Coin Metrics’ State of the Network: Issue 191

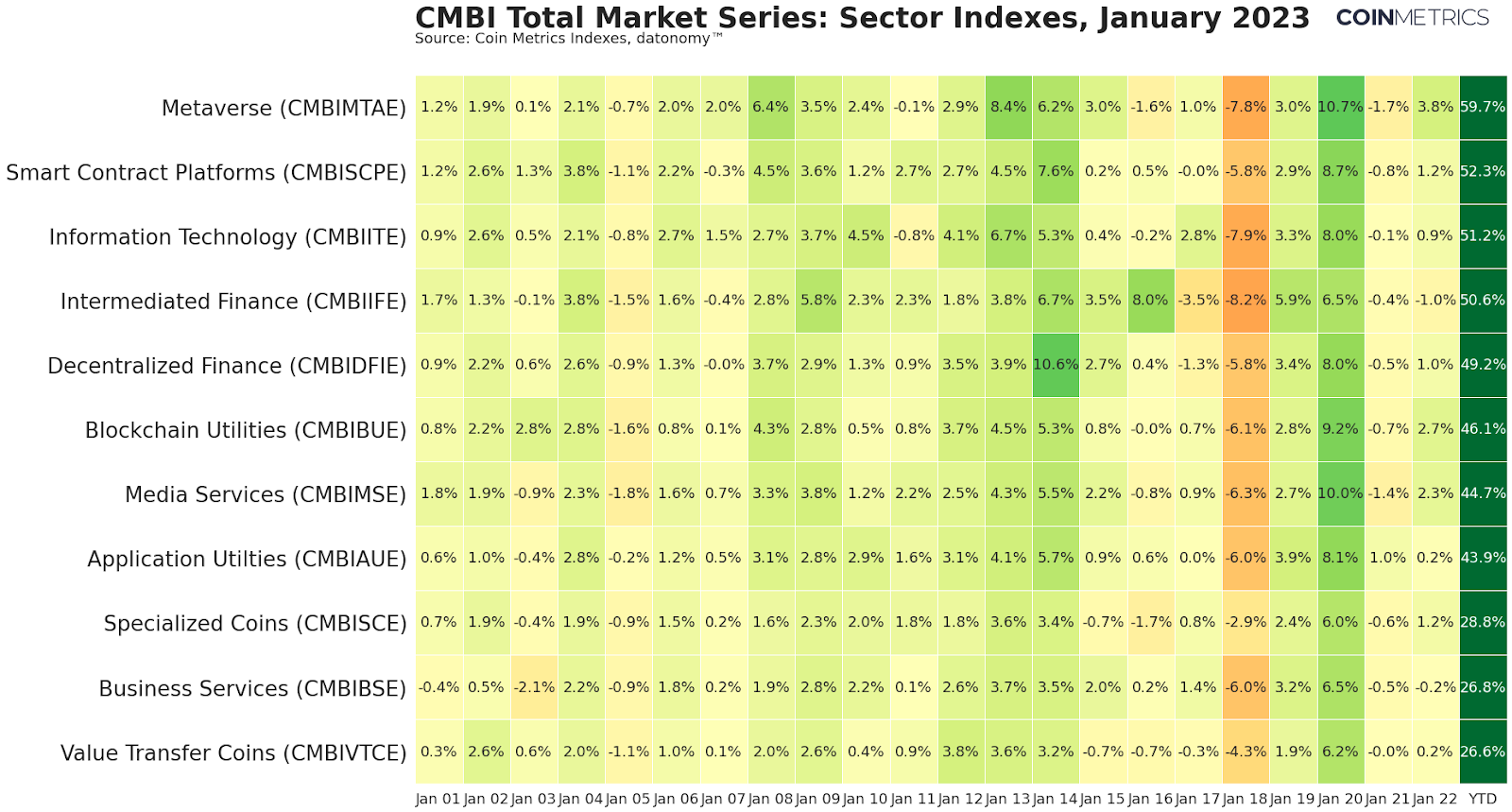

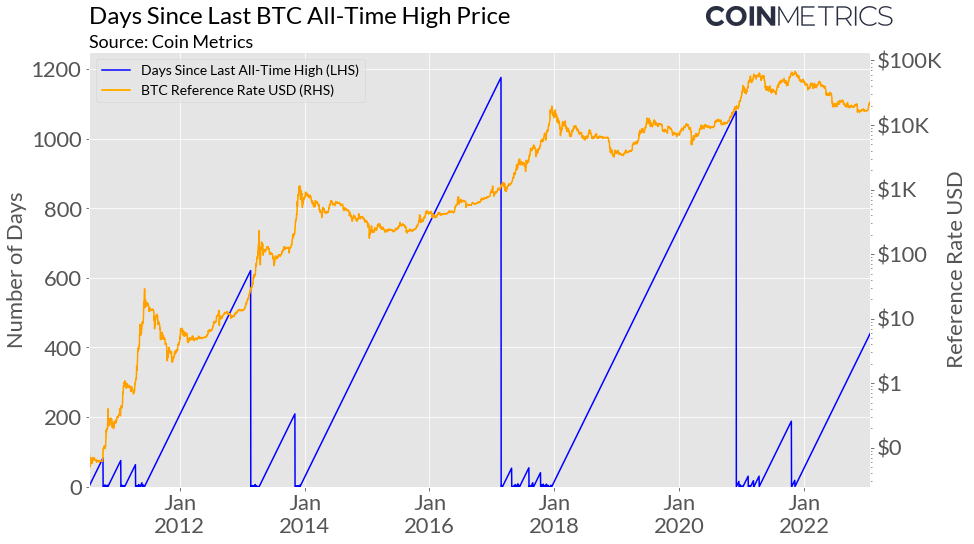

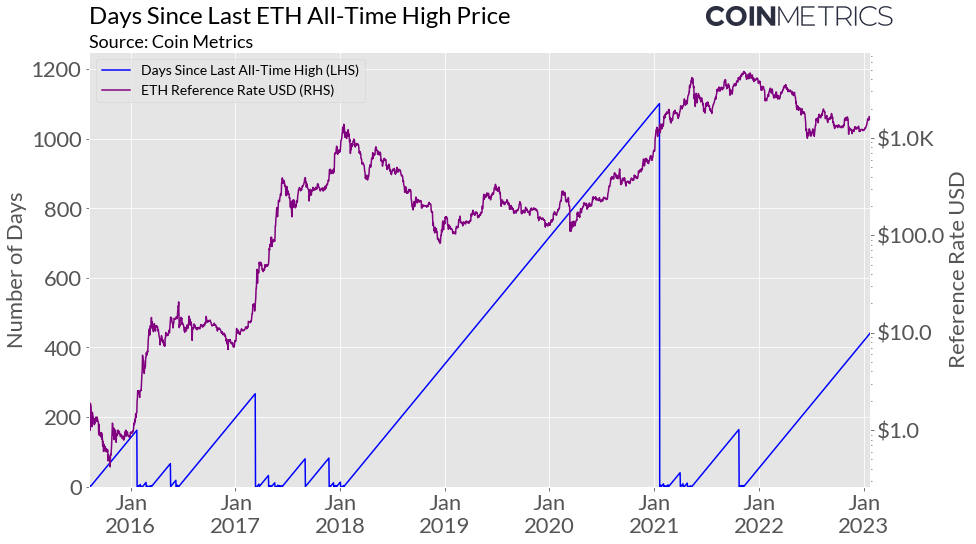

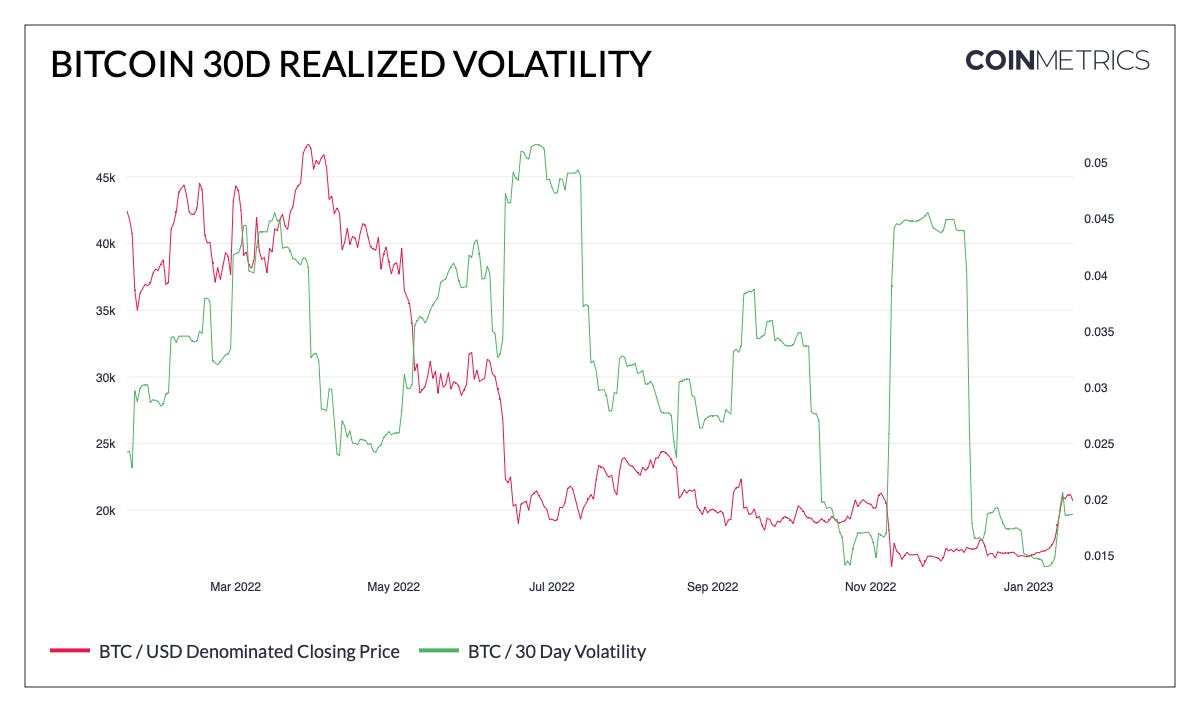

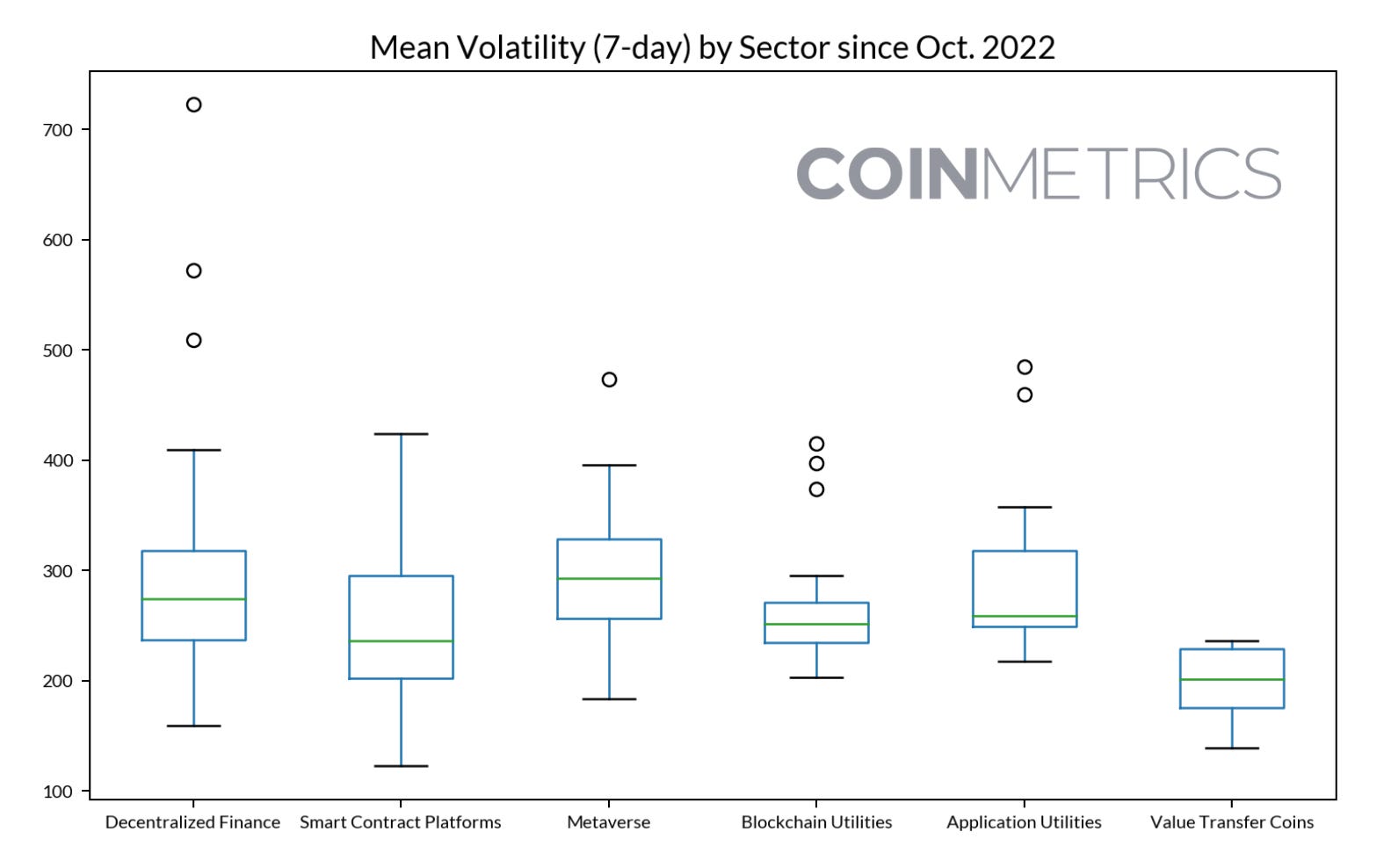

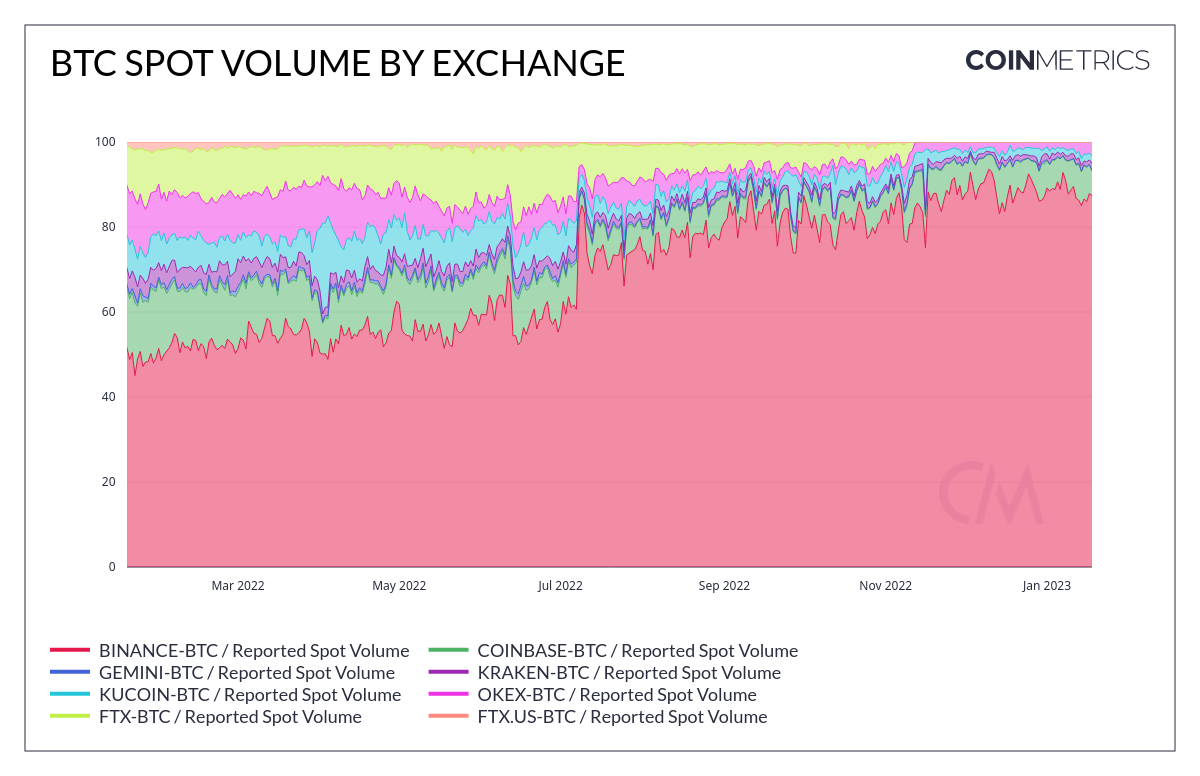

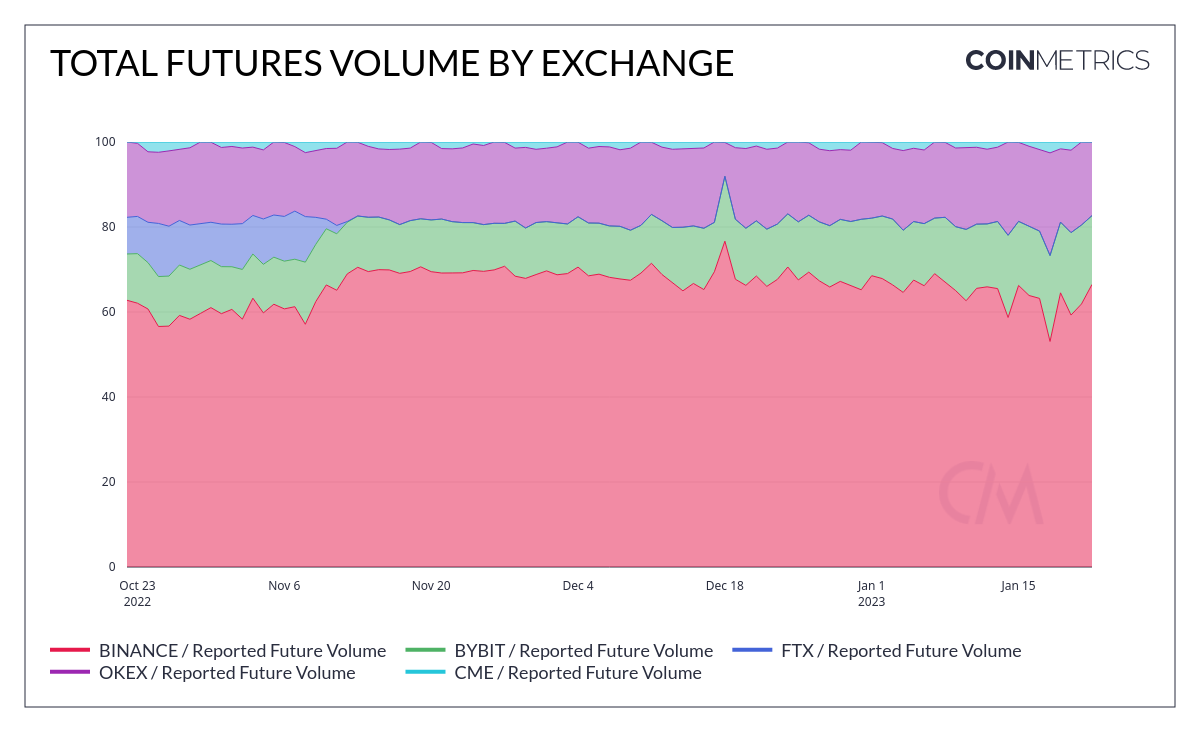

Get the best data-drive crypto insights and analysis every week: Monitoring the Currents of the Crypto MarketBy Matías Andrade and Kyle Waters The digital asset market is experiencing a surge in activity as we kick off the new year. Bitcoin is up 36% in January rising to $22,500, its highest level since last summer. This growth may seem surprising amidst the backdrop of economic uncertainty, including large-scale layoffs in tech giants and persistent macro risks. Nonetheless, this presents a unique opportunity to scout the trends in relative performance and track key market indicators to track the development of the market in upcoming months. Market ReturnsThe digital asset market has seen a