Earnings+More - Weekend Edition #86

Weekend Edition #86PointsBet says no to Mass, SIS sale, Bally’s new broom, Churchill Downs focuses on HRMs, sector watch – affiliates +MoreGood morning. Welcome to the latest Weekender. In today’s edition:

PointsBet balks in BostonHaving gone through the application process, PointsBet has decided against taking up a license in soon-to-open Massachusetts. Out of the running: The number of licensees set to hit the starting line on March 10 was reduced to nine yesterday after PointsBet became the latest company to withdraw their application.

Of the nine that were given the go-ahead yesterday, only seven are set to go live in March, including Barstool, BetMGM, Betr, Caesars, DraftKings, FanDuel and WynnBET. The remaining two licenses, Bally Bet and Fanatics, each reportedly told the Commission they would launch in May.

Pullback: In its most recent trading update, PointsBet said it had renegotiated its marketing deal with NBC having relinquished its rights to certain national advertising assets and allowing NBC to do a deal around the NFL with BetMGM.

Further reading: E+M’s Deal Talk in early January questioned whether PointsBet had enough runway to reach profitability in the US. ** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. SIS up for saleThe betting content supplier is being primed for a £200m sale. ITMA: Oakvale Capital has been tasked with finding buyers for the largely bookmaker-owned SIS, according to Sky News. Entain, William Hill and Betfred are on the shareholder list alongside investment trust Caledonia.

Bally’s rethinkNew CEO at Bally’s confirms the company is reassessing its OSB platform options. Not.Works: Former online COO Robeson Reeves, who is set to take over from departing CEO Lee Fenton at the end of March, admitted Bet.Works, bought in the summer of 2021 for $125m, was “not the right platform” for Bally Bet and that the company was evaluating third-party options.

Play how it lays: The group will focus on its iCasino expertise in the US and Reeves pointed to its launch in New Jersey four months ago as “a perfect example” of playing to Bally’s strengths. Bally’s is also live in Ontario and will soon launch in Pennsylvania.

National brand: Having closed its acquisition of the Tropicana in Las Vegas in September, retail president George Papanier said owning the property was part of Bally’s plan to be a “national company”. He added that the group was evaluating development opportunities there, but was “not interested in standing other people's mistakes”.

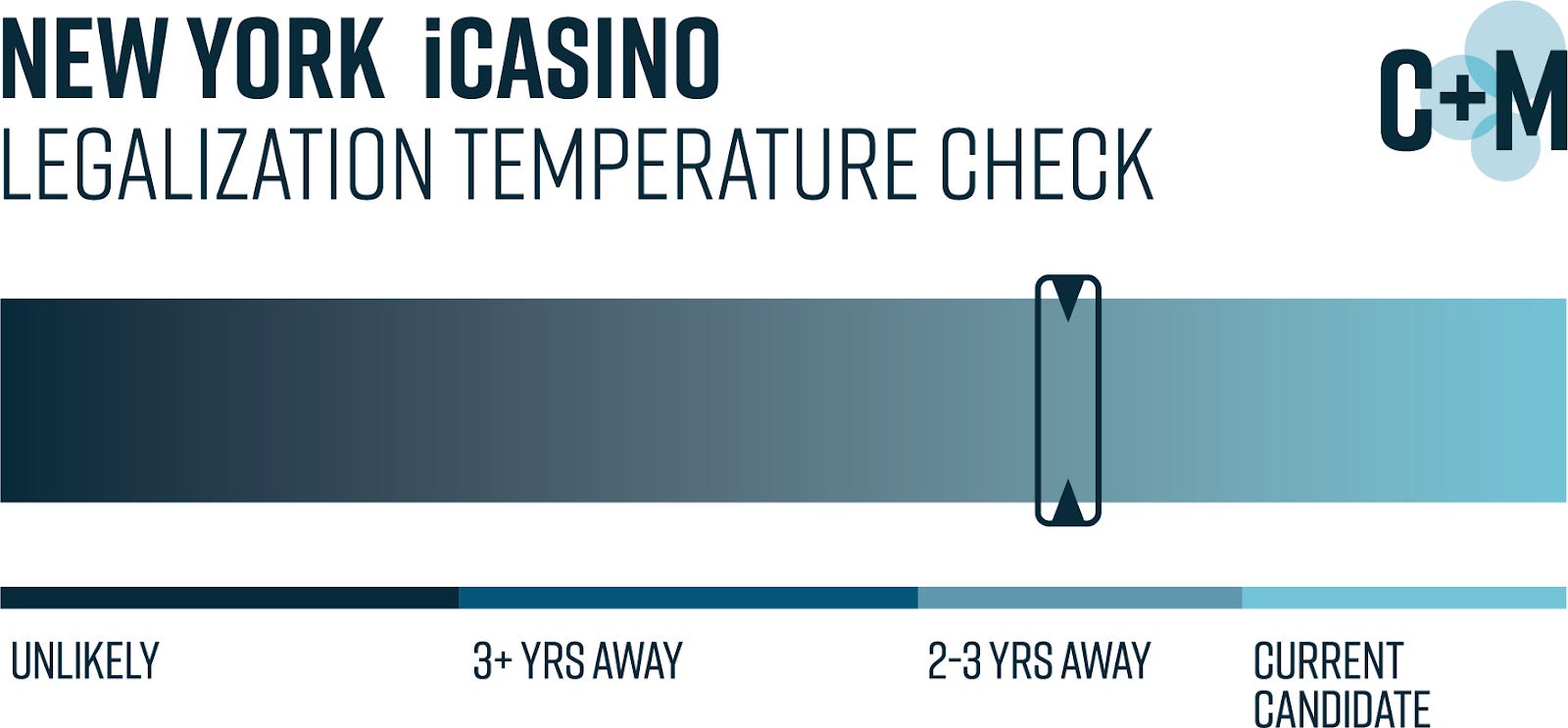

ICYMIiCasiNO: This week on Compliance+More, we reported Indiana online gaming legislation bit the dust, while the efforts in New York also appear doomed. In Earnings+More’s latest edition of Due Diligence, the arguments in favor of tax and regulatory changes were also examined. Also in Compliance+More this week:

On Earnings+More this week:

Churchill Downs keeps on goingAfter swallowing its largest ever transaction last year, Churchill Downs said it wasn’t slowing down this year. All you can eat: CEO Bill Carstanjen said Churchill Downs had “built and scaled” the business and was set to “digest and harvest” the benefits from the $2.75bn acquisition of Peninsula Pacific, which completed in November.

