DeFi Rate - This Week In DeFi – January 6

This Week In DeFi – January 6This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.To the DeFi community, This week, SushiSwap has announced that it will deprecate its Kashi lending platform and MISO token launchpad, due to poor design and a lack of resources. The company will phase out contributions to these offerings in the first quarter of 2023 and focus solely on its core decentralized exchange, which has $390 million in total value locked. SushiSwap is also in the process of designing new tokenomics, in an effort to boost liquidity and decentralization. The new proposed model involves time-lock tiers for emission-based rewards, as well as a token-burning mechanism.  🔮 Something exciting is brewing at Sushi 🍣...

Want the inside scoop on Sushi’s new proposed tokenomics?

🎧 Listen to the full recording here

🔗  Jared Grey @jaredgrey Crypto lending firm Vauld has rejected rival Nexo's latest acquisition proposal due to concerns about Nexo's financial health and other issues. Vauld's committee of creditors (COC) also rejected the proposal. Nexo's offer did not contain significant changes from its previous proposal, and Vauld continues to seek answers from Nexo regarding the company’s financial health and how it will treat claims from Vauld’s US-based creditors, following its recently-announced exit from the US market.  Two major concerns from vauld and users.

- No comment from nexo on financial (solvency due deligence)

- fair treatment for U.S creditors

@Nexo @AntoniNexo @Kalin_M7

Waiting for your AMA, and waiting for your reply on these to specific questions. The TON Foundation has launched a decentralized file sharing and data storage solution called TON Storage, which allows users to transfer encrypted and backed up data files of any size on the TON blockchain network. It functions similarly to peer-to-peer file sharing using torrents, but offers financial incentives to node operators on the network for hosting files for a set period of time. TON Storage aims to increase the accessibility of the TON network and grow the ecosystem by allowing anyone to become a node operator and receive payments for hosting files, even with just one node. TON-secured sites can also be hosted on the network.  .@Ton_blockchain's new storage product will enable users to exchange files of any size while providing financial incentives to node operators to host files for users. By Asa Sanon-Jules and @shauryamalwa.

A US Chief Bankruptcy Judge ruled that more than $4bn in cryptocurrencies deposited in the "Earn Accounts" of the bankrupt crypto lender Celsius do not belong to the customers who made the deposits, but rather to the company's estate. The assets, worth an estimated $4.2bn as of July 2022, were held in 600,000 Earn accounts. The Judge argued that the company's terms of use, which the vast majority of Earn customers agreed to, meant that the deposited crypto became Celsius' property, making the customers unsecured creditors.  Just in: The Celsius judge rules customers gave up legal rights to their crypto by using the platform.

