The eCoinomics Team - November 2022, #1

November 2022, #1This week, we discuss BTC/USD and ETH/USD areas of interest. The Fed v inflation. What is Web3? Some tokens we expect to benefit from the World Cup in Qatar and make the case for Polygon (MATIC).This week.

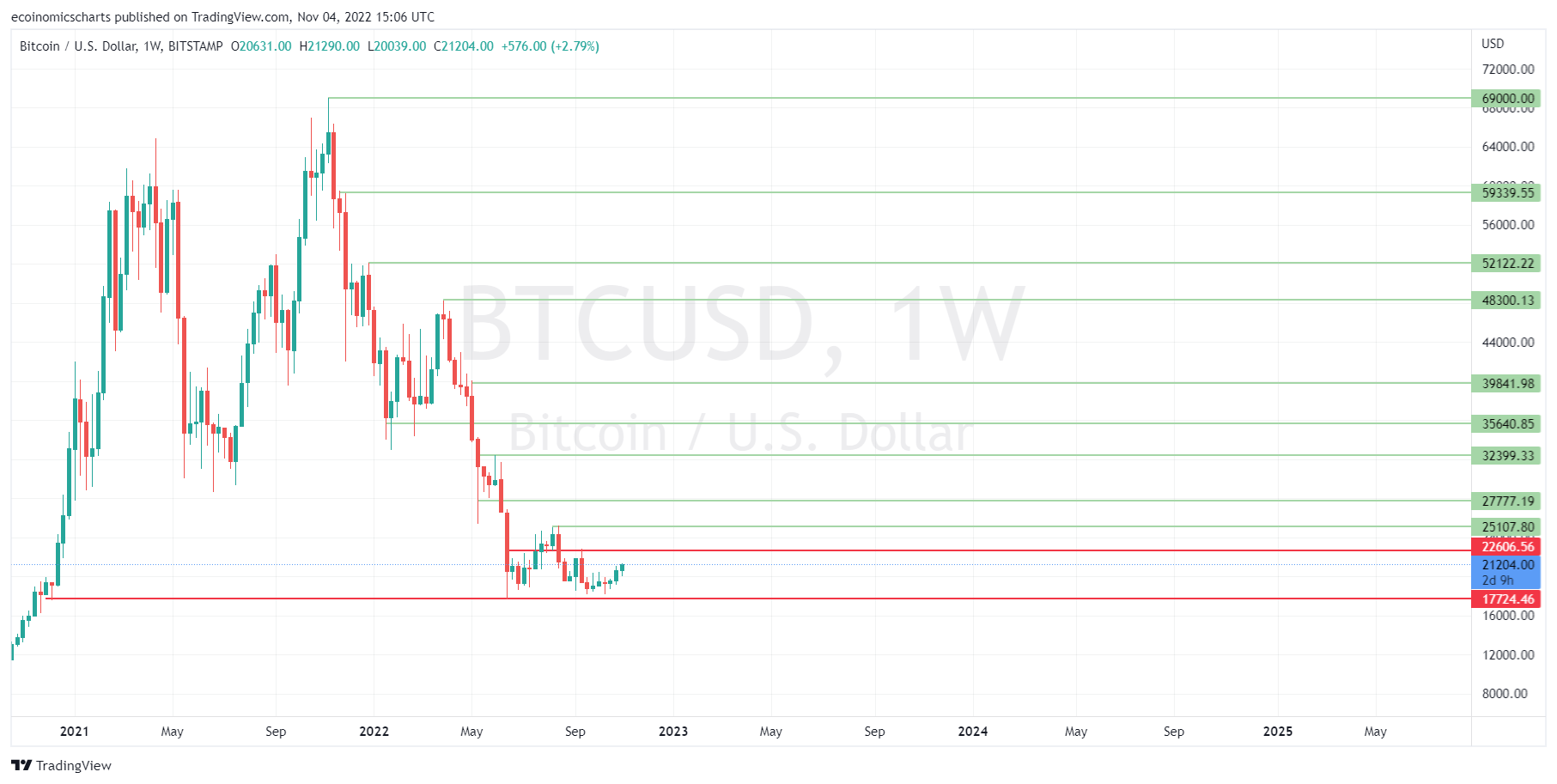

1. Bitcoin and Ether price action.This week, we don’t want to focus so much on the technical side of things. We don’t think they are as important as the fundamentals driving price action in the financial markets, including in crypto. So, we’ll do a quick run-through and get to the meat of the issue. BTC/USDAreas of interest.

