DeFi Rate - This Week In DeFi – December 9

This Week In DeFi – December 9This week, Maple Finance borrowers owe tens of millions, ConsenSys responds to privacy backlash, SushiSwap looks to boost its treasury and Chainlink launches staking.To the DeFi community, This week, uncollateralized lending protocol Maple Finance has seen Orthogonal Trading default on $36 million of loans – representing almost one-third of active loans across the platform. $31 million were in the M11 USDC pool, resulting in about an 80% loss for users lending to that particular pool. The other $5 million was in the Maven M11 WETH pool, which took a 17% loss. No other pools were directly affected. Orthogonal Trading defaulted due to having funds tied up in FTX before the exchange’s collapse, despite only claiming to have minor exposure to the exchange in November. Maple Finance has since severed its relationship with the company. Another borrower, Auros, has also missed a loan payment of 2,400 WETH worth $3.1 million.  On December 3rd, Orthogonal Trading informed us that due to funds held on FTX, they incurred a much larger loss than previously disclosed to us, and will not be able to repay loans or uphold their obligations as a borrower.

link.medium.com/6p58SPmQvvb

1/3 ConsenSys, the company behind MetaMask and Infura, has made a series of clarifications and plans addressing the backlash received by users over recent privacy concerns. The firm explained that it would only collect wallet and IP address data when transactions were made, but not when “read” requests are performed (e.g. to check account balances). It also stated that the infrastructure cannot stop logging IP addresses entirely, but would stop linking it directly to transaction data. ConsenSys also claims that it will be rolling out a new “advanced settings” page on MetaMask that will enable users to choose their own RPC provider at onboarding – rather than using the default Infura provider currently used.  We are committed to protecting the privacy of MetaMask users. Last month, the ConsenSys privacy policy update raised questions and misconceptions.

We heard you, went to work, and would like to share some important clarifications and updates 🧵👇

consensys.net/blog/news/cons… Decentralized exchange SushiSwap and its Sushi suite of DeFi products may have its future in danger, as the project faces “a significant deficit” in funding via its Treasury. CEO Jared Grey stated in a governance proposal that the current Treasury provides only for around 1.5 years of runway for operations, proposing “immediate action” to ensure sufficient resources for uninterrupted operation. The proposal involves increasing the “Kanpai” Treasury allocation to 100% of fees, effectively diverting fees from xSUSHI stakers to the treasury for operations. The reallocation of fees is proposed “for one year or until new tokenomics are implemented.”  As promised, here's my thread on the Sushi Kanpai proposal, why it's essential to the fiscal security of Sushi, and how Sushi's upcoming tokenomics helps bring realignment of value to its core customers, LPs, securing the DEX for the future. 1/ Leading oracle service Chainlink has introduced support for the beta version of its staking service. The service allows LINK holders to earn a native yield for the very first time. To participate in staking, token holders must lock up their LINK tokens in Chainlink's smart contracts to back performance guarantees for the protocol's oracle services. The initial staking pool will be capped at 25 million LINK, or around 5% of the token's circulating supply. The cap will be increased to 75 million over time.  General Access to Chainlink Staking v0.1 is now open! Stake your #LINK and earn rewards for helping secure the Chainlink Network and the broader Web3 Ecosystem.

Start staking today to secure your spot 👇

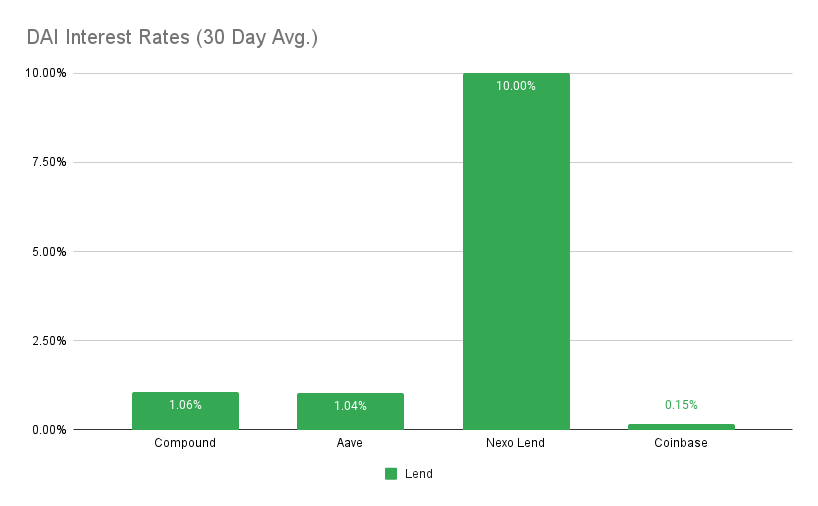

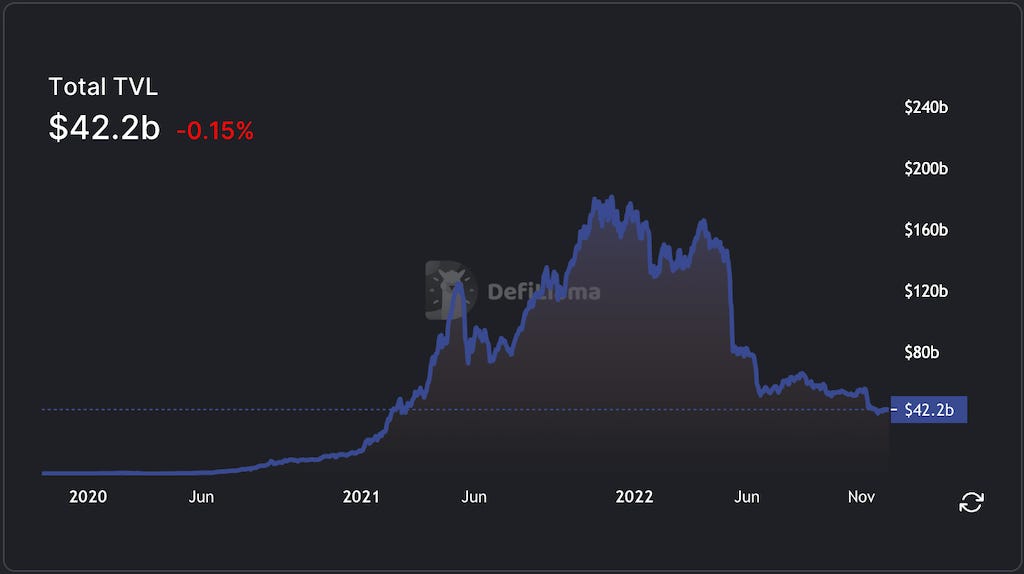

staking.chain.link Centralized points of failure once again weigh down Defi this week, this time as Maple Finance sees defaults on tens of millions in loans from its users. Orthogonal Trading has been accused of misrepresenting its risk exposure, leading to large losses for lenders – highlighting the human faults that true DeFi attempts to avert. On a more positive note, billions in funding has still poured into DeFi over Q3 – a 24% drop, but still a pleasant surprise in terms of investor confidence in the sector among the collapses of several major [centralized] entities. User-friendliness and privacy is seeing some positive progression, as Ledger releases its new “Stax” device, designed by no other than iPod inventor, Tony Fadell. MetaMask provider ConsenSys has also facilitated some better privacy-preserving options following backlash over storing user data. Although a lot of dust still needs to be settled from this year’s failures, it appears that DeFi is developing into its best form yet. Some dubious centralized entities still must collapse, however we’re well on our way to a more resilient, independent ecosystem. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.06% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 1.0% APY Top StoriesStablecoin Issuer Circle Cancels Plan to Go PublicAave Companies Acquires Social Metaverse Developer SonarLedger debuts new device designed by iPod inventor Tony FadellDeFi and Web3 Startups Attract $3B in Funding in Third QuarterStat BoxTotal Value Locked: $42.2B (down 1.0% since last week) DeFi Market Cap: $38.9B (down 0.9%) DEX Weekly Volume: $6.30B (down 30%) Bonus Reads[Lyllah Ledesma – CoinDesk] – Grayscale, in the Spotlight as GBTC Discount Widens, Says DeFi Fund Now Trading [Osato Avan-Nomayo – The Block] – 1inch tokens worth over $100 million set to be unlocked by Dec. 30 [Owen Fernau – The Defiant] – UNI Surges After ‘Fee Switch’ Vote is Proposed [Yogita Khatri – The Block] – DeFi derivatives protocol Perennial raises $12 million, launches mainnet |

Older messages

This Week In DeFi – December 2

Friday, December 2, 2022

This week, BlockFi files for bankruptcy protection, Uniswap launches its NFT marketplace aggregator, Telegram announces a DEX and wallet, and Apple tries to extort gas fees from Coinbase Wallet.

This Week In DeFi – November 25

Friday, November 25, 2022

This week, the FTX drainer dumps tens of thousands of ETH for BTC, Curve releases its stablecoin whitepaper, and MetaMask users outrage at IP data collection.

This Week In DeFi – November 18

Friday, November 18, 2022

This week, more details are revealed about the FTX collapse, Genesis and Gemini suspend redemptions for some users, users flock to safety in DeFi and StarkWare deploys $STRK.

This Week In DeFi – November 11

Friday, November 11, 2022

This week, FTX and Alameda Research go under, BlockFi halts customer withdrawals, Solana takes a huge hit and Wintermute's Bebop DEX launches on Polygon.

This Week In DeFi – November 4

Friday, November 4, 2022

This week, Meta officially integrates Polygon, Solana and Arweave for NFTs, Alameda Research worries some with its financials, and GALA has a $2B hack-scare.

You Might Also Like

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