The eCoinomics Team - November 2022, #2

November 2022, #2This week... (do we even need to do this?) You already know what we are most likely to write about. Except you have been living under a rock. 😑This week.

BTC/USDTbh, focusing any amount of effort on technicals this week feels like a waste of time. Bitcoin isn’t at the price it is right now due to a bunch of degenerates drawing squiggly lines on a chart. No, that’s not how we got here. How we got here is better described by the short clip below. Got it? No? Okay, here’s another one. 😑 Get the point now? Good! 👍🏽 Does that mean technical analysis is useless right now? Not so fast. It'll still help us to identify the HTF demand and supply zones for Bitcoin/Dollar. We marked our areas of interest in red lines in the charts attached above. Below the current price: $14,000 region is a good demand zone. Above the current price: Reclaim of the $19,000 region as support will signal bullish continuation especially since we got fundamentally bullish news from CPI data this month. More on this later. ETH/USDAreas of interest. (last week)

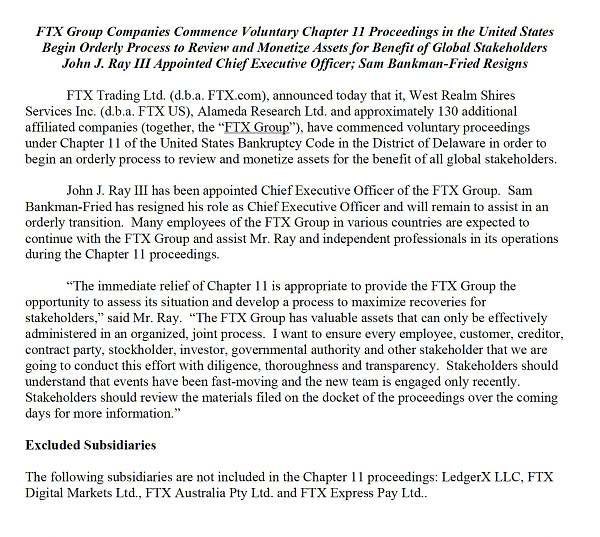

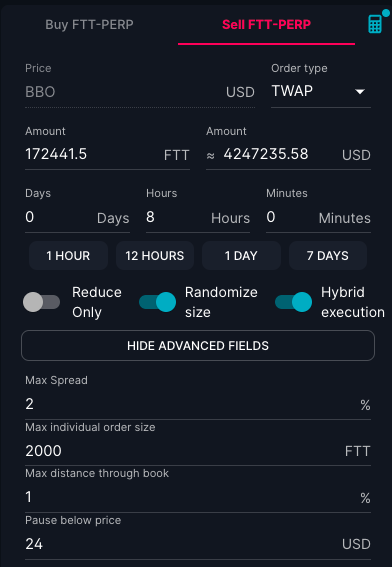

This week is the same, baring any delayed contagion from the ongoing FTX bankruptcy proceedings. 2. Fed v Inflation. (6 mins read)Last week, we discussed some of our thoughts on the macroeconomic environment and how it affects your favourite crypto Ponzi tokens. According to the latest report from the Bureau of Labor Statistics, the consumer price index (CPI) increased by 7.7% in October, which was lower better than expected. This is good news. It means there’s now a real possibility of a Fed pivot from hawkish tightening to dovish tightening. Last month came in at 8.2% for comparison. It’s still far from the target of 2% that the Fed has set for itself, but it means whatever chairman Powell and the other Fed humans =- A pivot will signal increased spending and taper the risk off attitude most traders are taking to the market now due to Fed tightening. Read more by clicking on the topic. (All underlined/green words are links for a deeper dive into the topic.) 3. The rise an fall of a crypto empire.In the beginning,God said let there be light, and there was light, and he saw that the light was good and, probably out of boredom, decided to try his hands at more things. And then came humans, and several civilizations later then came Sam Bankman-Fried. And that’s the beginning of our story. In 2017, an MIT genius - That was his claim to fame as far as crypto is concerned. In the same year, he launched his crypto research and trading firm Alameda research. In 2019, he launched FTX, a crypto exchange. Here is a history of FTX since its foundation in 2019. (3 mins read)At its last fund-raising event in January, where it raised $400m, FTX was valued at $32B. Today, that valuation is ZERO. “One minute, you’re the cock of the walk, the next minute, you’re the feather duster.” -Piers Morgan. In summary: The nice lady you see in the image above is none other than the charming Caroline Ellison who now holds the world record for the fastest time anyone has burnt through $10 billion. Congratulations to her. How did FTX get here?I already mention the two companies involved in this destruction of wealth. Alameda and FTX. Alameda is a trading company and FTX.com is a crypto exchange. Founded by the same person and run by a tight knit of wunderkids. Alameda and FTX were interconnected. Related parties. Alameda probably got burnt in any of the several crypto meltdowns that happened this year. In response, FTX dipped into user deposits to bailout Alameda. This put a dent in the balance sheet of FTX. And once the its biggest competitor’s CEO sounded the alarm, it induced a bank run which led to the insolvency of the company as those deposits had been diverted against the terms of service that users signed up for. How FTX’s relationship with Alameda became its poisoned chalice. (5 mins read)We all know what it’s like to have a demanding partner. Sometimes, the people you love the most get in trouble and you have to bail them out. Yeah, it’s exactly like that. Except for a lot of people got made love to in places they don’t like getting made loved to in.