DeFi Rate - This Week In DeFi – May 5

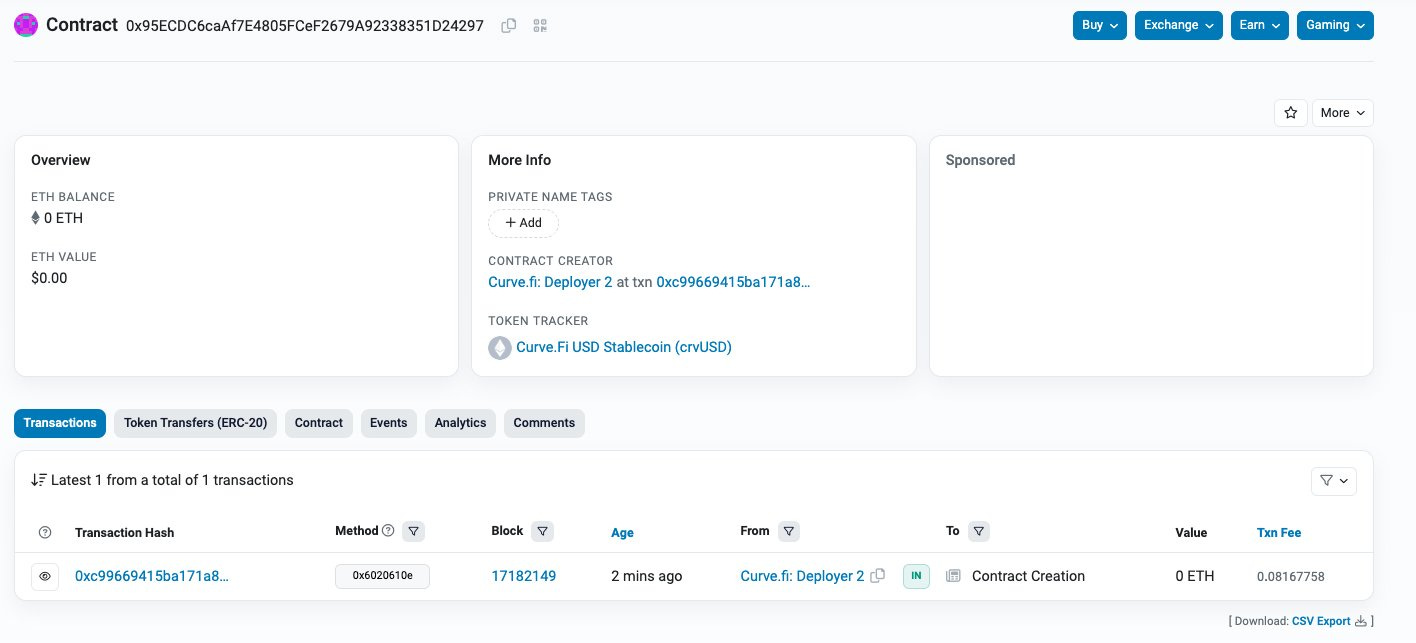

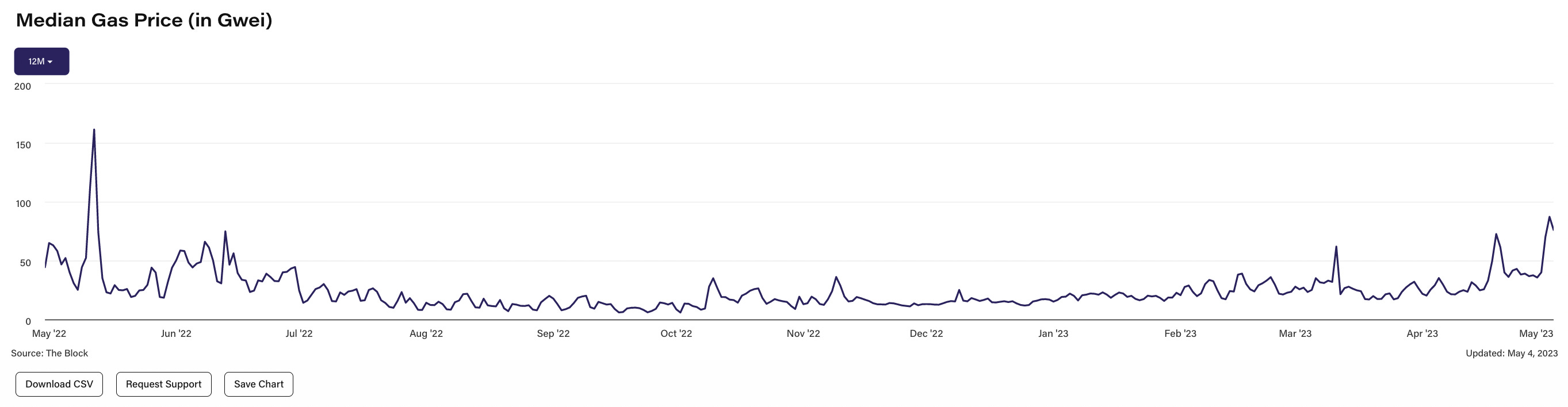

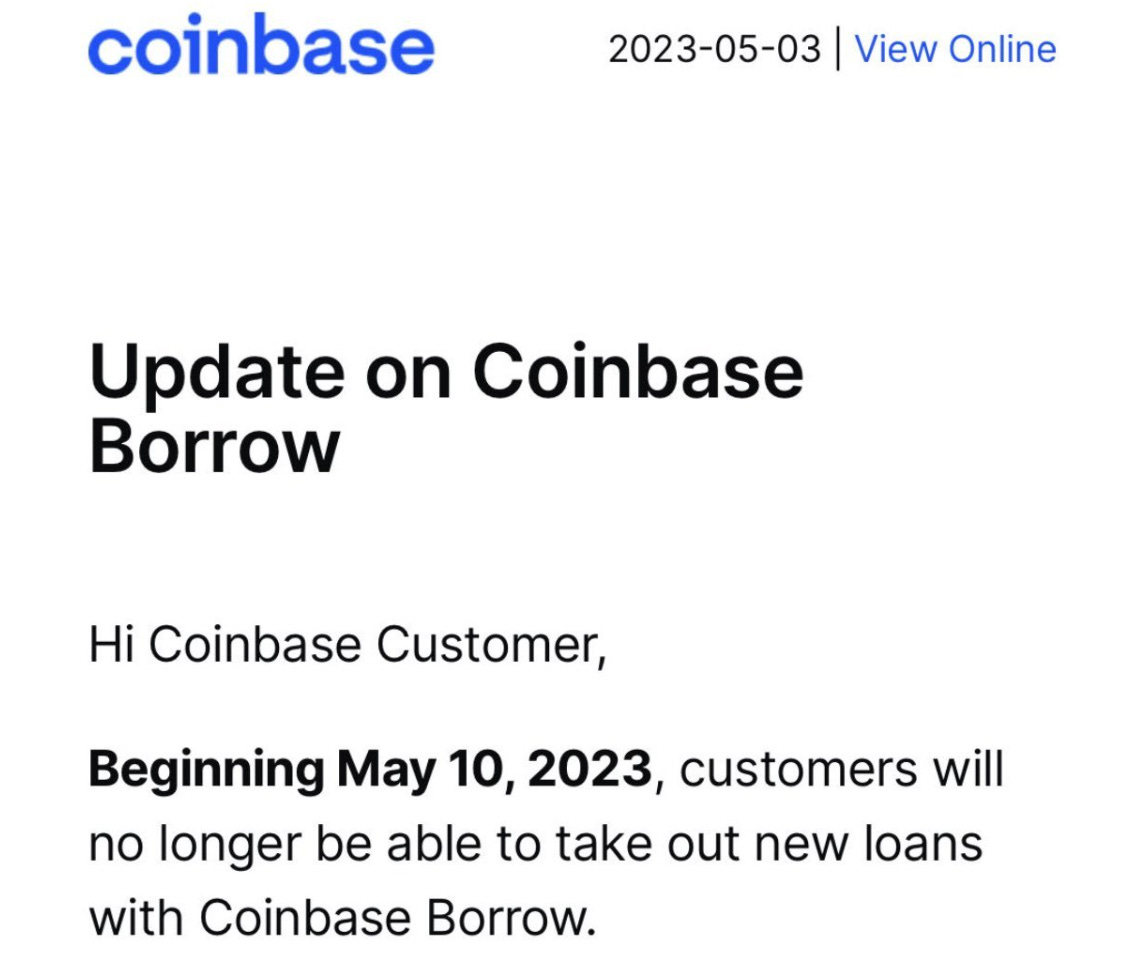

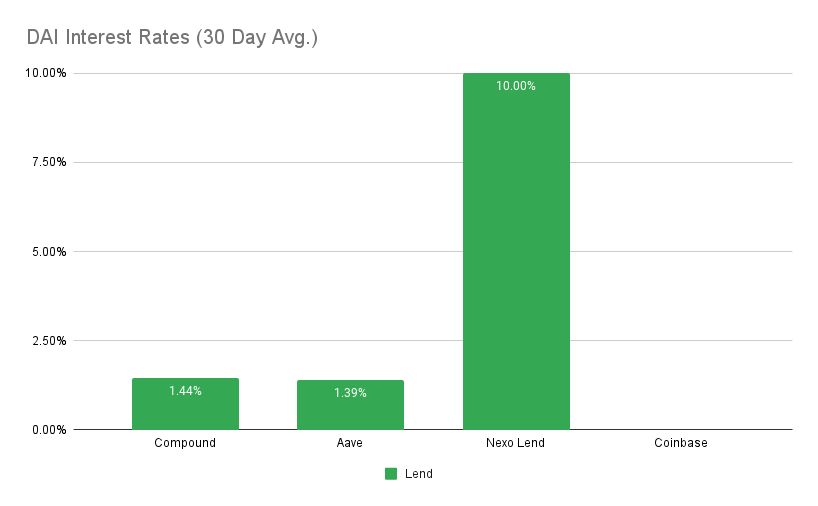

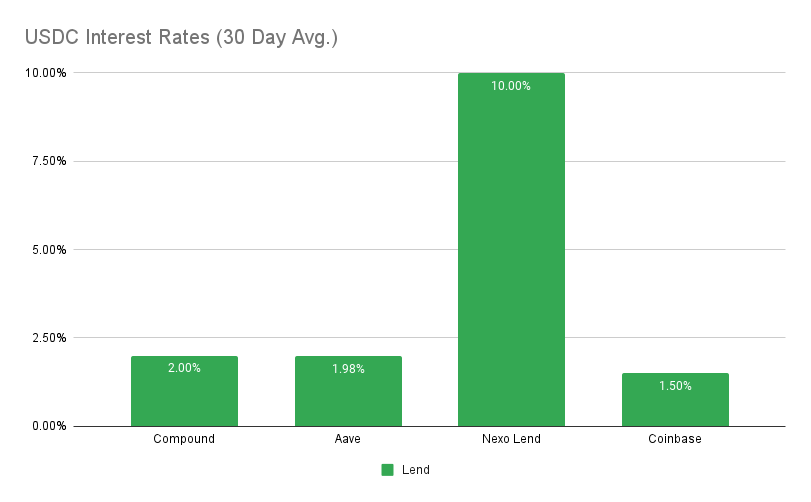

This Week In DeFi – May 5This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.To the DeFi community, This week, Curve Finance has deployed the smart contracts for its long-awaited stablecoin, crvUSD. The contracts were redeployed a pair of times – once due to a mistake in the deployment script concerning rewards, as well as a second time to implement an improvement to gas fees. The stablecoin is overcollateralized and backed by crypto assets, with its price pegged to $1. Curve will control the supply of crvUSD with a mint-and-burn mechanism similar to MakerDAO’s DAI or Aave’s forthcoming GHO. CrvUSD differentiates itself with its lending-liquidating algorithm called LLAMA that constantly rebalances users’ collateral as crypto prices fluctuate. The stablecoin will not be accessible to the public until it is integrated into Curve's user interface. https://twitter.com/chago0x/status/1653839145066700817 Sui, a Layer-1 blockchain developed by Mysten Labs, has launched its mainnet, with its native asset $SUI already trading on major exchanges including Binance, OKX, Bybit, and Kucoin. Sui aims to offer a highly-scalable blockchain capable of supporting decentralized applications with block finality of less than half a second, achieving a throughput rate of more than 300,000 transactions per second on testnet. The blockchain has a focus on user-friendliness for smart