Research on Survival of NFT Marketplaces (2) The dead end of trading mining

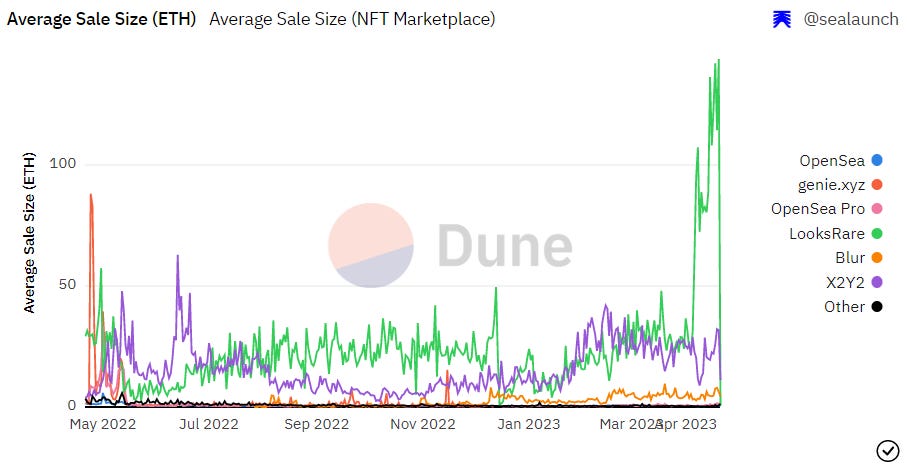

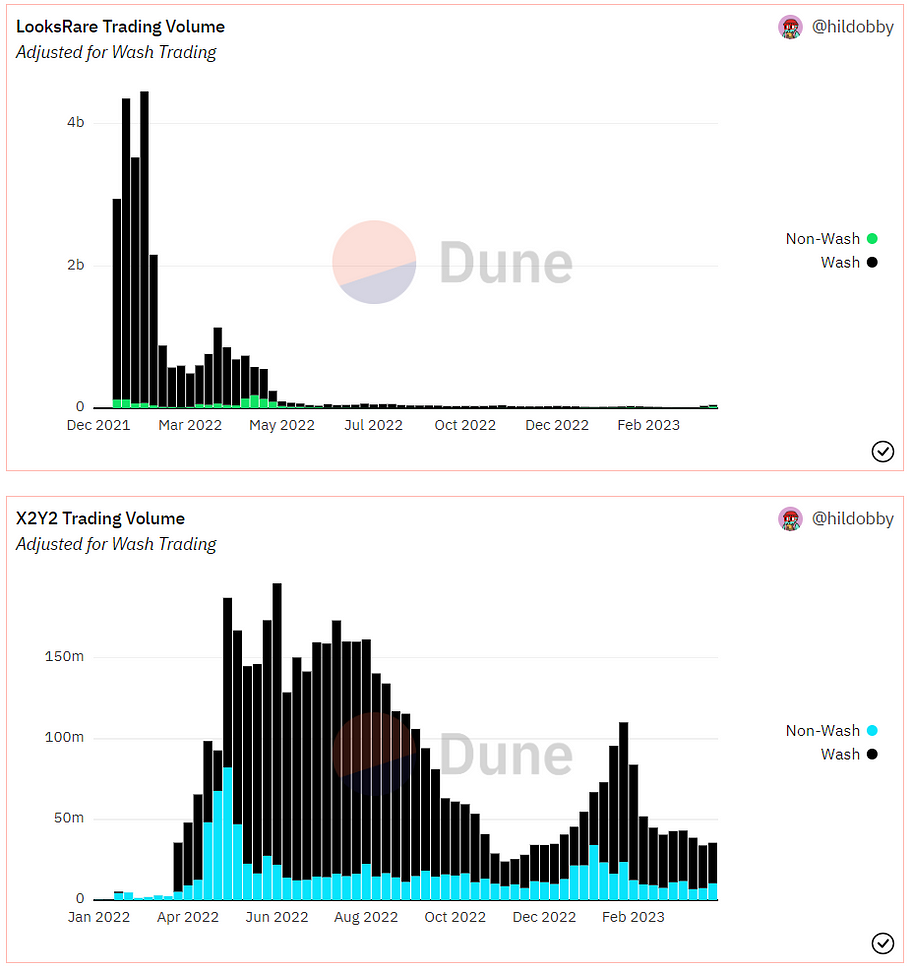

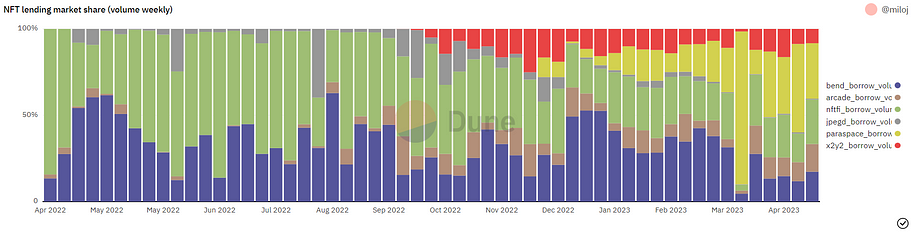

Author: @0xMavWisdom Disclosure: The author holds relevant assets such as NFT platform tokens as a personal investor and has no business dealings with any platform or project party. This is the second study on the survival status of NFT marketplaces, discussing the dilemma and breakthrough of trading mining platforms LooksRare and X2Y2, whether to lie flat or go ahead with determination. LooksRare and X2Y2 are representatives of the trading mining model and the earliest practitioners who continue to this day. The significant characteristic of the trading mining platform is the extremely high unit price of each transaction. n the bear market, this feature is still evident among a small number of users, but it supports a huge trading volume on the platform. According to data from @SeaLaunch_, during a period in April, the average transaction amount of LooksRare once exceeded 100 ETH, and even under normal circumstances, the average transaction amount of LooksRare and X2Y2 is between 20–30 ETH, which is almost 40–60 times that of OpenSea. (Source: https://dune.com/sealaunch/NFT?undefined=&Select+Timeframe_ef4aff=365+days) The core logic of trading mining is not complicated, that is, 100% of the platform fee paid for each transaction is captured by the Token staker. Generally speaking, the team/foundation or treasury will reserve some Tokens for sharing the captured platform fees through staking, thus serving as development funds to support the protocol. In theory, as the platform volume increases, more Tokens are staked by users, resulting in greater platform fees absorbed and more fees captured as rewards. Therefore, in the early stage of development from 0 to 1, trading mining is easy to form a positive drive, obtaining airdrops for trading, increasing trading volume leads to platform fee growth, platform fees are captured by stakers, and the APY of staking income increases, Token prices rise, the potential reward value of trading mining increases, attracting more users to engage in trading mining. However, with the downturn of the overall environment, the emergence of competitors, changes in market share, Token reduction and other multiple factors, this trading mining model is easily reversed and brings negative spirals to Tokens. Wash-trading in trading mining is not as complicated as in Blur. It is mostly done by whales who trade back and forth between their own controlled wallets. As long as the subsidized tokens can cover the platform fees paid in advance, it is profitable. Moreover, the subsidy is settled on a daily basis and there is almost no loyalty after receiving the tokens. The tokens are sold immediately to recover the cost, and then the profit is measured to decide whether to continue selling or reinvesting through staking. According to the data provided by @hildobby_, in the volume of last week (4.10–4.16), LooksRare accumulated a trading volume of $47,903,449, with wash-trading accounting for 45.6%; X2Y2 accumulated a trading volume of $36,039,982, with wash-trading accounting for 69.6%. This wash-trading-based trading mining activity brings continuous selling pressure to platform tokens in the low demand of the bear market, and LOOKS and X2Y2 have been performing poorly for a long time, especially X2Y2, which lacks market makers and is facing difficulties. (Source: https://dune.com/hildobby/nfts-wash-trading) The lack of long-term support for token prices has caused a lot of negative emotions and FUD in the community, especially in communities dominated by Chinese. However, even in the event of a decline, it is difficult to immediately abandon this trading mining model in the short term unless the project party reshapes the tokenomics, because the project party’s income almost entirely depends on the fees captured by the staked tokens. Therefore, if the utility of tokens is not reshaped in the tokenomics, blindly canceling trading mining will undoubtedly cut off one’s own source of income. But as more tokens are produced and flow into the market, it becomes increasingly difficult to modify the tokenomics. According to Token Unlock data, LOOKS has a circulation rate of 81.35% and is expected to be fully produced by March 1, 2024. X2Y2 has a circulation rate of 72.17% and is expected to be fully produced by April 3, 2024. With less than a year left until production is complete and less than a year of mining incentives remaining, and with the decreasing production rewards, the two major exchanges that focus on trading mining urgently need to find new survival opportunities and development directions to regain market share. In the face of internal and external troubles, the two may take different paths. X2Y2 is rethinking its market positioning, shifting from a single spot marketplace to a full financial ecosystem based on NFT. X2Y2 Loan is the first step and an important layout in NFTFI. Currently, X2Y2 Loan holds about 10%-15% of the market share in the NFT lending field. The second step is to expand allies and expand the ecological functional circle with X2Y2 as the core. Dew, a trading aggregator for NFT traders based on Polygon, is the first partner, and more partners representing a certain segment of the NFT race are expected to join in the future. NFT futures contract trading may also be introduced in the future. However, due to a lack of communication with community users, who may not understand the change in strategic thinking, leading to a significant amount of FUD in the community that the X2Y2 team urgently needs to reverse. (Source: https://dune.com/yaloong/x2y2-loan) LooksRare is different, more focused on the marketplace itself, and in its current situation it is relatively better than X2Y2, so it is relatively more laid-back. This is first due to LooksRare’s long-term good maintenance of the DeFi OG user group, as can be seen from BitMex CEO Arthur Hayes’ intentional or unintentional shout-outs in his blog posts. In addition, in my opinion, in the royalty war, LooksRare was relatively low-key, preserving its strength and not losing too much user goodwill. Here is a profound example: when Blur released an airdrop and officially declared war on OpenSea in a blog post, X2Y2 intervened inappropriately and became the object of ridicule. This was originally a positive confrontation between Blur and OpenSea, allowing users to choose between the two without directly colliding with other platforms. However, at this time, X2Y2 suddenly intervened and said, “You can choose both of them, or choose me.” Blur dared to challenge at this time because most of the core data was approaching or even surpassing OpenSea, and the core users were to some extent inseparable, so they had the strength to challenge. At that time, trading mining had already declined, and all data was far behind. Simply put, X2Y2 was not at the same level as Blur and OpenSea at that time. The unclear market positioning and blind intervention instead brought negative effects. LooksRare did better in “watching the show” and choosing not to participate in the final battle between Blur and OpenSea, which was undoubtedly correct. Later, LooksRare and Blur jointly announced that they would not display third-party platform marks (including OpenSea blacklist marks) by default in the UI, which also won the favor of many users. Today, LooksRare has also developed an APP similar to OpenSea and a trading aggregator similar to Blur, which is currently in beta testing. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

VC monthly report: the number and amount of financing increased slightly in April

Tuesday, May 2, 2023

Author: WuBlockchain According to RootData statistics, there were 101 publicly disclosed crypto VC investment projects in April, an 11% increase from the previous month (91 projects in March 2023) and

Global Crypto Mining News (Apr 24 to Apr 30)

Monday, May 1, 2023

1. The Bahamas is seeking to tighten its crypto laws in the wake of the collapse of FTX, according to a statement from the Securities Commission of the Bahamas Tuesday. The new bill will address

Asia's weekly TOP10 crypto news (Apr 24 to Apr 30)

Sunday, April 30, 2023

Author:Lily Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong SFC to issue crypto exchange license guidelines in May link Hong Kong's Securities and Futures Commission will release

Weekly project updates: StarkWare 2023 roadmap, Filecoin to launch FWS, Polygon Bridge, etc

Saturday, April 29, 2023

1. Solana's weekly summary a. Solana Labs announces open-source reference implementation for ChatGPT plugin link On April 26, Solana Labs announced an open-source reference implementation for the

WuBlockchain Weekly:Coinbase sues SEC、BinanceUS canceled Voyager purchase、Merlin DEX hack and Top10 News

Friday, April 28, 2023

Top10 News 1. Coinbase sues SEC to force response on cryptocurrency regulations petition link On April 24, Coinbase filed a narrow action in federal court to compel the SEC to respond yes or no to July

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