The Unbearable Heaviness of Being Positioned

Welcome to the 1,382 newly Not Boring people who have joined us since last Monday! There are officially over 200,000 of us here now! 🥳 If you haven’t subscribed, join 200,244 smart, curious folks on our journey to 1 million: Today’s Not Boring is brought to you by… Secureframe Easy SOC 2 compliance + AI-based RFP automation With a streamlined workflow and expert guidance, Secureframe automates the entire compliance process, end-to-end. What makes Secureframe different?

Trusted by hyper-growth organizations: AngelList, Ramp, Lob, Remote, and thousands of other businesses. Schedule a personalized demo of Secureframe: Hi friends 👋, Happy Monday! Hope you all had a great weekend. It was a good one here at Not Boring HQ. I got to take Dev to his first Sixers game – he made it through the whole thing, we got a W, and the Sixers are advancing to the next round. Excitingly, there are now over 200,000 smart, curious people here. Thank you to all of you for making this happen — I still can’t believe that so many of you read and share what I write, and give me feedback to keep making it better. I feel very lucky that I get to do this, and I’m more energized than ever to keep upping my game to keep up. So today, we’re going to tackle something I’ve wanted to tackle for a while: an alternative to disruptive innovation and the Innovator’s Dilemma for the very many cases where they’re misapplied. This whole post, oddly, started as an idea I had for a post called “America & the Innovator’s Dilemma” in which I was planning to shoehorn some of the challenges America faces with respect to progress and innovation – not building nuclear, pushing crypto offshore, NIMBYism, and more – into the Innovator’s Dilemma framework. But after thinking about it for a few minutes, I realized that I was falling into a common trap, labeling any incumbent’s difficulty of any kind with new technology of any kind “the Innovator’s Dilemma” when the facts don’t really fit. As I did more mental gymnastics, tried to figure out how to say what I wanted to say about the US of A, something struck me: What’s happening at Google is part of a broader, looser phenomenon than the Innovator’s Dilemma, one that applies at a bunch of different levels: at the corporate level, where it was born, up to the national level, and down to the individual level. America is deeply Positioned, which makes it challenging to innovate and take risks the way it used to. That’s a subject for another post. People can be deeply Positioned, too. The more time you’ve spent getting good at a particular thing, the more you identify with that thing, the more Positioned you are, the better you get at that thing but the harder it is to change when the circumstances do, too. Maybe that’s for another post, as well. Today, we’re going to talk about why Google’s deep Positioning in search is an anchor around its neck and how it might come out of this stronger. Let’s get to it. The Unbearable Heaviness of Being PositionedNot every new technology is a disruptive innovation and not every challenge to an incumbent presents an Innovator’s Dilemma. As AI, specifically Large Language Models (LLMs), threatens to eat away at Google’s dominant search business, the people who talk about this kind of thing have reached for Professor Clayton Christensen’s familiar frameworks to explain what’s going on. “This is classic Innovator’s Dilemma,” they tweet. Classic. Just check out the Twitter search for “google innovator’s dilemma.” (Narrator: It is not.) What people are missing in the analysis is that LLMs, and the products like ChatGPT built on top of them, aren’t a disruptive innovation – they don’t underperform on things that matter to mainstream computers and make it up by serving a small new or low-end niche well – but a superior product across nearly all dimensions. So Google isn’t facing the Innovator’s Dilemma; it’s just so deeply Positioned in search that it’s been a sitting duck for the first superior technology or business model strong enough to take it on. Positioning is the flip side of one of Hamilton Helmer’s 7 Powers, counter-positioning: “A newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.” As Helmer points out in the book, counter-positioning is distinct from disruptive innovation. Similarly, Positioning is distinct from the Innovator’s Dilemma. We can define Positioning as: “An incumbent is susceptible to a new, superior business model due to anticipated damage to their existing business.” I think this is what people are going for when they reach for the Innovator’s Dilemma. If a company adopts a new technology or business model, it will put their very good existing business model at risk. That new technology might be a disruptive innovation, and the company might be facing the Innovator’s Dilemma – those can fit within the Counter-Positioning / Positioning framework – but that’s not necessarily the case. It’s hard to blame people for their confusion. This happens every time there’s an exciting new technology that threatens an established business or industry. It happens with such frequency that Christensen, the co-author of the original post on Disruptive Technologies and the book, The Innovator’s Dilemma, took to the pages of HBR to clarify some things in 2015. Along with two co-authors, he penned What Is Disruptive Innovation? because, “Despite broad dissemination, the theory’s core concepts have been widely misunderstood and its basic tenets frequently misapplied.” My goal today is to provide a framework – Positioning – that we can all lazily reach for any time an impressive new technology or business model threatens an established incumbent (and many more situations, from the personal to the national, besides) without tripping any technical definitions. To do that, we first need to go back to see what people get wrong about Clayton Christensen’s theories. Disruptive Technologies and the Innovator’s Dilemma, By the Book What people often get wrong about Christensen’s theories is that they mistake sustaining technologies and paradigm-shifting technologies for disruptive ones. Christensen was very precise with his definitions. In The Innovator’s Dilemma, he made a clear distinction between two types of new technologies:

