Discussion: Will USDC Crashed? Who Will be the White Knight

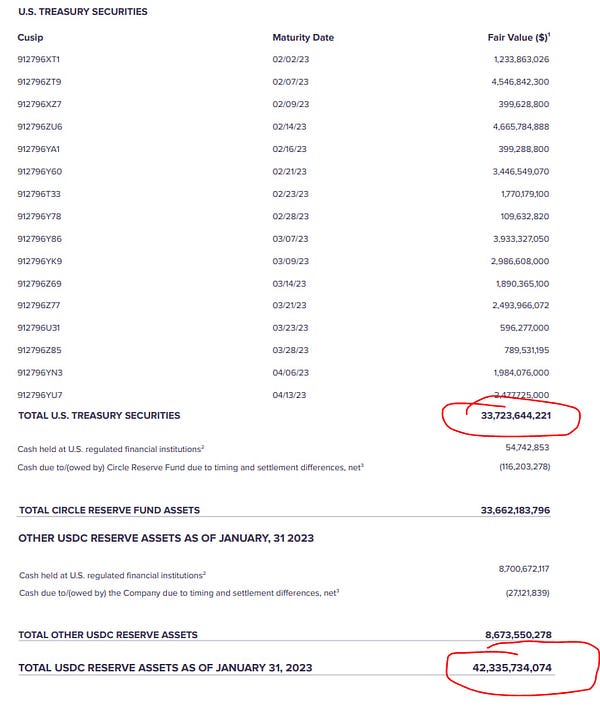

Summary: WuBlockchain On March 11, Circle disclosed that 3.3 billion USDC reserves were locked in Silicon Valley Bank, which declared bankruptcy. Coinbase urgently closed the fiat exchange channel and promised to open it when the banks opened on Monday. Whether USDC will be crashed or not, there are currently many discussions. Cobo Founder: Two Key Timing There are two key timing. The first is that there are 3 billion USDC collaterals in the MKR chain to mint DAI. Once the liquidation is triggered, the losses will be heavy. The second is that the bank will open the door to withdraw cash on Monday, and we need to pay attention to the run situation. Binance currently holds 3 billion+ USDC, and needs to pay attention to the exchanges and market makers. ps: MakerDAO launched an emergency proposal about USDC to limit Maker’s exposure to potentially impaired stablecoins and other risky collaterals, while maintaining enough liquidity to prevent DAI from trading significantly above $1 if conditions change, and ensuring there is adequate market liquidity to process potential liquidations of crypto collateralized vaults. NewHuo Researcher 0xLoki: The probability of problems with Circle is small The reserve assets of USDC can be divided into three parts: 1. a $32.4 billion portfolio of US Treasury bonds 2. $3.3 billion held in SVB, and 3. $7.8 billion held in banks outside of SVB. As of January this year, there were a total of 16 securities, with investment periods not exceeding 3 months and sufficient liquidity. Assuming a pessimistic recovery rate of 80%, Circle’s total loss would be approximately $2 billion, calculated as 33*40% + 33*20%. A more reasonable estimate is that Circle would lose approximately $700 million, calculated as 33*20% + 10% of one of the three banks. In the most extreme case, if SVB’s $3.3 billion and 50% of the remaining $5 billion in the other three banks cannot be recovered, the net value of USDC would be respectively 0.985 (normal situation), 0.954 (pessimistic situation), and 0.885 (extreme situation). Circle has no subjective fault or malicious behavior in this matter and is still a high-quality enterprise. Even if losses occur and Circle cannot resolve them, it is highly probable that other institutions will be willing to acquire or invest to solve the problem. There are three conditions that need to be met for USDC to truly collapse: 1. There must be enough funds in SVB and the three risky banks 2. The debt recovery rate of these banks must be low enough, and 3. USDC itself cannot bear the losses or cannot find funding to solve the problem. Therefore, in my personal opinion, the probability of problems occurring is not high, and even if they do occur, it is unlikely to be as serious as FTX. Read more Hedge Fund North Rock Digital Founder Hal Press: $0.77 Absolute Floor Circle holds 77% of their reserves in 1–4 month T-Bills. These T-Bills are held at BNY Mellon and managed by Blackrock. This provides an absolute floor on USDC of 0.77. The remaining 23% is all held in cash at various entities. Approximately 1/3 of that cash was held at SVB. SVB is going to liquidate all assets over the next couple months and most estimate will return no less than 10–20% of total asset value. It’s extremely hard to envision a scenario where you lose money buying USDC below that and most likely I think USDC ends up fully repegging. I am buying more at 88c as it is simply the best RR I have seen in a long time. Read more  Circle holds 77% of their reserves in 1-4 month T-Bills.

These T-Bills are held at BNY Mellon and managed by Blackrock. This provides an absolute floor on USDC of 0.77.

circle.com/hubfs/USDCAtte…

blackrock.com/cash/literatur… Muse Labs Jiang Jinze: Need to bet on a strategy Currently it looks like USDC is salvageable. After all, there is more than 30 billion short-term debt financing in hand (without floating losses or even the net value of the bond has soared higher than 1 recently). Just selling some casually is enough liquidity, but they have to bet on a strategy: whether to suspend redemption all the time, use selling financial management The money for the secondary repurchase. It is still open for redemption, but it can only be exchanged for 0.91. Personally, I think the first one is better, because in essence, those who sell USDC at a discount will carry the debt loophole. The second is to force everyone to share the shortfall equally, and the stable currency will be abolished. @wildPiPiLu: It is Silicon Valley Bank that decides the fate of USDC. If a large financial institution finally chooses to acquire Silicon Valley Bank, then the problems faced by Silicon Valley Bank and Circle will be resolved. If Silicon Valley Bank is eventually liquidated, it will basically confirm Circle’s short-term liquidity loss of 3.3 billion, and the prospects are worrying. Facilitating a takeover will be the most important task for the Fed and the New York Fed this weekend. Read the original text: Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Opinion: USDC's fate may depend on whether Silicon Valley Bank can be acquired

Saturday, March 11, 2023

Author: @wildPiPiLu Editor: Colin Wu At 7:42 pm (Beijing time), USDC/USDT declined around -9.58% in one day. It is still difficult to judge that this is the endpoint of decline, but from a technical

Weekly project updates: TwelveFold auction, Mirror's Subscribe to Mint, OKXNFT's first Bitcoin Ordinal NFT collect…

Saturday, March 11, 2023

1. PancakeSwap announces launch of V3 on BNBChain link PancakeSwap will launch PancakeSwap V3 on BNBChain in the first week of April 2023, which will offer several new features including better

CEX Data Report in Feb: Spot and Derivatives Volumes Both Slightly Up

Saturday, March 11, 2023

Data compiled by the WuBlockchain shows that: Spot trading volumes on major exchanges rose by 13.7% month-over-month in February. The top three gainers were Gate (+41%), Bitget (+29%), and Mexc (+26%),

WuBlockchain Weekly:Silvergate Bank liquidates、MakerDAO co-founder sell LDO、OPNX acquires CoinFLEX and Top10 News

Friday, March 10, 2023

Top10 News 1. Silvergate Bank to end operations and liquidate link On March 9, Silvergate Capital Corporation said in the document submitted to the SEC that it would end its operation and voluntarily

Cobo CEO Discus Fish: Why Did SBF Fall Into The Abyss?

Thursday, March 9, 2023

Discus Fish, the Co-Founder and CEO of Cobo, recently sat with DeThings, a Singapore-based blockchain new media platform, for an exclusive interview where Discus Fish shared his views and underlying

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