DeFi Rate - This Week In DeFi – January 13

This Week In DeFi – January 13This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.To the DeFi community, This week, Blockchain infrastructure firm ConsenSys has launched a private beta testnet for zkEVM – a new scaling and privacy technology for Ethereum. The testnet aims to explore the technology's potential to improve Ethereum's speed and transaction costs by over 100 times. ZkEVM allows developers to build applications using the same tools and coding language they are familiar with on Ethereum, but without needing to learn the cryptography and math required for zero-knowledge coding. The testnet has received over 150,000 applications since December, and participants can bridge assets between the Goerli testnet and zkEVM to test smart contracts, dapps, infrastructure, and wallets.  Hey folks! 👋 We’re excited to announce that the ConsenSys zkEVM Private Beta is now OPEN for selected users.🥳

More users will be onboarded in the coming weeks, so please read on for further information 👀👇 Ondo Finance has launched tokenized versions of US treasuries and bonds, which allow stablecoin holders to invest in bonds and treasuries. The offerings include the US Government Bond Fund, Short-Term Investment Grade Bond Fund, and High Yield Corporate Bond Fund. These tokenized funds are transferable on-chain, and Ondo Finance earns a 0.15% annual management fee through these bonds. The company previously raised $10 million in a public token sale in July 2022 and $20 million in a Series A funding round led by Peter Thiel's investment fund in April 2022.  1/ 🚨 @OndoFinance is bringing US Treasuries and institutional-grade bonds on-chain 🚨

We are making it possible for stablecoin holders to invest in US Treasuries through a daily liquid, bankruptcy-remote, tokenized fund with regulated service providers.

blog.ondo.finance/announcing-tok… Yearn Finance will allow users to create their own vaults to accrue yield and deposit proceeds to earn even more token rewards, charging 10% as performance fees. Until now, users have been limited to vaults created by Yearn contributors and developers – however, the “permissionless vault factory,” will let anyone create their own strategies and offer them on Yearn, where other interested users can deposit their own tokens and earn yields. Initially, users will be able to make vaults only for Curve Finance liquidity tokens, using veCRV.  Permissionless finance just got permissionless-er.

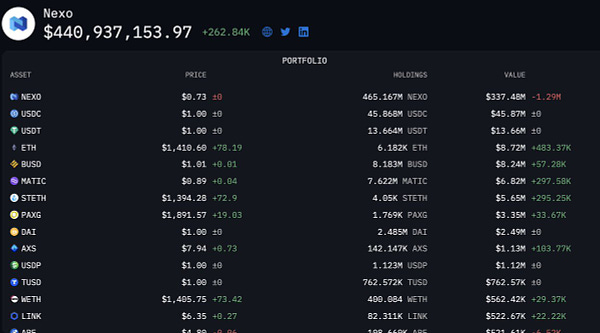

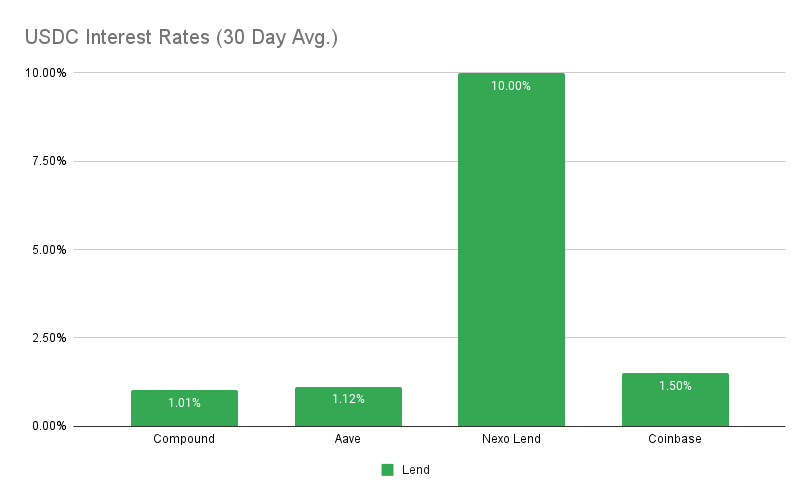

How much bear marketing building can we fit into one video? Let’s find out anon, try not to blink… 🔊🆙 CeFi crypto lender Nexo is facing pressure from regulators as its offices were reportedly raided as part of an international investigation. The operation, which began a few months ago, is targeting a large-scale financial criminal scheme involving money laundering and violations of international sanctions against Russia, and Nexo is alleged to be involved. Nexo has denied any wrongdoing and said it has been compliant with global crypto regulations and has enforced strict Anti-Money Laundering and Know Your Customer policies.  Nexo has ~450M according to tagged addresses on @ArkhamIntel but $337M of that is in their native token, NEXO New scaling platforms for Ethereum make headlines this week, as ConsenSys releases its zero-knowledge Ethereum Virtual Machine (zkEVM) platform in private beta. BitDAO has also launched a testnet for “Mantle”, its very own Layer-2 scaling network. BitDAO claims to have 37,000 developers already signed on to test their apps on the new chain (link in “Bonus Reads”). Tokenization has reached a new frontier, as the Peter Thiel-backed Ondo Finance puts US treasuries and bonds on the blockchain. The innovation sees an interesting integration of low-risk assets into a high-risk crypto ecosystem, however the asset could be argued to be very similar to a traditional stablecoin. Of course, “CeFi” continues to string together problems in crypto, as DCG is revealed to owe creditors more then $3 billion, Nexo gets raided by authorities and the latest stablecoin mishap surfaces in BUSD – revealed to have been insufficiently backed from 2020-2021. Although the negative headlines surrounding centralized parties in DeFi keep plaguing the space, it appears that both development and token prices are now making keener progress, at long last. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesDCG owes creditors over $3B, considering $500M VC portfolio saleBinance Admits Lapse In Maintaining Stablecoin ReservesApple and the Metaverse: Everything We Know So FarRipple Holders Receive Flare Airdrop Two Years After SnapshotStat BoxTotal Value Locked: $42.51B (up 7.5% since last week) DeFi Market Cap: $39.76B (up 13%) DEX Weekly Volume: $8.20B (up 58%) Bonus Reads[Osato Avan-Nomayo – The Block] – BitDAO launches testnet for Ethereum Layer 2 network Mantle [Vishal Chawla – The Block] – Lens Protocol lets creators issue token-gated content [Aleksandar Gilbert – The Defiant] – Avalanche and Amazon Ink Partnership to Boost Subnet Deployment [Cam Thompson – CoinDesk] – Unstoppable Domains and Ready Player Me Team Up to Create Interoperable Metaverse Identities |

Older messages

This Week In DeFi – January 6

Friday, January 6, 2023

This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.

This Week In DeFi – December 30

Friday, December 30, 2022

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

This Week In DeFi – December 16

Friday, December 23, 2022

This week, Binance.US agrees to acquire Voyager Digital, Visa considers StarkNet for automatic payments, Uniswap partners with Moonpay and Senator Toomey introduces a stablecoin bill before retirement

This Week In DeFi – December 9

Friday, December 9, 2022

This week, Maple Finance borrowers owe tens of millions, ConsenSys responds to privacy backlash, SushiSwap looks to boost its treasury and Chainlink launches staking.

This Week In DeFi – December 2

Friday, December 2, 2022

This week, BlockFi files for bankruptcy protection, Uniswap launches its NFT marketplace aggregator, Telegram announces a DEX and wallet, and Apple tries to extort gas fees from Coinbase Wallet.

You Might Also Like

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