The eCoinomics Team - January 2023, #2.

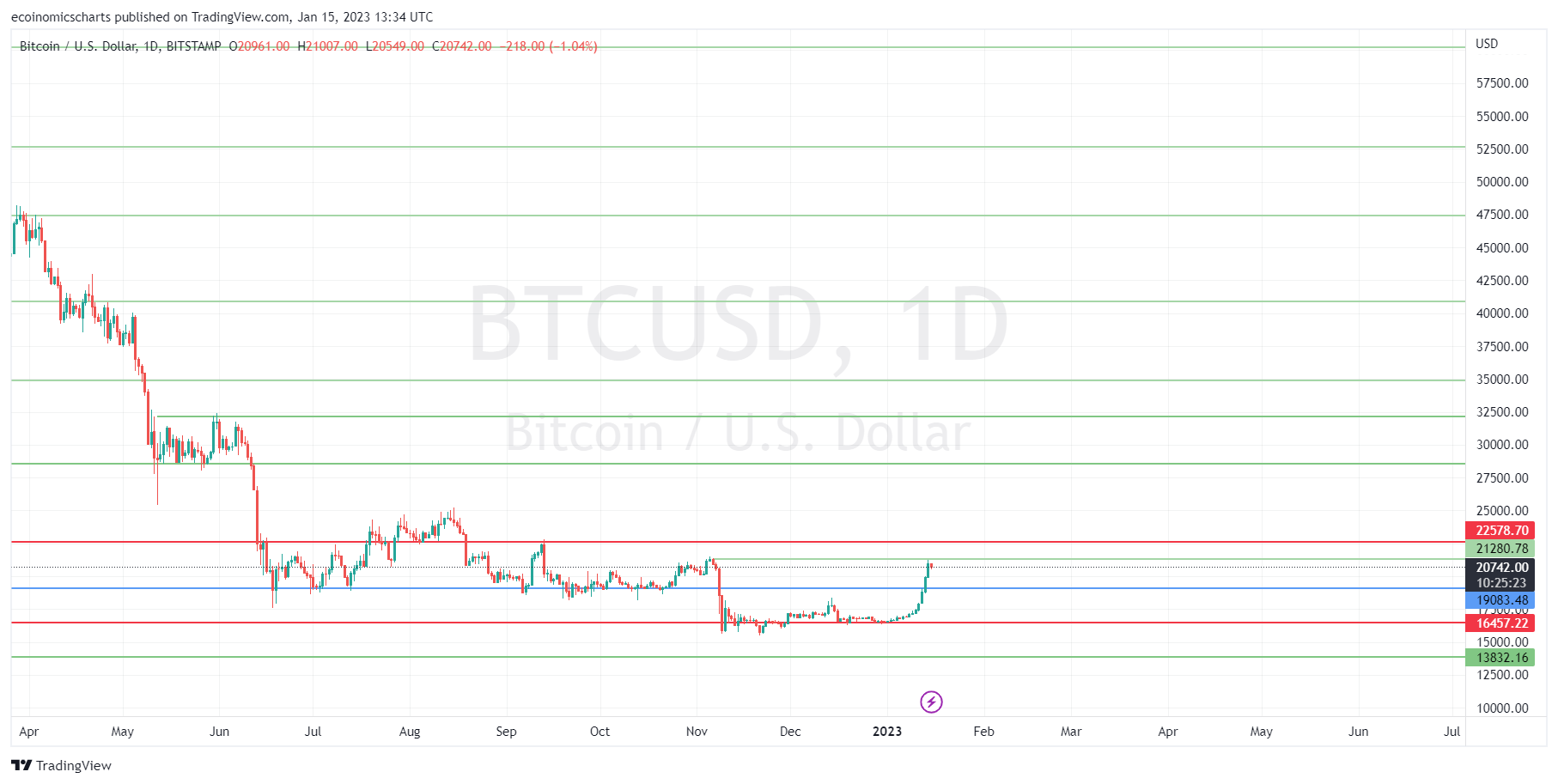

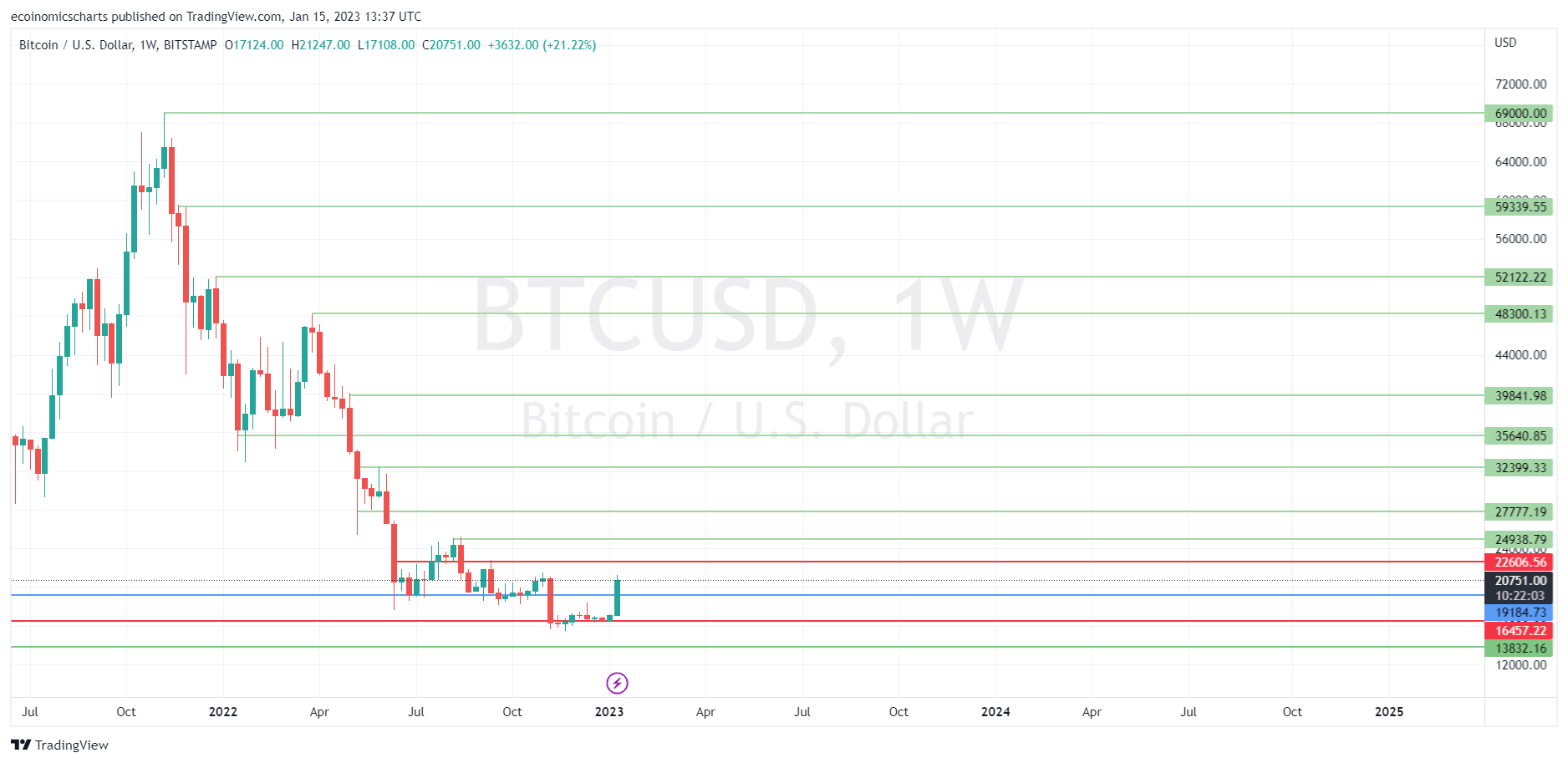

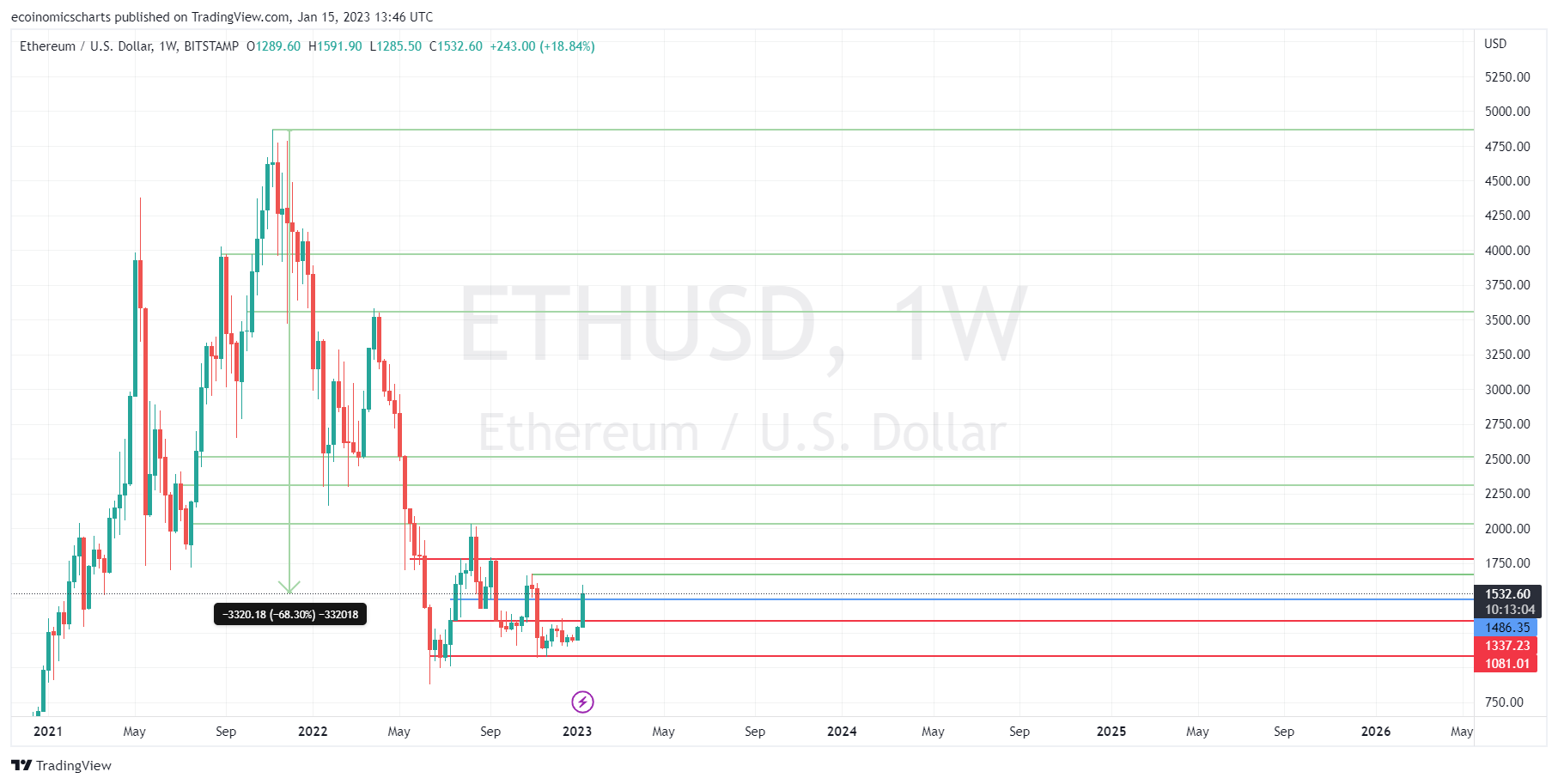

This Week. 1. Majors breakout. (📈) 2. Where do yields come from? (And when to fade them 🙅🏾♂️) 3. FTX Pre-Mortem by SBF. (Same old, a new medium 🥱) 4. The Next Stage of Crypto Airdrops. (How projects reward early adopters 🧧) 5. NFT Alpha for 2023 (🐵) Bitcoin/USDBitcoin (virtually every crypto token) made a new high this week. Inflation further cooled to 6.5% YoY according to the latest CPI data renewing hopes that the Fed will increase interest rate by only 25bps in its December meeting. Traders have taken a risk-on attitude following the news leading Bitcoin to break multi-timeframe resistance at $19,000 with ease and volume. $25,000 is now on the table. But first, $22.5k. Bitcoin will have to break the $21,300 local resistance and hold to confirm continuation. Alternatively, Bitcoin may retest the $19,000 level as support if multiple daily close below $21,000. Most of the buying pressure that we have seen have mainly occurred during the Asian session. As long as they continue to bid, the $21,300 resistance level should be flipped. From a R:R perspective, fresh longs at this level don’t give us a good risk:return. We will enter longs if $19k support is tested, and short $22.5k. Ether/USDThe $1,300 level has finally been defeated after multiple weeks of sideways price action. The prior all-time high level at 1,400 level wasn’t spared either with Ether making a