DeFi Rate - This Week In DeFi – December 2

This Week In DeFi – December 2This week, BlockFi files for bankruptcy protection, Uniswap launches its NFT marketplace aggregator, Telegram announces a DEX and wallet, and Apple tries to extort gas fees from Coinbase Wallet.To the DeFi community, This week, crypto lender BlockFi has filed for Chapter 11 bankruptcy protection. The firm's bankruptcy petition claims that it has over 100,000 creditors and assets and liabilities between $1 billion and $10 billion. The largest creditor is Ankura Trust Company, which has an unsecured claim of around $729 million. Other named creditors are FTX US and the Securities and Exchange Commission, with unsecured claims of $275 million and $30 million respectively. BlockFi has $256.9 million in cash on hand which is expected to provide sufficient liquidity to support operations during the restructuring process.  Today, BlockFi filed voluntary cases under Chapter 11 of the U.S. Bankruptcy Code.

businesswire.com/news/home/2022…

Uniswap Labs has officially launched its new NFT marketplace aggregator, bringing together NFTs for sale on OpenSea, X2Y2, LooksRare, Sudoswap, Larva Labs, X2Y2, Foundation and NFT20. Developers have been working on the product since June, when it purchased NFT aggregator Genie as part of expansion efforts to include NFTs and ERC-20 tokens among its products. The launch comes with some $5 million worth of USDC airdrops for eligible historical Genie users.  1/ NFTs are officially live on Uniswap!! 🎨🦄

Starting today, you can trade NFTs across major marketplaces to find more listings and better prices.

We're also airdropping ~$5M USDC to historical Genie users

& offering gas rebates to the first 22,000 buyers.

Telegram CEO Pavel Durov has announced that the popular messaging platform will build a decentralized exchange and non-custodial wallets that could reach millions of users. The statement is the first confirmation of Telegram's direct involvement in integrating TON blockchain into its messenger app. Telegram has also recently successfully sold $50 million in usernames for its platform via its blockchain-based auction platform, Fragment.  Durov, Telegram CEO, which has 600 million users, said that Telegram's next step is to build a set of decentralized tools, including non-custodial wallets and decentralized exchanges to securely trade and store cryptocurrencies, to fix the wrongs caused by centralization like FTX

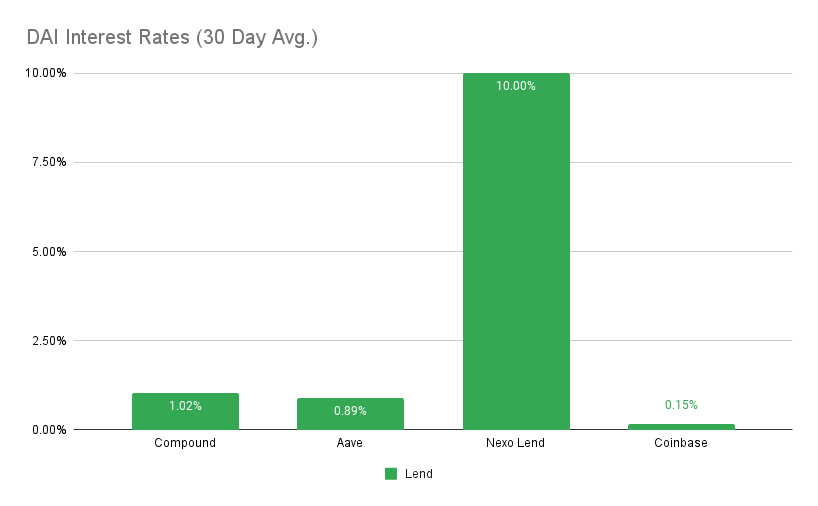

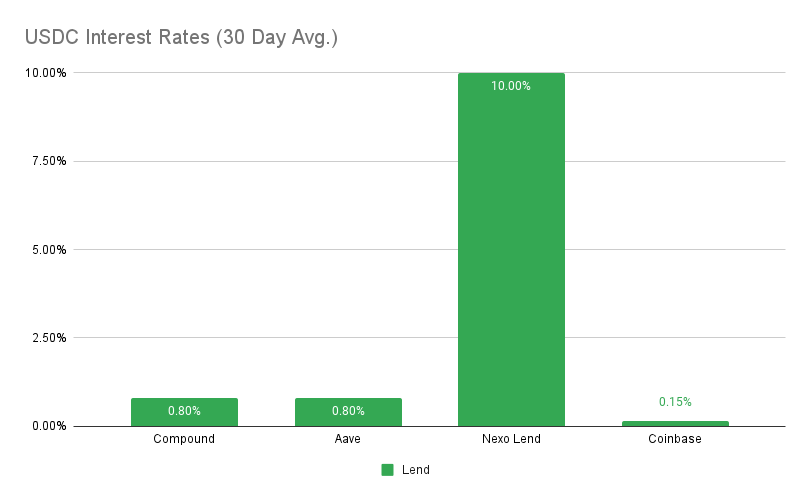

Apple has blocked the latest version of Coinbase Wallet on iOS, demanding that the gas fees associated with token transfers be paid via its in-app purchase system – a rule that intends to enable Apple to take a 30% cut of those fees. Due to the fact that blockchain gas fees are completely incompatible with Apple’s in-app purchase system, Coinbase Wallet has no choice but to disable the feature to remain in the App Store. This is likely to be a blow to NFT use within iOS-based web3 applications.  You might have noticed you can't send NFTs on Coinbase Wallet iOS anymore. This is because Apple blocked our last app release until we disabled the feature. 🧵 Centralized parties once again dominate DeFi news this week, with a variety of impacts from notable entities. Still lingering over our heads is FTX and its contagion, with BlockFi becoming the latest confirmed casualty. The firm was one of the last major centralized entities offering interest payments on crypto deposits, with only Nexo and Coinbase remaining. Nexo may draw red flags for some, with its consistently high annual returns of 10% on stablecoins – in comparison to just a mere 1% or so on decentralized platforms. ‘FTX itself may soon be probed by the Department of Justice – an inquisition that may appear to be well overdue for some, who still see founder and ex-CEO Sam Bankman-Fried unpunished for alleged fraud. Apple inflicting its somewhat-extortive policies on the DeFi world, this time seeking a portion of gas fees from Coinbase Wallet NFT transfers on iOS. Whether or not the policy remains in place may have a strong and lasting impact on the viability of many web3 iOS apps. One positive story that has arisen is Russia’s Sberbank making Ethereum and MetaMask integrations with its own proprietary blockchain platform, illustrating an embrace of new technology by the traditional finance sector. The integration will make it easy to deploy smart contracts on both the private platform and the public Ethereum blockchain. On the true DeFi side, we are witnessing a significant de-risking movement by lending platforms as they modify parameters in a low-liquidity market. Compound is placing borrowing caps on 10 assets, while Aave has rushed to freeze lending markets for more than a week to prevent exploits. The move appears to have been sparked by the recent market manipulation of Curve’s CRV, which left Aave with seven figures of bad debt. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.04% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 0.85% APY Top StoriesDOJ asks for independent probe into FTX bankruptcy, a likely tactic to gather evidence on alleged fraudRussia's Sber bank integrates Metamask into its blockchain platformCompound Caps Borrowing Levels for 10 Assets to Reduce RiskAave temporarily freezes lending markets to fend off further attacksStat BoxTotal Value Locked: $42.61B (up 3.9% since last week) DeFi Market Cap: $36.26B (up 6.5%) DEX Weekly Volume: $9B Bonus Reads[Vishal Chawla – The Block] – MakerDAO is voting on increasing yield for the dai stablecoin [Samuel Haig – The Defiant] – Hacker Makes Off With Millions After Minting Six Quadrillion of Ankr’s BNB Staking Tokens [Callan Quinn – The Block] – WEF denies it asked Shiba Inu to work with them on metaverse global policy [Tim Copeland – The Block] – Polygon bridge holds $27 million of unclaimed funds, ZenGo finds |

Older messages

This Week In DeFi – November 25

Friday, November 25, 2022

This week, the FTX drainer dumps tens of thousands of ETH for BTC, Curve releases its stablecoin whitepaper, and MetaMask users outrage at IP data collection.

This Week In DeFi – November 18

Friday, November 18, 2022

This week, more details are revealed about the FTX collapse, Genesis and Gemini suspend redemptions for some users, users flock to safety in DeFi and StarkWare deploys $STRK.

This Week In DeFi – November 11

Friday, November 11, 2022

This week, FTX and Alameda Research go under, BlockFi halts customer withdrawals, Solana takes a huge hit and Wintermute's Bebop DEX launches on Polygon.

This Week In DeFi – November 4

Friday, November 4, 2022

This week, Meta officially integrates Polygon, Solana and Arweave for NFTs, Alameda Research worries some with its financials, and GALA has a $2B hack-scare.

This Week In DeFi – October 28

Friday, October 28, 2022

This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.

You Might Also Like

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