remarkable rebound, as evidenced by the performance of the various indices tracked by Coin Metrics. Through the lens of datonomy™—the digital assets taxonomy developed collaboratively by Coin Metrics, Goldman Sachs, and MSCI—we are able to gain a deeper understanding of the market by analyzing and contrasting different sectors against each other. The CMBI Total Market Series indexes have all seen positive growth, all netting gains over 25% through January 22nd. The Metaverse sector is leading the market, with a near 60% rise year-to-date, followed by Smart Contract Platforms, which has seen an increase of 52%. The Metaverse and smart contract sectors have been performing particularly well in the current bull market and continue to outpace the overall digital asset market. Despite the move higher, there is still a lot of room to go to retake the 2021 highs. A full 400 days have now passed since BTC hit its last all-time high in November 2021. Source: Coin Metrics Reference Rates Likewise, ETH has also spent over 400 days now below its last ATH. Source: Coin Metrics Reference Rates Returns are only one part of a market’s anatomy. To understand recent market dynamics we must look at volatility as well. Bitcoin VolatilityRealized volatility is a valuable tool for assessing historical market behavior and characterizing the performance of assets over specific time periods. Using our reference rate data, we calculate a 30 day realized volatility metric. This measurement of volatility highlights different episodes that occurred in the market over the past year, including the Terra/Luna de-pegging in May and the collapse of FTX in November. Source: Coin Metrics Market Data Bitcoin’s realized volatility flat-lined towards the end of 2022. However, in recent weeks, a bullish trend has pushed prices higher, reaching $22,000 and volatility rising too, although still below previous levels. Sector VolatilityTo gain a comprehensive understanding of market volatility, we can analyze volatility across various sectors of our digital asset taxonomy. In the chart presented