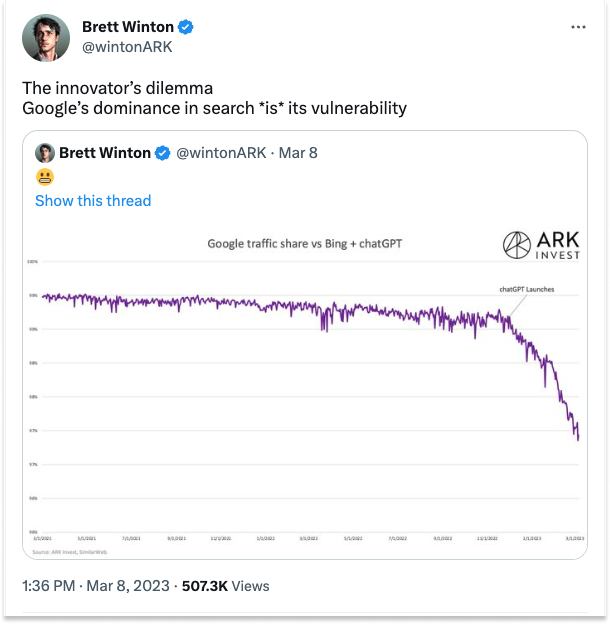

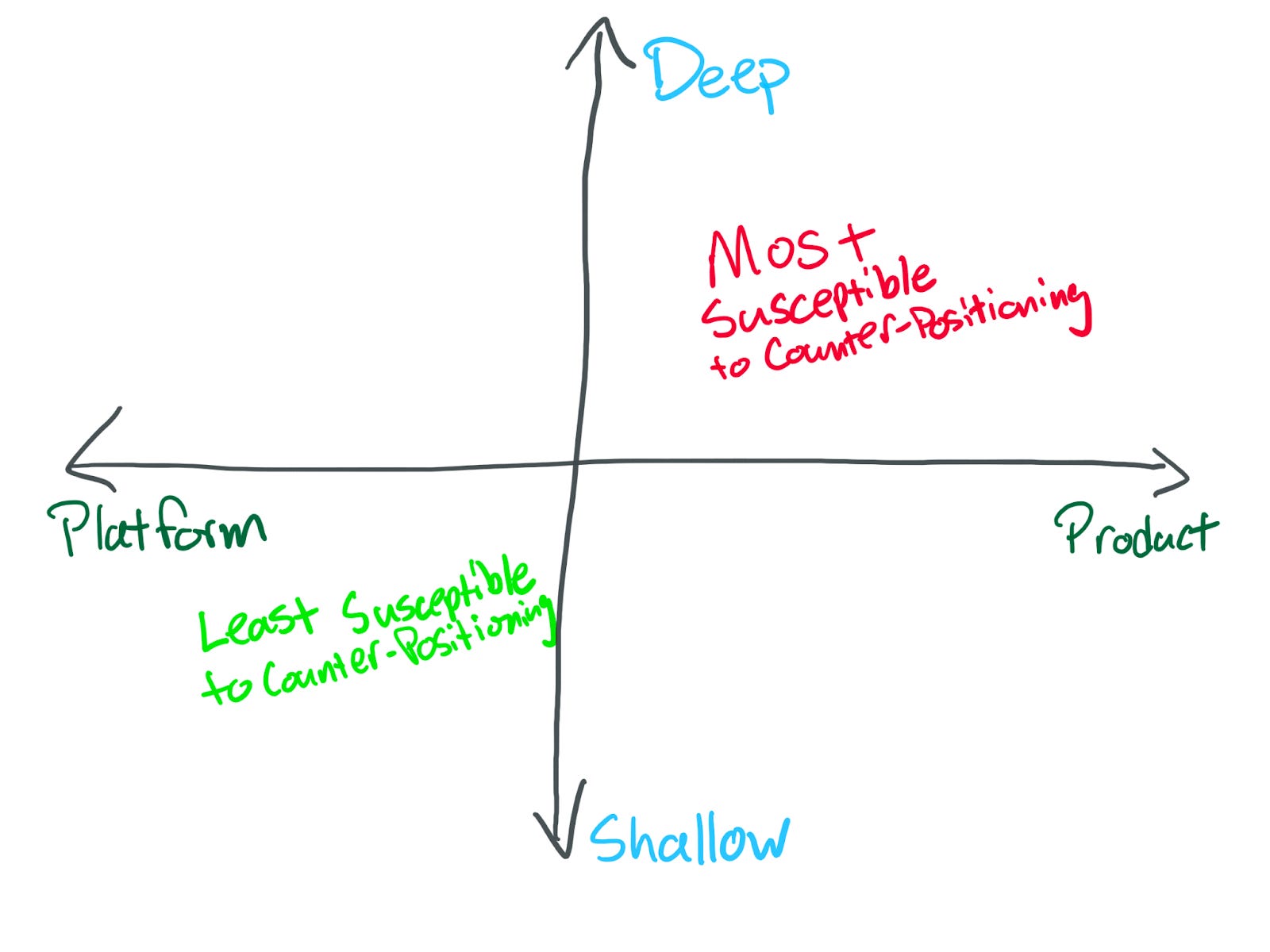

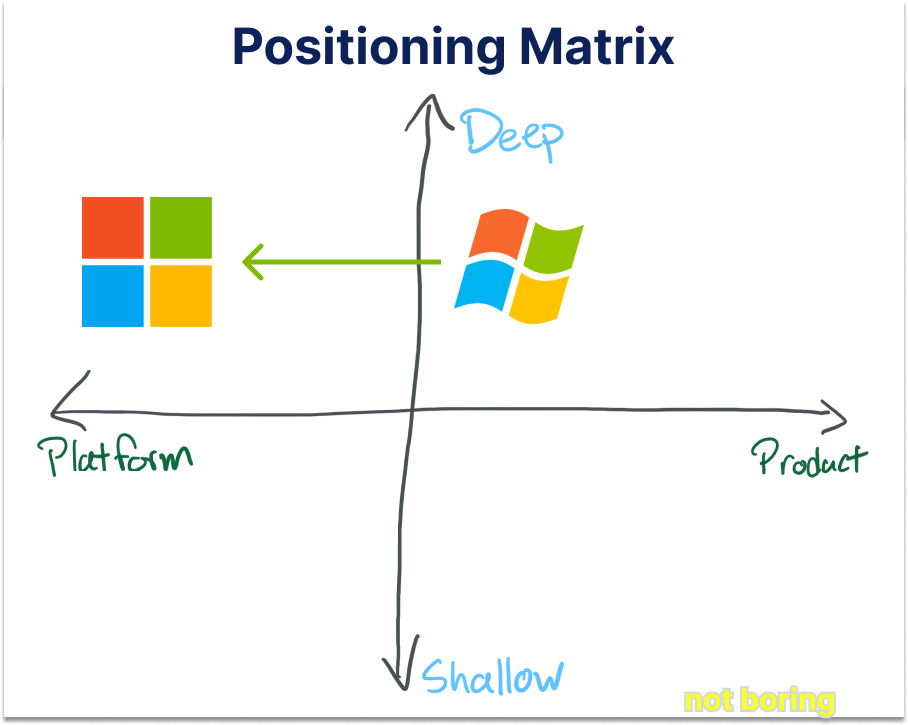

Well-managed incumbents are great at using sustaining technologies to make their products better in all the ways their customers are willing to pay for. The Innovator’s Dilemma occurs specifically when incumbents are faced with a disruptive technology and do two things that they’re supposed to do: 1) listen and respond to the needs of their best customers, and 2) focus investments on innovations that promise the highest returns. Turns out, existing customers rarely want the new, underperformant technology, and that investing in that new, underperformant technology rarely offers higher returns than investing in a sustaining technology that makes the core product better. So the incumbent eschews the new technology (even though they’re often the ones who developed it!), focuses on serving the high-end of the market, and ignores the low-end of the market (or a potential market that doesn’t currently exist), leaving a foothold for new entrants, who serve that low-end or new market with the disruptive technology, and then ride its improving performance up to the mainstream. Imagine you sat down at the Black Jack table and promised yourself that you would do what the book says every hand. Every time the dealer shows a six or below, you stay. And hand after hand, you keep losing. Turns out, the deck was loaded with extra shitty, ugly, low cards, a bunch of 2s and 3s. You played by the book, and you lost it all anyway. That’s the Innovator’s Dilemma. “That’s why we call it the innovator’s dilemma,” Christensen wrote, “doing the right thing is the wrong thing.” Like I said, a lot of smart people have observed that what’s happening to Google with LLMs is a classic case of the Innovator’s Dilemma, so I don’t mean to pick on any one person in particular, but I think this tweet is instructive: Offensive y-axis aside, the fact that Google’s dominance in search is its vulnerability isn’t the Innovator’s Dilemma. To be fair, it’s a dilemma faced by an innovator, but it’s not The Innovator’s Dilemma™️. Check the footnote for a little more on why I think that, but to boil it down to one idea: LLMs are widely recognized to be the bleeding edge of humanity’s technological capabilities. They’re not bad enough to fit Christensen’s definition of a disruptive technology. Sometimes, a technology emerges that is simply better than the previous ones, that pushes out the Pareto frontier. These technologies might be closer to sustaining technologies, but they don’t fit that definition perfectly, either. They’re better, but they don’t improve products “along the dimensions of performance that mainstream customers in major markets have historically valued,” because in these cases, mainstream customers didn’t even know that these dimensions of performance were available to them. “If I had asked people what they wanted, they would have said faster horses” and all. Often, the next big thing will start out looking like a toy, but