Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #331

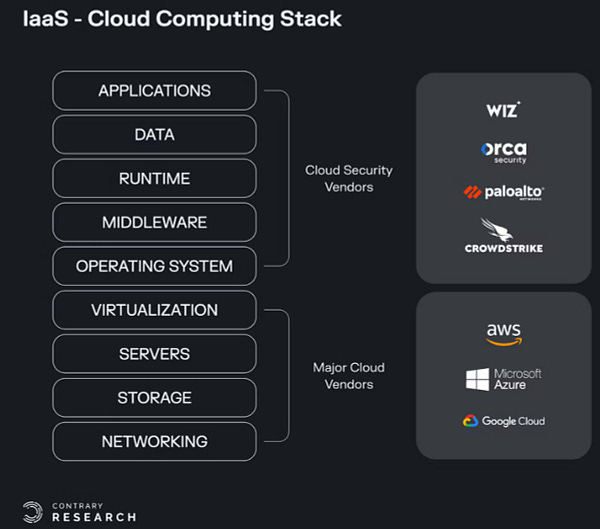

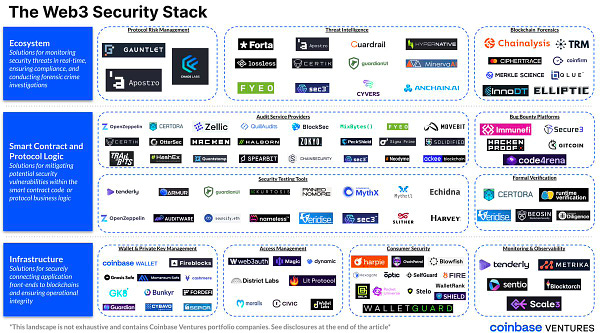

What's 🔥 in Enterprise IT/VC #331The fear of running out runway vs. stepping on the gas - don't miss your window of opportunityI am seeing signs of positivity in VC and founder land. Checkbooks are opening up again for Series A and beyond rounds as there was lots of activity in the portfolio this week that resulted in some signed term sheets and/or closings of rounds - Woo hoo! It was also a big week for Israeli cybersecurity as you will read in the the Enterprise Tech section below. Wiz in the cloud security space raised at a $10B valuation and an outlier multiple, Axis Security in SASE (secure access edge market) sold for $500M for what I hear is also a “strategic” value (i.e., meaning not grounded in any existing ARR but for tech), and rumors that NoName in API security space could be bought. BTW, don’t be surprised if Cisco’s name pops up on the radar as I hear they are hunting, especially as they are sitting on lots of cash. Switching gears, I’ve talked to a number of founders who are obsessed with runway and rightly so…but IMO, perhaps at the expense of capturing opportunities that are sitting right in front of them. I get it, and I understand the fear of going from 24 mos to 20 mos runway, especially in an uncertain economic environment. But ask yourself one question, if I could go faster, what would I do, and what results could I expect? I’ve found that simple question can unlock a ton of insight. Some founders will say there is nothing an extra dollar of spend would do to unlock more value. Others that I’ve spoken with will come back and tell me they’ve actually been holding back and are chomping at the bit to do more, to run faster, but fear running out of cash. Perhaps an extra engineer or two can help you ship those features 3 mos faster to unlock a blocker to sales. Perhaps a sales engineer can help close more deals and let that engineer or you, the founder, get back to your other options. Yes, cash runway matters, but don’t use that as your only goalpost as this is also a great time to step on the gas when others are also pulling back. This is also a great opportunity to take an insider led up-round vs. down round to top off the cash. Perhaps you can run faster if you had 6 more mos of runway in a simple, fast, and clean process from existing investors. The tradeoff will be if taking the additional dilution now will allow you to create much more value by going faster today versus waiting and going slower. Either way, be honest with yourself and ask if you are holding your self back due to fear and missing out on market opportunities. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

Enterprise Tech

Markets

What's Hot in Enterprise IT/VC is free today. But if you enjoyed this post, you can tell What's Hot in Enterprise IT/VC that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

What's 🔥 in Enterprise IT/VC #330

Saturday, February 25, 2023

On founder led sales for your first 10 customers + importance of desire + attitude

What's 🔥 in Enterprise IT/VC #329

Saturday, February 18, 2023

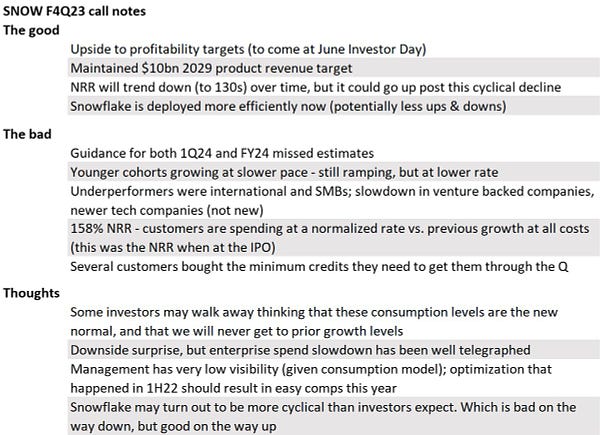

Where will best in class Net $ Retention land in 2023?

What's 🔥 in Enterprise IT/VC #328

Saturday, February 11, 2023

Avoid the death spiral of activity - also meet EdGPT 🤖

What's 🔥 in Enterprise IT/VC #327

Saturday, February 4, 2023

Hope springs eternal especially when it comes to AI

What's 🔥 in Enterprise IT/VC #326

Saturday, January 28, 2023

On planning...Be Macro Aware, Micro Obsessed

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