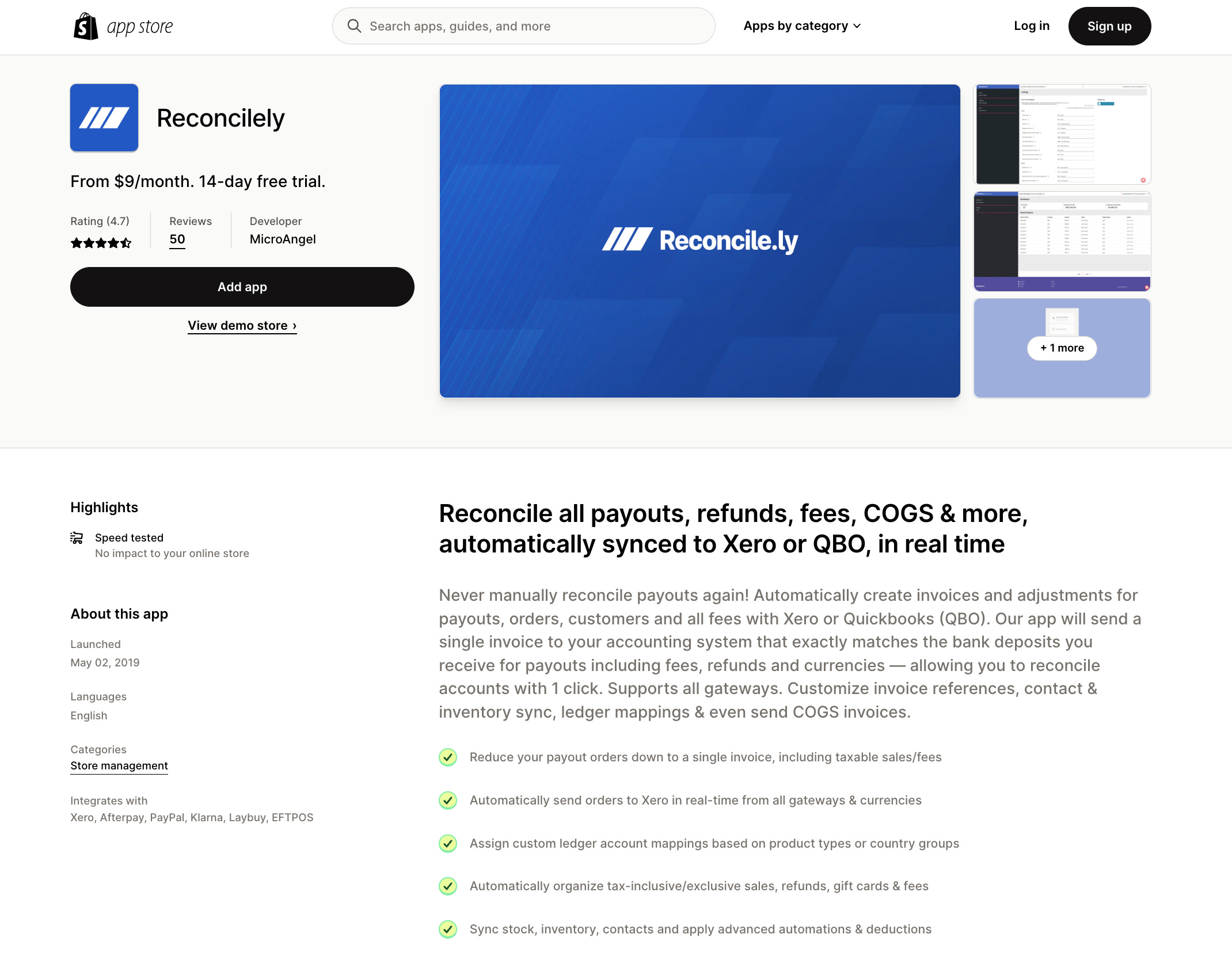

In a way, pushing the 24 month timeline to 27 months was the correct financial call as it enables me to collect all of my initial investment in cash-on-cash. But it was bound to produce this mental state, as I’ve struggled to maintain motivation and am very much feeling the effects of burnout at this point, as I push myself to the finish line. Thankfully, as Fund I is approaching the end of its lifetime, the future is getting clearer. The MicroAngel DAO team pivoted into the founding partners of Fund II, which is an LP fund we are organizing to provide the MicroAngel playbook as an accredited investment opportunity. The development of the next iteration of the MicroAngel brand also means that for the first time, I’m starting to become intentional about the brand itself so it can grow into something greater than myself. I’m partnering with 4 awesome individuals who have followed the MicroAngel story from the beginning. I’m excited for us to tell you all about our experience organizing the fund, raising from LPs, acquiring and growing the products we acquire, and exiting in time to return value for our investors. In terms of the fund itself, I spent a solid chunk of the month otherwise occupied with the DAO proposal I’m working to deliver against, with the majority of my work in the fund being in the back-office. Caught up on bookkeeping, prepared tax declarations, and advanced our R&D tax claim application, which is still blocked due to documents we need to have after remittance. I didn’t get to put in any work into product, so I continue to appreciate the efforts Eric is deploying against any fires that come up. Speaking of fires, Reconcilely cashflow took a hit as a result of a bug that was introduced last month, and which wasn’t fixed in time relative