occasionally, the next big thing will start out looking like the next big thing. When that happens, it’s not a disruptive technology, even if it “disrupts” existing businesses. This is the challenge Google is facing with respect to LLMs. Everyone recognizes that AI is the next big thing, but to fully embrace AI, Google might have to sacrifice the position it’s build up over decades. That’s not the Innovator’s Dilemma. It’s something else. I think the word we’re all looking for is Positioned. PositionedCounter-positioning is my favorite concept in business strategy. Hamilton Helmer, who includes counter-positioning as one of his 7 Powers, defines it as: “A newcomer adopts a new, superior business model which the incumbent does not mimic due to anticipated damage to their existing business.” In counter-positioning, the new entrant adopts a business model that the incumbent can’t copy without inflicting collateral damage on itself. Like Bill in Kill Bill after The Bride touches his chest, if the incumbent takes five steps in the new entrant’s direction, they’re dead. Jiu jitsu is another helpful analogy: successful counter-positioning involves leveraging an opponent’s strengths and movements against them, using technique and strategy over brute force. Startups can’t win a boxing match against an incumbent, but they have a shot in jiu jitsu. In the book, Helmer spends as much time detailing the reasons that an incumbent fails to mimic a counter-positioned upstart as he does describing how an upstart can use counter-positioning, but he never gives the incumbent’s position a name. That unnamed state is exactly what I think most people are trying to say when they say that a company is facing the Innovator’s Dilemma, so let’s give it a name. To be counter-positioned against, a company needs to be Positioned. Based on the definition of counter-positioning, we can come up with a definition of Positioning: “An incumbent is susceptible to a new, superior business model due to anticipated damage to their existing business.” This encapsulates some of the challenges an incumbent faces in the Innovator’s Dilemma – adopting a disruptive technology can hurt existing customer relationships and divert resources from higher ROI projects – but it’s broader. It covers situations in which an incumbent faces a new business model but not a new technology, situations in which an incumbent faces new technologies that are just better on all the important dimensions, like Uber was for incumbent taxi companies, and situations in which incumbents somehow fail to adopt even sustaining technologies. The more deeply positioned a company becomes, the more susceptible it becomes to being counter-positioned against when a superior new technology or business model emerges. A company doesn’t have to be actively counter-positioned against to be Positioned; becoming more Positioned just increases the potential for counter-positioning. I want you to imagine the word “Positioned” as something that can take on weight and direction. Companies can be Positioned on two axes:

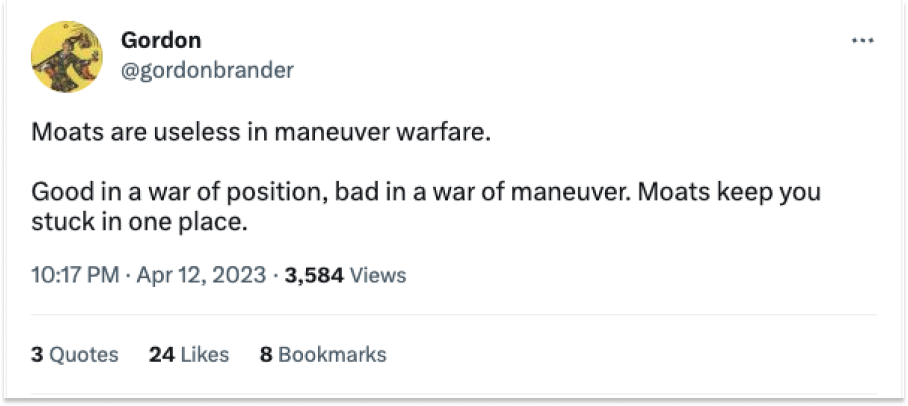

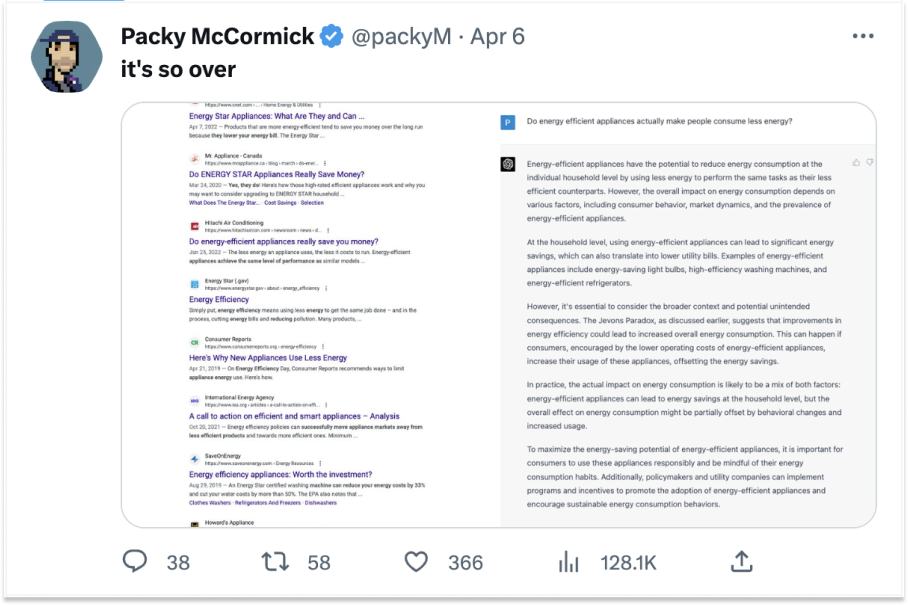

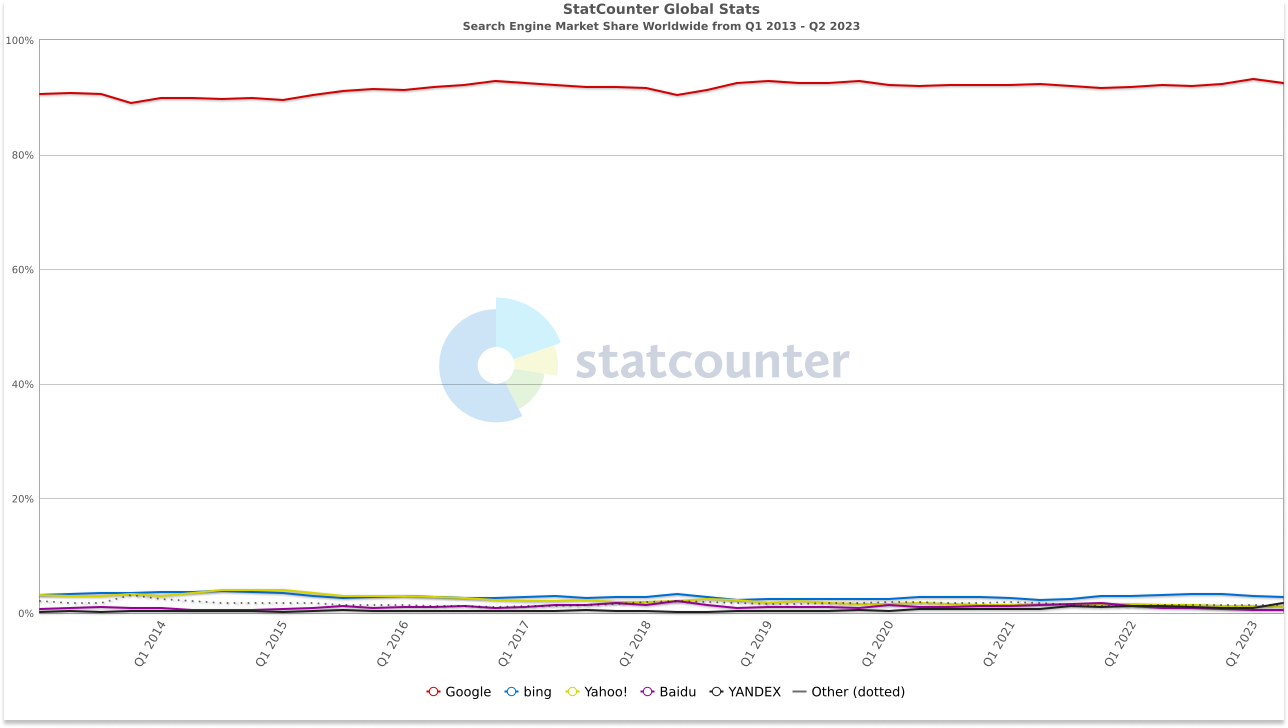

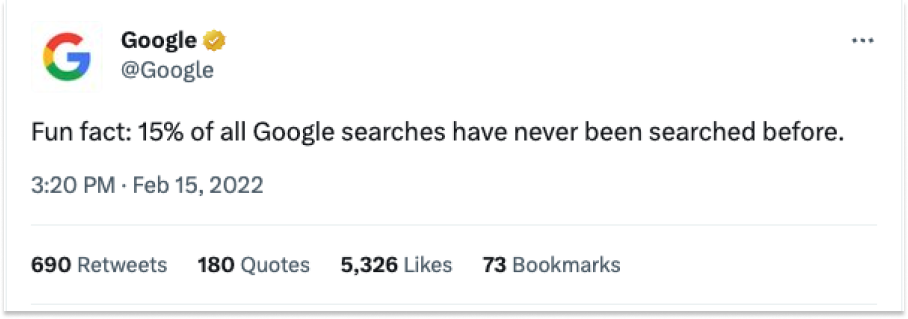

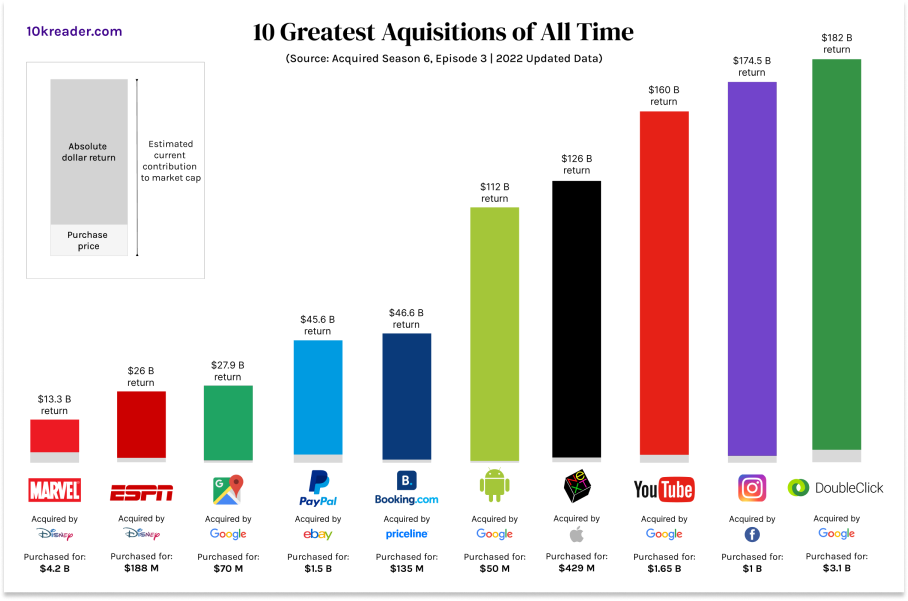

Companies that are deeply positioned on one product are the most susceptible to counter-positioning. I like the way Gordon Brander describes the issue: Reading that, I picturing a medieval army holding the high ground with comfortable tents and lavish meals, dug in, impervious to its enemy’s attacks, when out of nowhere, bombers fly in and demolish the concentrated target. Being Positioned is neither inherently good or inherently bad. It’s both and either depending on the circumstances. In a war of position, when no sufficiently superior new business model exists with which newcomers might mount a credible counter-positioning attack, being deeply positioned on a product is the best place to be. But with that comfort comes risk. When a new business model enters the fray, the contest switches to a war of maneuver, and the more deeply Positioned a company is when the shift occurs, the less prepared it will be to fight the new war. Let’s look at the good and the bad through the lens of Google and LLMs. The Situation in a Nutshell: OpenAI vs. GoogleFor those who are unfamiliar with the threat that OpenAI and other LLM-based chat products pose to Google, I’ll give you the nutshell version. Google makes the vast majority of its vast amounts of money from selling ads against the searches you make. When you search, it shows you a bunch of links, some of which show up because an advertiser paid, some of which show up because they’re the most relevant, and some of which show up because the company behind them is good at Search Engine Optimization. When you click on ad links, Google makes money. AI-based chat, like OpenAI’s ChatGPT, doesn’t give you links. It gives you answers. Here’s a comparison of Google search results vs. a ChatGPT answer for a question I asked recently: From my perspective as a user, the ChatGPT answer is more useful, although it’s not 100% reliable so it depends on how much precision I need. From Google’s perspective as a search ads business, the ChatGPT answer is terrible: there are no links! Regardless of my preference or Google’s, products are shifting from links to answers. Competitors are experimenting with new capabilities and new business models. A company’s willingness to take risks seems to track how Positioned a company is in search. Microsoft, whose Bing is a distant second most popular search engine, beat Google to market with an AI product built on OpenAI’s models, and it uses a mix of traditional search and chat, leaving room for ads. Last week, The New York Times reported that Samsung is considering switching to Bing for default search on its devices, likely because of Bing’s inclusion of AI chat. OpenAI, which had no business model until a few weeks ago, offers