below, we calculated a seven-day volatility for each asset in our sample, since October 2022. All of these assets experienced more than 200% volatility in the period observed. However, it is interesting to note that Value Transfer Coins had lower volatility compared to tokens used in DeFi, which exhibited some of the highest volatility levels across these sectors. Sources: Coin Metrics Reference Rates and datonomy™ Spot & Futures Exchange DataRecently, there have been notable shifts in the relative market share of exchange-traded volume within the digital asset market. These developments have further entrenched Binance as the leading exchange in terms of volume traded. Our sample indicates that Coinbase was the second-highest volume traded since the beginning of the year. Source: Coin Metrics Network Data The market for derivatives trading exhibits a slightly greater degree of diversity in the choice of venues. One easily noted player in this market is CME, which only conducts trades during U.S. open market hours and is visible near the top of the chart below. However, the majority of futures volume trades take place on Binance, Bybit, and OKX. Source: Coin Metrics Network Data ConclusionIn conclusion, the digital asset market has seen a remarkable rebound, as evidenced by the performance of various indices tracked by Coin Metrics. Additionally, by utilizing the datonomy framework, it is possible to gain a deeper understanding of the market by analyzing the relative performance of different sectors. These insights provide valuable information about the current state and potential future trends of the digital asset market. As global financial markets warm up to the prospect of a “soft-landing” following a turbulent 2022 of rate hikes and soaring inflation, crypto market participants would surely welcome an easing macro headwind. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro The recent market rally has yet to lead to a boost in most measures of on-chain activity. Bitcoin active addresses fell 6% week-over-week to 932K, while Ethereum active addresses held steady at 524K. Stablecoin on-chain activity was also down slightly over the week, broadly. Some DeFi tokens saw higher activity, including a flurry of activity in Chainlink’s LINK as well as Curve DAO’s CRV and 1INCH. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter.Coin Metrics' State of the Network is free today. But if you enjoyed this post, you can tell Coin Metrics' State of the Network that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Coin Metrics’ State of the Network: Issue 190

Friday, January 20, 2023

Wednesday, January 18th, 2023

Coin Metrics’ State of the Network: Issue 189

Tuesday, January 10, 2023

Tuesday, January 10th, 2023

Coin Metrics’ State of the Network: Issue 188

Wednesday, January 4, 2023

Wednesday, January 4th, 2023

Coin Metrics' State of the Network: Issue 187

Tuesday, December 27, 2022

Tuesday, December 27th, 2022

Coin Metrics’ State of the Network: Issue 186

Tuesday, December 20, 2022

Tuesday, December 20th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