Research on Survival of NFT Marketplaces (1) The Post-Royalty War Battle for the Leading Position

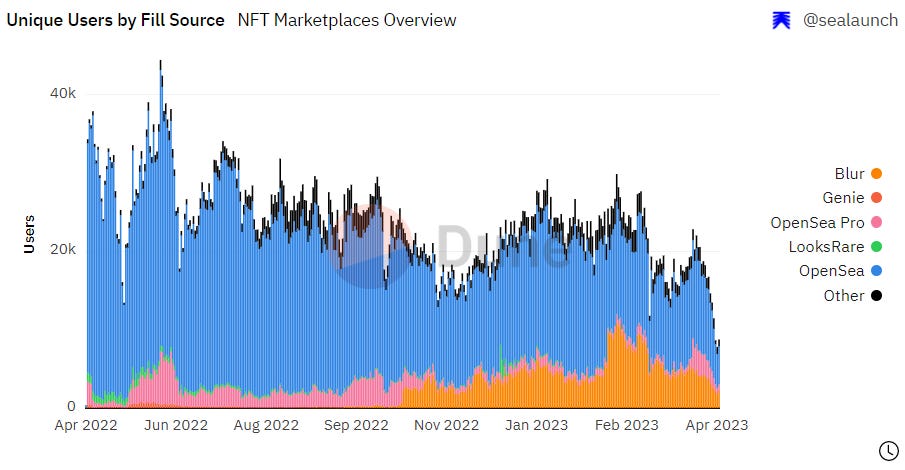

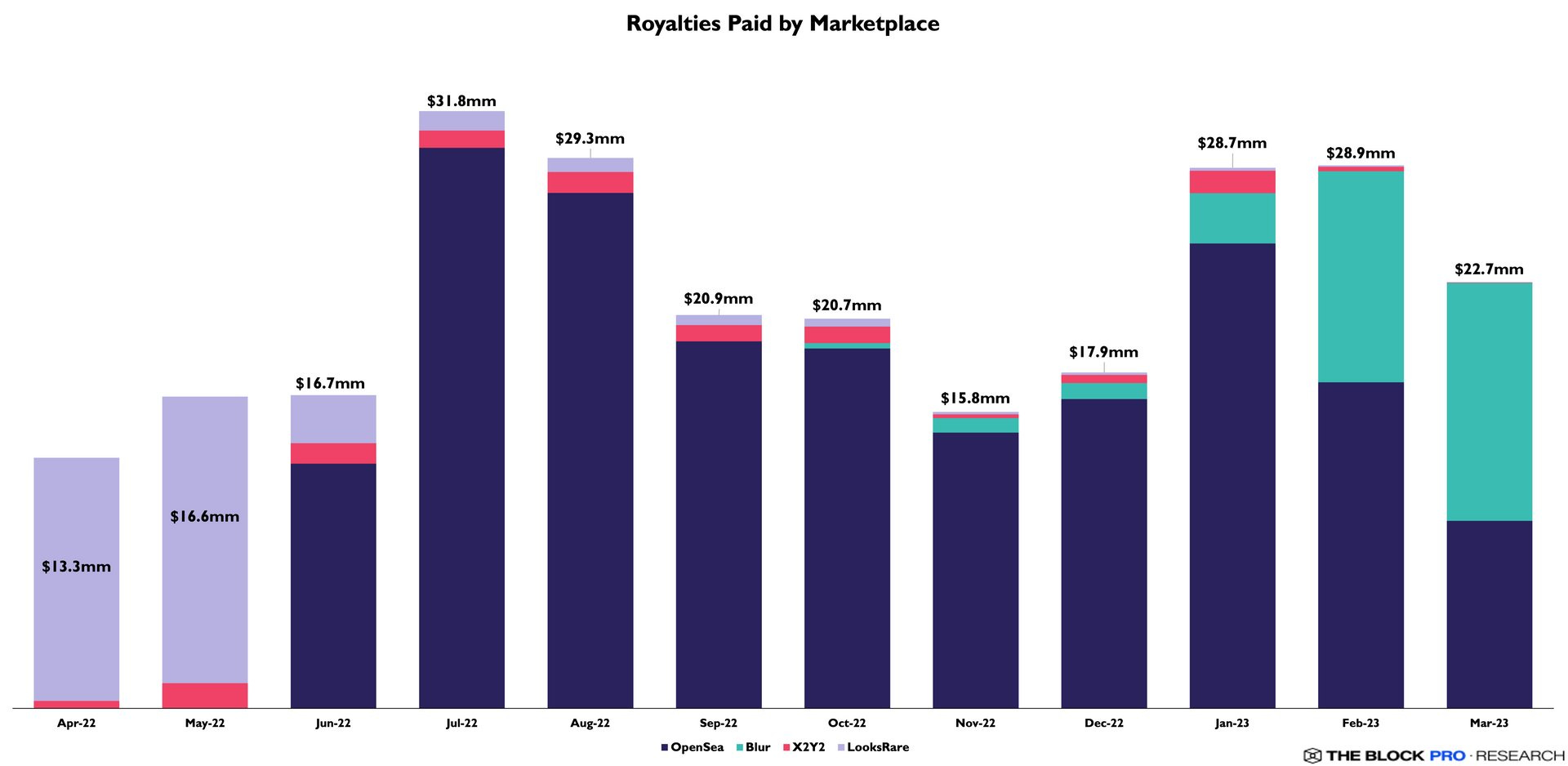

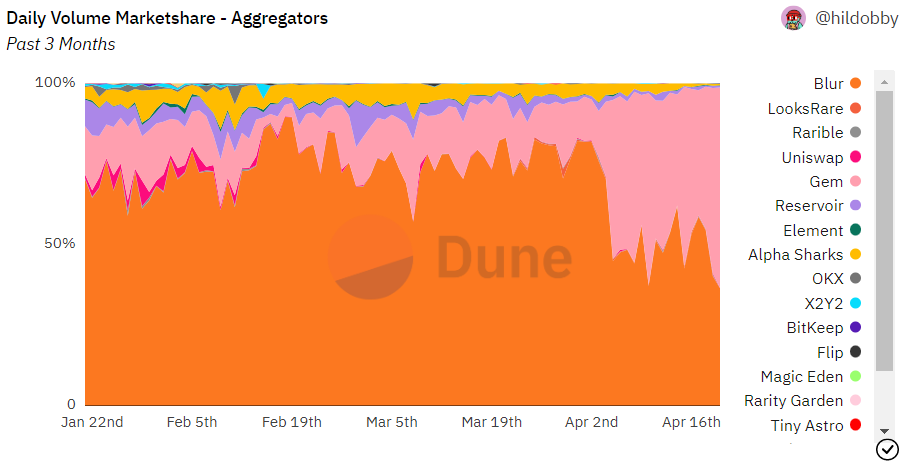

Author: @0xMavWisdom Disclosure: The author holds relevant assets such as NFT platform tokens as a personal investor and has no business dealings with any platform or project party. The NFT marketplace has been in a continuous slump, with three key indicators - volume, transactions, and numbers - at their lowest levels in the past one year. According to @SeaLaunch_ data, on April 19th, the number of NFT marketplace users and transactions both hit new low points in the past year, the trading interest of both regular users and NFT traders has been declining. In addition, the floor prices of blue-chip NFT series such as BAYC and Azuki have been falling for an extended period, and BendDAO's blue-chip liquidation is happening almost every few days. Even the former NFT giant Franklin has surrendered in the poor market environment. NFT marketplaces are currently facing a challenging environment, and platform tokens have also been declining. However, as of now, no mainstream platform has announced surrender, and most are still developing according to their own strategies, with occasional bright spots. This article is the first in a series of studies on the survival status of NFT marketplaces, focusing on Blur and OpenSea in the post-royalty era. Source: https://dune.com/sealaunch/NFT?undefined=&Select+Timeframe_ef4aff=365+days As the strongest challenger to OpenSea, Blur's strategy has been very clear since its inception. As a trading aggregator, it aggregates others but does not allow others to aggregate, using the time spent on market disputes to gain space for action. Through the use of points in three airdrops, the first phase rewarded historical users - capturing competitors' users and using the aggregator's advantages to convert them into their own users; the second phase incentivized sellers on their own platform, attracting user retention, gaining platform reputation, and demonstrating their strength in the royalty war; and the third phase introduced bid rewards - after achieving good seller liquidity, they turned to stimulate buyer liquidity, pioneering the Bid Pool and moving from peer-to-peer trade to more efficient peer-to-pool trade, while continuing to expand their brand influence and lead the royalty war. From the second to the third airdrop, from incentivizing sellers to incentivizing buyers, from participating in the war to leading the war, Blur's shifting market position in different stages is evident. Of course, excellent UI/UX and smooth experiences for professional traders are the prerequisites and guarantees for Blur's strategic actions. In the author's opinion, Blur may have planned the specific path for the three airdrops since its inception, and its focus on serving professional traders is a foresighted strategic move. Around the royalty war, Blur has at least two important milestones: (1) During the second phase of the listing incentive period, which took place in late October to early November, as a new generation of zero-royalty platform, Blur did not fall behind OpenSea in the competition for Art Gobblers, which has the potential to become a new blue-chip. From the first day of the NFT launch, Blur has been in direct conflict with OpenSea and has not fallen behind. In