DeFi Rate - This Week In DeFi – January 20

This Week In DeFi – January 20This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.To the DeFi community, This week, the Shiba Inu team has announced the beta release of Shibarium, an Ethereum Layer-2 scaling network. Shibarium aims to minimize costs and increase transaction speeds through a Delegated Proof-of-Stake (DPoS) Layer-2 blockchain. Validators and delegators will stake their tokens to receive rewards in the form of BONE, a governance token for decentralized exchange ShibaSwap. A soon-to-be-launched TREAT token will also play a role in the ecosystem, yet to be revealed. A new SHIB burning mechanism will also be implemented on the network, which will put deflationary pressure on the total SHIB supply.  🍖 Introduction to Shibarium: Shiba Inu's Layer 2 Network — Rejoice #ShibArmy! Shibarium Beta is about to be launched, and through this article we want to introduce some basic concepts in order to provide clarity to the community.

Read more: blog.shibaswap.com/introduction-t… SushiSwap CEO Jared Grey has announced several planned updates to the platform in a new Medium post – including a decentralized exchange (DEX) aggregator, set to launch in Q1 of this year. The updates are aimed at increasing the platform's market share by 10x in 2023, and follow after a Dec. 6 governance proposal that revealed that Sushi’s treasury only had one and a half years of runway left. Grey confirmed that measures have been taken to secure the platform's runway for multi-year operations. Additionally, Sushi is building a governance dashboard and focusing on user experience.  The CEO of $Sushi has released a roadmap for 2023 - it is planned to launch a DEX aggregator router in 1Q, a change in tokenomics and it is planning to launch a decentralized incubator called Sushi Sushi Studios! DEX aggregator 1inch Network has introduced the 1inch Hardware Wallet, a proprietary hardware wallet that. The device is designed to be small, roughly the size of a bank card and comes with a 2.7-inch E-Ink grayscale touch display. The device is waterproof and has a damage-resistant Gorilla Glass 6 surface and a stainless-steel frame. The wallet also supports wireless charging and is designed to last for roughly two weeks of use. Additionally, the wallet replicates the design of the Apple product line and comes in five colors, with two limited editions.  1/ 💳 Meet a cutting-edge solution for cold #crypto storage that's no bigger than a bank card.

We're excited to introduce to you the #1inchHardwareWallet!

✅ Join the waiting list now: hw.1inch.io

➡️ Read more: blog.1inch.io/introducing-th…

#1inch #DeFi Decentralized cross-chain liquidity protocol Swing has rolls out a new widget and software developer kit (SDK) to simplify cross-chain crypto deployments. The new widget and SDK support 21 Ethereum Virtual Machine-compatible chains including Ethereum, BNB Chain, Arbitrum and Optimism – with plans to expand to cover four non-EVM networks like Solana and Cosmos. The technology is aimed at eliminating liquidity fragmentation, where liquidity is siloed across different blockchains and cannot easily flow between chains. The goal is to make it easier for developers to complete bridge integrations for their decentralized applications and make the process of cross-chain deployment easier.  📢The wait is over! Swing SDK & Widget is now Live🚀

Easily connect your dApp to cross-chain liquidity from bridges and blockchains with just a few lines of code.

