Margins - SVB and the Wealth Creation Flywheel

Ranjan here, just back from SXSW and oh what a few days. This week I’ll be writing about, yes, you guessed it, Silicon Valley Bank. On Friday morning, I was on the Big Technology podcast with Alex Kantrowitz, along with Dan Primack, discussing SVB. About 15 minutes after we finished recording, the news came out that SVB had gone into receivership. On Sunday, I took a break from the SXSW hoopla to write and just as I was about finished, the rescue was announced. I’m going to try again because this story brings ZIRP together with the intersection of finance and social media, my two favorite things, in such a perfect way. The prevailing narrative around the SVB collapse has been that it was just really bad risk management by the bank, and exacerbated by chatty and panicked VCs. The WSJ:

The idea that this was simply borne out of errors in banking basics ignores just how unique the depositors in the SVB saga were, and why I think they should garner a bit more scrutiny. So. Much. Money.I’m sure most Margins readers have likely been following the SVB story. The threadbois and girls have been hard at work delivering us some great content, but let’s start with a quick refresher on how I think about money:

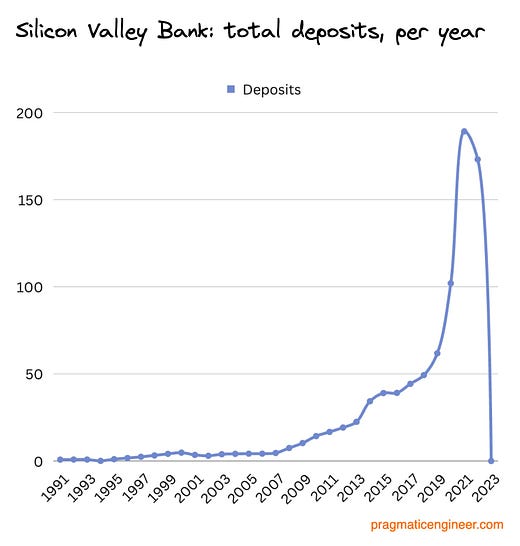

Money moving around like an organism, hankering for more yield, was how I tried to make sense of a distorted economy. ZIRPsurdity helped me make sense of multi-million dollar monkey jpegs and 15 minute delivery and whatever else popped up, but I never thought it’d be a central character in the collapse of a bank that just bought a lot of treasuries. This whole thing has been such a fascinating new wrinkle in the larger ZIRP tale. Over the past few years, SVB’s customer deposit growth graph looks like the fundraising graph for every late-stage, Tiger-funded startup:

All that new money being created needed a home, and SVB became that place. SVB more than tripled deposits between 2019 and Q1 2022, while the overall banking industry grew deposits by “only” 37 percent in the same period. The amazing part is that it was so much money that SVB couldn’t even act like a normal bank and simply lend it out. Most of you know the next chapter: SVB invested it in supposedly safe long-dated US Treasuries and highly-rated mortgage-backed securities. That portfolio dropped in value as interest rates rose through 2022, which hurt SVB’s overall economics, which scared depositors. SVB depositors had already been withdrawing money, and then panicked and withdrew $42 billion in a day. The bank collapsed, the depositors were rescued, and here we are. Et tu, Moral Hazard?The general sentiment seems to be depositors were protected and that is good. “Investors”, or the bank's shareholders and management, were wiped out, and that is good. Even President Biden, in his speech on the bank rescue, said:

and then more importantly:

That narrative that an equity wipeout with a depositor guarantee would kill the fat-cats and save Everyday-Farmer-Payroll-Mom-and-Pop, was echoed by a guy who founded an $18 billion fund:  SVB. Wipe out all the fat cats. Sell the assets and send $$ to the folks like this who are rightfully stressed and did nothing wrong. @theallinpod Even his newsletter-highness, Matt Levine, pushed the idea that the backbone of the banking system is the need for customers to not worry about deposits:

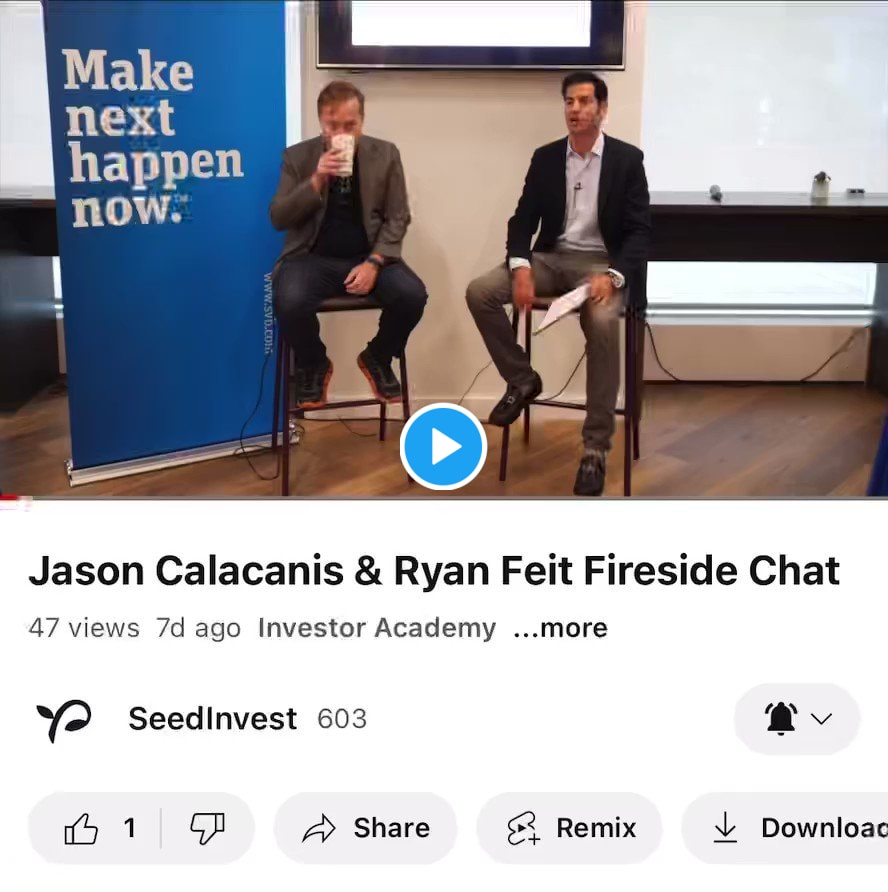

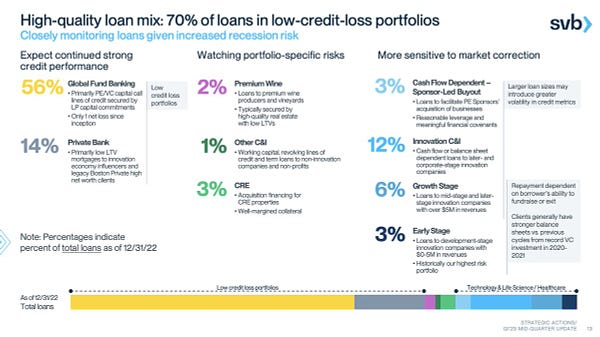

But not all deposits are created equal. All the SVB problems come back to that monstrous deposit growth over the past few years. It’s what led to bad risk management, bank runs, and bailouts. That deposit growth, which was nearly 6x the industry average, was the direct result of the unique way SVB did business. This was, in turn, an important part of the engine that drove incredible wealth creation for its concentration of depositors. SVB helped enrich depositors just as much as it did its shareholders. There have been headlines decrying how SVB executives sold $84 million in shares over the past two years. That’s not a great look, but that’s like one founder’s net worth after a solid late-stage Tiger round. These depositors weren’t innocent bystanders. Wine and CringeLet’s start here, because you need to spend your afternoon listening to Jason Calacanis talk about how SVB bankers would ply him with wine while giving him a personal mortgage: It’s cringey, but it’s important. I had heard murmurs about SVB giving founders and VCs preferential rates on mortgages in the past, but loved catching this slide (h/t deebosa) where they proudly advertise 14% of their loan book are in low LTV mortgages to “innovation economy influencers” (more cringe).  wait.... what are "innovation economy influencers"?

Silicon Valley Bank has loans out to them as part of its private bank business

$SIVB The WSJ additionally noted:

Take a moment to recognize the interconnected nature of SVB buying shares in startups it counts as clients, while those startup founders can get personal loans from the bank. We’ll get back to this. Venture debt is a unique market. Lending to startups that have unpredictable (if any) cash flows makes for difficult debt pricing, but SVB was very there for their clients:

Let’s add on how venture debt has been a quiet, vital cog in helping keep private market valuations inflated as many companies (and VCs) would rather startups take on high-interest debt versus issuing new equity and doing a down-round. Let’s also add on, most of SVB’s loan business was capital-call lines of credit, which were lines that VCs could draw down to quickly fund an investment while waiting for their limited partner to eventually provide the committed capital:

This is a very reasonable piece of banking infrastructure, but has been another vital cog in creating the environment where capital became “better, faster, and cheaper.” None of the late-stage craziness happens without this type of product. Then you get into SVB investing directly into many of these top-tier VCs:

