VC monthly report: funding amount ended a four-month decline in February

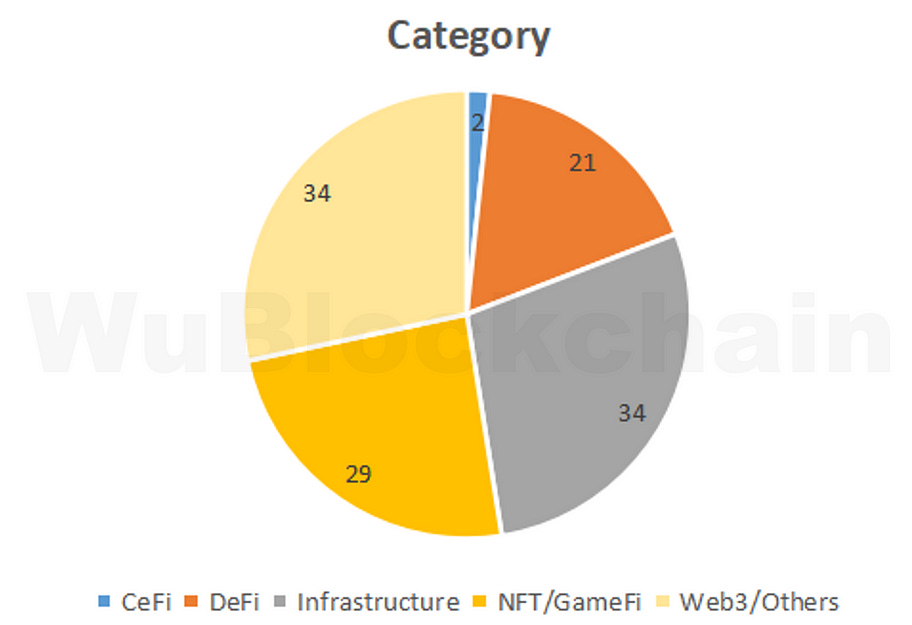

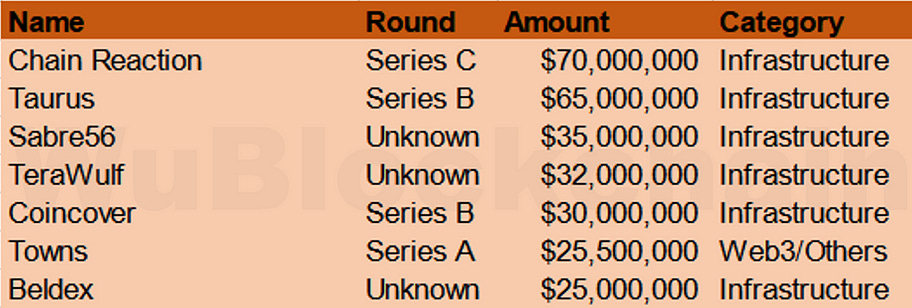

Author: WuBlockchain According to RootData statistics, in February, there were 120 public investment projects of crypto VC. The number increased 62% month-on-month (74 projects in January 2023) and decreased 23% year-over-year (155 projects in February 2022). Industry-level classification is as follows: In February, infrastructure projects accounted for about 28%, DeFi about 18%, and NFT/GameFi about 24%. Total financing in February was US $950 million, up 66.7% month-on-month (US $570 million in January 2023) and down 76.6% year on year (US $4.06 billion in February 2022), ending a four-month decline. More than $20 million of these rotations (excluding CeFi, miners and other centralised institutions) are as follows: Chain Reaction, a blockchain chip startup, was led by Morgan Creek Digital in the funding, which will be used to expand its engineering team. CEO Alon Webman said the company will begin mass production of its blockchain chip Electrum in the first quarter, and plans to launch a “full homomorphic encryption” chip by the end of 2024, allowing users to process data as well as encrypt it. Taurus SA is a Swiss digital asset infrastructure company that assists companies in issuing, hosting and trading any digital asset: including Asset Staking and Tokenization. Credit Suisse led the funding round with participation from Deutsche Bank, Swiss private bank Pictet Group and Cedar Mundi Ventures, a Lebanese investment firm focused on technology. Sabre56, a bitcoin mining consultancy, has so far raised $35 million to build its hosting site, with the goal of building 150MW of installed capacity by the end of the year. The first four sites, totaling 115MW, are located in Wyoming and Texas and have already begun construction. Chief Executive Phil Harvey said the $35 million investment was largely private. TeraWulf is a BTC mining company that maximizes energy to crypto value chain through power optimization. In January, Cumulus Data announced plans to start TeraWulf this year, making it the first nuclear-powered bitcoin mine in the United States. Coincover is committed to providing unique technologies to protect the digital assets of crypto companies and individual investors, including monitoring and analysis to identify suspicious transactions accessed without authorization, compensation for certain hacks, and end-to-end encryption vaults for secure storage and private key recovery. The funding round was led by Foundation Capital. Towns is the first product from Here Not There Labs, a group chat protocol and application designed specifically for online communities. This is a Web3 group chat protocol and application that enables online communities to build blockchain-based gatherings in a fully decentralized manner. Any group can use Towns to meet and chat freely in Spaces designed to suit their needs — without fear that some organisation will change the rules, profit from their activities or take away their rights. The financing was led by a16z crypto. Beldex is a privacy technology startup. The funding was led by digital asset market maker DWF Labs. The money will be used for research and development of the Beldex ecosystem, with DWF acting as an adviser and helping with marketing campaigns. The Beldex ecosystem includes BChat, a private messaging application, BelNet, a decentralized virtual private network (VPN), the Web3 browser, and cross-chain privacy protocols. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

WuBlockchain Weekly:Silvergate fallout、Justin Sun bolstered Lido’s TVL、UK banks restrict cryptocurrencies and Top1…

Friday, March 3, 2023

Top10 News 1. Silvergate's weekly summary a. Silvergate may be poorly capitalized link Silvergate, a prominent crypto-friendly bank, couldn't file its annual financial report on time and told

Fore Elite Capital: How to do a compliant cryptocurrency fund in Hong Kong?

Friday, March 3, 2023

This article is an interview with Fore Elite Capital CFO Wing Tan Ask : Could you please provide some information about Fore Elite Capital's history, status, and future development plans? Wing Tan:

Underestimated Ambitions and Three Challenges: Unveiling the Hong Kong Cryptocurrency Consultation Paper

Thursday, March 2, 2023

Author:William, Special Researcher Editor: WuBlockchain On February 20, 2023, the Hong Kong SFC issued the “Consultation Paper” on cryptocurrency transactions, marking an important step taken by the

Typical case: US court freezing Chinese user's USDT

Wednesday, March 1, 2023

Author: Bitrace Original link: https://mp.weixin.qq.com/s/KRwCWnJUTZ2_P6SmCR_8Dg In recent years, with the gradual upgrading of the US government departments' regulatory measures for

TreasureDAO's Biggest Competitor? TridentDAO's new play on risk to earn

Tuesday, February 28, 2023

Author: @0xMavWisdom The Arbiturm ecosystem has continued to explode recently, with a game project called TridentDAO sparking community discussion. This free to play game project, developed by Geyser

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