History lesson: Analysts at JMP suggested the HRM story was “one of the most impressive” across the gaming space, noting its contribution to total revenues at Churchill Downs was now 22% from just 7% in 2019.

REITs reportEarnings from gaming REIT giants VICI and GLP hit the tapes yesterday. The 101ers: Buoyant numbers came from the leading lights of the gaming REIT sector, with VICI showing Q4 revenue growth of 101% to $770m and GLP also achieving record revenues in the last three months of 2022 of $336.4m, up 13%.

Caesars analyst takesOn the level: The team at B Riley suggested forecasts for EBITDA at Caesars Las Vegas operators to be essentially flat in 2023 were too low. “We struggle with consensus,” the team added, suggesting the strengthening group picture, new events (including F1) and the ongoing return of older visitors and international traffic bodes well for the year.

Earnings in briefGalaxy Entertainment: The Macau operator said it was “cautiously optimistic” after a solid performance from CNY. Q4 net revenue was down 39% to HK$2.9bn while the company registered an adj. EBITDA loss of HK$200m, an improvement on the HK$600m loss in Q3. The Lottery Corporation said its efforts to develop omni-channel products had led to a strong increase in active customers as the newly demerged entity reported a 7.5% rise in revenues to A$1.9bn and a 15.8% leap in EBITDA to A$409.4m in H123. CIRSA: Land-based casino was the driver as CIRSA saw revenues rise 31% to €496m and EBITDA jumped 28% to €154.6m. Highlights included the performance of the E-Play24 brand and expansion in LatAm. Tote operator Webis said torrential rainfall in northern California and race cancellations had led to a 4% drop in handle to $38.2m and a net loss of $330k in H1. The group said the B2B market was “getting tougher, with certain operators willing to take wagers at an almost zero percent margin”, and will focus on its B2C activities. Sector watch – affiliatesBig week: With Better Collective now owning 5% of Catena Media, the two produced their results within 12 hours of each other this week as rumors swirled about BC’s intentions for its erstwhile super-affiliate peer.

What do I get? Catena’s assets include the market-leading LegalSportsReport.com and Lineups, as well as the more recent assets gained from the i15 Media acquisition. However, an unspecified proportion of its North American revenues came from its relationship with Virtual Gaming Worlds, which runs the social casino brand Chumba.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com NewslinesWinning ugly: Elys Game Technology has announced a deal to run a retail sportsbook out of The Ugly Mug restaurant in Washington, DC. GiG will expand its relationship with News Corp. into Ireland. Hacksaw Gaming will supply its online slots and scratchcard content to William Hill. What we’re readingHuddle Up on why Penn bought Barstool for $551m. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Caesars high on Vegas supply

Wednesday, February 22, 2023

Caesars confirms buoyant results, the super affiliates report, BetMGM remains on top in Michigan +More

A taxing issue – the New York debate

Tuesday, February 21, 2023

DraftKings' and FanDuel's New York tax arguments examined, recent analyst takes +More

DraftKings soars 85% in 2023

Monday, February 20, 2023

DraftKings' post-earnings uplift, Pennsylvania data, startup focus – Betscope +More

DraftKings’ surgical strikes

Friday, February 17, 2023

The latest commentary from the DraftKings Q4 earnings call +More

Weekend Edition #85

Friday, February 17, 2023

DraftKings's profitability push, New Jersey's January data, LeoVegas exits 'smaller markets', the AGA state of the industry +More

You Might Also Like

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

10 Trend Predictions for Coaches, Consultants & Experts in 2025

Wednesday, January 15, 2025

From platform shifts to portfolio careers: my thoughts on what's coming in the year ahead. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Breaking What Isn’t Broken: Lessons from USWNT Coach Emma Hayes

Wednesday, January 15, 2025

The moment we settle for what's comfortable, we stop evolving, learning, competing and getting better.

Refershing Campaigns

Wednesday, January 15, 2025

Oops.

Walmart deepens its metaverse presence with new e-commerce experience selling physical goods on Zepeto

Wednesday, January 15, 2025

Walmart's decision to focus on virtual clothing items for its latest foray into the metaverse shows how the company has learned from its previous experiments in the space. January 15, 2025

🔔Opening Bell Daily: Big bank earnings begin

Wednesday, January 15, 2025

Financial stocks have rallied since Trump won the election and soft-landing hopes have climbed.

Cash rich

Wednesday, January 15, 2025

Startups raised over $200m in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Hidden early stage growth hack of Airbnb

Wednesday, January 15, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Hidden early stage growth hack of Airbnb A script was scanning all new rental properties on

Big eCommerce Goals for 2025? We got you🎯

Wednesday, January 15, 2025

Essential Guides for eCommerce Success Hello Reader, Whether you're setting fresh goals or planning to build on last year's wins, we're here to help you achieve your eCommerce goals in 2025

Brand-new site gets 13 million monthly visits from Google!?

Tuesday, January 14, 2025

Content sites aren't dead yet