The Pomp Letter - Grow or Die

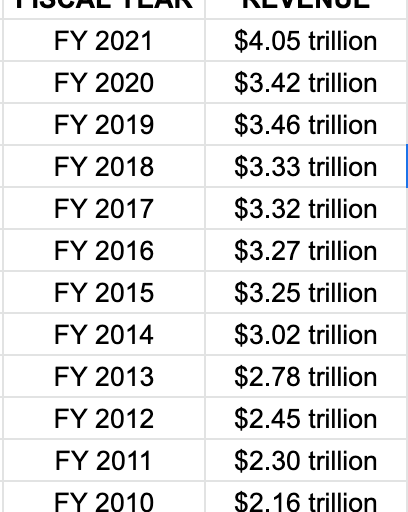

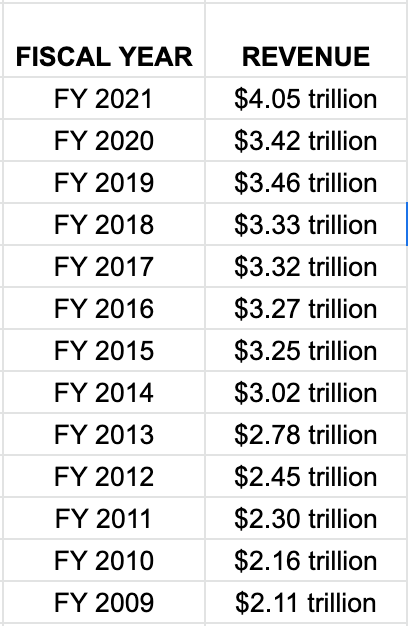

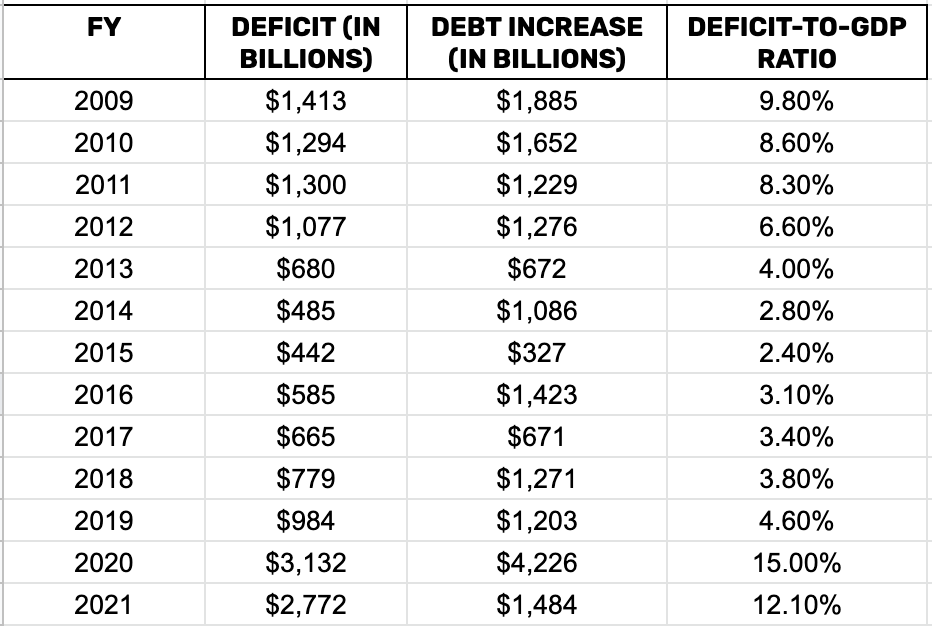

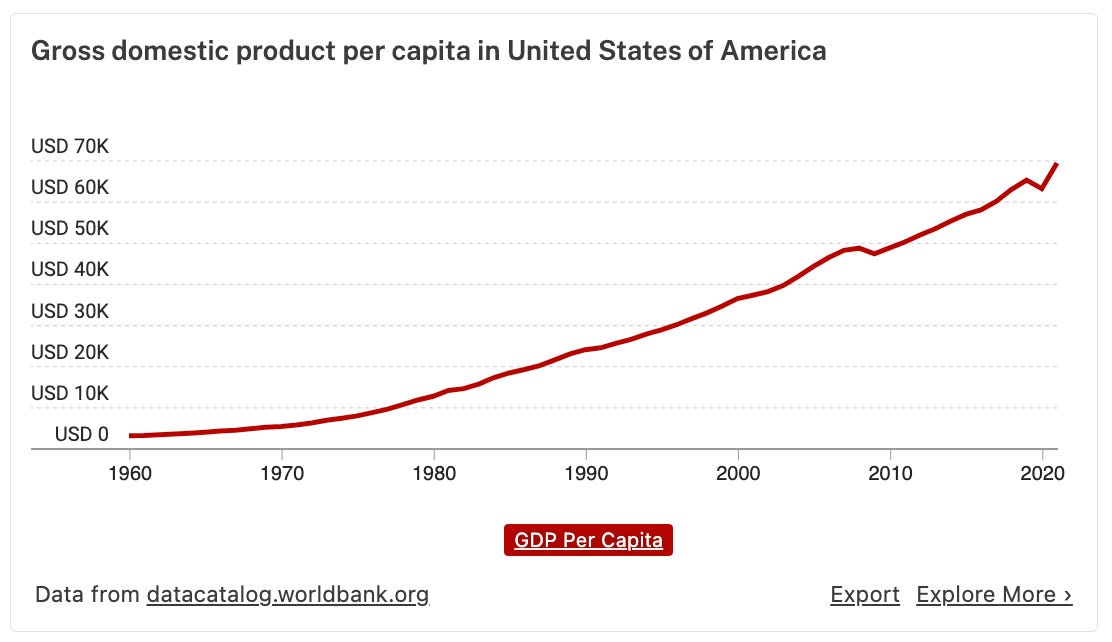

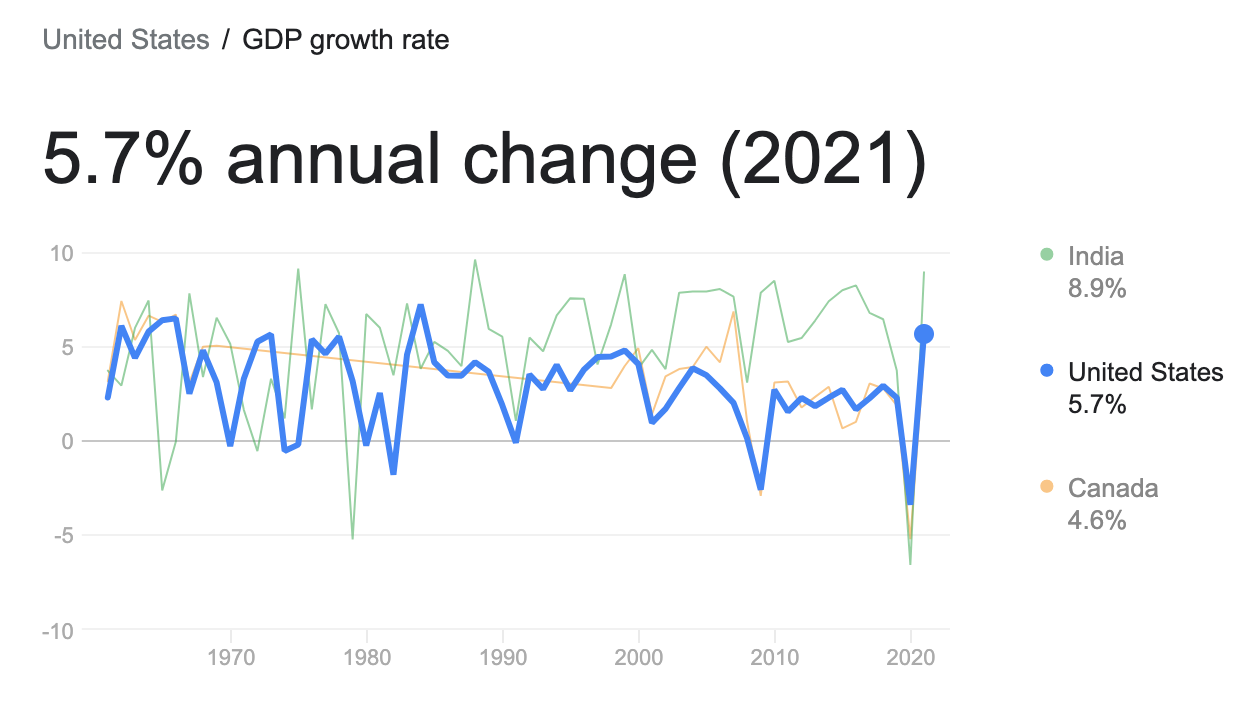

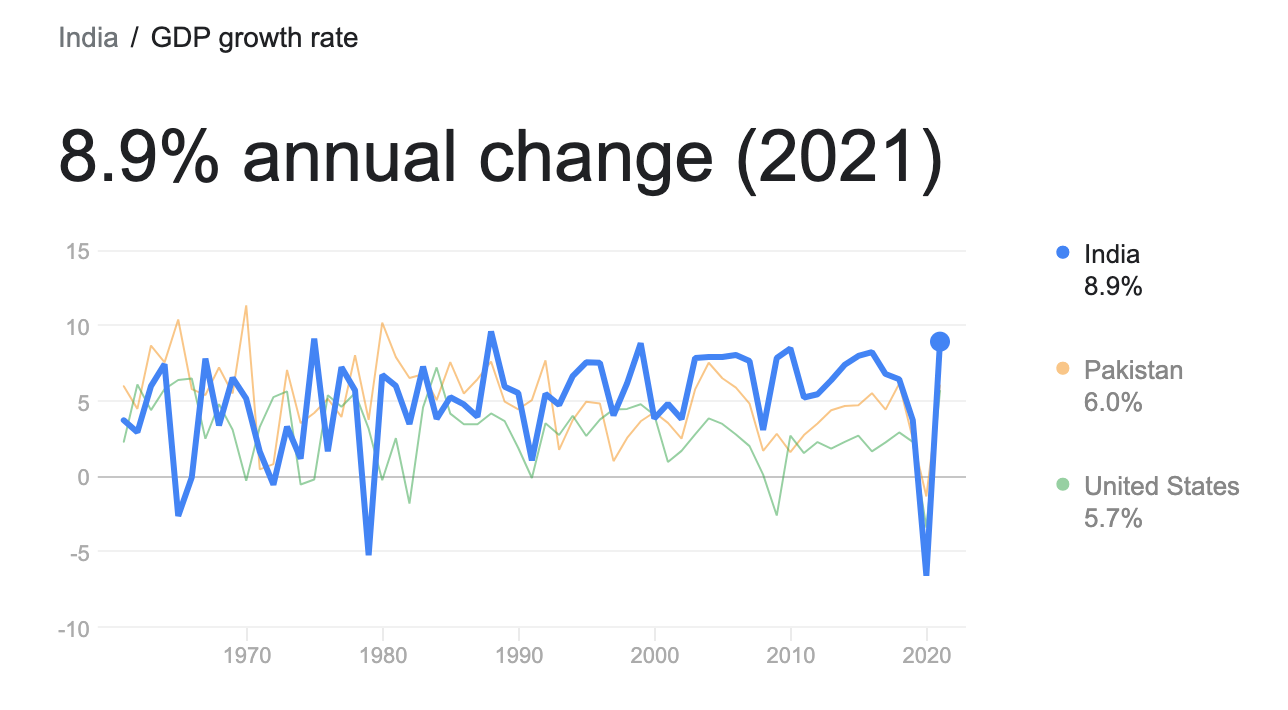

To investors, The US national debt is over $31 trillion and US GDP is just under $26 trillion. This gives the largest economy in the world a debt-to-GDP ratio of ~ 125%. Not exactly an ideal situation. The proposed solution for this problem by the majority of individuals and organizations is to reduce the United States’ debt. This would be incredibly difficult to do. Federal income tax revenue has been higher every single year since 2009 (except for 2020), yet the federal deficit has continued to expand each year. The deficit has not been expanding by small single-digit percentages in the last two years, but rather by double-digit numbers. The problem is getting worse and there is no solution in sight. This is the equivalent of a business capturing more revenue each year, but the losses remain. Eventually shareholders will ask the question — “can we ever stop losing money?” That answer is unclear. On the other hand, in an effort to be fair to all sides of the conversation, there are many people would would argue that a government is not a corporation and profitability is not a goal. That is a tough perspective for me to get onboard with because I believe a balanced budget is important. If we dig deeper into some of the statistics, we can see that GDP per capita continues to grow like a rocket ship in the US. If GDP per capita is growing, then GDP growth should be in