Earnings+More - Promo addiction and GGR fiction

Promo addiction and GGR fictionDebut Massachusetts data suggests DraftKings bought market share, a habit practiced widely in in Pennsylvania and Michigan +MoreGood morning, welcome to the latest edition of the Data Month, which takes a deeper dive into the debut numbers from Massachusetts and makes some comparisons with the figures for promotional spend in Pennsylvania and Michigan.

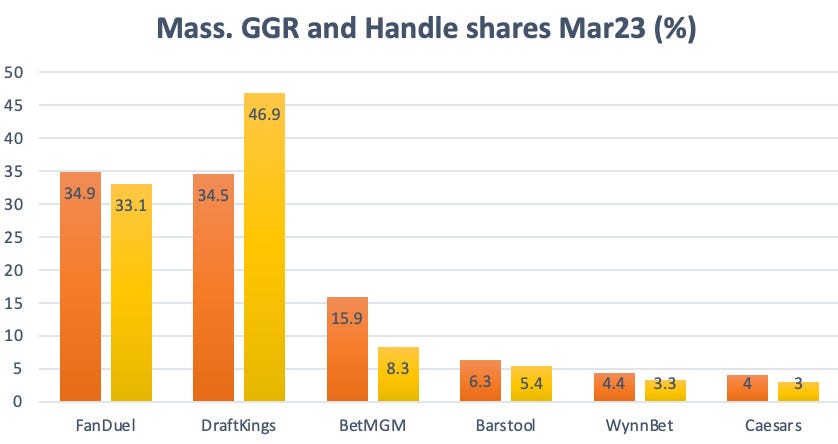

What’s your addiction? Is it money? DraftKings’ Mass. gambitMassachusetts saw DraftKings almost break the mold as it narrowly failed to eclipse FanDuel in the market’s first 22 days. How to have a No.1 the easy way: The first data from Massachusetts since launch on March 10 displayed a familiar picture after FanDuel, DraftKings and BetMGM grabbed the podium positions and ~83% of total GGR. However, the race for top dog was the closest seen in any new state for a while, with FanDuel and DraftKings almost neck and neck.

🍎‘s to 🍏’s: Massachusetts GGR and handle shares Mar23 On hold: The failure to translate the dominance in handle through to GGR is explained by the hold at each competitor. DraftKings achieved 6.3% hold while FanDuel managed 9%.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports. To find out more, please visit www.metricgaming.com Home turfNever gonna give you up: As the team at EKG put it in their analysis of the Massachusetts debut figures: “If you know anything about DraftKings, you know there was simply no way the company was going to play second fiddle to rival FanDuel on its home turf”.

Give me strength: Meanwhile, players such as Caesars, Barstool and Wynn have collectively made it abundantly clear in a succession of earnings calls that they do not intend to carry on in the same vein with promotions as was the case previously.

And the winner is: Regulus points out that FanDuel will – as has been the case in every other state launch in recent years – be the happiest. “FanDuel’s strategy is clearly working in Massachusetts just as it is nearly everywhere else,” the team suggests.