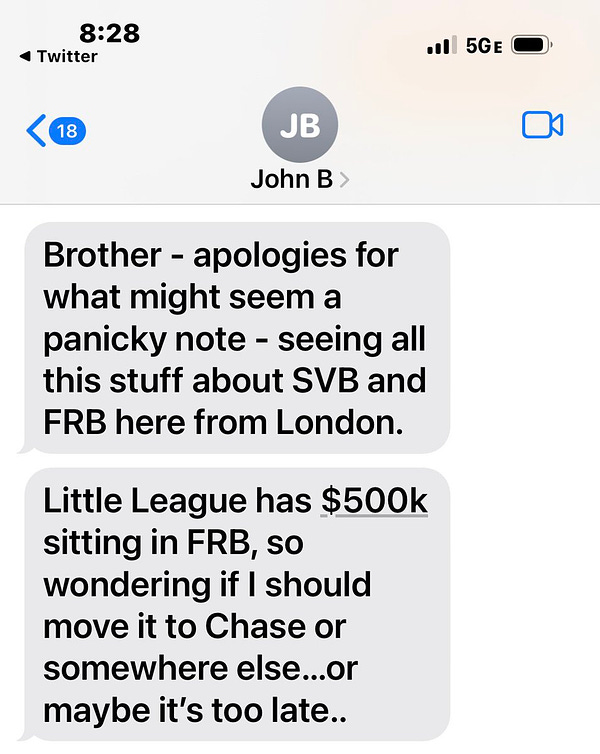

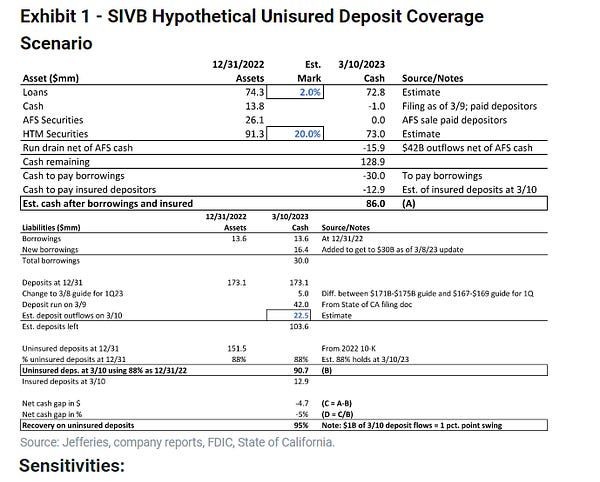

There are just so many self-reinforcing variables at the micro and macro level that enriched SVB depositors in ways community or regional banks could never dream of. A prominent VC partners with SVB and their capital call credit business to help speed up the pace of investing. SVB then invests in the VC’s new funds. SVB also might invest alongside the VC in various startups. Those VCs pressure potential investments to bank with SVB. SVB gives preferential mortgages to startup founders banking with them. I’m sure I’m missing other variables in this equation, but just think about the incredible accelerant for wealth creation among this concentration of clients that SVB played. There’s no way your typical SVB depositor generated as much wealth without the very unique structure of SVB’s business. Memestocks don’t happen without Robinhood, and the COVID-ZIRP manic tech boom doesn’t happen without SVB. And as depositors got richer, and as tech valuations skyrocketed and companies IPO’ed, more and more money came into SVB. It was the magnitude of those deposits that set off the shitty risk management chain of events that got SVB into trouble. And the greatest irony of all is, it was the same depositors, who got disproportionately rich thanks to SVB and whose wealth was too much for SVB to handle, that brought down the bank by both withdrawing their own money and advising all their startups to as well. WHY PANIC?So about those innocent depositors. When the news of the receivership broke, I’ll admit, I did have worries we’d enter a world of chaos where depositors wouldn’t have access to anything over 250k for months. Maybe the payroll fear was real. But all it took was a quicking Bing (yes, I used Bing, not Google. It’s happening.) of IndyMac and WaMu to remember that in bank failures, the regulators wind things down in an orderly manner and customers are always made almost whole. What made things even more confusing about the apocalyptic screaming was old-fashioned math. That same $120 billion portfolio of treasuries and MBS that caused problems was so liquid that markets that regulators could sell them off in a matter of hours and probably not even move the markets by doing so. The $75 billion loan portfolio would take longer, but it wasn’t the end of the world. Yes, there would be realized losses, but this would not be utter chaos. Both Cats on Twitter and bankers from Jeffries seemed to agree:  Jefferies analysts calculate possible 95% recovery on SVB insured deposits based on 2% writedown on loan book and 20% writedown on HTM portfolio: Even Sheila Bair, who ran the FDIC from 2006 to 2011, noted that these companies would’ve received a sizable dividend per normal procedures (also calling the resolution a dangerous precedent):