contract developers and emphasizes composability. The launch comes as the project raised $300 million in a September 2022 funding round, valuing the project at over $2 billion. https://twitter.com/SuiNetwork/status/1653731940107956225 The median average transaction fee on the Ethereum network has surged to its highest level since May 2022, largely due to increased on-chain activity surrounding memecoin trading. Ethereum's fees jumped to around 87 gwei on May 2, primarily due to the high demand for Pepe the Frog-themed token. The coin's market cap rose to over $500 million before falling back down below $400 million again, leaving it susceptible to sharp price swings. To avoid high transaction fees, users have been seeking alternatives, leading to a surge in daily new unique addresses of EVM-compatible blockchains such as BNB Chain, Polygon, and Avalanche. https://twitter.com/apolynya/status/1654020493152862209 Coinbase is discontinuing its Borrow program from May 10, 2023. The program allowed users to borrow cash using bitcoin as collateral. The move is said to be due to a lack of demand for the product. Coinbase first unveiled the Borrow program in August 2020 and launched it in November 2021. It allowed users to avoid selling their bitcoin when they needed cash urgently, which could incur a taxable gain or loss. The termination of the program comes amid a regulatory dispute between Coinbase and the Securities and Exchange Commission. Coinbase had to shelve its Lend program in September 2021 after an SEC warning. https://twitter.com/ChainDustry/status/1654143820244680707 Memecoins have truly taken over the Ethereum