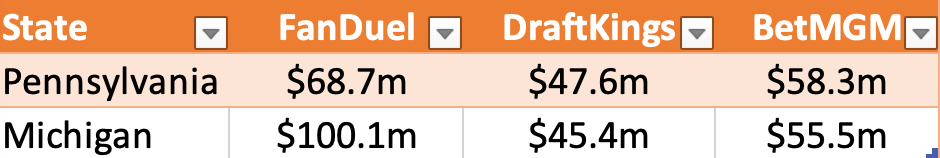

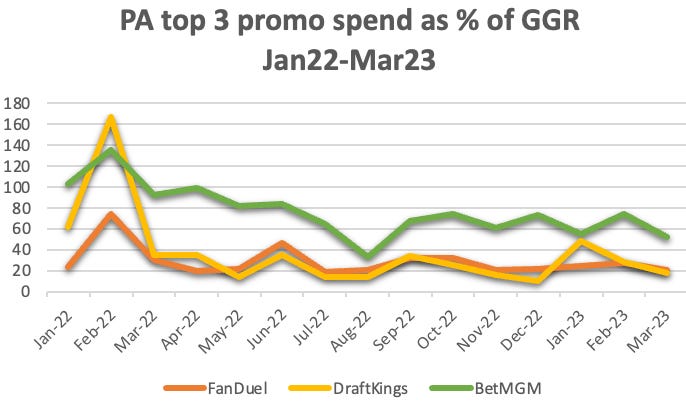

Promo fomoBuying market share with promo spend isn’t just a new market phenomenon. Giving it all away: The pattern set for gaining market share by offering bonuses and free bets has been evident for some time. As can be seen in the table below, between Jan22 and Mar23 FanDuel gave out $168.8m of free bets and promos in Pennsylvania and Michigan alone; DraftKings was on $93m and BetMGM $113.8m. 💵💵💵 Top 3 largesse: promo spend from Jan22-Mar23 in PA and MI

🧐 Promo pros: the top three in Pennsylvania Spend, spend, spend: BetMGM’s average promo spend as a percentage of GGR is 77% over the 15 months in question vs. 29% for FanDuel and 37% for DraftKings. In Michigan the picture is similar: FanDuel expends 34% of its GGR on promos, DraftKings 64% and BetMGM 53%.

The figures for March in Michigan give a picture of what happens to revenues when promos are taken into account. While market leader FanDuel spent the most on promos in absolute terms at $6.5m, it also made the most GGR ($30.4m), so its NGR only fell to $23.9m.

But what about iCasino? No figures from either Pennsylvania or Michigan are available but standard iCasino marketing practice also relies on bonusing, albeit to a lesser extent than sports.

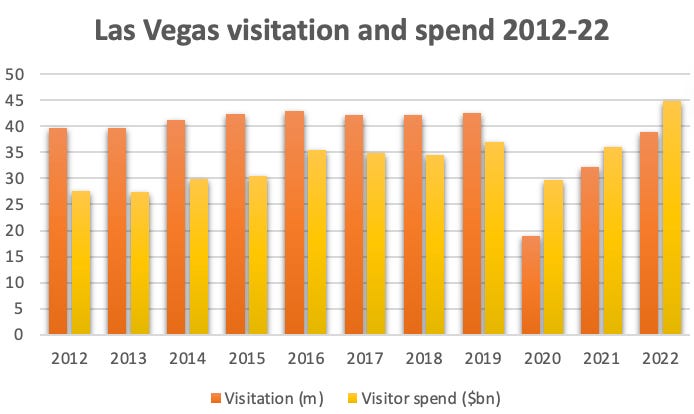

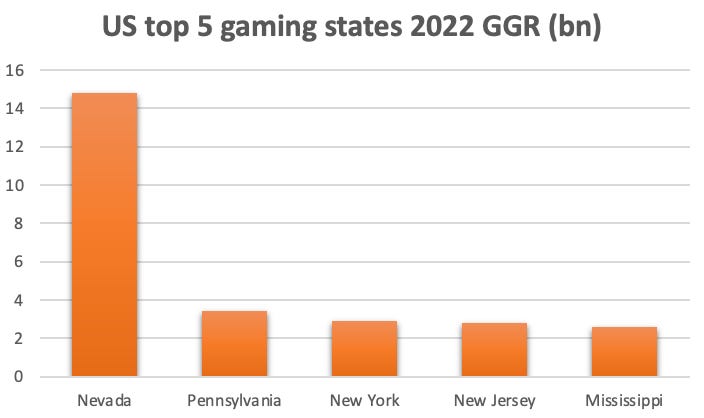

Vegas’s room to maneuverThe data for 2022 shows the number of visitors still lagging 2019 despite record spend. Boomtown: Visitors to Las Vegas spent an all-time high of $44.9bn in 2022, an improvement of 21% on the pre-pandemic high of $36.9bn in 2019 and 24% ahead of 2021. Recall, in 2022 the Las Vegas Strip generated GGR of $8.3bn.

🎉 Party like it's 2022 This ain’t over: Whether 2022 marks some kind of high-water mark for visitor spend lies in the lagging number of visitors. Though convention attendees were more than double that of 2021 at 5m.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Data pointsStart spreading the news: A recent note from the analysts Bank of America noted New York could hit $5bn GGR and $2bn+ in combined EBITDA.

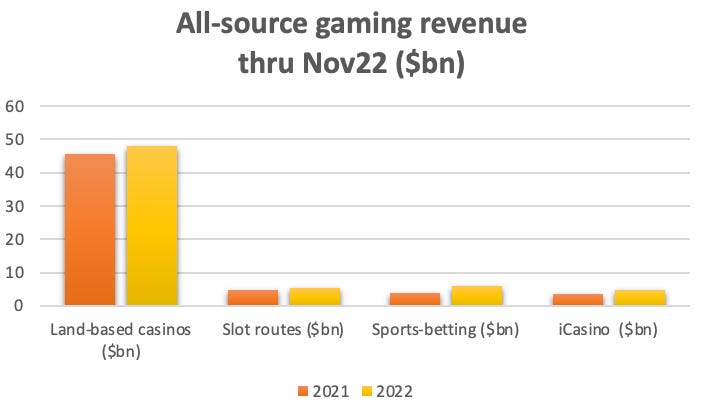

🍎 New York is already a big gaming state All-in: Truist took a look at how the rise of sports betting and iCasino impacts the overall gaming revenue picture. As can be seen, while both the newcomers are on the rise, up from $4bn to $6bn for sports betting and $4.7bn to $5bn for iCasino, the market is still dominated by land-based gaming. 🎰 Dwarfed: sports betting and iCasino in the shadow of land-based gaming Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. Earnings+More is free today. But if you enjoyed this post, you can tell Earnings+More that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

MGM and Push keep schtum on rumor

Monday, April 24, 2023

MGM and Push quiet on €150m deal, Churchill Downs and Evolution in the week ahead, analyst takes, startup focus – Data Skrive +More

Lottomatica to seek deals outside Italy

Friday, April 21, 2023

Lottomatica IPO, GAN's new creditor, DraftKings analyst take, Entain's share price lag, sector watch – sports streaming +More

LVS: Macau ready to tee off

Thursday, April 20, 2023

Las Vegas Sands benefits from Macau rebound, Rank sees land-based return +More

888 back in the Middle East VIP game

Wednesday, April 19, 2023

888's new Middle East onboarding, Earnings+More readers poll, Lottomatica listing, NY casinos, Japanese resorts casino news +More

MGM’s ‘Japan dream’ comes true

Wednesday, April 19, 2023

MGM's Japanese opportunity, Better Collective makes adtech buy, LVS in the week ahead, startup focus – Kutt +More

You Might Also Like

Lessons From Dot Com Boom

Thursday, March 20, 2025

+ Homes in Delhi are becoming obscenely expensive. Meanwhile, IndiGo is looking to soar greater heights.

Topic 32: What is Qwen-Agent framework? Inside the Qwen family

Wednesday, March 19, 2025

we discuss the timeline of Qwen models, focusing on their agentic capabilities and how they compete with other models, and also explore what is Qwen-Agent framework and how you can use it

🦅 This will help you from being stopped by imposter syndrome

Wednesday, March 19, 2025

xAI's first acquisition | Instagram tests AI-generated comments | Facebook Stories now eligible for creator monetization

From $0 to $12 Million Per Year With Fat Joe

Wednesday, March 19, 2025

This week, we're excited to have Joe Davies from FatJoe.com on the Niche Pursuits Podcast. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Skype is dead, but SORA changes everything😲(read ASAP)

Wednesday, March 19, 2025

View in browser ClickBank Hi there, You may have heard that after 22 years, Microsoft is killing off Skype and replacing it with Teams 😬 but let's be honest... this isn't exactly exciting news.

You’re the heart of social—we see you

Wednesday, March 19, 2025

And you deserve better tools, better support, and better balance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Here’s the One Investment That Can Change Your Life in 2025

Wednesday, March 19, 2025

The Biggest Opportunity of 2025

Founder Weekly - Issue 677

Wednesday, March 19, 2025

March 19, 2025 | Read Online Founder Weekly (Issue 677 March 19 2025) Welcome to issue 677 & of Founder Weekly. Let's get straight to the links this week. Google purchased Nest ($3.2B), Amazon

A look at the categories for this year's Greater Good Awards

Wednesday, March 19, 2025

As companies tackle pressing issues like wellness, sustainability and local community betterment, their efforts often go unnoticed despite their powerful impact. The Greater Good Awards offer a

Google just released AI Mode...

Wednesday, March 19, 2025

Google released its newest AI search feature this month, but not everyone has access to it (yet). It's called AI Mode. To use it, you have to be in the US, over the age of 18, and opt-in via Labs—