Ankur Nagpal (Founder, Ocho): How Creators and Business Owners Can Build Wealth

Ankur Nagpal (Founder, Ocho): How Creators and Business Owners Can Build WealthLearn how you might save thousands of dollars in this tax seasonDear subscribers, Whether you’re a creator, business owner, or employee - you’re probably leaving thousands of dollars on the table if you haven’t studied the tax code closely. Ankur Nagpal is the founder of Ocho, a platform that helps creators and business owners build wealth. Previously, he co-founded and sold Teachable for $250M. I spoke to Ankur just in time for tax season about:

None of what follows is financial advice. This post is brought to you by...Taplio Having an audience of people who follow you on social media is one of the biggest level-ups for your career. And you don't need a 100K+ audience to make a splash. With 850M+ users, LinkedIn is a great platform frow growing your personal brand. Taplio is the leading AI-powered publishing tool for LinkedIn. It lets you:

Attract more job and business opportunities on LinkedIn, try Taplio for free for a week with the link below. How employees can keep more of what they earnWelcome Ankur! Can you start by sharing some advice on how employees can build wealth on W2 income? Unfortunately, W2 is the worst type of income to keep more of what you earn. The tax code is written to encourage activities that the government wants you to do. In the US, starting a business and investing in real estate are two of those activities. That being said, here are some things that you can do to optimize your W2 income:

You mentioned real estate - how can you use that to reduce your taxes? Real estate depreciation lets you deduct part of the cost of your investment property from your income. Here’s how it works:

So for example, if you buy an investment property for $1M, you might be able to use the strategy above to get a tax deduction of $250K+ right way. There’s one catch - you can only deduct the $250K+ from passive income sources like rentals unless you or your spouse are real estate professionals. I know some couples who pay zero taxes on $1M+ income by having one person work in FAANG and the other person get qualified as a real estate professional. It’s complicated, but this shows the power of what you can do with the US tax code. Wow. Maybe the government should fix some of these loopholes. Yes, sometimes, when I share this information, people ask: “Why don’t you just pay your taxes?” And I’m like, look, all the wealthy people already know this stuff. They already have accountants doing this. So we may as well democratize this information and talk about it more openly. How creators and business owners can build wealthWhy did you decide to start Ocho to help creators and business owners build wealth? When I sold Teachable, I spent a lot of money hiring lawyers and consultants to help me structure my money, estate, and taxes. As an immigrant, it blew my mind how complicated the tax code was and how many loopholes there were for creators and business owners. Talking to other folks made me realize that they struggled with the same thing. So I want to help them keep more of what they earn. What are your top 3 tips for creators and business owners to build wealth? Great question. Here’s what I recommend:

Let’s talk more about incorporation. Can you explain more what an S-corp is and why it’s better for tax savings than an LLC? When you have an LLC or are unincorporated, all the income you make as a creator is subject to self-employment taxes. With an S-corp, you can split out your income as business owner and employee income. For example, if you made $100K this year, you can claim $50K as your employee salary and $50K as business profit. Since you only pay self-employment tax on your salary, you likely be able to save $5K in taxes on $100K income by using an S-corp. This is something that a lot of people don’t know about, but it produces thousands of dollars in tax savings upfront. Can the business owner set their own salary range? Yes, but it has to be somewhat defensible to the IRS. You can’t be like “I’m gonna pay myself $1K a year on $100K+ income.” It has to be reasonable like $50-60K. Great, now let’s talk about business expenses. What are some expenses that a business owner can deduct from tax? Business expenses include:

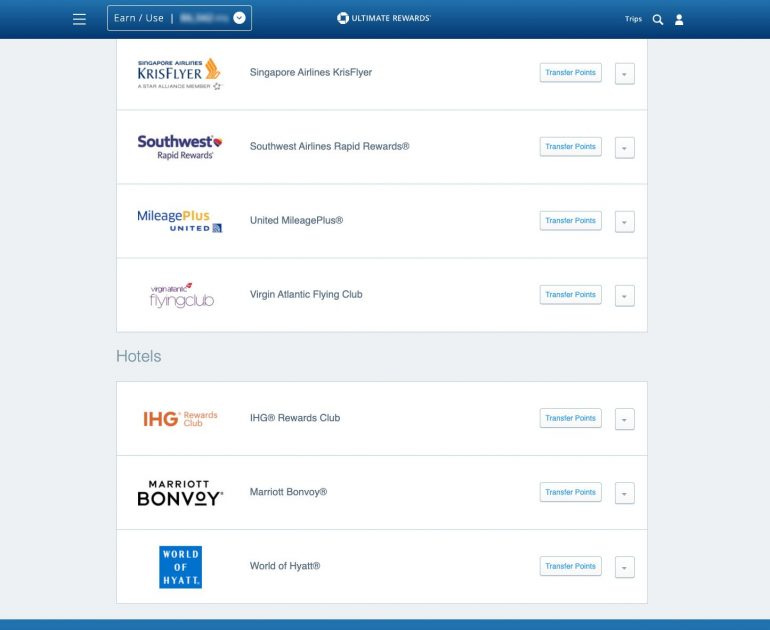

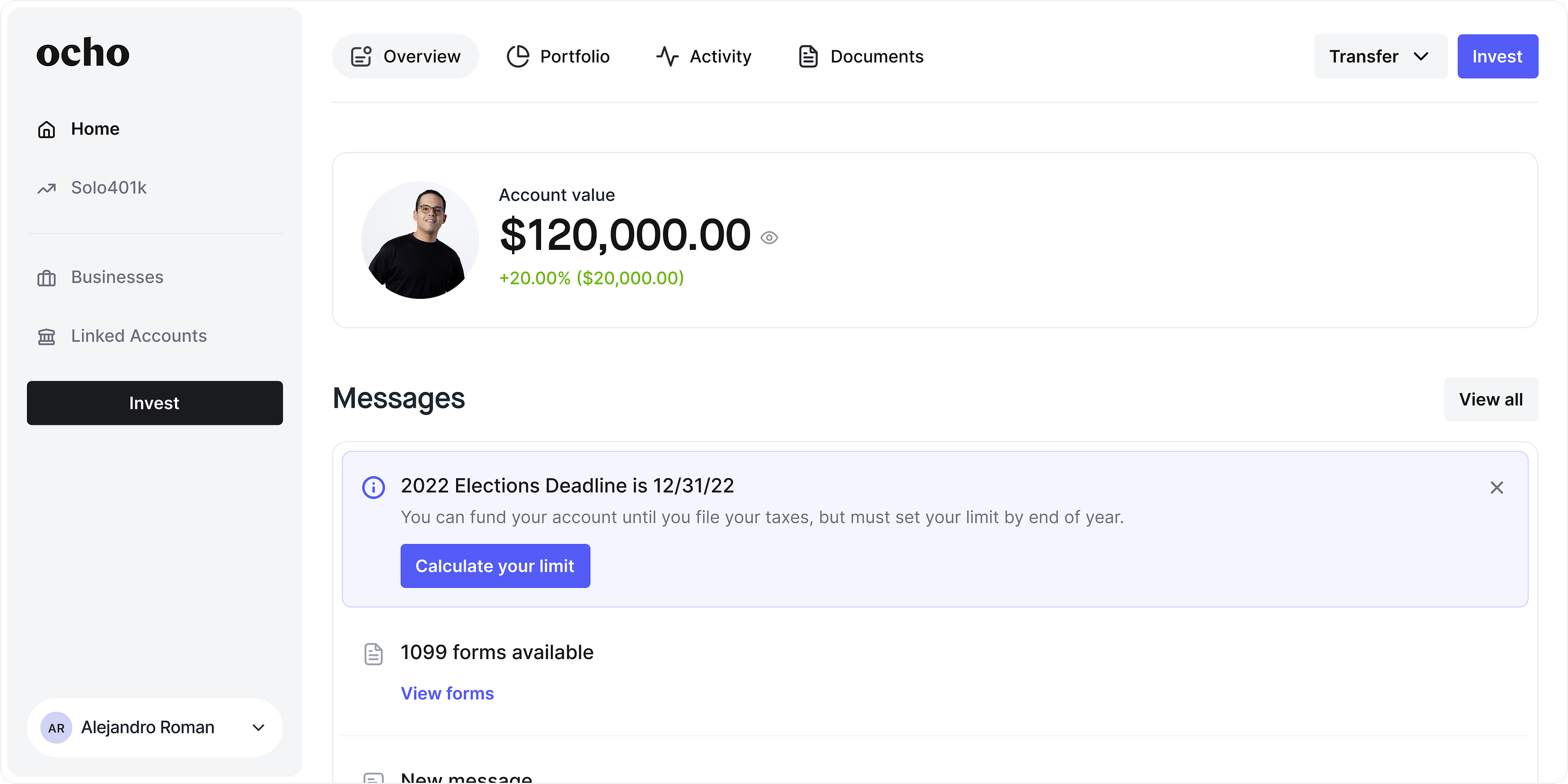

The list goes on. How can a business owner use credit cards to get more value out of these expenses? I use Chase Sapphire Reserve and AMEX Platinum cards because I love to travel. My biggest advice for using these cards is to never redeem points on the rewards website. Instead, you should transfer these points out to an airline. For example, I recently used 50K points to fly business class from Argentina. That’s $500 worth of points vs. $6,000+ if I bought the ticket. Will this work if a business has multiple owners? If your startup has multiple owners, it’s better to use a business credit card. It’s unfair to your employees and other owners if you’re racking up points on Chase by yourself. Ok let’s talk more about your third tip - what’s a solo 401k and why is it so powerful? I think the solo 401k is the best retirement account in America for three reasons:

With a solo 401k, are all your gains tax-free? I’m splitting my solo 401k into pre-tax and Roth accounts to mix and match. Last year, I contributed $20K to my solo Roth and $20K to my solo pre-tax accounts. I use my Roth account to make investments in startups. If any of those startups succeed, I can make hundreds of thousands in tax-free money for retirement. That’s incredibly powerful. Can corporate 401Ks be rolled over to a solo 401K? Yes, they can! Where can someone set up a solo 401k? Major brokerages like Fidelity, Schwab, and Vanguard all offer solo 401k. But to be honest, I found every single provider to be subpar. That’s why we decided to make solo 401k our first product at Ocho. We’ve onboarded a couple hundred customers and are about to roll out investing. It’s been a fun journey. How to get educated and hire the right helpWhere can people learn more about building wealth? You can find more information about these topics online but it takes a lot of work. At Ocho, we have a free learning section and a paid education product in Ocho Money. It's a membership site where we offer courses and training. Our vision is to integrate education and technology to create a seamless user experience to help you build wealth. Are most of your customers creators? We use the term "business owners." Many of them are creators, but many are also freelancers, consultants, and old-school business owners. If you have any kind of business or side hustle, you're the target audience. How can people hire better professional help? How can you find out if your accountant or financial planner is good? I think the most effective way is to ask