If I were you, I’ll set my buy/sell orders at these prices and wait! ETH/USDAreas of interest.

Again, set your entries at these prices and go wait! 80% of trading is waiting - Bureau Of Imaginary Statistics (BIS) Macro stuff.The financial markets tumbled earlier this week wiping out most of last week’s gains as the Fed chairman, Jerome Powell appeared to take a more hawkish stance in the fight against inflation. Market speculators had priced in a signal from the Fed’s statement on the 2nd of November that hinted a Fed pivot from rate hike aggression from 75bps (0.75%) to 50% bps (0.50%) may be coming in December. This caused a short-term rally. The Feds chairman then announced in a subsequent speech on Wednesday that the ultimate level of rates could be higher than previously expected, which caused an instant dump as the opposite had been priced in beforehand to front-run plebs. (Do not google what is a pleb?) 😂 In October, the Dow Jones (DOW) had its best month since 1976 settling at $32,732. The S&P 500 rallied from $3600 to a high of $3,900 and the crypto market saw Bitcoin hit $21,00 for the first time in six weeks and Ether rally to $1662 in October as rumours swelled of a Fed pivot. During the FOMC press conference, the Fed’s chairman said they will keep raising rates until inflation hit its 2% target. The Fed chairman shut down any remaining hopes of a pivot by saying, “The incoming data since our last meeting suggest the terminal rate of Fed Funds will be higher than previously expected (4.63%), and we will stay the course until the job is done.” Market speculators had expected the Fed to pause or pivot once the terminal rate of (4.63%) is hit next year. In continuation, chairman Jerome Powell said, “Risk management is key here: If we were to over-tighten, we could use our tools to support the economy later on; but if we failed to tighten enough, inflation would become entrenched and that would be a much bigger problem”. The Fed hasn’t seen a satisfactory slowdown in US inflation. There is still substantial wage growth in the labour market, employment continues to rise by an average of 289,000 jobs per month according to Non-Farm Payroll data and unemployment has not hit an undesirable number to form concerns of deflation. And real GDP is still growing at a pace of 2.6% as of last quarter. Inflation is at a 40-year high of 8%, still a long way from the target of 2%. Different reasons have been attributed to high inflation such as excess money supply in reaction to the COVID-19 pandemic as well as geopolitical conflict in Eastern Europe causing a hike in prices of oil, gas and commodities like wheat. Jerome Powell claimed during the press conference that the Fed have the tools to support the economy later on if they over-tighten. I.e. quantitative easing, i.e. money printing. I.e. the money printing machine goes brrrrrrr. But until then, we are in the Fed purgatory, and as a Finance professor, Martin Zweig once said, “do not fight the Fed.” How does this affect your favorite crypto ponzi coin?The Fed will not rest until they mop up whatever liquidity they can from the market to douse inflation. For risk-on assets like crypto tokens, that likely means the bottom is not in. But it's not all bad news. A pivot to 50bps in December as expected should provide short-term relief for crypto tokens. Even if it means the Fed will raise interest rates for longer. We’ll keep you updated on how to play it. 🤝 2. What is Web3?Here’s a YouTube video from one of our favorite crypto youtubers. tsk tsk. Watch this video and answer the questions below.