weekly high of $1,591. The next resistance level where we would be looking to short is the $1,660 level with a tight stop loss at +3%. $1,300-$1,400 will serve as our support level where we will look to enter fresh longs. As previously mentioned, rally is being driven during the Asian session roughly between 11AM-4AM Nigerian time. We will continue to pay keen attention to this. When HongKong stops bidding, we’ll be more biased towards a retest of the $1,300-$1,400 level rather than a continuation to $1,680-$1,770 resistance level. Where do yields come from?In light of recent events in the crypto market that have largely led to many retail investors losing their life savings in the implosion of centralized financial services (CEFI) like Celsius, BlockFi, and Voyager, due to the contagion of TerraUSD/LUNA de-pegging, it begs the question: where do yields come from in crypto? Prior to the events that led to the suspension of withdrawal and ultimately bankruptcy filings by several crypto CeDeFi companies, many of these platforms promised juicy yields and high APR to depositors that are generally larger than what traditional brick-and-mortar banks or financial services offer. As the saying goes, if you don't know where the yields come from, you are the yield. As we have come to learn in recent court filings and exposés, some of these CeDeFi services engaged in uncollateralized lending to high-risk counter-parties and leverage trading/investments with user funds without disclosure or proper risk management practices that would have prevented high drawdowns during volatile market conditions. For any platform promising high yields/APR, it is within the reasonable context of caution to question where those yields are coming from and how sustainable they are because of hidden risks. In crypto, there are various ways yields are generated. Below are some of the most common ways in which yields are generated in a somewhat sustainable manner. Yields can come in the form of rewards and incentivization of Liquidity Providers (LP). These sets of users/individuals are generally referred to as LPs in DeFi. They help provide liquidity in the form of stablecoins or volatile assets to be locked into a pool for those who may want to trade or make swaps on that pair on a DeFi protocol. Part or all fees paid by protocol users during trades or swaps and other fees generated during protocol activities are shared with liquidity providers depending on the governance design. Due to the demand for leverage in crypto by retail traders, user assets in custody of CeFI/CeDeFi platforms are lent out to margin traders/borrowers at higher interest rates, from which a part of it is offered back to depositors as yields (FTX/BlockFi). In a practical sense, borrowers are required to post collateral in order to access these loans, which are available on both centralized and decentralized exchanges and yield-bearing platforms like Anchor, Celsius, BlockFi, and Voyager. However, the large failure of these centralized entities in 2022 was due to their failure to handle counterparty risk, as well as offering these loans to uncollateralized/undercollateralized borrowers coupled with nonexistent due diligence, which ultimately led to their bankruptcies. On the other hand, DeFi platforms like Aave, Compound, MakerDAO, and Venus are better placed to efficiently work without trust assumptions since they use self-executing smart contracts that are hardcoded into the protocol and can liquidate borrowers' assets if they fail to repay their loans, thereby curtailing the contagion of counterparty risk, which eventually wiped out the savings of depositors on CeDeFi services. Another very common source of yield in crypto is staking rewards. This is mostly generated through the protocol that the native asset is staked on. These staking rewards are usually emitted in the native assets, and stakers are rewarded for supplying assets either to protect the network, as is the case on a Proof of Stake (PoS) consensus network, or for supplying assets to provide liquidity and earn a percentage of the network rewards. Staking rewards from protocols/networks usually start off as high yields/APR, but eventually dwindle down as more tokens are emitted according to each epoch in the protocol tokenomics design. In conclusion, the next time you see a CeDeFi service advertising and offering high yields/APR on their platform, first ask yourself: where are the yields coming from, are they sustainable, and what are the risks (counterparty, smart contract, arbitrage, and regulatory) that are involved, before committing to locking your money into it.