blockchain over the past week, spiking gas prices to highs not seen since an entire year ago – and sending $PEPE to a $1.5 billion market cap in the process. The network congestion is, however, once again re-igniting the need for scaling solutions or lower-cost chains. Coincidentally Sui is one solution attempting to fill this gap, launching its mainnet this week. At a $13 billion fully-diluted valuation, the platform may need to rely more on platform innovation and organically attracting customers, rather than price speculation. Following the trend, CeFi providers continue to work out their issues. Digital Currency Group (DCG), Genesis, and Gemini have initiated a 30-day mediation process, where DCG is expected to arrange the payment of $630M to the Genesis bankruptcy estate. Gemini has warned that DCG may be forced to default on the payment. To add insult to injury, Coinbase has shut down its “Borrow” feature, enabling users to borrow fiat against their crypto – not long after having to close their staking program. CeFi may well and truly be over for now, leaving users somewhat restricted solely to DeFi or the traditional financial system. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.0% APY Top StoriesUS Federal Reserve increases interest rates by 25 basis pointsGemini Warns Barry Silbert's Digital Currency Group of $630M Default RiskCentral Bank Digital Currencies Are Unexpectedly Becoming a Presidential Election IssueLiquid Staking Platform Lido Surpasses 6M Ether Deposits as Shanghai Upgrade Spurs InflowsStat BoxTotal Value Locked: $48.62B (down 2.1% since last week) DeFi Market Cap: $48.81B (down 