Earnings+More - Lottomatica to seek deals outside Italy

Lottomatica to seek deals outside ItalyLottomatica IPO, GAN’s new creditor, DraftKings analyst take, Entain’s share price lag, sector watch – sports streaming +MoreGood morning. On the Weekender agenda:

Lottomatica IPOThe Italian gaming giant confirms approval for its $3bn listing in Milan. Forza Milan: The Apollo-owned omni-channel betting and gaming shares have been admitted to the Milan Euronext exchange, with a bookbuilding effort planned for next week aiming to raise €600m. The proceeds will go towards repaying a shareholder loan and a portion of the company’s debt. The shares will be priced at €9-€11.

Lottomatica generated revenues of €1.39bn and adj. EBITDA of €460m in 2022 across its three online, sports-betting retail franchise and gaming retail franchise propositions. It is the number one operator in Italy with ~27% market share and claims “Italian national champion” status.

** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. ICYMIIn Compliance+More this week, we discussed the questions raised by the English Premier League’s decision to phase in a ban on shirt sponsorships by gambling companies. In Earnings+More’s latest edition of Due Diligence on Tuesday, we analysed the issue of how Playtech’s B2B arm is performing given what we know about the importance of the possibly departing Caliente. In Sharpr this week, there was a look at Esports Entertainment’s restructuring as announced by CEO Alex Igelman in a letter to shareholders, which included a renewed focus on B2B provision in esports. Earnings+More readers poll – last chanceThe readers poll is closing after the weekend. If you wish to take part, follow the link. It’s quick and easy. We promise.

GAN’s new loanGAN has agreed a new $30m debt arrangement that sees Sega Sammy come on board. Sega mega drive: As part of the complicated transaction, previous debt holder Beach Point Capital will see its original 14% interest rate $30m loan repaid, with the Japanese-listed gaming entity Sega Sammy taking over as the creditor.

Recall, GAN CFO Brian Chang said during the company's Q4 earnings it could violate financial covenants on the $30m loan. At the same time it announced a strategic review, saying it would be concentrating on sportsbook backend provision and Coolbet’s LatAm B2C operations.

A’s coming to VegasLas Vegas is set to gain a Major League Baseball team as the A’s enter into an agreement to purchase a parcel of land near the Strip. Stealing base: The Oakland A’s will set up home on the site of the former Wild, Wild West property after buying the land from Red Rock Resorts for an undisclosed sum. The A’s plan to build a 35,000-seat stadium, which they would move into by 2027. Red Rock would retain an area of the land for its own future development.

Home run: CBRE suggested being the new home of the A’s would bring in more visitors, albeit not at the same magnitude as the Raiders and the Allegiant; estimates suggest up to 70% of the average attendance would be locals. Further, adding another major league sports team adds to the “long-term thesis for continued population and economic development in Las Vegas”. LVS plauditsConfidence is flowing after Las Vegas Sands issued its forecast-busting Q1s. Don’t stop me now: Having less reliance on junkets vs. its peers prior to the pandemic and a higher mix of direct VIPs has helped LVS gain market share in the premium segment, according to Roth MKM analysts.

Fat of the land: CBRE said the EBITDA recovery “surprised on the upside” with margins at 31%. “This gives us confidence margins could eventually exceed 2019 levels when revenue more fully recovers,” the team added.

Profits watchDraftKings will see a “sharp ramp” in profitability going into next year, suggests Morgan Stanley. Inflectious: As a market leader and bellwether stock, DraftKings is the “most levered” to the move towards profitability, given its sustained market share and the amount of short interest with investors still focused on the negatives.