😖 FTX bailed Alameda out up to the tune of $10B using customer deposits which were about $16B. This invariably led to its downfall fall. One can argue it was only a matter of time. We reported in our October newsletter how FTX recorded “record liquidations". One can assume their only plan to make it back was liquidating customers at never seen rates. Someone was bound to say something in time. Bankman-Fried’s Cabal of Roommates in the Bahamas Ran His Crypto Empire – and Dated. Other Employees Have Lots of Questions. (3 mins read)I don’t know what this article means by “lots of questions.” I have zero. All this makes absolute sense. A bunch of socially awkward wunderkids got together, dated each other, started a company together, became roommates, and then burnt through $32B of value. I am not sure which part of that is supposed to be confusing. Passion is a consuming fire. The romantics would understand. Anyway, we have gotten to the end of our story for now. It ends like all the best passionate love stories end. In ruins, leaving a trail of victims in its path. 4. USDT v NGN.The Central bank of Nigeria has been trying to “arrest” the perpetual fall of the naira and seem to have finally succeeded by failing at it. The CBN governor, fondly called “Meffy,” has threatened everybody and everything but in the end, all he had to do was wait for a crypto exchange valued at $32 billion to fail which will cause a bank run on Tether (USDT) and other stable coins as users scrambled to be safe in Naira (NGN) in the case of further contagion. The USD/NGN rate has fallen from a high of N900/$1 to currently trading around N700 as crypto traders fought to front run each other in the struggle for safety. Although the black market continues to trade at N845/$1. 😵💫 5. Relocked Solana (SOL) tokens. (2 mins read)A record amount of SOL tokens were due to be unstacked. It was evident from the mood of the market following the fall of FTX’s House Of Cards that it was going to be a bearish unlock for Solana as stakers will look to sell first, and ask questions later. Solana is tied to FTX in many ways. A high percentage of the balances, debts and collateral on FTX’s books were locked and unlocked SOL tokens. The expectation was that FTX will dump their tokens the moment they got their hands on them to raise liquidity. In the end, none of that happened as SOL gained 27% post-unlock. “The foundation had tweeted late Wednesday that about 28.5 million SOL tokens scheduled to be unstaked had been re-staked due to a policy change of cloud service provider Hetzner on Nov. 2.” - Coindesk. But is SOL safe considering how tied it is to the FTX ecosystem? This thread doesn’t think so. 🙆🏽♂️ 6. The man who saw the future.He saw it all coming.  Im taking all of my capital out of @FTX_Official and going short $FTT 📉

FTX has been swinging and missing all year long on so many activations

AND

Something shady is going on at FTX.

Here's 12 reasons why I'm completely out on the FTX mafia and @SBF_FTX: 🧵👇

[1/20] Check the date on the thread. Thank you for reading. For comments and feedback, please write to us at ecoinomicsweekly@gmail.com. Groovy and Oloye for CryptoRoundUpAfrica ®️ Shameless 🔌 Follow us on Twitter. Like us on Facebook. Connect on LinkedIn.

|

Older messages

November 2022, #1

Saturday, November 5, 2022

This week, we discuss BTC/USD and ETH/USD areas of interest. The Fed v inflation. What is Web3? Some tokens we expect to benefit from the World Cup in Qatar and make the case for Polygon (MATIC).

October 2022, #1

Friday, October 28, 2022

Welcome back, welcome back, welcome baaack. - Mase.

“Sorry for the break in transmission, we rebranded.”

Thursday, October 20, 2022

nu brand, who dis? 😋

January 2022, #1

Friday, January 14, 2022

We discuss the majors' limp into 2022 and upcoming token unlocks schedule for some crypto projects.

eCoinonomics Crypto Report and 2022 Theses.

Saturday, January 1, 2022

Trends, narratives, sectors and tokens we think will dominate 2022.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