a good place too, right? Well, it depends on how you look at it. GDP in the United States had been growing at ~2% per year from 2010 to 2019, which was followed by negative growth in 2020 and then a banner year of 5.7% growth in 2021. The sub-5% GDP growth has basically been the standard since the 1970s with only a few outlier years over the decades. This looks incredibly slow compared to a country like India where over 5% GDP growth has been the standard during the same time frame. This isn’t a huge surprise. US GDP was $23 trillion in 2021 and India’s GDP was just over $3 trillion. It is much harder to grow year-over-year when you are a double-digit trillion dollar economy. India’s economy is expected to slow down in 2023 to only 7% growth, which will take them out of the #1 spot globally for major markets in terms of annual GDP growth. They are being replaced by Saudi Arabia, who is expecting 7.6% GDP growth this year. The reason I bring up US debt-to-GDP and India’s GDP growth is that we may have been looking at the US problem incorrectly. We have two options — count on politicians to stop running a deficit or encourage the private sector to spur economic growth. That is really it. Stop making the problem worse or grow your way out. Majority of the US citizens that I speak with on a weekly basis have little confidence that the US government will return to spending surplus in any short timeframe. This is where the private sector must step up. We either grow our way out of this problem or we force the hand of the Fed to continue devaluing the currency, so they can monetize the debt. This leads to the multi-trillion dollar question — how do we