the expectations of new customers. We earned a few strong yearly customers, but subsequently lost them due to the bug, and it showed in the latest payout. It’s important to consider that the cashflow gains you get from monthly yearly plan subscriptions — that is, earning new yearly customers every month, at the same pace — those are not MRR. They’re still straight ARR, and their MRR of course is represented as 1/12 of the ARR value. But what happens when the yearly subscriptions happen every month? At which point do you start considering that monthly cashflow injection to be recurring? Well, for the past 3 months it has been very much recurring. And it would have recurred this month too, had we not lost the 4-5 new customers who have represented that gain. Really sucks but that’s a factor of trying to improve the product. Can’t be scared to break things provided the end-result is a stronger, more bullet-proof product. In that pursuit, the product reached a total of 200 unit tests across the different functions and use cases we have run into. This allows us to continue improving the product without much fear as it relates to Tier 1 bugs; but it is still possible such bugs could come into existence without their use case being handled in the unit tests. In those instances, we must add the test and the code to satisfy the new use cases and march on, just a little stronger. We successfully transitioned the apps to the new Shopify App store by way of refactoring the listing copy to be compliant with its new format. I find that installs have slowed a little bit despite the apps gaining in terms of ranking positions — this is purely a seasonal factor that I was able to verify against last year’s numbers. January, February and March should be strong months. Onwards! Current fund lifecycle stage