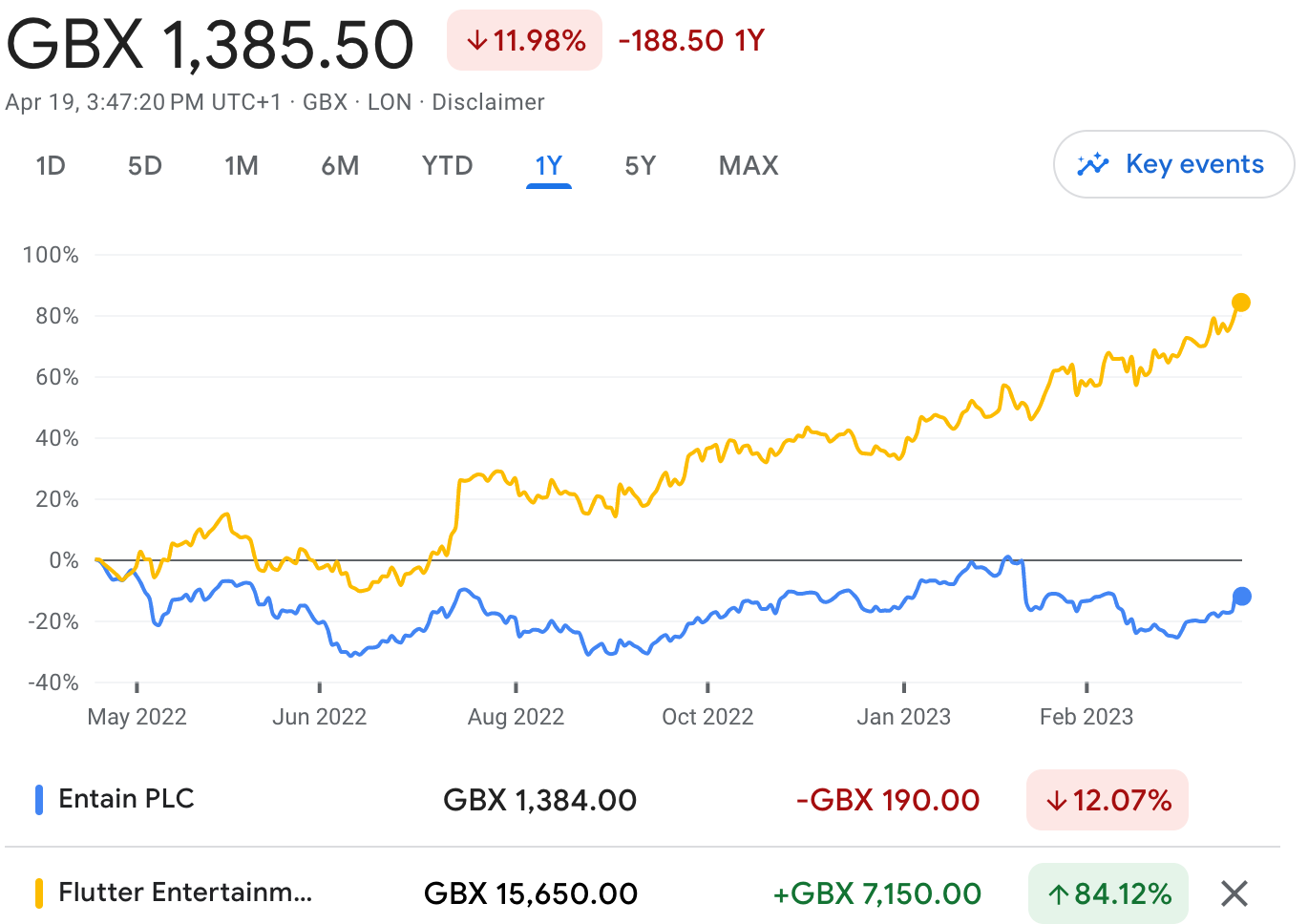

The shares weekEntain enjoys an earnings-led bounce but it still badly lags its main rival Flutter. Faraway, so close: The near 7% gain this week displays some faith in the company following its Q1 trading update on Tuesday but that doesn’t extend to closing the gap on major rival Flutter.

🐢 Entain struggles to keep up with the US-bound Flutter Monster magnet: Peel Hunt noted Entain’s M&A strategy was “not only driving growth, it is driving scale” while also helping Entain to diversify into higher-growth markets. CBRE said M&A is “more than making up for regulatory impacts”.