other successful creators and business owners for referrals. I’ve probably recommended accountants to people at least 10x in the past two weeks because it’s tax season. Creators and business owners can also greatly benefit from discussing money matters with each other. Thanks so much Ankur for your advice! I honestly think this conversation will save people thousands of dollars. If you enjoyed this interview, follow Ankur on Twitter and check out Ocho to set up your solo 401k and learn more about these topics. Creator Economy by Peter Yang is free today. But if you enjoyed this post, you can tell Creator Economy by Peter Yang that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

How to Run Meetings That Don't Suck

Wednesday, March 8, 2023

The four types of meetings and how to make each one actually useful

How to Make Great Decisions Async and Avoid Endless Meetings

Wednesday, March 1, 2023

Most decisions can be made async. Follow these five steps to do it effectively.

Amit Fulay (VP, Microsoft): PM Lessons from Google, Meta, and Microsoft

Wednesday, February 22, 2023

A candid conversation about Google's confusing messaging strategy, Satya Nadella's superpower, and the ups and downs of PM careers

The Future of Search is Conversations

Friday, February 17, 2023

Microsoft, Google, and the race to make search feel more like talking to a trusted friend than navigating 10 blue links

Elena Verna (Head of Growth, Amplitude): The Journey From Growth Leader to Solopreneur

Wednesday, February 1, 2023

How you can apply growth frameworks to take power back in your career

You Might Also Like

Lead, Don’t Feed

Tuesday, March 4, 2025

Depth > Frequency.

"What You’re Made For": Lessons from a Life Well Lived

Tuesday, March 4, 2025

We are not merely here to exist, survive, or drift along—we are here to truly live.

WTF is attribution modeling?

Tuesday, March 4, 2025

Despite signal loss and last-touch bias limiting its usefulness, marketers are still turning to attribution modeling to measure the impact of their ad spend. March 04, 2025 PRESENTED BY WTF is

🔔Opening Bell Daily: Stocks believe Trump now

Tuesday, March 4, 2025

The S&P 500 just had its worst day of 2025 as the president confirmed tariffs.

From 0 to $5B (local non-US market)

Tuesday, March 4, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From 0 to $5B (local non-US market) Nadiem Makarim is a guy who managed to create

Quiet quitting is out. Revenge quitting is in? 😜

Tuesday, March 4, 2025

Do it loud. Do it proud, I guess.

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance