Top of the lyne - It's time to send in the cavalry

For Zapier, it was around the $140M ARR mark. Dropbox - at around $100M. Slack? $50M. Github - $25M. Word of mouth, viral loops and referral mechanisms can get you far and wide and deep within accounts, but there comes a time in every PLG company’s life when it’s time to send in the cavalry. Sales. For enterprise-wide adoption, your product has to reach new users (even those who aren’t natural adopters), new teams where it solves new use-cases, then enable new features that may not be compelling to individual users, but are to the collective - improved security, support, SSO - and all the other squiggly lines on the bottom right corners of pricing pages.

That you’ve hit PMF and have hit the double/triple digit ARR through a pure self-serve model are perhaps good indicators that it’s time. But a more subtle tell, and where top-down sales becomes a true force multiplier is when the organic expansion levers are working and you have penetration within accounts.

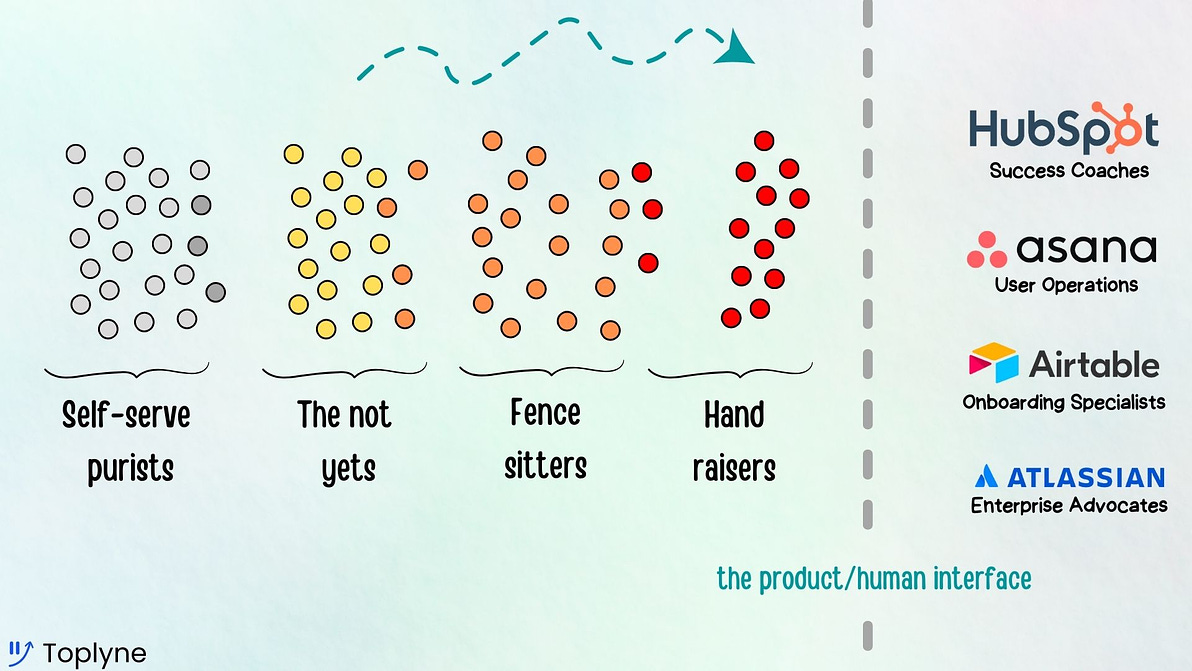

Docking the bottom-up flywheel to a top-down sales engine is a maturing science. One calls for the guile and craft of a Rembrandt brushstroke. And the other is like passing a bill in congress. Making the two work in tandem is a feat that very few have managed to do well. Part 3 of the Expansion Manifesto is on just that: On how the best PLG companies use top-down sales as a force multiplier on top of a self-serve motion to drive expansions. Toplyne analyzes product-usage data to surface expansion and conversion opportunities in your CRM. Here’s how it works, in 1 minute: Breaching the product/human interface 〰️Crossing the product-human barrier brings into play, along with traditional sales, a powerful weapon in the conversion arsenal of PLG companies: a sales assist. Called “success coaches” at Hubspot, “user operations” at Asana, and “Onboarding specialists” at Airtable, sales-assist steps in to guide users into defined paths of expansion through product-education, feature adoption, etc. The million-dollar question for sales-assist is this:

Well, that depends on the user. The “not yets” just aren’t ready and the “self-serve purists” do not want to talk to humans. Forcing a human touch for these two cohorts of users can be damaging to user experience, and turn users away completely, leading to churn. That leaves two types of users: Hand-raisers 🙋🏻♀️Hand-raisers will stand up, raise their hand and tell you that they want to talk to someone from your team, breaching the product/human interface voluntarily.