Sector watch – streamingThe auction process currently underway for the rights to show English Football League games has the potential to transform soccer broadcasting in the UK. A watershed moment: Under the current system in the UK, broadcasters are disallowed from showing 3pm Saturday games for fear it will diminish the number of spectators in stadiums.

What’s on TV: DAZN faces tough competition in the race for the rights. Current EFL broadcast partner Sky will be putting itself forward once again. This season it will broadcast 138 games plus the play-offs.

** SPONSOR’S MESSAGE ** Challengers welcome GeoComply and Citi invite start-ups and emerging operators and suppliers to free NYC Summit with superstars of gaming Avengers assemble: innovators, disruptors and grizzled veterans set to share hacks, tips and tricks with developing companies targeting regulated gaming markets in the US.

Come with us: the US gaming market can be a tough nut to crack. To get some free advice from some who have cracked it, apply for this exclusive event here. What we’re readingOllie Ring: Hello esports, my name is macro-economic downturn. NewslinesKindred has launched a Unibet-branded sportsbook at Swinomish Casino & Lodge in Washington. PrizePicks has signed an agreement with NASCAR to become an official fantasy sports partner. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

LVS: Macau ready to tee off

Thursday, April 20, 2023

Las Vegas Sands benefits from Macau rebound, Rank sees land-based return +More

888 back in the Middle East VIP game

Wednesday, April 19, 2023

888's new Middle East onboarding, Earnings+More readers poll, Lottomatica listing, NY casinos, Japanese resorts casino news +More

MGM’s ‘Japan dream’ comes true

Wednesday, April 19, 2023

MGM's Japanese opportunity, Better Collective makes adtech buy, LVS in the week ahead, startup focus – Kutt +More

Playtech B2B feels the Caliente heat

Wednesday, April 19, 2023

Entain's first quarter, Playtech's B2B issues, Better Collective's M&A commentary +More

Bottle job: Belgium’s betFIRST up for grabs

Tuesday, April 11, 2023

The betFIRST biding battle, quarterly transactions review, Playtech's Hard Rock Deal +More

You Might Also Like

The #1 customer LTV in the world (4 keys)

Thursday, March 20, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

Lessons From Dot Com Boom

Thursday, March 20, 2025

+ Homes in Delhi are becoming obscenely expensive. Meanwhile, IndiGo is looking to soar greater heights.

Topic 32: What is Qwen-Agent framework? Inside the Qwen family

Wednesday, March 19, 2025

we discuss the timeline of Qwen models, focusing on their agentic capabilities and how they compete with other models, and also explore what is Qwen-Agent framework and how you can use it

🦅 This will help you from being stopped by imposter syndrome

Wednesday, March 19, 2025

xAI's first acquisition | Instagram tests AI-generated comments | Facebook Stories now eligible for creator monetization

From $0 to $12 Million Per Year With Fat Joe

Wednesday, March 19, 2025

This week, we're excited to have Joe Davies from FatJoe.com on the Niche Pursuits Podcast. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Skype is dead, but SORA changes everything😲(read ASAP)

Wednesday, March 19, 2025

View in browser ClickBank Hi there, You may have heard that after 22 years, Microsoft is killing off Skype and replacing it with Teams 😬 but let's be honest... this isn't exactly exciting news.

You’re the heart of social—we see you

Wednesday, March 19, 2025

And you deserve better tools, better support, and better balance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Here’s the One Investment That Can Change Your Life in 2025

Wednesday, March 19, 2025

The Biggest Opportunity of 2025

Founder Weekly - Issue 677

Wednesday, March 19, 2025

March 19, 2025 | Read Online Founder Weekly (Issue 677 March 19 2025) Welcome to issue 677 & of Founder Weekly. Let's get straight to the links this week. Google purchased Nest ($3.2B), Amazon

A look at the categories for this year's Greater Good Awards

Wednesday, March 19, 2025

As companies tackle pressing issues like wellness, sustainability and local community betterment, their efforts often go unnoticed despite their powerful impact. The Greater Good Awards offer a