access to ChatGPT Plus for $20 a month and recently announced ChatGPT plugins, which I wrote about in Attention is All You Need. I think plugins have the potential to challenge Google even more than ChatGPT itself because they both connects to the internet for real-time results and get into the valuable commerce searches – travel, shopping, food, and more – that ChatGPT hadn’t previously touched. Users may prefer a chat that takes actions on their behalf to a page full of links they need to search through themselves. It’s still very early in the race, but it puts Google’s search business in an uncomfortable position for the first time in 25 years, a period of near-monopoly during which the company has built tremendous advantages in search. During that period, being Positioned has been all upside. The Upside of Being PositionedGoogle is deeply Positioned on one product, search. Being deeply Positioned can be excellent, as Gordon points out. If you’re in a war of position, like Google has been in search for over two decades, being Positioned lets you accumulate advantages and dig deeper moats over time. For example, Google has arguably the greatest business model in the history of the world: search ads. In 2022, it generated $282.2 billion in revenue, $224.7 billion of which came from ads, $162.5 billion of which came from search ads specifically. It threw off over $60 billion in free cash flow last year alone. Its worldwide search market share has been practically impenetrable, ranging between 90% and 93% for the past decade, with an all-time high of 93.1% last quarter, while everyone called for its demise. That market share, the fact that it sees 20-30x more searches than its closest competitors, compounds its advantage. Results get better the more people search. When people search for new things, which happens at a surprising rate, Google is best-positioned to get good at serving those edge cases faster than anyone else. By having the best product, it can build a better product. And with a better search product, it can generate more search ads revenue. All of that sweet, sweet cash that ads throw off allow Google to spread its tentacles throughout the internet, even into its competitors’ fortresses: it pays Apple somewhere between $15-20 billion per year to be the default search in Apple’s products. Using its cash, the company has made some of the best acquisitions of all time to both strengthen and leverage its ad capabilities: Android puts its search front and center on three billion phones. YouTube generated $30 billion last year from ads, in part by being able to tap into Google’s ad infrastructure and relationships. DoubleClick, the second greatest acquisition of all time according to Acquired (first in the chart using updated 2022 data), allowed Google to bring its ads to the entire internet. Plus, it employs the people who are best in the world at search, many of whom have worked