DeFi Rate - This Week In DeFi – January 26

This Week In DeFi – January 26This week, Uniswap looks to deploy on BNB Chain, Aave soon to launch v3 and GHO stablecoin on Ethereum, dYdX delays its token unlock and Moody's develops stablecoin ratings.To the DeFi community, This week, a "temperature check" vote has been conducted in the Uniswap community, to gauge support for deployment of the decentralized exchange's V3 protocol to BNB Chain. 80% of UNI token holders voted in favor of the move. Reasons for a possible move to BNB Chain include its large and growing user base, as well as high transaction speeds and low fees – making it a suitable platform for Uniswap's DEX services. It is estimated that the move could attract at least $1 billion in additional liquidity and 1-2 million new users. 0xPlasma Labs, who floated the idea, is expected to submit a final proposal outlining the move in the coming weeks. Aave is expected to launch the latest version of its software on Ethereum on Friday, with AAVE token holders expected to approve the move in a vote ending 5pm Wednesday (Eastern Time). In addition to the v3 release, Aave's GHO stablecoin is expected to be released in the coming weeks. Aave v3, has already existed on other blockchains for almost a year, with more than $5.5 billion in total value locked (TVL). The protocol includes a feature called "efficiency mode" that will offer a better loan-to-value ratio when borrowing assets correlated with their collateral, as well as a "portal" feature that will allow users to move liquidity across Aave's several blockchains.  In an interview with The Defiant, @AaveAave founder @StaniKulechov said Aave's $GHO stablecoin would be released “in weeks,” 👀 👻

While $GHO is widely anticipated, it’s just one of several benefits promised in the protocol’s latest software release. The dYdX Foundation has announced a delay in the release of 130 million DYDX tokens, worth around $300 million, which were originally scheduled for release on February 3rd. The tokens will now be released on December 1st instead. The delay follows significant public scrutiny of the token's release schedule, which would have seen the token's supply increase by 88% in one week. The release schedule will now begin with 30% of the tokens entering circulation on December 1st, with the remaining tokens being released in tranches until June 2026.  So after hearing the news about dYdX changing its vesting date, I and @luigyGT were curious about exactly how they handled vesting in the first place.

What we found was not pretty 🧵 Global ratings agency, Moody's, is developing a system to score up to 20 stablecoins based on the quality of attestations on the reserves backing them. Moody’s already provides credit ratings for publicly traded crypto companies such as Coinbase Global Inc. and issues broader analysis reports on the sector. The project is still in early stages and will not represent an official credit rating.  scoop! credit ratings agency Moody’s is working on a scoring system for stablecoins as the asset class rises in popularity among crypto traders and tradfi firms alike.

still in early stages, it could include up to 20 tokens

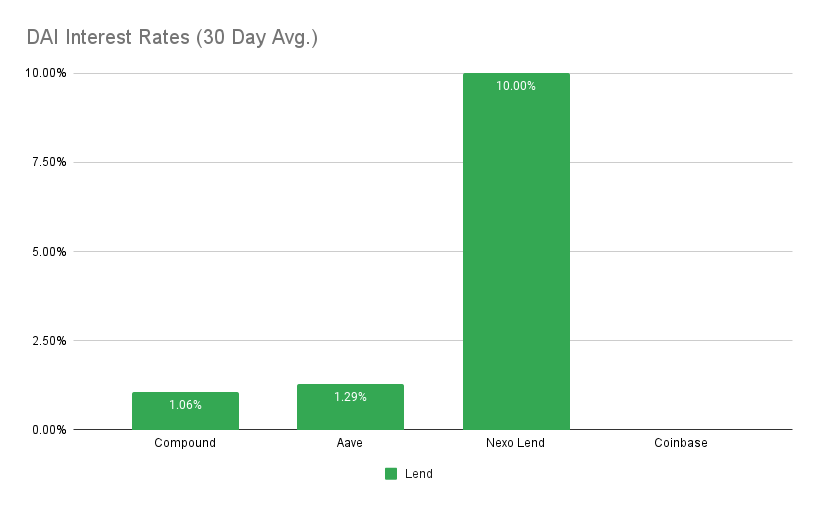

on Terminal now 🖥️ web 🔜 Attention is well and truly back on development and progress over the last week, as several projects announce releases and/or voting on new and exciting developments. Uniswap, the most popular decentralized exchange is considering deploying on BNB Chain to capture a whole new market segment, while Aave’s GHO stablecoin appears to be just around the corner, ready to follow its v3 protocol deployment on Ethereum. Outside of Ethereum, we have Injective Protocol launching a massive $150 million incentive fund to improve adoption on Cosmos, which is still a new and budding network. China’s equivalent of “Instagram” has partnered with the lesser-known Conflux blockchain for NFT integrations, adding to centralized expansions into Web3. One of the most interesting developments has been the announcement of Moody’s venturing into rating stablecoins, based upon the integrity of their reserve attestations – yet another nod of acknowledgement from the traditional finance space toward crypto and DeFi. Most fun to watch over the next few weeks may be decentralized stablecoins, as we watch the eventual release of GHO and perhaps some pressure on Curve to launch crvUSD. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.3% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Coinbase at 1.5% APY Top StoriesCrypto Exchange Mango Markets Sues Exploiter for $47M in DamagesVitalik Buterin Outlines Stealth Address Possibilities on EthereumBinance USD Stablecoin Sees $2B Reduction in a Month Amid Token MismanagementInjective launches $150M ecosystem fund to boost DeFi, Cosmos adoptionStat BoxTotal Value Locked: $47.51B (up 5.9% since last week) DeFi Market Cap: $46.76B (up 9.3%) DEX Weekly Volume: $12.26B (down 7.7%) Bonus Reads[Osato Avan-Nomayo – The Block] – Sushi DAO implements proposal to direct all trading fees to treasury [Vishal Chawla – The Block] – MakerDAO community backs plan to deposit $100 million into Yearn Finance [Aleksandar Gilbert – The Defiant] – Optimism Activity Plummets After NFT Incentives End [Press Release - CryptoBriefing] – China’s “Instagram” Chooses Conflux Network for Permissionless Blockchain Integration This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – January 20

Friday, January 20, 2023

This week, Shiba Inu announces its Layer-2 scaling platform Shibarium, SushiSwap will build a DEX aggregator, 1inch introduces a hardware wallet, and Swing rolls out a handy cross-chain developer kit.

This Week In DeFi – January 13

Friday, January 20, 2023

This week, ConsenSys launches their zkEVM scaling platform testnet, Ondo Finance tokenizes US treasuries and bonds, Yearn makes vault creation permissionless, and Nexo gets raided in Bulgaria.

This Week In DeFi – January 6

Friday, January 6, 2023

This week, SushiSwap explores new tokenomics, Vauld rejects Nexo's final acquisition proposal, TON launches a data sharing solution and a judge rules that customer funds belong to Celsius.

This Week In DeFi – December 30

Friday, December 30, 2022

This week, Alameda Research addresses continue to engage in shady behavior, 1inch releases its "Fusion" upgrade and Stacks looks to bring smart contract functionality to Bitcoin with sBTC.

This Week In DeFi – December 16

Friday, December 23, 2022

This week, Binance.US agrees to acquire Voyager Digital, Visa considers StarkNet for automatic payments, Uniswap partners with Moonpay and Senator Toomey introduces a stablecoin bill before retirement

You Might Also Like

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