Fund Activity

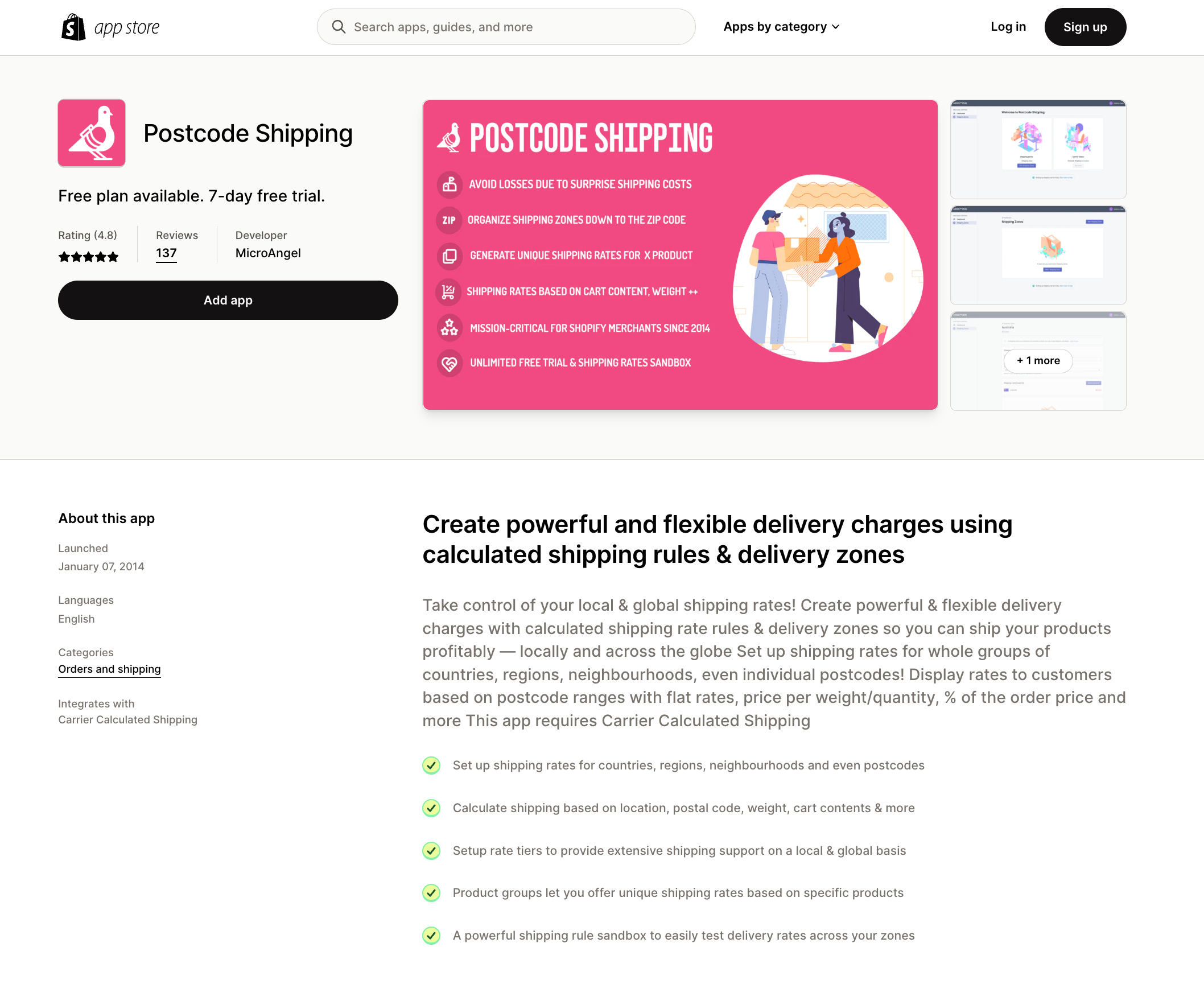

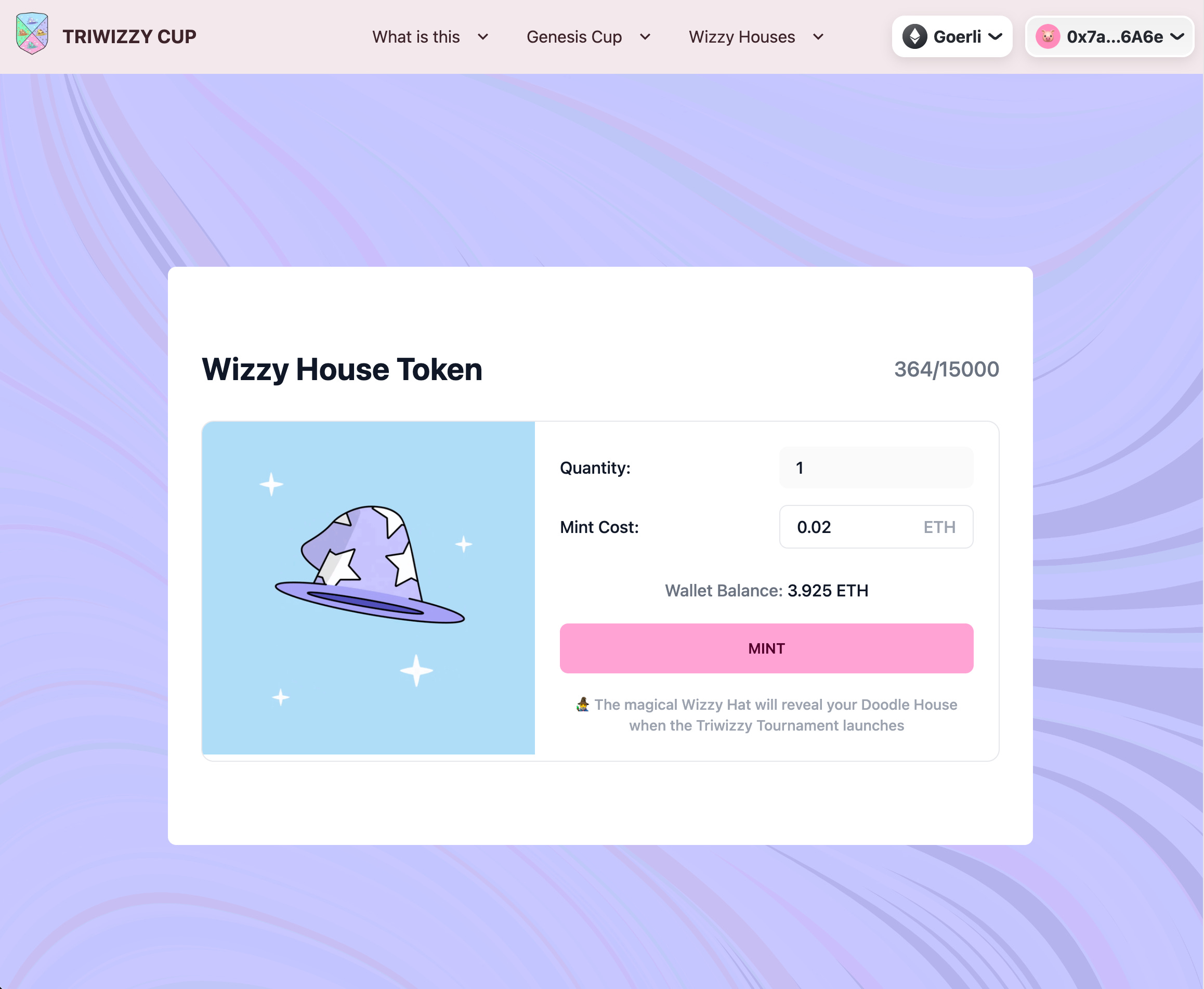

The little issue we experienced last month got priced in November’s first payout. It made me realize a shortcoming of my reporting now that yearly plans are being sold and relied on. Specifically, I’ve been calculating most of my stuff on an ARR and cashflow basis. Since we’d add yearly plans every month, it made cashflow feel like MRR was actually growing by as much as the ARR (as we pocket that revenue immediately, and this happens each month with each new customers). Obviously, the MRR growth is not the value of the yearly plans. So when a yearly plan fails to convert the following month, I cannot consider that to be MRR churn, even though I’ve seen monthly recurrence from the yearly plan sales. Despite that, I’m still reporting a -12% cashflow deceleration on the Reconcilely side, which of course is relative to last month, when the yearly plans converted just fine (as usual). So even though cashflow might have decreased by -12% as a result of not closing yearly sales that month, MRR has actually gone up slightly as a result of adding other new customers on monthly plans, which didn’t impact cashflow nearly as much as yearlies, obviously. I don’t particularly mind the false negative of reporting valuation decrease against churn that isn’t necessarily there, but I do expect to do a full audit by year’s end (or shortly thereafter) to qualify my revenues and numbers per the CSV exports directly. End of year slumpInstalls are down slightly, and it looks to be a seasonal effect. Last year was the same — folks don’t care much about accounting during BFCM month (that’s the month to make some money!). Inevitably, January and February are very busy months and I expect installs to follow through. That’ll be a good time to be launching new features which are in the pipeline. Support volume went way up this month, with a bunch of corner cases making it through the cracks as a result of a bug that was introduced last month. The thing about asynchronous products is that if something breaks, nobody is immediately affected because the value being delivered (an invoice) is very rarely needed on a real-time availability. A bug that prevent invoices from being sent is not a big deal the day the bug happens, but it does kickoff support debt like a spring getting compressed. A growing number of customers have invoices that aren’t being sent for the use case affected by the bug. So eventually, when folks start looking into their bookkeeping (i.e. at the beginning of that week), they all run into the fact they’re missing invoices at the same time, and a support spike occurs. This isn’t particularly good or bad, it’s an ebb and flow of what can happen as a result of research and development. Things can break when we make large changes, and provided we mend those in time and backdate any affected invoices, nobody is affected. The problem is that I’ve noticed escalations have been taking much longer. That has been a factor of the bugs introduced and not being solved in a reasonable amount of time, which had an impact downstream on new customer churn (bug