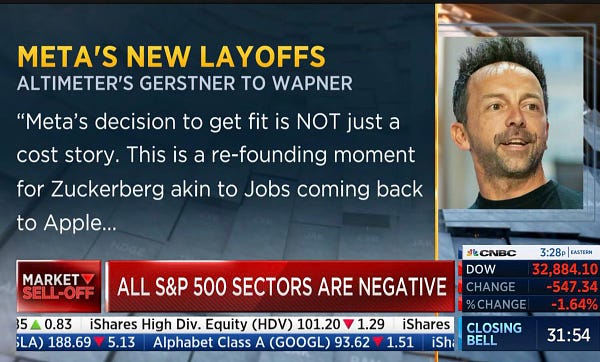

It would just take a basic understanding of banking history to know depositors would get enough cash right away to keep operating, and probably, at worst, take a minor haircut in the long run. But instead, the chaos monkeys were unleashed, and suddenly every the beneficiaries of the SVB machine were worried about the farmers, or this would be an extinction-level event for startups, or they were hearing rumors that foreign adversaries were going to spur contagion, or this was all JPow’s fault, and whatever else. I don’t discount the panic founders were feeling. I spoke with plenty of people who were genuinely convinced their businesses might fold on Monday or they’d have to furlough huge portions of their team because that’s what their investors told them. Again, the probability of something like that happening was so small, why were the VC’s whipping everyone up into a frenzy? This is the part that still genuinely confuses me. The most generous explanation is they just continued getting each other worked up in private chats and convincing themselves the world would end. But I genuinely would give (many) of these investors a lot more credit than that. The most ridiculous explanation was that these VCs were suddenly worried about layoffs and really cared about the consequences for the little guy (Note 1). The VCs certainly leaned into this one, after months of telling us how companies have gotten fat and need to cut like Elon. Brad Gerstner, the Altimeter's founder, probably did it best. This was the guy who had written an open letter in October to Zuck for Meta to “get fit” as a company (it’s actually a great letter). His very last tweet before the SVB panic was calling Meta’s big layoff announcement Zuckerberg’s Steve-Jobs-back-to-Apple moment.  Jobs realized the complex managment blob at Apple had undermined talent, velocity and invention. Zuckerberg is on a mission to get simpler and faster not just to save $$ but because it will unlock the mojo needed to win in the Age of AI. #efficiencyandai @CNBC @theallinpod Then, for a few days, Gerstner pivoted to wanting to wipe out fat-cats, and worrying about the ex-McKinsey $5k butler startup’s employees.  Lindsey is the story - thx for your courage. She deserves to have her savings / deposit protected. Not a dollar more for anybody. There are plenty of assets - the FDIC, Fed and Treasury need to speak with clarity NOW that this is over. Sell the assets - deposits 100% protected.  Lindsey Michaelides @lcmichaelides Then, the very day after the rescue, he went back to tweeting about how Zuckerberg’s new layoff announcement should be an HBS case study in brilliance.  Zuck / $META is emerging as a leading candidate for HBS case study on change management. Urge all tech leadership / boards to read this memo now. In an uncertain / fast changing world, getting fit is essential not optional. Not to name names - but $GOOG, $AMZN, all VC. https://t.co/4DA4MXf6yA  Quartr @Quartr_App So what was it all about? This is something I’m genuinely curious to get a better understanding of. These VCs put their own companies and the public through a short spurt of hell. Why? Whatever the motivation for the freakout was, it’s certainly nice for the tech investment community that the odds of a Fed Fund 50bps hike have gone down by historical proportions since last Friday and risk assets are suddenly back in vogue. What Now?Where do we go from here? My one takeaway from sitting on a trading floor through the 2008 crisis is this stuff does not happen everything, everywhere, all at once (sorry!). This was another hiccup in a financial system that continues to unwind years of ZIRP-y buildup that has leveraged things in so many ways that hadn’t previously made headlines. As we all collectively watch for what’s next I’ll leave you with this from Christopher Leonard’s the Lords of Easy Money:

Note 1: I love the “it’s all about the little guy” playbook. A quick recent hall-of-fame in this category would include Facebook’s “Speaking Up for Small Business” campaign and Doordash’s “A Neighborhood of Good”. Even TikTok just announced it’s fighting its proposed ban with a new docuseries about how it helps small businesses.,

Margins by Ranjan Roy and Can Duruk is free today. But if you enjoyed this post, you can tell Margins by Ranjan Roy and Can Duruk that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Fad or Trend

Wednesday, March 1, 2023

Reflecting on 2 years worth of hype while building a startup

Alexa, what happened?

Friday, February 24, 2023

Sometimes innovation just ain't enough

Google vs. ChatGPT told by aglio e olio

Friday, January 20, 2023

I hate monopolies and welcome our AI overlords

FTX and How to Lose Money

Wednesday, November 23, 2022

The Dong, Shitcoins, and SBF

Shein and the Tech Cold War

Saturday, October 8, 2022

Algorithmic tweaks and clothing as trash

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The