Fake Debt Ceiling Crisis Sends Investors Searching For Safety

To investors, There is an insane, childish game being played with the US economy right now — hello, debt ceiling! For those of you who are unaware, here is how the Treasury Department describes the debt limit (also known as debt ceiling):

Some of you may be surprised when you read that definition. You may ask yourself why the US government needs to borrow money to meet obligations? Or why it is using debt to fund Social Security and Medicare? Or maybe you were confused why the government needs to borrow money to pay interest on money that the government previously borrowed? These are valid questions. The truth may make you uncomfortable, but it is important to understand — the United States government is broke. It literally doesn’t have the money necessarily to run the government each year, so it is forced to borrow money. An easy way to understand what is happening is to use a private organization as the example, rather than think of a national government. Let’s call our private organization Bad Management Inc for fun. Bad Management Inc has found itself in a very awkward position. Each year for a decade it has continued to pull in more top line revenue from customers and partners, but the losses each year are getting worse and worse. No matter what Bad Management Inc does, it can’t seem to break even. But Bad Management Inc needs to pay the bills. So years ago it started to borrow money to help make up the differences between revenue and expenses. At first, Bad Management Inc only needed to borrow small amounts of money. Unfortunately it couldn’t figure out how to pay off those initial loans, so it started to take out larger and larger loans. These new loans were used to not only pay for the annual difference in revenue and expenses, but the new loads were also used to pay off the old loans and their interest payments. Eventually, Bad Management Inc has found itself in a huge, horrible, nearly impossible situation. It went from owing millions of dollars, to owing billions of dollars, to now owing trillions of dollars. And the only way to pay for the interest on the past debt is to borrow even more money today. This is insane. Any person with half a brain would look at this situation and say that it was unsustainable. The alarm bells would be going off. Do something different or shut it down. Now remember…Bad Management Inc is a fictitious company we invented for discussion purposes. We can laugh and move on with our day. No harm done. But, as you already guessed, the US government has done exactly what Bad Management Inc was reported to have done in our example. The US national debt has officially topped $31.4 trillion this week. Do you know how much money that is? $31,400,000,000,000. Double-digit zeros after the 31 in that number. Literal madness. This is where the debit limit comes in. Congress is technically in-charge of setting the debt limit. It is the check and balance on the Federal Reserve, Treasury, and other finance-related organizations. Back in December 2021, after a heated debate across party lines, Congress agreed to increase the previous debt limit to the current $31.4 trillion number. It was using new debt to pay for old debt and expenses. Again, the definition of insanity. Now that we have hit the new debt limit, we are watching another partisan debate unfold. Democrats are asking Congress to raise the debt ceiling again. Republicans are saying “no, not unless you agree to reduce spending in other areas to offset the increase in debt.” Neither will agree with the other. They won’t meet at the negotiating table. There is just a bunch of bickering going on, including via tweets and press releases. I told you there were insane, childish games being played. So until further notice, the American economy is faced with default or emergency action. Thankfully, the US Treasury has stepped in and it is taking emergency action to buy the US economy time until approximately June before a true default would take place. What is that emergency action? Tami Luhby explains it best:

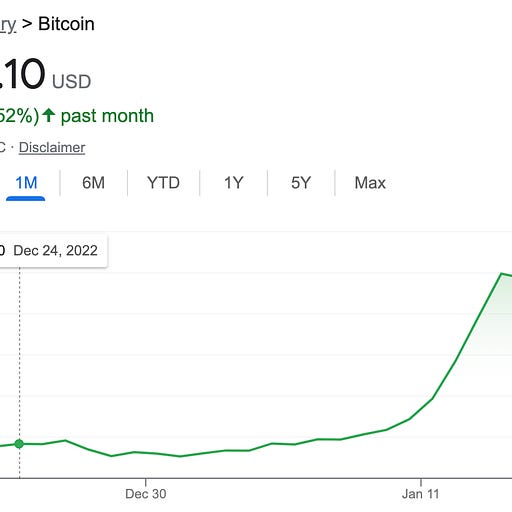

I am not convinced that it makes sense to play with retirement funds under the promise of making the receipents whole later. That seems like the plot to a really bad, underfunded Hollywood film where the citizens get screwed. Ok, back to the debt limit. The US government has bills to pay. It doesn’t have enough revenue to cover the expenses. The government has to borrow money. But the only way the government can borrow money is if Congress authorizes them to do it. But Congress is controlled by Republicans right now and they’re not excited about borrowing more money. It is a showdown. Everyone wants attention and press hits. But nothing is getting done. And time is ticking. We don’t know the end of the story yet. We have to wait until June, but my guess is that the debt limit will get raised. Congress may even wait till the last few hours as if it is a group of undisciplined college kids who cram for an exam the night before. But the limit will get raised and the US economy will avoid default. To make it even spicier, the mainstream media will yell and scream about the crisis for months. They will fear monger and say things like “this is the first time in history that the US is going to default!! Be very afraid!!” Calm down. The US is not going to default. Don’t confuse political games for actual crisis. So what should you be paying attention to if you’re not paying attention to the debt limit hysteria? Asset prices. Keep your eye on the ball. Asset prices is where the real action takes place. But the action you are about to see is not the action you are probably expecting. See, to fully understand the debt ceiling faux-crisis, you have to put yourself in the shoes of a financial investor anywhere in the world. These investors use US treasuries as a core benchmark for their portfolios. If there was a default by the United States, these treasuries would lose the historic trust that the asset has held and most investors would not know where to go to find safety for their financial assets. So when the debt limit crisis is surfaced, we should expect safe haven assets to start increasing in price as investors seek them out. And, almost on cue, the safe haven assets are doing their job. 🚨 The rest of this letter is only available for paying subscribers to The Pomp Letter. Their support makes this work possible. If you’re not a subscriber, consider subscribing to read the rest of this letter and help us continue to create independent work on financial markets 🚨... Subscribe to The Pomp Letter to read the rest.Become a paying subscriber of The Pomp Letter to get access to this post and other subscriber-only content. A subscription gets you:

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||

Older messages

The War of Art (Stop procrastinating!)

Friday, January 20, 2023

Listen now (11 min) | Pomp's notes on The War of Art by Steven Pressfield

Why Is The Inflation Methodology Being Changed?!

Friday, January 20, 2023

Listen now (6 min) | The BLS is changing how inflation is calculated in the middle of an inflation crisis

How Good Profit Built A $125 Billion Business

Monday, January 9, 2023

Listen now (10 min) | Pomp's notes on Good Profit by Charles Koch

Grow or Die

Friday, January 6, 2023

Listen now (5 min) | The motto of America for the next 80 years

The Fed Has A Shotgun, Not A Sniper Rifle

Wednesday, January 4, 2023

Listen now (8 min) | Impact of the Fed's tighter financial conditions

You Might Also Like

The Silver Influencer 🩶

Monday, March 10, 2025

Work with Gen X and Boomer influencers.

Elon lost the fight to Open AI

Monday, March 10, 2025

but did he really lose?..... PLUS: Authors sued Meta!

TikTok updates, video editing hacks, avoiding AI hallucinations, and more

Monday, March 10, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry... we've got your

How Amazon Lures Chinese Factories Away From Temu [Roundup]

Monday, March 10, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Dry powder piles up for mature funds

Monday, March 10, 2025

Defense tech VC deals balloon; data dive on VC's emerging opportunities; France's positive quarter, but sluggish year Read online | Don't want to receive these emails? Manage your

Digiday wants to hear from you

Monday, March 10, 2025

As a loyal reader, your feedback is vital as we continue to evolve our products and coverage. We're reaching out to see if you'd answer a few questions to help make your experience with Digiday

Advertisers are calling for full URL-level campaign reporting, and DSPs are responding in different ways

Monday, March 10, 2025

The Trade Desk quells talk of full URL-level campaign reporting (similar to Amazon), but there are nuances. March 10, 2025 PRESENTED BY Advertisers are calling for full URL-level campaign reporting,

The 90-10 Rule: Why Great Leaders Don’t Need Universal Approval

Monday, March 10, 2025

Leaders who focus too much on making everyone happy may inadvertently stifle the very innovation and progress that constructive dissatisfaction can inspire.

Athletes Are Making Their Own Chip Deals 🥔💰

Monday, March 10, 2025

Athletes turning snacks into serious cash 🚀🥔