affected new users mostly) Those bugs plus the escalation failures this month means we failed to retain one $490 customer and 2 $990 customers who had signed up, which is a damn shame, and reduced collected cash by about 12% for the month due to this variance. Reporting refresh & auditWith the roll-up period starting as of January, I’ve been meaning to audit my reporting and do a full run-through of my bookkeeping, regular and SDE P&L, and general performance of the whole fund leading up to the exit. I’ll also need to invest some time to compile the unit economics that buyers will be asking for. I realized my reporting doesn’t very accurately capture the ups and downs created by the new yearly signups since a lot of it is ARR based and some calculations are MRR based and dividing by 12 doesn’t always capture the full story. Collected cash takes a dive if our new yearly plans don’t convert well that month, and creates a seesaw pattern I hadn’t considered as a result of simply adding new ARR divided by 12 into the MRR calculation. Not that it’s entirely important in the long run at all but represents important context for a buyer who builds enough confidence in new yearly plan conversions every month to consider that MRR (which it officially isn’t). Yearly plans need to be treated as mega VIPs. They are a true double-edged sword. They can very rapidly amplify the run rate, but can also cause a crater in the cashflow if they don’t come in like they regularly do, especially if due to a failure in support escalations. Moving forward, I should have clarity on current MRR vs. new MRR rather than simply recording collected funds and reverse-engineering MRR growth from that. This way, any yearly signups that fail to convert won’t negatively affect MRR churn, as it is not yet churn. App store changesThe Shopify app store completed a redesign and I must say I’m very impressed with the quality of the listings. They’ve done an excellent job of putting the information merchants are looking for front and center. I also appreciate the work they’ve deployed to better educate merchants who are logged out. I’m not sure if or how applications that don’t follow the current trend (i.e. that’s Checkout Extensions right now) will be able to collect attention or be featured by the staff. Thankfully, our rankings slightly improved as a result of the new changes brought to our listings. I took the chance to completely rewrite our value proposition and benefit hooks so they would make the most of the space made available by the new Shopify listings Unfortunately, the line breaks are stripped out of the text, so the delivery of the main paragraph is impacted. But so far, seems like nothing has completely cratered though I’ll really know after the new year. During BFCM, nobody focuses on tax and/or touching critical infrastructure like shipping rates. So everything becomes stable for a little while, then rapidly takes off again as tax season comes about and/or EOY profitability push merchants to improve shipping rates. I took the opportunity to review messaging and tighten up the value proposition and key benefits, which had a tangible impact on the quality of