there for over a decade and are well-versed in the way Google does things. It can use its cash and world-class employee perks (massages, chefs, disregard for whether you actually work at all) to hire nearly unlimited geniuses, crown them with colorful spinny hats, and train them at the knee of the world’s greatest search experts. It can take cutting edge advances in distributed systems, quantum computing, and of course, AI, and apply them to the challenge of serving ever more relevant search results, and ever more tempting search ads. Google even spun up the Google Brain research team, which came up with the Transformer architecture that powers LLMs, and acquired DeepMind, which solved the protein folding problem. Last week, the company merged the rival teams in an effort to get super serious about its AI efforts. There are many more benefits besides the ones I’ve listed, many captured in the other six of the 7 Powers: scale economies, network economies, process power, switching costs, cornered resource, and branding. That last one is easy to see in the context of Google: people don’t “search” for something, they “Google it.” All of these moats have made Google an impenetrable fortress for a quarter century. One of my core beliefs, though, is that everything in life is a double-edged sword. Your greatest strength is often your greatest weakness. Being deeply Positioned can be terrible when things start to change quickly, when you enter a “war of maneuver.” The Downside of Being PositionedWhen OpenAI launched ChatGPT late last year, Google was caught predictably flat-footed. Less than a month after ChatGPT’s launch, Google CEO Sundar Pichai declared “code red.” Its search engine was, for the first time in two decades, in peril. How it got here is a case study in the downsides of being deeply Positioned on one product. Google engineers invented the Transformer architecture. The company built its own AI chatbot, LaMDA, that was good enough to convince at least one Google engineer, Blake Lemoine, that it was sentient. But the company held LaMDA back, concerned about the risk of releasing a product that was known to hallucinate (a risk to Google’s brand around accurate information) and undoubtedly worried about how a bot that gives answers instead of links would monetize (a risk to Google’s golden goose). Instead, OpenAI stole the spotlight with ChatGPT, and then again with plugins, a combination that threatens to bring down Google’s search monopoly. Even Microsoft, another incumbent, an also-ran in search with inferior AI capabilities (save its savvy partnership with OpenAI) was willing to risk its own chatbot, Sydney, saying unhinged things. How was Google so slow to react? The downsides of being Positioned come in many flavors and from many directions. All of the benefits we discussed above have evil (or at least lazy or risk-averse) twins. As Ben Thompson wrote in 2016 in The Curse of Culture:

The biggest and most obvious downside is that Google’s search ad business is just too good to risk. Counter-positioning works precisely because incumbents aren’t willing to risk damaging their existing business. It stands to reason that the better that existing business is, the less willing an incumbent would be to risk it. The better your Position, the better target you are for counter-positioning. And at $225 billion, Google’s search business is as good as it gets. In humans (and companies are made up of humans), this idea is known as loss aversion. Introduced by Daniel Kahneman and Amos Tversky, loss aversion is a cognitive bias where people feel the pain of losing something more intensely than the pleasure of gaining something of equal value. This leads to risk-averse behavior and a preference for maintaining the status quo. Google’s position as a near-monopolist in search means it has too much to lose to risk cannibalizing itself until and unless it becomes clear someone else might eat it. Relatedly, Arrow’s Replacement Effect also kinda fits here, as Ashwin Varma pointed out on Twitter: In 1962, economist Kenneth Arrow wrote Economic Welfare and the Allocation of Resources for Invention, in which he showed that monopolists may underinvest in R&D because they are more concerned with maintaining their current market position and profits than risking the introduction of innovations that could render their existing products obsolete. I actually don’t think this one fits perfectly either – Google invested in R&D, it just didn’t productize the fruits of that research in a way that might put the core business at risk. As I highlighted in Internet Computers, Google is so deeply Positioned on search that it’s willing to make its products worse in order to get people to search more! Risk is at the heart of Positioning. When companies have more to lose, they tend to become more risk averse. It’s understandable, but companies need to realize that they’re taking a big risk by avoiding taking risks. Byrne Hobart and Tobias Huber explained it well in Against Safetyism, “by mitigating or suppressing visible risks, safetyism is often creating invisible or hidden risks that are far more consequential or impactful than the risks it attempts to mitigate.” The same applies to companies, and it certainly seems to apply to Google. In one of the more thoughtful and damning former-employee posts of all time, The maze is in the mouse (which you should read if you want to viscerally feel how heavy being Positioned can be), ex-Googler (Xoogler?) Praveen Seshadri wrote:

This isn’t the Innovator’s Dilemma. This is a company that is so deeply Positioned that it’s paralyzed. Noam Bardin, the founder and CEO of Waze, said something similar in his 2021 post, Why Did I Leave Google, Or Why Did I Stay So Long? Bardin paints a picture of a company more focused on protecting itself than serving its users. This post is worth a read too, but his conclusion makes the point succinctly: “The innovation challenges at Corp-Tech will only get worse as the risk tolerance will go down. Soon, Lawyers > Builders and the builders will need to go elsewhere to start new companies.” Not all of this is Google’s fault, per se. As Bardin points out, the company faces a lot of regulatory heat. It has to be responsible; it has to manage risk. But with this context, it’s not surprising that seven of the eight Google researchers who co-authored Attention is All You Need have left Google to start their own companies. As a company deepens it Position, it builds a stronger and stronger desire to protect the core, and more and more detritus designed to do just that. It becomes risk averse. The rebels who want to build great things leave. Even when it doesn’t intend to add policies and features and reviews and all sorts of things that slow it down, those things appear anyway, like cobwebs on an unused door. The people get better and better at doing things a certain way, and their doing-new-things muscles atrophy. Not to introduce another new concept this late in the game, but the company’s core capabilities become core rigidities. The upshot for Google is that it has too much to lose, and that made it a sitting duck for counter-positioning. OpenAI introduced one new business model – subscription chat that gives answers – that could eat at its market share, and another – plugins – that could crush it entirely. Google’s challenges, the ones that allowed it to be counter-positioned against in the first place despite the fact that it developed LLMs first, are internal. OpenAI just took advantage of them. To whit, this is the company’s mission statement: To the extent the company put that mission first, above all else, LLMs would have been the greatest gift possible. Another tool in the information organization, accessibility, and usefulness toolkit. But as of late, it seems that the mission has not come first. At best, it’s come second to the search ad business, as you’ll recognize after viewing the results on just a few queries. At worst, it’s further down the list, behind internal politics and employee career advancement and political correctness and comfort and a whole bunch of other things that have built up as Google has deepened its Position. Plus, unlike some of its rivals, most of those things have built up around one core product, because Google is deeply Positioned in search. Positioned Products Versus Positioned PlatformsThus far, we mostly covered the depth of an incumbent’s Position. But how they’re Positioned matters a great deal too. And it’s why Google seems to be the company everyone thinks is most at risk from LLMs. The depth axis on the positioning matrix is fairly intuitive. Roughly, the longer a company does something and the better it does that thing, the deeper its Positioning. But the other axis, the product/platform axis, is just as important for understanding how a company will respond in the face of a big technological or business model shift. Companies closer to the Product end of the axis are more susceptible to counter-positioning than those closer to the Platform end, because the Platforms develop capabilities more than they develop any single product. When a new technology with a new business model emerges, platform companies are more easily able to incorporate it into their capabilities than a product company. Microsoft is the prime example of a platform company, and not just because it added some AI to Bing. The company nearly fell victim to the last two big shifts – mobile and cloud – because of its reliance on Windows as its core product. Its recent success is instructive for Google. During the Ballmer era, Microsoft made a series of decisions that made it clear that, even though it had always been a “platform company,” that platform, Windows, was the product. In the face of the shift to mobile, it launched Windows Phone. It acquired another victim of the mobile shift: Nokia. Both mobile attempts were flops. As software moved to the cloud, Microsoft kept its Office suite off of iOS devices. It named its cloud services provider “Windows Azure.” By being so deeply Positioned on Windows, Microsoft let Microsoft flounder. Over the 14 years of Steve Ballmer’s tenure from 2000 to 2014, Microsoft’s stock price dropped 21%. Within the first months of Satya Nadella’s tenure, Microsoft visibly shifted its strategy. It launched Office for iPad. It renamed the cloud service from Windows Azure to Microsoft Azure. In the nine years since Nadella took the reins, it’s become the most strategically savvy of the tech giants. Thompson’s The End of Windows is a good read on Microsoft’s transformation, but one line that he includes from Nadella’s first internal strategy memo captures the point well:

Microsoft was no longer the Windows company. It re-Positioned on being a platform company that sells enterprises productivity. That’s a much more flexible position from which to maneuver through big shifts. When challengers like Zoom and Slack emerge, Microsoft can copy them and sell Teams to its enterprise clients. When new operating systems emerge, Microsoft can sell its software and services through them. When AI took off, Microsoft both partnered with the space’s leading company and was the quickest of the big tech companies to visibly inject LLM-based products into its software. From this position, as long as there are enterprises to buy whatever comes next, Microsoft will be able to adapt quickly to sell them productivity in whatever form it takes. As a result, Microsoft’s stock is up over 650% since Nadella took over, outperforming the Nasdaq by a very wide margin. Google, on the other hand, is decidedly a product company. In one of the best pieces of tech writing I don’t know how I hadn’t read until recently (thanks Jeremy Diamond), Stevey’s Google Platform Rant, Google engineer Steve Yegge shared his strong view that Google was a product company that needed to become a platform company. He wrote (emphasis mine):

This was 12 years ago, but it rings true today. You should really read it, but my takeaway is that, as a Product Company, deeply Positioned on search, Google believed that it could reliably predict what people want and deliver it for them, like it had with search. “You can't do that. Not really. Not reliably,” Yegge ranted. He proposed that Google needed to become a true platform company, to open itself up to the ecosystem, use tools besides ones built for Google, let others build on Google, and eat its own dogfood. “I'm not saying it's too late for us,” he warned, 12 years ago, “but the longer we wait, the closer we get to being Too Late.” Twelve years later, is it too late for Google? Is the company too deeply Positioned on search to maneuver its way into AI? I don’t think so, but I think it’s going to take a shift from Product to Platform. Organizing the World’s InformationGoogle is facing an existential threat, if not an Innovator’s Dilemma. Through its entire history, it’s built skills and structures that reinforce its ability to give the best links for any given search query, and to sell ads against those searches. It has become deeply, deeply positioned in search. Now that AI’s time has finally come and the battleground is shifting rapidly, Google’s strengths have become weaknesses. It has a lot to lose, and risks losing it all by not taking risks. To survive, it will need to cut weight, take risks, and move fast. Just as Microsoft under Nadella shifted from a Windows company to an enterprise productivity company, from a Product to a Platform, Google needs to return to its mission and shift from a search company to an information organization company. Efforts are underway in Mountain View to build AI into everything that Google does. Larry and Sergey have come back to work on AI. Google launched Bard, its somewhat weaker ChatGPT competitor. It’s put together a 160 person team to work on Project Magi, its efforts to infuse AI into its search product. The good news about being Positioned is that it’s actually somewhat easier to deal with than the Innovator’s Dilemma once a company acknowledges that it’s no longer in a war of position but a war of maneuver. The Innovator’s Dilemma requires companies to take a bet on external factors – whether or not there will be a market for this crappy new thing eventually – but in the case of AI, there’s no doubt about the size of the prize for the winners. The required shift is an internal one, a coming-to-grips with the fact that what got you here won’t get you there. Luckily, the Position that Google has built up over the past 25 years gives it a lot of the pieces required to thrive. Google.com is the most trafficked website in the world. When Attention is All You Need, that’s an invaluable asset. While ChatGPT and Bing have garnered the early attention, if Google moves relatively quickly, it will provide most people’s first interaction with LLM-based products. Just as that volume gives Google the ability to provide better search results for the new things people search every day, it might also give Google’s LLMs the ability to learn more quickly. It’s a captive data source in a world in which captive data sources matter more than ever. As models become more multi-modal, and as video becomes a bigger part of the AI story, Google’s treasure trove of YouTube videos will be an invaluable resource. Despite losing the authors of the Transformer paper, Google Brain DeepMind is still one of the most formidable AI research organizations in the world. Through its advertising business, Google has more relationships with companies trying to sell products and services than any other company in the world. If it can shift to become a Platform – a big shift, to be sure – it has the potential to build a strong competitor to the ChatGPT plugins ecosystem while that ecosystem is still in its infancy. As I wrote, I believe that an Apex Aggregator that takes actions and makes purchases on its users’ behalf has the chance to become a bigger business than search. No company in the world has proven better at monetizing intent than Google has. Doing search well is a very hard problem, and no one does it better than Google. If it can get its juice back, it can leverage these powerful new AI capabilities to build products that organize the world’s information and make it accessible and useful, even if that sometimes means putting search ads second. Of course, Google has a lot of cultural baggage to shed. It may need to suffer from short-term revenue hits. It will need to learn to take big risks again. But not taking those risks is an even bigger risk: if Google isn’t willing to cannibalize itself, others will happily eat it. The things that got Google here as it became more deeply Positioned in search during the war of position have become weights in the war of maneuver. But they can also be weapons. Thanks to Dan for editing! That’s all for today! We’ll be back in your inbox on Friday with a Weekly Dose of Optimism. Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #39

Friday, April 21, 2023

Starship, How Solar Got Cheap, AgARDA, Against Safetyism, Dr. Peter Attia

Weekly Dose of Optimism #38

Wednesday, April 19, 2023

EVs, Battery Recycling, Child Mortality Rates, The State of Crypto, SimsGPT, The Problem of Abundance

Sign in to Not Boring by Packy McCormick

Wednesday, April 19, 2023

Here's a link to sign in to Not Boring by Packy McCormick. This link can only be used once and expires after 24 hours. If expired, please try logging in again here. Sign in now © 2023 Packy

Intelligence Superabundance

Wednesday, April 19, 2023

Induced Demand, Jevons Paradox, Jeff Bezos, AI, and Our Jobs

Crypto (Could) Fixes This

Monday, April 10, 2023

Elon, Substack, and Crypto as Insurance

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month