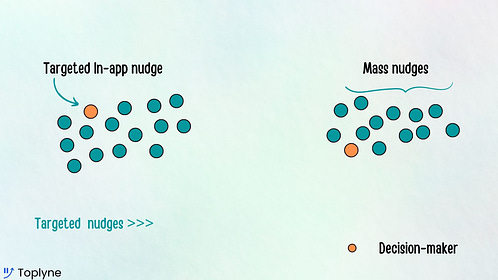

Fence-sitters 🧐Your Product-Qualified Leads are finding value from your product already, and are primed for expansion/conversion. It’s time to extend a hand. Nudges or notifications powered through tools like Appcues and Braze actively encourage or incentivize a hand-raise within the product. These nudges are most effective when they’re cognizant of who, where, and when - the user, the placement, and the timing. The who - In an ideal world, you’re triggering only the decision maker/product administrator, while keeping the product experience “pure” for all the others on the team. The where - Configuration management screens, installation pages, admin panels are primed for expansion pathways. The when - When are your users doing something on your product other than using it for the day-to-day? Like configuring new features, for example. Passing a bill in enterprise congress 🧾At this point, the product/human interface has been breached, ‘sales-assist’ has stepped in to upsell users to team/pro plans and likely looped in post-sales roles at the same time: account management and customer success.

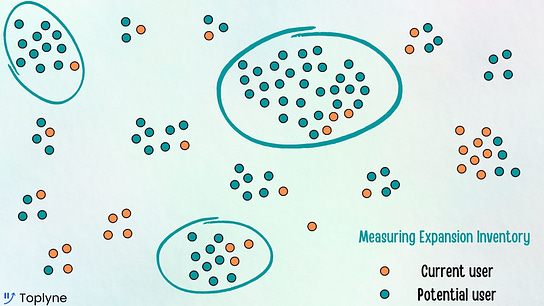

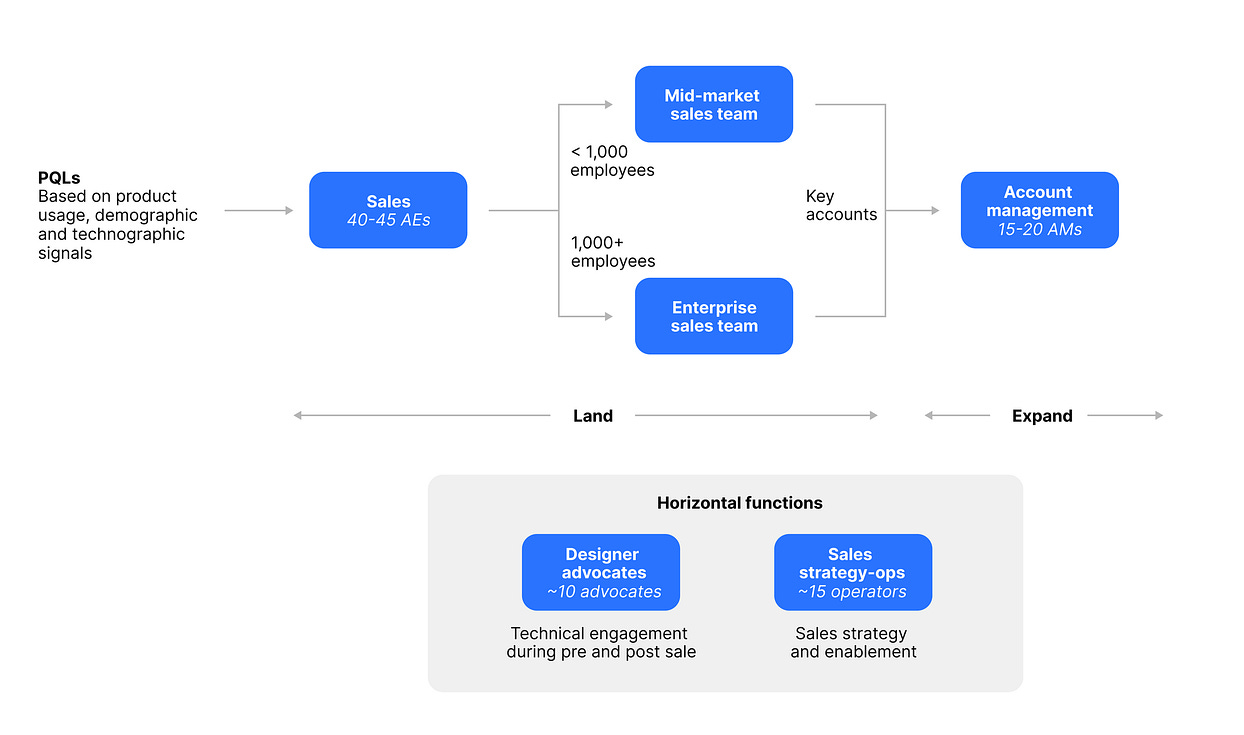

As far as your top-down sales teams are concerned, it’s go time. But an enterprise-wide deal is akin to getting a bill passed in congress. The lead-cycles are long, incumbents are aplenty, and there are many stakeholders involved - so many: legal, security, compliance, the senate, the Galactic republic. Prioritize: Feed your sales teams the hottest accounts based on product-qualification and expansion inventory (what’s the headroom for expansion in target accounts? Prioritize accounts with high headroom rather than 1st deal size.) Find your champion: Let the product-usage data be your guide. Analyze account-level user signals to find a champion who will rally your cause from within. Have eyes and ears within: Post-sales roles are your eyes and ears within accounts to stay alert for prime expansion moments (M&As, stack upgrades, new product launches, etc.) Avoid deal creep: Front-loading too many features, products, or solutions and involving other teams who may also be interested in your product can confuse your core initial set of users and sabotage the larger opportunity. Embed deeply in existing workflows: Sales assist, account management, and customer success teams parallelly invoke network and cross-network effects to ensure your tool’s deeply embedded into existing workflows. At Figma, where cross-network effects completely transform product-development at user accounts, account management teams own expansion targets:

Navigate to the decision maker: Product-usage data when enriched and aggregated is rich with such intelligence as org hierarchies, decision making ability, and even data that’ll help navigate to the decision maker.

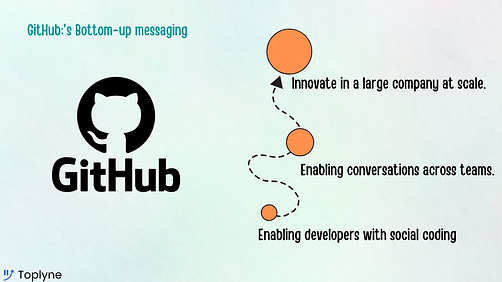

Bottom-up messaging: As GitHub introduced top-down sales, the messaging now had to speak to three different personas at three different levels.