the new app listings. I couldn’t find the motivation to create a video for each of the listings, mostly as a factor of being focused on solving open issues (and ensuing consequences) created by bugs that were introduced to the code early on in the month. Not a huge fan of the explainer videos offered by the many agencies who offer these kinds of services, and would probably gain much from creating an authentic video for both apps myself. Really looking forward to not relying on the app store as much anymore, but I’ve failed to properly equip my new prospecting partner with a working Sales Navigator account due to some weird account issues on LinkedIn — and I have no interest in creating a fake persona. I’ve been in a support loop hell with LinkedIn to get Sales Navigator back to my grandfathered account. I’ve had that account for nearly 10 years, and pay like $99/yr for Premium. Unfortunately it looks like they removed Sales Navigator from the grandfathered account, which I’m trying to get back as that’s what I signed up for. In the meantime, this is impacting my ability to do prospecting. What have you been using to turn company names and domains into qualified leads? DAO Proposal progressMy main ‘side hustle’ the past two months has been building the Triwizzy Tournament for the Doodles community, as a result of a passed DAO proposal that funded the project with about $100k. I’m creating a platform to house and manage an annual creative competition that anyone can sign up to, with several challenges available and awesome prizes up for grabs for the winners. A fantastic change of pace that brings me back to my B2C days in gaming and esports. I made my teeth creating one of the first eSports platforms of its kind, and am pretty intimately connected to the workflows of league, ladder and tournament management. Of course, the main difference and challenge here is that I’m building a Web3 product. Though I’m not committing any of the results to the blockchain, must of the functionality I’m building is either token-gated or requires an Ethereum wallet to work. For example, access into the app is token-gated to holders of the ‘Wizzy Hat’ NFT. And that NFT will be made available for claim and public sale based upon a variety of factors. It’s a fantastic learning experience attached to an excellent purse of funds I can use to expand Web3 investments at a time when fear, uncertainty and doubt are starting to bottom out. It does take a lot of time lately between managing contractors and my own work. Though I’m having loads of fun, I’m looking forward to delivering the project and returning to full focus my own devices. MicroAngel LP FundDespite the DAO project being on hold, the growing community has remained hungry to participate and to that end I’ve joined forces with the DAO founders-to-be to launch the first LP fund for MicroAngel. In doing so, we’ve taken the time to explore what we’re trying to build, and where the MicroAngel brand fits into that. There are 5 of us spread across North America with a wide variety of expertise and complementary skillsets. And the business we’re aiming to launch will build upon three core competencies:

In the end, our approach will be very familiar to MicroAngel subscribers: 👉 We acquire high-cashflow, profitable software products Naturally, we can’t advertise this anywhere. So we’re starting to kickoff conversations with different subscribers, friends, family and other colleagues who would like to gain exposure to this asset class. I’ve noticed PE is often compared to VC where it comes to returns. But the two are different asset classes. An investor like a family fund that wants exposure to high technology should aim to be an LP in both VC and PE because they are exposed to different kinds of deals. The opportunityTraditionally, you either invest in startups directly as an angel or into a VC fund as an LP. In both cases, you’re looking for a 10x return. You’re making several small bets early that you can double-down on later in the hopes of producing a 10x-100x outcome. But both of those approaches rely on the startups selling for millions for you to make those returns. That means high-risk, high-reward. The math works out provided you are exposed to enough deals so your winning investments more than make up for your losers and the sum of all parts is still profitable. Turns out not many VCs are able to do that consistently. Many end up returning as little as 2x or 3x over a fund lifetime of 5-7 years. Kind of like gambling. Our opportunity is not to compete against VC but to provide an alternative investment that helps spread out some of that risk via a repeatable, straightforward process that doesn’t depend on the same variables or dealflow. This often translates to more medium risk with just as high of a reward in the long-term. Instead of a potential 10x in 7 years, it’s a near guaranteed 2x in 2 years, every 2 years. 2x every 2 years for 7 years is still still 10x, but with this model, the LP gets 3 chances to exit fully or compound profits by rolling them into the next deal. The asset class we are exposed to is NOT on the radar of VCs either because they are too small to interest them, which means they are not ‘venture fundable,’ and that means outside of venture scale and into ours. We focus on the cashflow and scale of the cashflow as a regular and consistent means of delivering value rather than only hoping for a massive outcome downstream. This VC approach often pushes entrepreneurs to try and raise as much money as possible as quickly as possible as the primary method for increasing valuation quick enough to stay the course for a shot at the moon. Yes, post-money valuation can grow as a result of selling equity, but the real earnings-based valuation inevitably catches up, especially in the context of going public where that metric becomes the only source of truth. VCs don’t invest in niche products due to the lack of moonshot — but a moonshot is not required in this playbook; in fact this a slow and steady approach instead that provides clarity on value and consistent and frequent returns. Think Warren Buffett meets MicrosaaS! The MicroAngel PodcastGood friend and fellow microangel Vahid Jozi and I are planning on launching the MicroAngel Podcast, a new destination for MicroSaaS founders focused on buying, growing or selling their products for freedom and profits. Our goal will be to interview some of the space’s most talented founders and to dig deep into specific things they’re doing to improve the valuation and run rate of their products. The idea is to enable listeners to walk away with at least one golden nugget each time they tune in, with content that enables both you and the community to come together and benefit from the ecosystem. It’ll also be a fantastic way for the brand to spread its wings across different media and social platforms. This should result in the community blossoming both in terms of the Discord membership and the LP pool itself.

Look out for some teasers s00n! 👀 Learnings & AdjustmentsI’m mostly staying the course this month and trying to get through some of my deliverables on the product-side. I’d like to unblock some of the initiatives that are currently at a standstill and pay close attention to the App Store rankings over the month as competitors inevitably jostle for better positions. By year’s end, it will be time to start packaging at least one product for sale — and the prospect of doing that is very exciting both from the perspective of inking in paper profits but also to reclaim some mindshare in pursuit of making good on the Reconcilely opportunity before handing it off. I expect to list Postcode Shipping on MicroAcquire sometime in January, and will thus get started preparing any necessary paperwork and details that will make it possible for potential buyers to make a decision, an offer and an acquisition of our product. Until next time, thank you for checking in and take care of yourself! 1 I need to audit myself and readjust how I calculate this. I’ve been shooting from the hip based on payout amounts ever since we released yearly pricing. I’ve lost that ability since releasing yearlies. With a CSV export of the payouts, I can get a general sense of how much was billed each month You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

MicroAngel State of the Fund: October 2023

Saturday, November 5, 2022

Reached 70% cash-on-cash, passed $30k MRR, adjusted selling multiples, new outreach campaign. 30-day Revenue: $31.45k

MicroAngel State of the Fund: September 2022

Saturday, October 8, 2022

Team fatigue, exciting MRR & MOIC milestones, high holidays, DAO pivot & a fun web3 project. 30-day Revenue: $29.45k

MicroAngel State of the Fund: August 2022

Thursday, September 8, 2022

Pricing update oops, listing requirements, support tool consolidation & expansion mechanisms. Closing MRR: $27.76k

MicroAngel State of the Fund: July 2022

Tuesday, August 2, 2022

Yearly pricing boost, new team member, support platform migration & cash-on-cash acceleration. Closing MRR: $26.6k

MicroAngel State of the Fund: June 2022

Saturday, July 2, 2022

Fund success! Passed 2.7x total return & 50%+ cash/cash, annual experiment successes & growth optimization. Closing MRR: $26k

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved