The eCoinomics Team - November 2022, #3.

November 2022, #3.This week we discuss BTC and Ether/USD price action. Is the bottom in? An insider's account of what went down at now bankrupt FTX/Alameda. Nike NFTs marketplace and Yuga Labs acquires WENEW.This week.

1. BITCOIN/DOLLARBetween our last issue and this, Bitcoin hasn’t moved at all. Our areas of interest remain the same. $19,000 resistance and $14,000-$12,000 for support. It’s never a good thing when Bitcoin loses high time frame support. But we are not betting against a reclaim of $19,000 either. The FTX implosion seems to be weighing heavily on the market. The fear of yet-to-be-detected contagion might be holding traders back even as CPI data came in less than expected, which would have been a good buy signal. Not much selling or buying is happening. And when things finally move, we reckon they’ll move in a big way. Our advice is to avoid catching knives. Don’t be a hero.

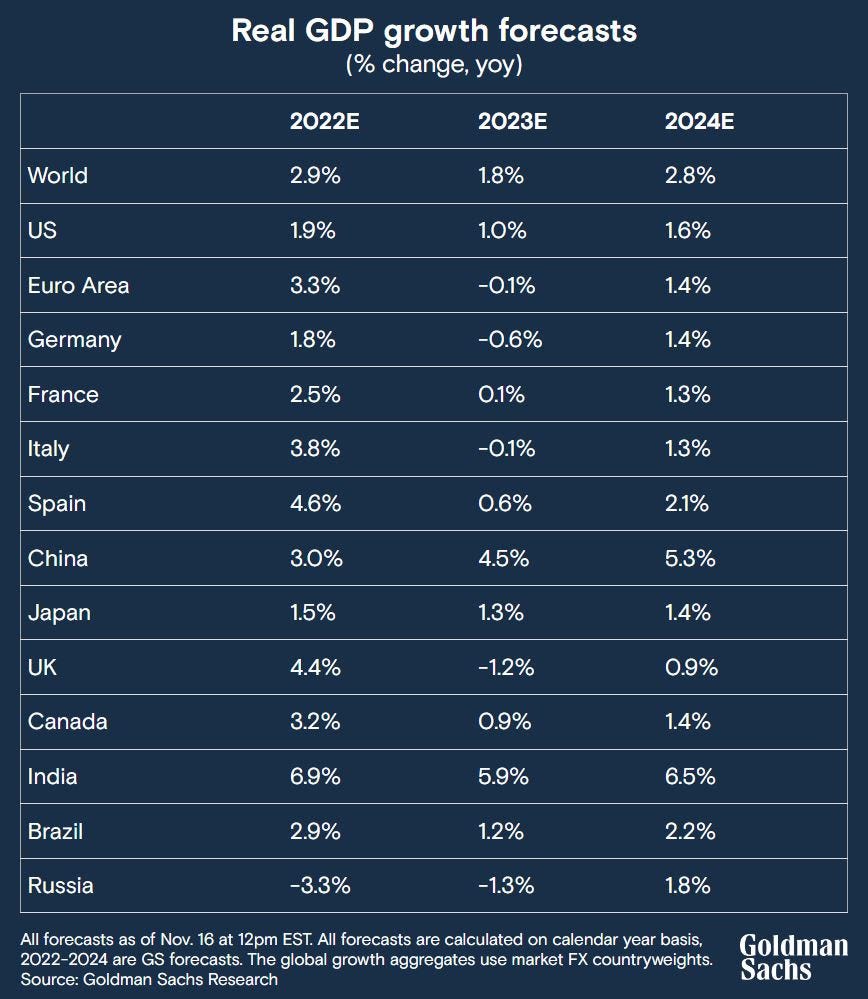

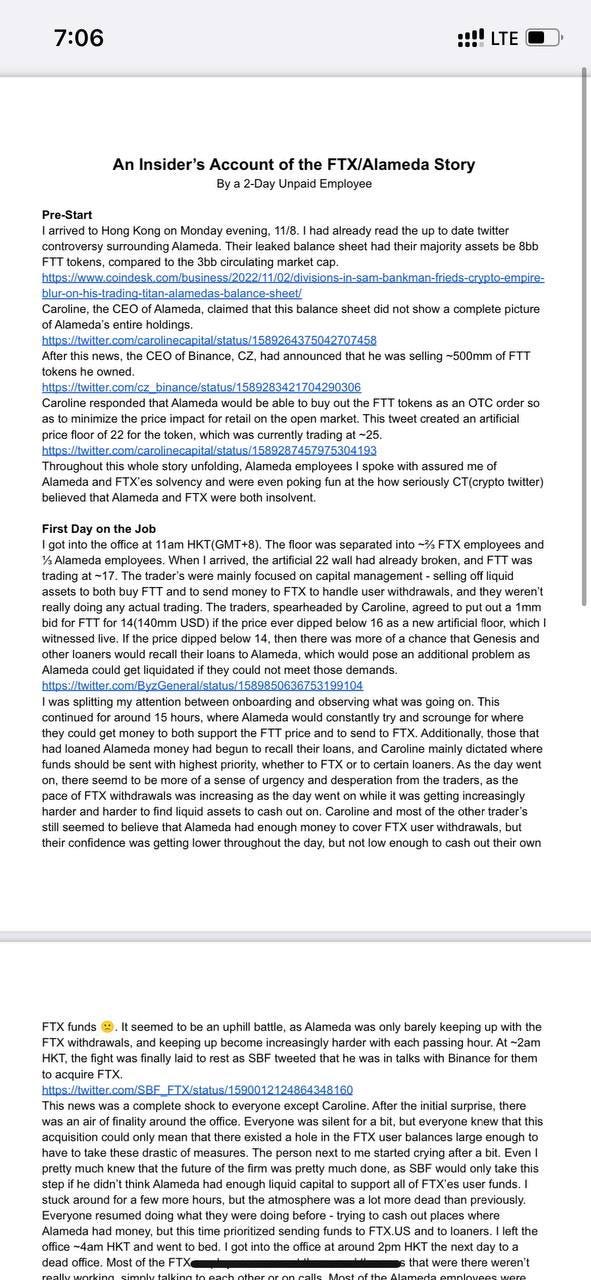

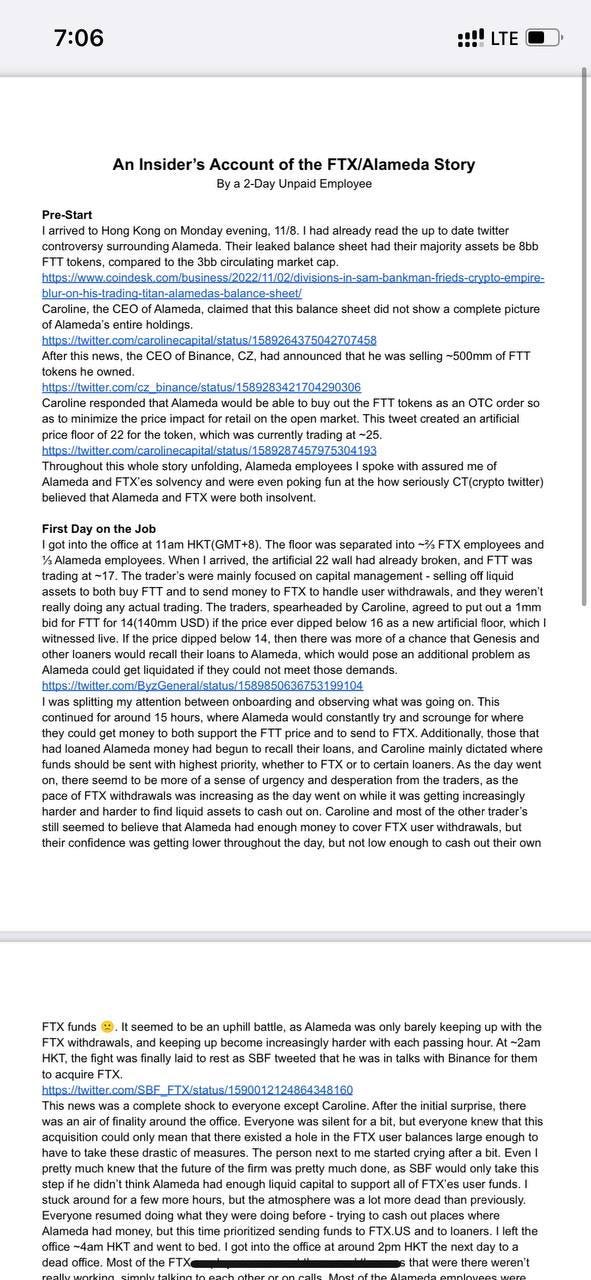

ETH/DOLLARAs it’s for Bitcoin, so it is for Ether this week. There’s no significant price action to speak of since the last issue. ETH has held onto its HTF support as it continues to hover around $1200. We expect the $800-$1,000 zone to hold and withstand any violent move. We are really just you know.. hoping 🤞🏽. Up top, $1,500-$1,700 is the resistance zone. We wait. Is the bottom in?While we believe we are close, we are not quite there yet. Barring any more FTX scale ****ups of course. In their 2023 Outlook, Goldman economists expect the U.S. to narrowly avoid a recession next year as Europe's economy contracts. What does this mean for risk-on assets like crypto? Tbh, it’s hard to put a finger on it at this point. A recession in the Euro area would imply that spending dwindles. Which will suck liquidity out of risk-on assets. But it could also lead to quantitative easing which was the trigger for the last bull market as governments increased the money supply to cover the spending shortfall. What this chart shows, if the predictions are true, is that we are not out of the dog house yet. There’s more to it obviously but we are trusting that the geniuses at Goldman have done their assignments and we can depend on them to factor as many relevant inputs as possible into these figures. 