the nearly 10,000 ETH volume generated in the three hours before the launch, OpenSea accounted for 52% and Blur accounted for 43%. Since November 2nd, Blur has surpassed OpenSea in Art Gobblers volume for several consecutive days, and with the support of Art Gobblers, Blur's total volume has beaten OpenSea for an extended period - a feat not seen in some time. Although Art Gobblers eventually fell, Blur completely stood on the historical stage in this small-scale battle, and also verified the success of its second-phase incentive plan. In November, nearly half of OpenSea's blue-chip liquidity and volume, which is the foundation of its existence, was captured by the zero-royalty platform, with a large part flowing into Blur. (2) (Continuing to promote bid rewards around Bid Pool,) Blur officially declared war on OpenSea after the airdrop was released. At that time, Blur had already achieved a prominent position in the NFT marketplace with the incentive of bid blind box airdrops and Bid Pool innovation, and users were no longer surprised by Blur's volume exceeding OpenSea. At this point, users' emotions were to some extent aligned with Blur's. On the day after the BLUR airdrop was claimed, Blur released a blog post targeting NFT creators, explaining the differences between royalty payment options between Blur and OpenSea, and suggesting that creators disable OpenSea and enforce full royalties on any NFT projects that do not use OpenSea. It was originally thought that OpenSea would resist, but within two days, OpenSea announced that it would reduce platform fees to 0 and switch to a 0.5% creator revenue model. OpenSea's change basically replicated Blur's fee structure, and it was thoroughly defeated in the royalty war. Blur proclaimed itself the victor and reigning champion of the war in a decisive manner. According to data from The Block Pro, Blur paid more royalties to creators in March than OpenSea, reaching $12.6 million, an increase of 12.5% month-on-month. In contrast, OpenSea's royalties fell from $17.3 million to $9.9 million, meaning that Blur brought more profitability to NFT projects or creators it serviced than OpenSea. Source: https://twitter.com/TheBlockPro__/status/1645792435237429250?s=20 Of course, there are many exciting details in the royalty war, such as Blur's use of OpenSea's Seaport to bypass the Yuga series NFT trade blacklist, and it is not limited to just Blur and OpenSea. To some extent, Blur's ultimate victory is also thanks to X2Y2. When SudoSwap opened the door to zero royalties, there was hardly any discussion, but it was X2Y2, a latecomer, who took on most of the public opinion firepower of the NFT community on the issue of zero royalties, ultimately making it easier for Blur to come out on top, but it is worth noting the subtle timing of Blur's entry into the game. [Note: For the origin and process of the royalty war, refer to my article from last year: https://mp.weixin.qq.com/s/Ebee0XxplmAXdUZe6nN_JQ] However, the royalty war is just a process in the development of the NFT marketplace, which may be insignificant in the long history, or there may be another royalty war in the future. The victory of Blur in this royalty war does not mean its success, obviously. In Blur's various incentive plans, due to the fact that they are all post-incentives, the general method of identifying trade mining by wash-trade is almost useless for Blur, and many of Blur's volume activities are mistakenly regarded as organic. This blinded many users and data analysts in the first quarter of this year, and in fact, Blur's organic volume may be much lower than imagined. The consequences of false prosperity are also exposed in a worse market environment - due to the lack of actual trading demand and the relatively small market value of NFT, the Blur Bid Pool has gradually become a powerful tool for market manipulation by whales, especially in Season 2, which has been continuing the double points until today. In order to obtain points and the narrow profit margin under the liquidity, whales rely on stronger financial strength than retail investors to set up mobile false Bid Walls to play with retail investors in NFT trading, earning meager profits from it. However, based on the principle of small profits but quick turnover and the considerable subsidies based on future airdrops based on points, whales are still enthusiastic about it. The ultimate result is that whales control the NFT market price, the floor price drops and fluctuates dramatically. In addition, Blur's roadmap is also worth mentioning. When the author first saw Blur's IDEA MAP, it seemed to see the shadow of BAYC. As we all know, BAYC has excellent storytelling ability, and its roadmap is displayed by a comic strip, but there is no starting point, no endpoint, and even no idea where it will go next. The roadmap only tells you where you might go, and as for when to go, how to go, the official will hide these clues in a series of tweets and videos, guiding the community to speculate and explore in the form of Easter eggs. Returning to Blur, the author also felt that a similar team was taking similar actions, hoping that Blur could release more powerful tools in the future. The above whole is centered around the perspective of Blur, and now let's talk about OpenSea. As the elderly of the market, OpenSea has been around for more than 2 years before NFT exploded in 2021, and even now it is much better than 2020 ago, so OpenSea should appear the most calm in the current bad environment. OpenSea's historical past is also familiar to most users, and most users' first NFT purchase was on OpenSea, which is not elaborated here. OpenSea's advantage lies in the brand effect of the scalable circle under the first-mover advantage, and the trustworthiness that has been tested for a long time. Unlike Blur, Blur's short-term motivation is very clear, to defeat OpenSea and snatch OpenSea's users. Although it has won a lot of market share from OpenSea with excellent operational strategies, its incremental contribution to the entire NFT market is very limited and has not escaped the scope of internal competition. In addition to bringing new user growth, OpenSea's circle expansion effect is also reflected in its cooperation with traditional art markets/auction houses, Sotheby's and Christie's cooperation with OpenSea has brought digital art into the real world. Despite bowing down in the royalty war and losing some market share, OpenSea's strong first-mover advantage was not enough to allow Blur to take advantage, still leading by at least twice as many daily trading users. In response to the growing professional trading needs of NFT Traders and the community's call for airdrops, OpenSea upgraded the long-idle Gem it acquired in April last year and rebranded it as OpenSea Pro. As a professional trading platform, OpenSea Pro largely borrows from Blur's