Questions:1. What is the most important change you believe Web3 will usher in? 2. What is the main difference between Wed 2.0 and Web 3.0? 3. What kind of application would you build on Web 3 if you could build anything? Answer in the comments. I’ll say “the best answer wins.” But we all know that’s a twitter styled clickbait. 😂 3. FIFA World Cup 22, Tokens to watch out for.Disclaimer: This is not financial advice. Nothing you read in this newsletter is financial advice. That said. A twitter friend’s tweet last week got me thinking.  If you’re an active investor, always follow liquidity. The narrative for this month is football cos of the World Cup and my bet is that liquidity will flow into football tokens. Won’t be explaining further or recommending what to buy. Goodluck We would be explaining further and recommending what to buy. 😑We nor dey fear anybody. 😑 Some of the most profitable trades in the crypto are also the most predictable. Like when Elon Musk’s tweets about Dogecoin. The World Cup is one of the biggest events of the year whenever it comes around. 100s of millions of fans around the world will be rooting for their favorite teams. (Not named Super Eagles.) With that much visibility, it’s a good assumption that whichever companies tie their brands to the popularity of such an event is bound to generate some buzz off it and in the case of a crypto company, buzz usually means an uptick in token price. That being said, here are 3 tokens we are watching and why. 1. Chiliz (CHZ):CHZ runs on the Ethereum-based Chiliz blockchain. It was the most popular sports token once. It serves as the currency that allows users to purchase and trade sports-related NFTs on the Socios marketplace. Sports fans and e-sports enthusiasts can use the utility token to participate in the management of their favourite sports teams. Any World Cup-related fantasy league with prizes to be won should draw more fans to Socios. Socios is the official token partner of 62 football teams including Argentina -which should get to the later stages of the competition- UEFA and Ballon d’Or. 2. Algorand (ALGO):Algorand is the official blockchain partner of FIFA after agreeing on a sponsorship and technical partnership deal. As per the sponsorship agreement, Algorand will be a FIFA World Cup Qatar 2022™ Regional Supporter in North America and Europe, and a FIFA Women’s World Cup Australia and New Zealand 2023™ Official Sponsor. No doubt this visibility cannot harm ALGO’s popularity amongst the crypto initiated who are also football fans. 3. Crypto.com (CRO):CRO is also an official sponsor of the 2022 Qatar FIFA World Cup. Crypto.com will build a marketing campaign around the event which starts this month by providing opportunities for new and existing users to attend matches football matches, be a part of exclusive events and or win exclusive merchandise during the event. We expect this to mean well for the token which has lost 88% of its token value since its All-Time High price. Honorable mention:

Let us know in the comments if you think we left anyone out. Also tell us what teams, you’re rooting for by leaving comments. 🤝🏽 4. Making a case for Polygon (MATIC).Polygon’s (MATIC) business development team have set itself apart from many of the other crypto projects in the market by inking big deals with the likes of Starbucks, Meta, Reddit, Disney, Adobe and DraftKing in a bid to push mainstream adoption of crypto/web3 even in a bear market. On Wednesday night, Instagram announced that it will enable NFTs minting and trading for US users and content creators on the Polygon Network. As covered in last week’s issue, Reddit avatar collectables have become some of the top-selling NFTs in the market. The Reddit collection was also launched on the Polygon Network L2. Why are Web2 social media giants choosing Polygon? Polygon was launched in the last bear market as an Ethereum Network scaling solution and was one of the biggest winners in the bull market. Over the past four years, the Polygon team has consistently shown a path towards building technologically superior solutions for web3 on the most popular and largest blockchain application layer (Ethereum.) As Web2 giants look to enter into the Web3 space they are looking for battle-tested solutions that solve the blockchain trilemma (security, scalability & decentralization) and make users' experience as seamless as Web2. Cheap gas fees and speedy transactions are the bedrock of Polygon’s rise as the dominant layer 2 solutions. Polygon acquired standalone protocols like Mir Protocol and Hermez and has embarked on a mission to build Zero Knowledge Ethereum Virtual Machine (zkEVM) that further scales its network by reducing gas fee and finality time. When the good times roll by again, we believe that MATIC will get repriced according to its true value proposition and network effect. It is a good one to keep an eye on as we expect the $1 resistance level to get broken sooner than later. Thank you for reading. For comments and feedback, please write to us at ecoinomicsweekly@gmail.com. Groovy and Oloye for CryptoRoundUpAfrica ®️ Just before we finish, we’d like to give a special shout out to Olivia. One of our subscribers who sent us a lengthy email feedback on how to make this newsletter better for everyone. We appreciate it and looking forward to your continuous feedback. 🙏🏽 Shameless 🔌 Follow us on Twitter. Like us on Facebook. Connect on LinkedIn. If you liked this post from ecoinomics, why not share it? |

Older messages

October 2022, #1

Friday, October 28, 2022

Welcome back, welcome back, welcome baaack. - Mase.

“Sorry for the break in transmission, we rebranded.”

Thursday, October 20, 2022

nu brand, who dis? 😋

January 2022, #1

Friday, January 14, 2022

We discuss the majors' limp into 2022 and upcoming token unlocks schedule for some crypto projects.

eCoinonomics Crypto Report and 2022 Theses.

Saturday, January 1, 2022

Trends, narratives, sectors and tokens we think will dominate 2022.

December 2021, #2

Wednesday, December 8, 2021

We discuss last week's liquidation cascade, Ethereum reclaims support post pullback, introducing Bitpowr, a blockchain solutions company and Zoom-In on Polygon (MATIC) and Bit Torrent Token (BTT)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