2024 looks like a good year and may coincide with the next bull market as major economies come out of inflation in 2023 and strengthen in 2024. Bitcoin $100k anybody? 🤑 Barring any major ****ups. 🤞🏽 2. An insider’s perspective into what was happening at FTX/Alameda during the crash. (12 mins read)As we continue to try to understand the events that led to the catastrophic FTX/Alameda crash, we have been drawing from various streams of information to help us understand exactly what went wrong. Maybe it’ll help someone find closure and help them realize it wasn’t their fault and stop beating themselves up. We must first accept that this terrible thing has happened. We must go past denial. And attempt to find peace and forge a path forward. The account in the linked post aims to provide a fuller picture of what went down as we continue to piece the puzzle together to try to understand how millions of people lost their fortunes, including employees of SBF’s companies. 3. What we know about FTX/Alameda’s bankruptcy proceedings so far. (7 mins read)The linked Twitter thread provides insight into the ongoing Chapter 11 First Day Affidavit released by John Ray, the appointed CEO of FTX and all its subsidiaries included in the bankruptcy filing. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.” Read on by clicking on the topic. Side note to help you understand some of the terms in the filing:Chapter 11 is the US Bankruptcy Code that governs reorganizations of operating businesses: If you are a business, and you run out of money and can’t pay your bills and creditors, but you need to continue operating to try to find the money to pay, you file Chapter 11. (If you’re just going to liquidate all your stuff and close up shop, you file Chapter 7.) Chapter 15 is the US Bankruptcy Code that governs international bankruptcies where the *main* proceedings are somewhere else: E.g Bahamas. FTX is headquartered in the Bahamas. “Generally, a chapter 15 case is ancillary to a primary proceeding brought in another country, typically the debtor's home country.” 4. On-chain analysis: The implosion of FTX/Alameda. (20 mins read)The linked article contains a timeline of on-chain transfers between FTX, Alameda and other third parties like Celsius. Its aim is to use on-chain data analysis with dates of events to establish verifiable proof of activities that led to the bankruptcy of FTX. From inception to demise. Key Takeaways