potentially double the GDP growth of America? There is really only one viable path in my opinion. We have to double and triple down on technology and innovation. We have to create new products and services. We have to be the leader across artificial intelligence, bitcoin, space, genome sequencing, psychedelics, and much more. If the idea is fringe and potentially disruptive today, the United States must pour immense resources into the sector. Many things won’t work. That is perfectly fine. The venture capital model is proven for driving innovation. If the US government, and private investors, can unilaterally pursue a similar strategy of funding innovation, we may have a shot of turning this problem around. If not, the United States will continue to erode away as every great nation has done in the past. Grow or die. That is the motto for America over the next 80 years. History tells us what happens if we fail at the mission. Hopefully we are smart enough to avoid that fate. Hope everyone has a great weekend. I’ll talk to you on Monday. -Pomp Announcement: I am hosting a conference at the Miami Beach Convention Center on March 4, 2023. The goal is to bring together people from different walks of life to debate important ideas that impact our society on a daily basis. The speakers are many of the most popular guests from the podcast over the last few years, along with a few surprises. If you’re interested in attending, you can read about the event details here: https://www.lyceummiami.com/ Reader Note: It feels good to be back writing longer letters to each of you. I have set up my personal schedule in 2023 to spend more time each morning putting these together. My goal is to provide the highest quality information and content possible. I don’t aspire to merely regurgitate the news you can read elsewhere, but rather present unique ideas and opinions that will make you think more critically about various business and investment topics. If you are interested in reading these letters more often, and want to support the work that our team does, please consider subscribing as a paid member of The Pomp Letter. We appreciate you reading. You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Fed Has A Shotgun, Not A Sniper Rifle

Wednesday, January 4, 2023

Listen now (8 min) | Impact of the Fed's tighter financial conditions

Empire State of Mind -- Pomp's Notes

Monday, January 2, 2023

Listen now (11 min) | Pomp's Notes on Empire State of Mind by Zack O'Malley Greenburg

My Top 10 Books of 2022

Wednesday, December 28, 2022

Listen now (7 min) | To investors, I have read approximately one book per week during 2022. It started off as a personal challenge — could I stay disciplined enough to read consistently? But as with

Sign in to The Pomp Letter

Wednesday, December 28, 2022

Here's a link to sign in to The Pomp Letter. This link can only be used once and expires after 24 hours. If expired, please try logging in again here. Sign in now © 2022 548 Market Street PMB 72296

Podcast app setup

Friday, December 23, 2022

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

The Keywords No One’s Using—Yet

Monday, March 10, 2025

Most SEOs chase the same keywords. You won't. Get ahead by targeting search terms no one else knows about—yet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.