FTX Pre-Mortem by SBF.This Sam Bankman-Fried’s piece addresses the FTX bankruptcy. According to Bankman-Fried, Binance's CEO's fast and deliberate targeted actions led to the insolvency of Alameda research. According to Bankman-Fried, FTX US is still totally viable and is able to make all current clients whole, and also theorised that a very significant recovery is still feasible. And he’s willing to help as ever. Read the piece by clicking on the topic. The Next Stage of Crypto Airdrops.When done correctly, airdrops can help drive new user growth, retention, and increase TVL (Total Value Locked.) This article analyzes the present airdrop strategy and how it can be improved to deliver value to the projects conducting these airdrops. Improvements to airdrops could include implementing a schedule, basing distribution on reputation, promoting behavior loops, and prioritizing project loyalty. As users looking to invest in crypto by taking advantage of airdrops, it’s important to learn how airdrops might be conducted in the future. Read the piece by clicking on the topic. NFT Alpha for 2023Blue chip NFTs are currently down across-the-board. This piece details alpha on the ones which could hold the most value this year that NFT investors can buy at giveaway prices currently. Read the piece by clicking on the topic. Thank you for reading. For comments, feedback and ad inquiries, kindly write to us at ecoinomicsweekly@gmail.com. Groovy and Oloye for CryptoRoundUpAfrica ®️ 🔌 Join Telegram community. 👈🏾 Follow us on Twitter. 👈🏾 Like us on Facebook. 👈🏾 Connect on LinkedIn. 👈🏾 Till next time… |

Older messages

January 2023, #1.

Saturday, January 7, 2023

Is the worst over in the crypto markets? 6 things to pay attention to in 2023. 13 narratives to watch out for and some to avoid this year.

December 2022, #1.

Monday, December 5, 2022

This week. Bitcoin and Ether v USD. (Squiqqly lines on a chart 📈) Have a Fed-ry good Xmas. (Santa Jerome Powell Claus 🎅🏽) Contago Extraordinaire. (BlockFi bites the dust 💥) The future is multi-chain. (

November 2022, #3.

Sunday, November 20, 2022

This week we discuss BTC and Ether/USD price action. Is the bottom in? An insider's account of what went down at now bankrupt FTX/Alameda. Nike NFTs marketplace and Yuga Labs acquires WENEW.

November 2022, #2

Saturday, November 12, 2022

This week... (do we even need to do this?) You already know what we are most likely to write about. Except you have been living under a rock. 😑

November 2022, #1

Saturday, November 5, 2022

This week, we discuss BTC/USD and ETH/USD areas of interest. The Fed v inflation. What is Web3? Some tokens we expect to benefit from the World Cup in Qatar and make the case for Polygon (MATIC).

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