5. NFT Market update: Nike NFT Marketplace and Yuga Labs acquire WENEW. (4 mins read) RTFKT, together with Nike CryptoKicks, introduce the future of Sneakers, powered by Skin Vial tech

Welcome to 2052 : 🌐👟🧪

They recently announced an acquisition of WENEW labs co-founded by Beeple, one of the top-selling NFT artists. The acquisition means Yuga labs adds 10KTF to their collection of arts which includes BAYC, MAYC, Bored Ape Kennel Club, Otherdeed for Otherside, CryptoPunks and Meebits collections.

Users will be able to create their free .Swoosh IDs as free NFTs on the Polygon blockchain. Registration for .Swoosh IDs started Nov 18. Ad: ByBit is giving new users a $10 airdrop that can be leveraged up to 50X. All you have to do is sign up for a new ByBit account with this link. Deposit a minimum of $50 and click this link to claim the airdrop. PS: The $10 is not withdrawable unless you trade with it and make a profit. ByBit is a top crypto exchange offering zero fees on all spot trading pairs. Thank you for reading. For comments, feedback and ad inquiries, kindly write to us at ecoinomicsweekly@gmail.com. Groovy and Oloye for CryptoRoundUpAfrica ®️ Till next time. Shameless 🔌 Follow us on Twitter. Like us on Facebook. Connect on LinkedIn. |

Older messages

November 2022, #2

Saturday, November 12, 2022

This week... (do we even need to do this?) You already know what we are most likely to write about. Except you have been living under a rock. 😑

November 2022, #1

Saturday, November 5, 2022

This week, we discuss BTC/USD and ETH/USD areas of interest. The Fed v inflation. What is Web3? Some tokens we expect to benefit from the World Cup in Qatar and make the case for Polygon (MATIC).

October 2022, #1

Friday, October 28, 2022

Welcome back, welcome back, welcome baaack. - Mase.

“Sorry for the break in transmission, we rebranded.”

Thursday, October 20, 2022

nu brand, who dis? 😋

January 2022, #1

Friday, January 14, 2022

We discuss the majors' limp into 2022 and upcoming token unlocks schedule for some crypto projects.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