3.3%) DEX Weekly Volume: $7.70B (down 7.6%) Bonus Reads[Tim Copeland – The Block] – ConsenSys Layer 2 network Linea adds loyalty NFT campaign to drive adoption [Adam James – The Block] – Binance USD stablecoin activity slides to two-year low [Samuel Haig – The Defiant] – New Bitcoin Token Overtakes WBTC on Avalanche [Elizabeth Napolitano – CoinDesk] – Decentralized Exchange SushiSwap Rolls Out V3 Liquidity Pool on 13 Chains This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – April 28

Friday, April 28, 2023

This week, Binance launches a liquid staking token, Ethereum DEX unique users near 2-year highs, users seek an airdrop for LayerZero and Solana wallet Phantom expands to Ethereum & Polygon.

This Week In DeFi – April 21

Friday, April 21, 2023

This week, net ETH staking briefly turns positive, PancakeSwap looks to go deflationary, Agility quintuples its TVL, and a16z launches an OP client.

This Week In DeFi – April 14

Wednesday, April 19, 2023

This week, Shapella goes live on Ethereum, Uniswap's iOS app is approved by Apple, Maple Finance opens a pool for US Treasuries, and SushiSwap suffers a $3.4M exploit.

This Week In DeFi – April 7

Friday, April 7, 2023

This week, LayerZero achieves a $3B valuation, PancakeSwap launches V3 on Ethereum and BNB Chain, S&P Global is hiring for DeFi and Unbound will issue a stablecoin against Uniswap LP tokens.

This Week In DeFi – March 31

Friday, March 31, 2023

This week, Polygon Labs and Consensys each launch zkEVM scaling networks, the Euler Finance hacker returns $100M+, and dYdX is moving to Cosmos.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