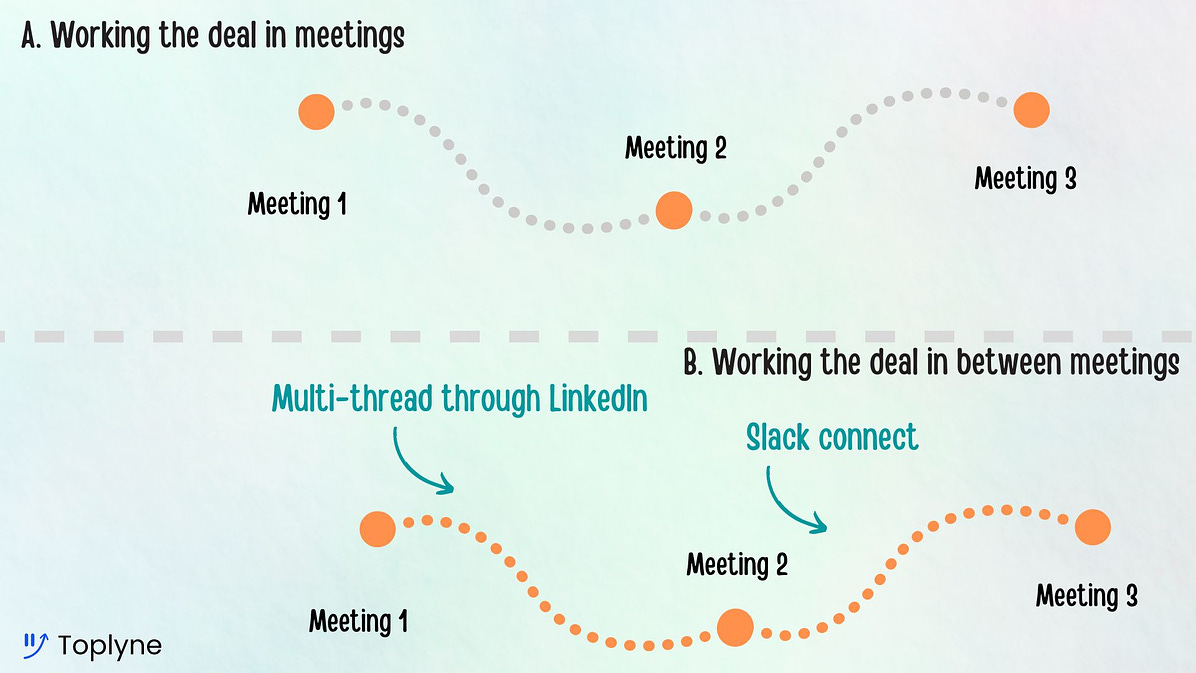

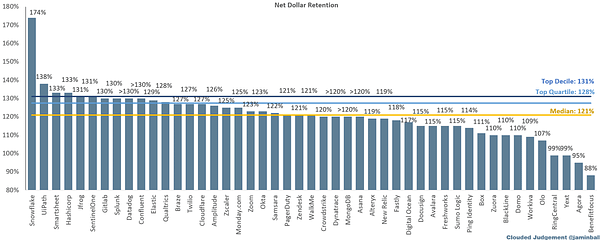

Remove friction with content: It’s time for your PMMs to shine. Through customer customer-messaging and targeted content, your PMMs can warm up accounts for expansion and remove future friction from the expansion sale. Work the deal in between meetings: Drift’s expansion teams multi-thread through LinkedIn, loop in legal, security, and compliance teams on Slack connect, and warm up to a call with the C-suite with a 5-minute intro-video made on Drift. Be like Drift. And so in summary…That’s a wrap on our three-part series on expansion. Revisit part 1: What SaaS can learn about expansion from cats. Where we defined the extent of the expansion goldmine. And part 2: What SaaS can learn about expansion from viruses. A breakdown of the best organic levers of team and account expansion we’ve seen in PLG tools. When the market takes a turn for the worse, the “land” in “land and expand” becomes tougher than ever. Expansion’s the name of the game.  Net retention will be an incredibly important metric in any market downturn. In down markets, it's tougher to get new deals across the finishing (more CFO scrutiny). Companies will rely more on growth of existing customers. In Q1 elite businesses had net retention >131% |

Older messages

The key ingredients of organic expansion

Thursday, January 5, 2023

Part 2 of the Expansion Manifesto: How the most viral products expand within accounts

2022 Wrapped in Memes

Tuesday, December 27, 2022

The dankest moments of 2022 from the world of SaaS and product-led growth

The Expansion Manifesto: Part 1/3

Friday, December 16, 2022

What SaaS can learn about expansion from cats

Meet the hottest speech AI tool in town: Deepgram

Tuesday, December 6, 2022

Hot off a $72M Series B in a market where Amazon Alexa is on pace to lose $10B and Google is eyeing cuts to Google Assistant

Building the fastest e-mail experience known to man

Thursday, December 1, 2022

With Gaurav Vohra, Founding Team member at Superhuman

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