VC monthly report, The number and amount of financing have dropped significantly in Mar

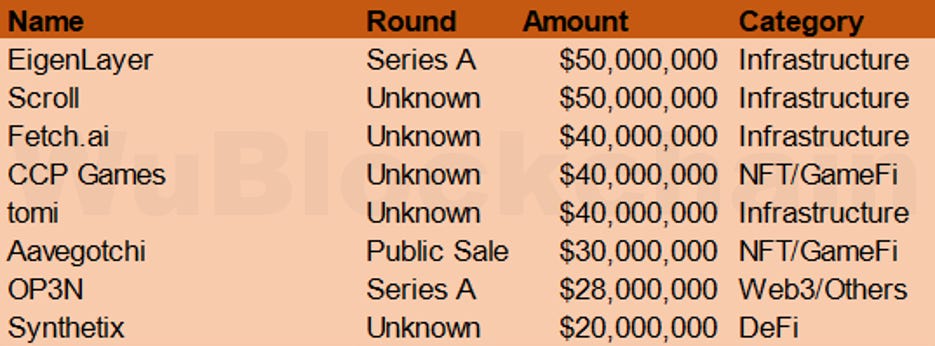

Author: WuBlockchain According to RootData's statistics, there were a total of 84 publicly announced investment projects in March in the cryptocurrency venture capital (VC) field, representing a month-on-month decrease of 31% (compared to 122 projects in February 2023), and a year-on-year decrease of 59% (compared to 203 projects in March 2022). The industry's primary classifications are as follows. In March, among various categories in the cryptocurrency market, the financing proportion of infrastructure projects was about 31%, DeFi accounted for about 18%, CeFi accounted for about 11%, and NFT/GameFi accounted for about 20%. The total financing amount in March was 770 million US dollars, a month-on-month decrease of 19% (compared to 950 million US dollars in February 2023), and a year-on-year decrease of 80% (compared to 3.89 billion US dollars in March 2022). The rounds exceeding 20 million US dollars (excluding CeFi, mining companies, and other centralized institutions) are as follows. EigenLayer is a protocol built on Ethereum that introduces restaking, a new primitive in cryptoeconomic security. This primitive enables the rehypothetication of $ETH on the consensus layer. Users that stake $ETH can opt-in to EigenLayer smart contracts to restake their $ETH and extend cryptoeconomic security to additional applications on the network. Part of EigenLayer’s potential, therefore, lies in its ability to aggregate and extend cryptoeconomic security through restaking and to validate new applications being built on top of Ethereum. Scroll is a zkEVM-based zkRollup on Ethereum that enables native compatibility for existing Ethereum applications and tools. Scroll processes transactions off-chain and publishes concise correctness proofs on-chain. Scroll is currently valued at $1.8 billion, with investors including Polychain Capital and Sequoia China. On February 28th, Scroll released a testnet version of its Ethereum L2 on the Goerli testnet, transferring zk-EVM from pre-alpha to alpha testing phase. Fetch.ai is a blockchain platform based on artificial intelligence and machine learning, allowing anyone to share or exchange data. This funding round is led by DWF Labs and will be used to deploy decentralized machine learning, autonomous agents, and network infrastructure. Tomi is a Web3 company created by a group of anonymous cryptocurrency professionals, focusing on providing decentralized services for hardware and software, including decentralized cloud mining, cloud storage, and cloud hosting solutions. This funding round is led by DWF Labs, with participation from Ticker Capital, Piha Equities, Hirokado Kohji, and others. The funds will be used to attract content creators to the network. CCP Games is an independent game developer using blockchain technology with the EVE universe as the backdrop. Since 2018, 50 million EVE players have created over 276 billion items and participated in some of the largest and most expensive wars in gaming history. The community has established a rich ecosystem of third-party tools and applications supported by APIs. Aavegotchi is a DeFi-supporting cryptocurrency collectibles game developed by Pixelcraft Studios, allowing players to stake NFT avatars with interesting tokens and interact with the Aavegotchi metaverse. Aavegotchi plans to launch its own blockchain called Gotchichain using Polygon Supernets. Aavegotchi's Eco-Governance Token GHST will be used to pay for the Gas on Gotchichain. OP3N's user interface is similar to TikTok and is an application that allows creators to easily interact with fans using Web3 technology, adding audio, video, and mixed media content to on-chain interactions. This funding round is led by Animoca Brands, with participation from Dragonfly Capital, SuperScrypt, Creative Artists Agency, New Enterprise Associates' Connect Ventures, Republic Crypto, Avalanche, Galaxy Digital, Warner Music Interactive, GSR Markets, and The Spartan Group, valuing the company at $100 million. The new funds will be used to further develop their application and expand their leadership team. Synthetix, a synthetic asset protocol, announced via email on Monday that market maker DWF Labs purchased $15 million worth of SNX on March 16th, followed by another $5 million. This collaboration will allow DWF Labs to integrate Synthetix perpetual contracts into their trading business and become a significant trading volume driver for the protocol. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekly project updates: BNBChain proposes lower fees, Sei Foundation, THORChain halted globally, etc

Saturday, April 1, 2023

1. ETH's weekly summary a. Ethereum Foundation announces Shapella network upgrade activation date link On March 28, the Ethereum Foundation officially released an announcement: The Shapella network

WuBlockchain Weekly:Binance sued by CFTC、Gucci teams up with Yuga Labs、SBF charged with bribery and Top10 News

Friday, March 31, 2023

Top10 News 1. Yuga Labs' weekly summary a. Gucci teams up with company behind Bored Ape Yacht Club link On March 27, Luxury brand Gucci has announced a partnership with Yuga Labs, and Gucci will

Opinion: What is the Role of Blockchain in the Era of Strong Artificial Intelligence?

Thursday, March 30, 2023

Author: Cofounder of Solv Yan Meng @myanTokenGeek Editor: WuBlockchain A lot of people have been asking me recently, ChatGPT has made AI popular again, blockchain and Web3 have been robbed of the

Ethereum L2 zkSync Era mainnet online, What are the ecological projects to follow

Tuesday, March 28, 2023

Author: @0xMavWisdom The day after the Arbitrum airdrop, zkSync, another Layer 2 project jokingly referred to as the Big Four, officially released its V2 network, zkSync Era. Although zkSync officials

Global Crypto Mining News (Mar 20 to Mar 26)

Monday, March 27, 2023

1. The price of the most efficient bitcoin mining rig has risen by 9% in the past two months. The rise in bitcoin prices comes as miners are finally seeing electricity prices plummet — essentially

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