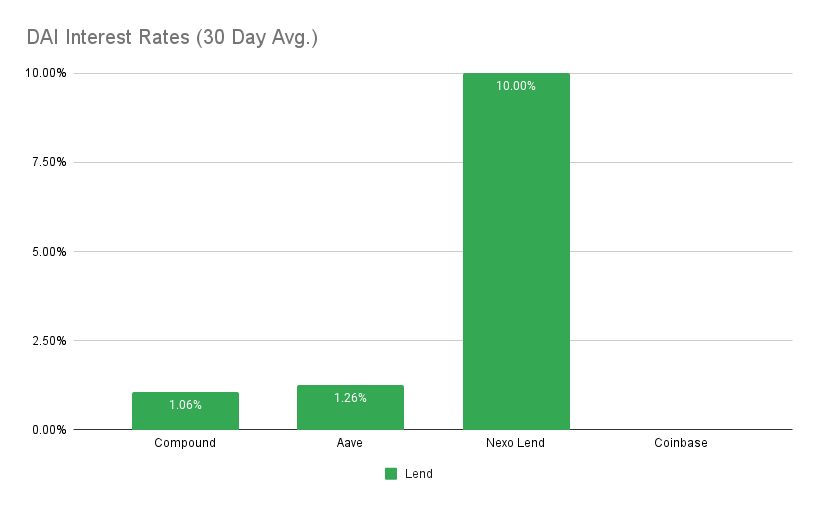

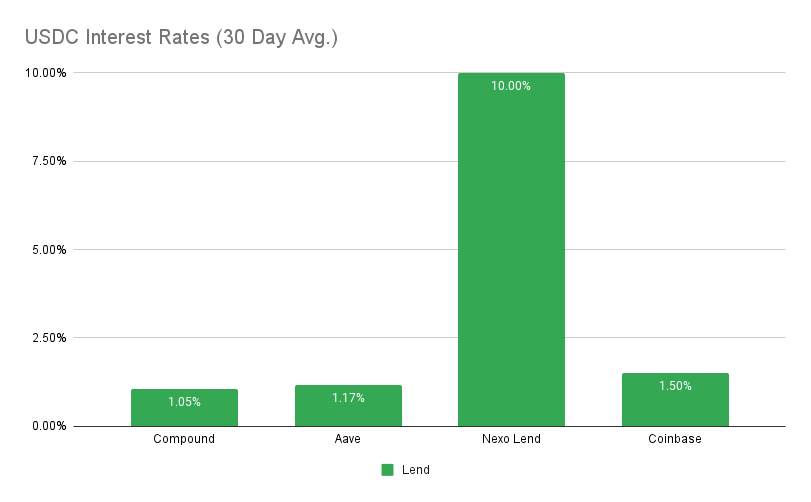

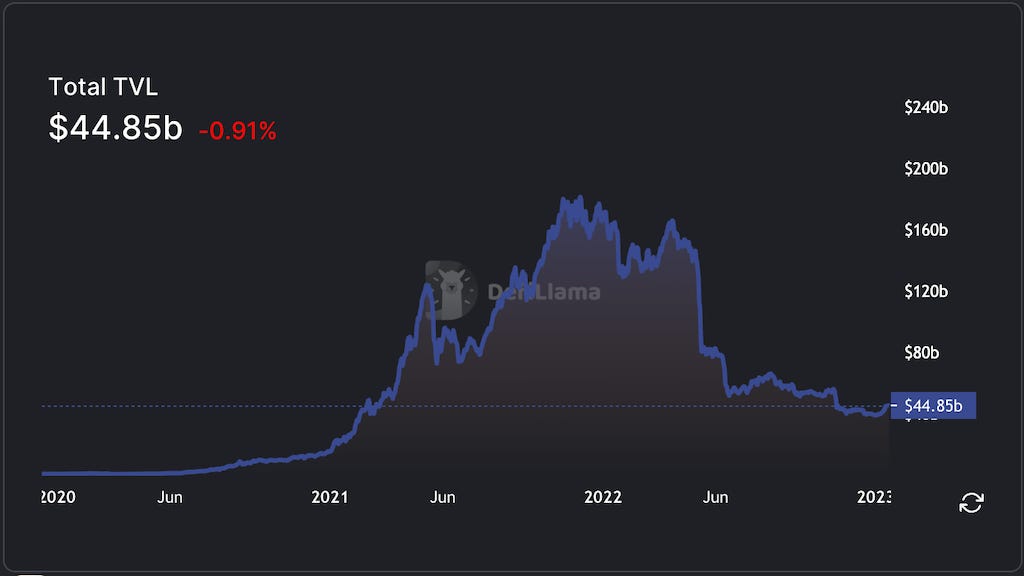

Get Started: swing.xyz/developer-hub  The Block @TheBlock__ Centralized news has finally taken a backseat to real DeFi development this week, as several projects announce new and exciting moves. Competition is heating up again in the Ethereum Layer-2 scaling space, as Shiba Inu’s “Shibarium” enters the race, while Optimism takes the lead ahead of Arbitrum in transaction volume – possibly a symptom of users sick of waiting for an Arbitrum governance token. SushiSwap is also adding a competitor to the decentralized exchange aggregator space, as it looks to renew its relevance in the DEX ecosystem. Although Sushi has lost some of its allure over the last year or so, sticking to its principles of sovereignty and autonomy may be a valuable feature as competitors such as Uniswap become more “compliant” and controlled. The integration of blockchain into traditional finance also continues to develop, as Australian “Big 4” bank NAB launches its own stablecoin backed by the Australian dollar. This represents yet another solid confirmation that public blockchains can provide benefits to the existing financial system. It's refreshing to see DeFi back in a building mindset, with less impact of market prices and centralized drama – let’s see what leaps the technology can make this time around. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.2% APY Top StoriesAussie ‘Big 4’ bank mints stablecoin for carbon trading and remittancesPolygon Completes Hard Fork to Reduce Gas Fee Spikes, Disruptive ReorgsVote on Crucial European Crypto Legislation Delayed AgainSEC Files “Totally Counterproductive” Charges Against Gemini and GenesisStat BoxTotal Value Locked: $44.85B (up 5.5% since last week) DeFi Market Cap: $42.79B (up 7.6%) DEX Weekly Volume: $13.28B (up 62%) Bonus Reads[Kari McMahon – The Block] – ZK tech developer Nil Foundation raises $22 million at a $220 million valuation [Osato Avan-Nomayo – The Block] – MakerDAO voting to limit DAI exposure to Gemini amid insolvency fears [Shaurya Malwa – The Defiant] – DeFi Protocol Frontier Brings In-Browser Wallet Support for Aptos, Sui and 33 Additional Blockchains [Mike Truppa – The Block] – Ethereum Layer 2 protocol Optimism surpasses Arbitrum in transaction volume |

Older messages

This Week In DeFi – January 13

Friday, January 20, 2023

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

This Week In DeFi – January 6

Friday, January 6, 2023

This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.

This Week In DeFi – December 30

Friday, December 30, 2022

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

This Week In DeFi – December 16

Friday, December 23, 2022

This week, Binance.US agrees to acquire Voyager Digital, Visa considers StarkNet for automatic payments, Uniswap partners with Moonpay and Senator Toomey introduces a stablecoin bill before retirement

This Week In DeFi – December 9

Friday, December 9, 2022

This week, Maple Finance borrowers owe tens of millions, ConsenSys responds to privacy backlash, SushiSwap looks to boost its treasury and Chainlink launches staking.

You Might Also Like

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