DeFi Rate - This Week In DeFi – November 25

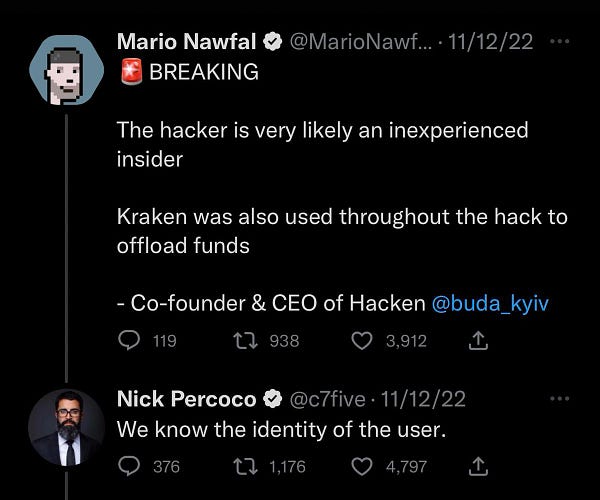

This Week In DeFi – November 25This week, the FTX drainer dumps tens of thousands of ETH for BTC, Curve releases its stablecoin whitepaper, and MetaMask users outrage at IP data collection.To the DeFi community, This week, the FTX drainer account scared the Ether market as it dumped 70,000 ETH for renBTC, also making it apparent that the address was not the Bahamian government – but a hacker instead. There were two primary wallets holding FTX funds, each holding hundreds of millions of dollars; one controlled by Bahamian authorities, and the other a hacker who stole funds at around the same time. At present, it seems that the much larger of the two wallets belongs to the hacker – contrary to what most assumed. As a result, it appears that the hacker is laundering their proceeds through renBTC into mainnet Bitcoin, while the Bahamian government only seized a smaller portion of the exchange’s remaining funds.  1/ I have seen a ton of misinformation being spread on Twitter and in the news about the FTX event so let me debunk the three most common things I’ve seen

“Bahamian officials are behind the FTX hack”

“Exchanges know who the hacker is”

“FTX hacker is trading meme coins”

Curve finally released its stablecoin whitepaper to the public via GitHub, unveiling its new “LLAMMA” mechanism – an automated market-maker designed to smooth-out collateral liquidations in times of volatility. LLAMMA enables the protocol to handle liquidations gradually with collateral price changes, rather than the large “block” liquidations seen in existing stablecoin models. Despite the release, several questions still remain about the stablecoin’s supported collateral assets, its deployment date and more.  Curve launched their stablecoin whitepaper today, called LLAMMA (lending-liquidating amm algorithm)

Been thinking about how lending markets are linked to fickle dex liquidity, LTV params are similar to option pricing

Both brilliant and simple, here's a quick explainer: 🧵

Curve’s stablecoin information release coincided perfectly – perhaps on purpose – with some major volatility in the protocol’s CRV token, which was at the center of a “trading strategy” using Aave. One whale, reported to be Avraham Eisenberg, borrowed tens of millions of dollars’ worth of CRV against USDC on Aave. Eisenberg crashed the price of the token, which later rose dramatically and liquidated the lending position – leaving Aave with $1.6 million in bad debt.  1/ THE HORSEMAN OF #DEFICALYPSE IS HERE!

Yesterday #DeFi markets had an irregular day, as the famous trader @avi_eisen, known for very profitable trades, opened a massive $63M short for $CRV Curve token on @AaveAave.

It did not go well. Keep reading.

👇👇👇

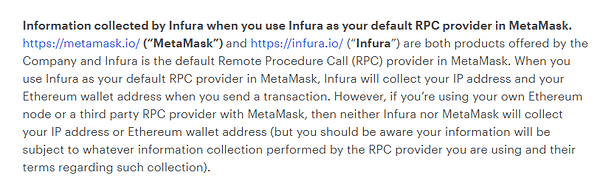

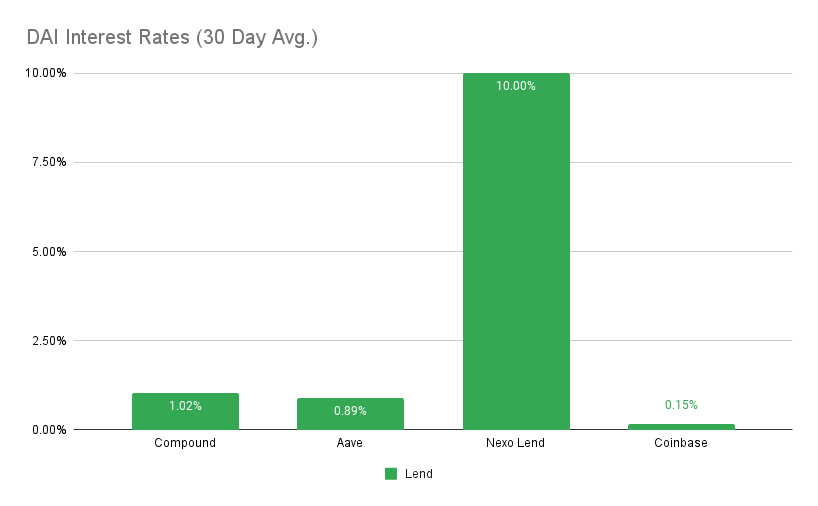

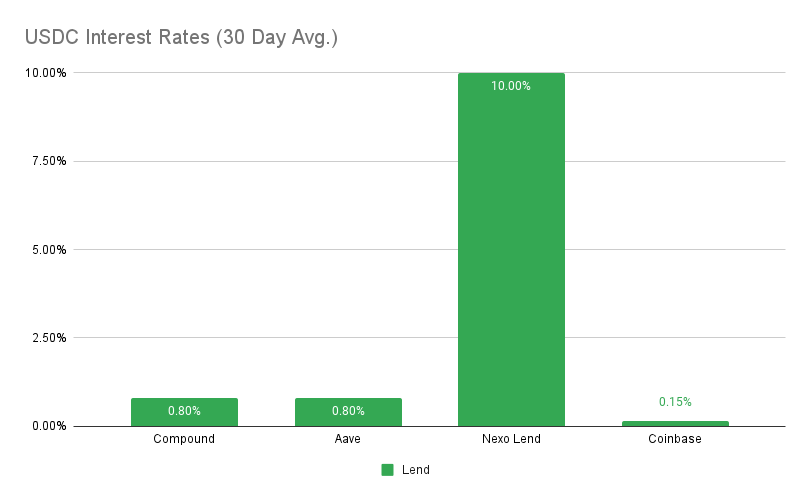

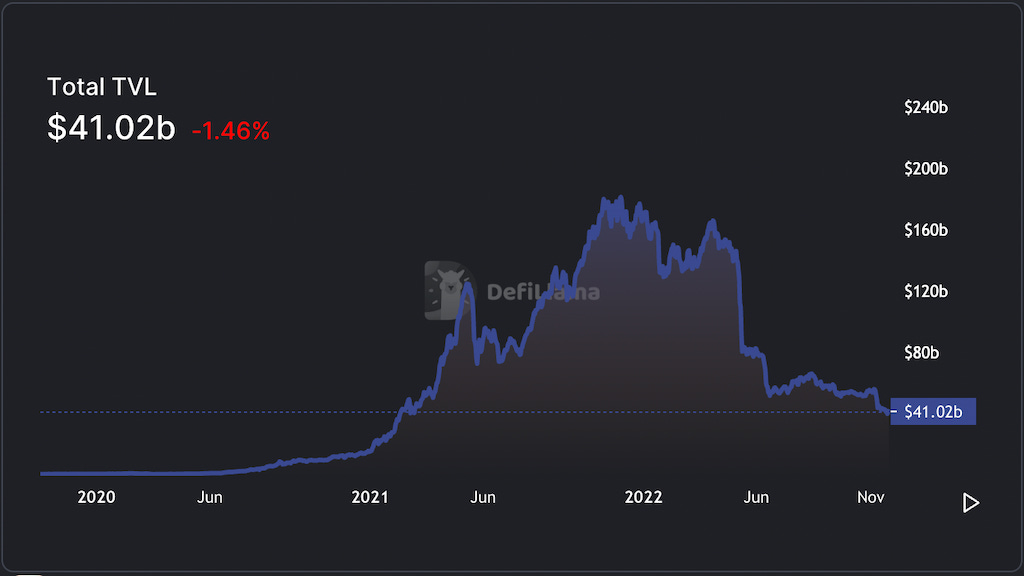

DeFi users are scrambling for alternatives after blockchain company Consensys revealed an update to their privacy policy, affecting the highly-popular MetaMask wallet. ConsenSys disclosed that it is now gathering IP and wallet address data from its users, whenever they make transactions via their Infura remote call procedure service (RPC). Being the default RPC for the Ethereum mainnet, users are highly unhappy with the revelation that they will be involuntarily tracked.  ConsenSys announced an update to its privacy policy on November 23 (including metamask infura and more): When you use Infura as your default RPC provider in MetaMask, Infura will collect your IP address and your Ethereum wallet address when you send a transaction. Centralized finance drama once again overshadows the rest of DeFi, as further threats loom from large entities. This time, Digital Currency Group (DCG) is the at the center of attention, as its subsidiary Genesis seeks urgent funding to keep itself afloat – another victim of FTX contagion. Due to the vast number of crypto sister companies under the DCG umbrella, there is significant concern that Genesis insolvency could spread across these other businesses. The most significant of these is Grayscale Investments, which some fear could end up having to wind down their gigantic institutional trusts: GBTC, ETHE and others. It may be a stretch to suggest it as a possibility, but dissolving such investment vehicles could potentially result in the market being flooded with an extra supply of the most major cryptocurrencies. Unlikely? Maybe. But if FTX has taught us anything, it’s that nothing is impossible in the crypto space. The other key topic at hand this week is privacy, as MetaMask and Uniswap – two of the most popular tools in DeFi – reveal new privacy policies which harvest user data. Users are not happy with the news, which may begin an exodus from the once-favorite platforms. We can expect an increase in DeFi user priority for security and privacy, based on alternative Web3 wallets, RPCs and decentralized exchanges. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.04% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 0.86% APY Top StoriesInvestors Eye Digital Currency Group After FTX’s ImplosionNew York Imposes 2-Year Moratorium on New Proof-of-Work MiningEthereum Foundation To Test Withdrawals of Staked ETHBinance.US to Bid for Crypto Lender Voyager, CZ ConfirmsStat BoxTotal Value Locked: $41.02B (down 4.3% since last week) DeFi Market Cap: $36.86B (down 3.2%) DEX Weekly Volume: $3.2B Bonus Reads[Tarang Khaitan – The Defiant] – Tornado Cash Developer to Remain in Detention for Another Three Months [Vishal Chawla – The Block] – Uniswap's new privacy policy says it collects data tied to user wallets [Mike Truppa – The Block] – ZkSync passes security audit as it gears up to expand access to the public |

Older messages

This Week In DeFi – November 18

Friday, November 18, 2022

This week, more details are revealed about the FTX collapse, Genesis and Gemini suspend redemptions for some users, users flock to safety in DeFi and StarkWare deploys $STRK.

This Week In DeFi – November 11

Friday, November 11, 2022

This week, FTX and Alameda Research go under, BlockFi halts customer withdrawals, Solana takes a huge hit and Wintermute's Bebop DEX launches on Polygon.

This Week In DeFi – November 4

Friday, November 4, 2022

This week, Meta officially integrates Polygon, Solana and Arweave for NFTs, Alameda Research worries some with its financials, and GALA has a $2B hack-scare.

This Week In DeFi – October 28

Friday, October 28, 2022

This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.

This Week In DeFi – October 14

Friday, October 21, 2022

This week, Aptos goes live and airdrops 20M APT, Frax Finance announces liquid staking, Edge Capital Management raises $67M for DeFi funds and Ripple plans an EVM sidechain.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