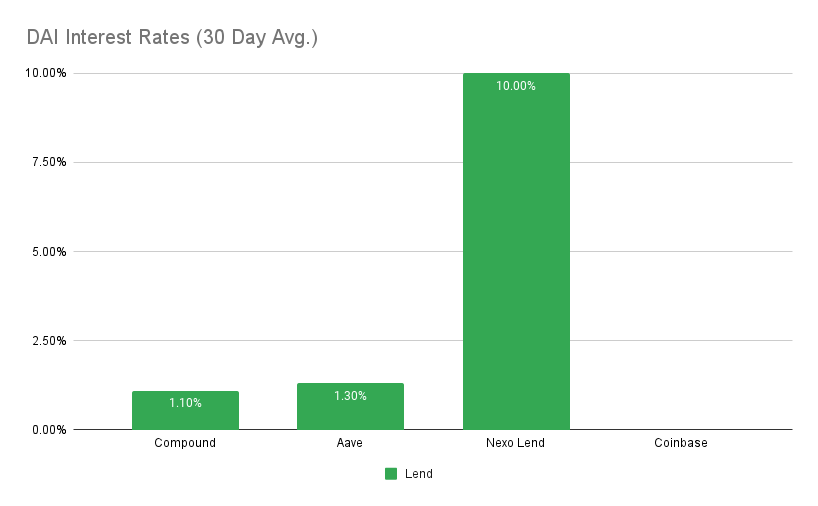

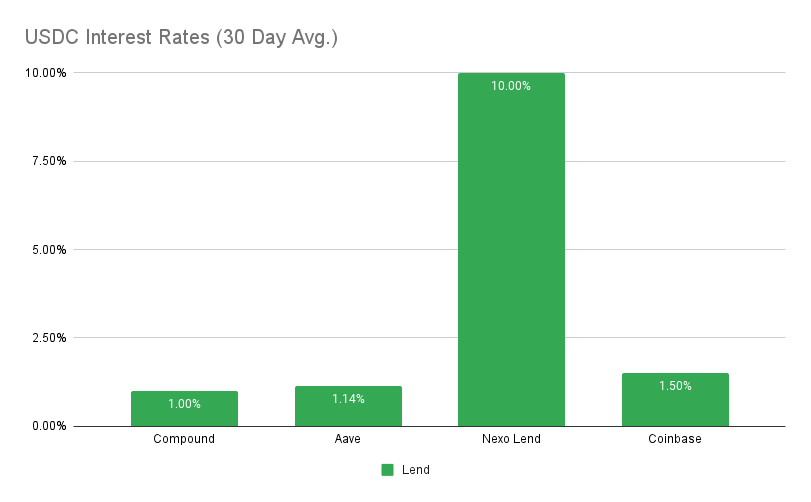

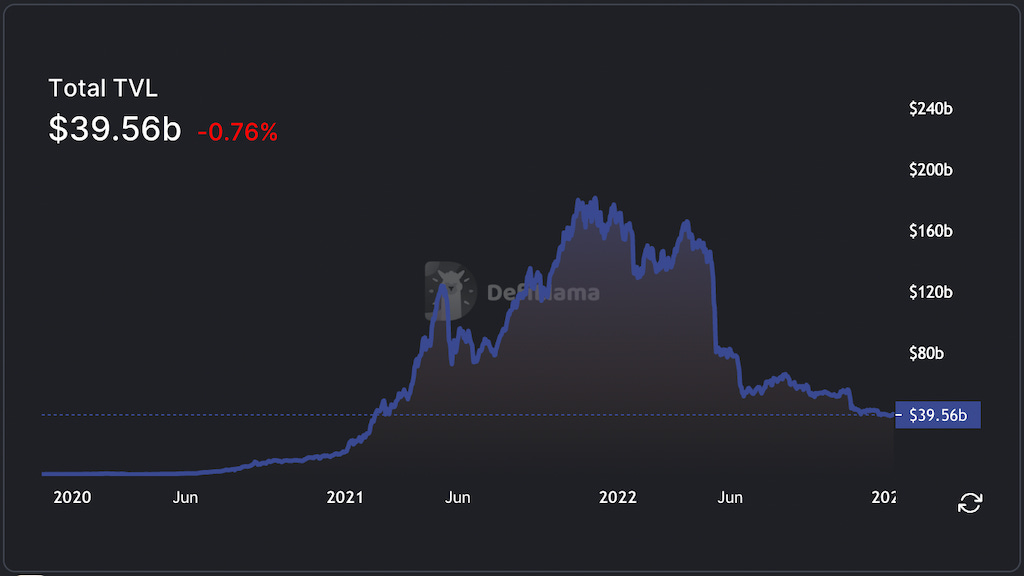

This is 100% correct. It hurts but it’s fact. When you leave your assets on a centralised platform they do not belong to you! Take self custody. It’s not hard. The beginning of 2023 is already driving home the popular adage, “not your keys, not your coins,” as a US judge rules $4 billion of customer assets the property of Celsius due to its terms of use. On top of other centralized platforms attempting to reach resolutions with their customers, Nexo is also finding itself under some scrutiny following Vauld’s acquisition offer rejection – could the platform be in trouble? On the real DeFi side of things, protocols appear to be refining their economic models, as SushiSwap and Convex attempt to revamp tokenomics and/or incentives. What we are seeing appears to be a sharpening of decentralized protocols, as projects improve their efficiency and effectiveness for longevity to get through the bear market. Ethereum staking platforms are also seeing rallies in token prices, as the Shanghai upgrade and enabling of ETH withdrawals becomes a more certain reality in the near future. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesSam Bankman-Fried Pleads Not Guilty To Fraud ChargesNY AG files lawsuit against Alex Mashinsky, alleging he hid Celsius’ 'dire financial condition'Genesis says it needs more time for lending crisis solutionLido overtakes MakerDAO and now has the highest TVL in DeFiStat BoxTotal Value Locked: $39.6B (up 1.8% since last week) DeFi Market Cap: $35.16B (up 3.0%) DEX Weekly Volume: $5.19B (down 4.6%) Bonus Reads[Tom Blackstone – Cointelegraph] – Balancer warns some LPs to remove liquidity ASAP because of a 'related issue' [Mike Truppa – The Block] – DeFiLlama's new DEX Aggregator is showing early signs of adoption [Shaurya Malwa – CoinDesk] – DeFi Tool Convex to Make Changes to Staking Service for Curve Token Rewards [Mike Truppa – The Block] – Security firm Dedaub finds critical vulnerability in Uniswap smart contract |

Older messages

This Week In DeFi – December 30

Friday, December 30, 2022

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

This Week In DeFi – December 16

Friday, December 23, 2022

This week, Binance.US agrees to acquire Voyager Digital, Visa considers StarkNet for automatic payments, Uniswap partners with Moonpay and Senator Toomey introduces a stablecoin bill before retirement

This Week In DeFi – December 9

Friday, December 9, 2022

This week, Maple Finance borrowers owe tens of millions, ConsenSys responds to privacy backlash, SushiSwap looks to boost its treasury and Chainlink launches staking.

This Week In DeFi – December 2

Friday, December 2, 2022

This week, BlockFi files for bankruptcy protection, Uniswap launches its NFT marketplace aggregator, Telegram announces a DEX and wallet, and Apple tries to extort gas fees from Coinbase Wallet.

This Week In DeFi – November 25

Friday, November 25, 2022

This week, the FTX drainer dumps tens of thousands of ETH for BTC, Curve releases its stablecoin whitepaper, and MetaMask users outrage at IP data collection.

You Might Also Like

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