approach, adopting a zero-fee model, doing aggregation, and having an Offer Wall (Bid Wall). In addition, after the successful brand upgrade, OpenSea Pro also airdropped NFTs for free to Gem's historical users, which is in line with the community's long-standing call for airdrops, although it is fundamentally different from the expected OpenSea Token. The launch of OpenSea Pro has also given the OpenSea team another idea. As the entity that may seek compliance, OpenSea is unlikely to have a definitive answer between listing and token issuance in the short world. Launching OpenSea Pro can win a lot of attention transfer in the community for the entity. Additionally, the official documentation of OpenSea Pro also emphasizes that more NFTs will be used as rewards for the community in the future. A brand new continuous NFT airdrop reward route is indeed a good narrative to shift community attention to OpenSea Token. As the first NFT airdrop of OpenSea Pro, the commemorative Gemesis NFT's performance is also remarkable, and it can be sold for over a hundred dollars in the early stage of launch, with a floor price of over 60 dollars now. Furthermore, this NFT airdrop with a big brand endorsement has also given the project a new way of issuing NFT, which can be called Airdrop as NFT Drop, meaning airdrop issuance. Using this method to issue NFT rewards historical users and brings volume to the platform, especially FOMO trading volume in the early stage of launch. For the project side, although they give benefits to users during the minting phase, they receive support from the platform, win attention and traffic, and pay more attention to community maintenance in the later stage. Of course, other project parties may not necessarily be compared with the deep binding relationship between Gem and OpenSea, but this does not prevent it from becoming a possible new NFT issuance strategy for OpenSea in the future. Returning to OpenSea Pro itself, as a counterattack to OpenSea, it has also performed well after its brand reshaping and has become one of the highlights of the post-royalty era. According to @hildobby_ data, since the launch of OpenSea Pro, its aggregated volume and user base as a trading aggregator have roughly equaled Blur in recent times. Of course, the aggregated volume of OpenSea Pro mainly comes from Blur and OpenSea, and Blur may still have a slightly larger share in direct perception. However, even the non-duplicated volume of OpenSea + OpenSea Pro currently does not account for 50% of Blur's, and there is still a lot of room for OpenSea Pro to play. Source: https://dune.com/hildobby/nft-aggregators In the post-royalty war era, the entire market environment has become worse. As two outstanding players in the NFT marketplace, OpenSea and Blur have both encountered developmental bottlenecks. OpenSea's daily active users have almost returned to the level of July 2021, while Blur's Bid Pool has become a tool for market manipulation by whales and the delay in halving earnings has been criticized by the community. However, on the other hand, in order to survive the winter, there is also the possibility of mutual learning between the two. OpenSea has borrowed from Blur's professional trading interface to complete the brand upgrade of OpenSea Pro, and Blur has learned from OpenSea's supplement to the art market. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Fishing Traps in the Crypto Airdrop Tutorial

Wednesday, April 26, 2023

Author: Bitrace Airdrops are marketing events in which DeFi protocols distribute tokens for free to early active community members as a way to reward their early support and encourage continued use of

Cryptocurrency entrepreneurs are fleeing Singapore for Bangkok and Hong Kong because of high prices

Tuesday, April 25, 2023

Source:link Singapore is no longer the Promised Land of the middle class. Six months after arriving in Singapore, Wang Feng made a decision to leave Singapore. It took Wang just five seconds to make

Global Crypto Mining News (Apr 17 to Apr 23)

Monday, April 24, 2023

1. It's been only one year since Intel officially announced its Bitcoin-mining Blockscale ASICs, but today the company announced the end of life of its first-gen Blockscale 1000-series chips

Asia's weekly TOP10 crypto news (Apr 17 to Apr 23)

Sunday, April 23, 2023

Author:Lily Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong urged to innovate and make money by Xia Baolong link On April 16, Xia Baolong, the top leader in charge of Hong Kong in

Weekly project updates: Arbitrum passes AIP-1.1 and 1.2, Base mainnet in 2023, Sui mainnet on May 3, etc

Saturday, April 22, 2023

1. ETH's weekly summary a. Ethereum Conference EDCON 2023 to be held in Podgorica, Montenegro in May link Vitalik and other eight members of the EF confirmed to attend the Ethereum Conference EDCON

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