DeFi Rate - This Week In DeFi – April 7

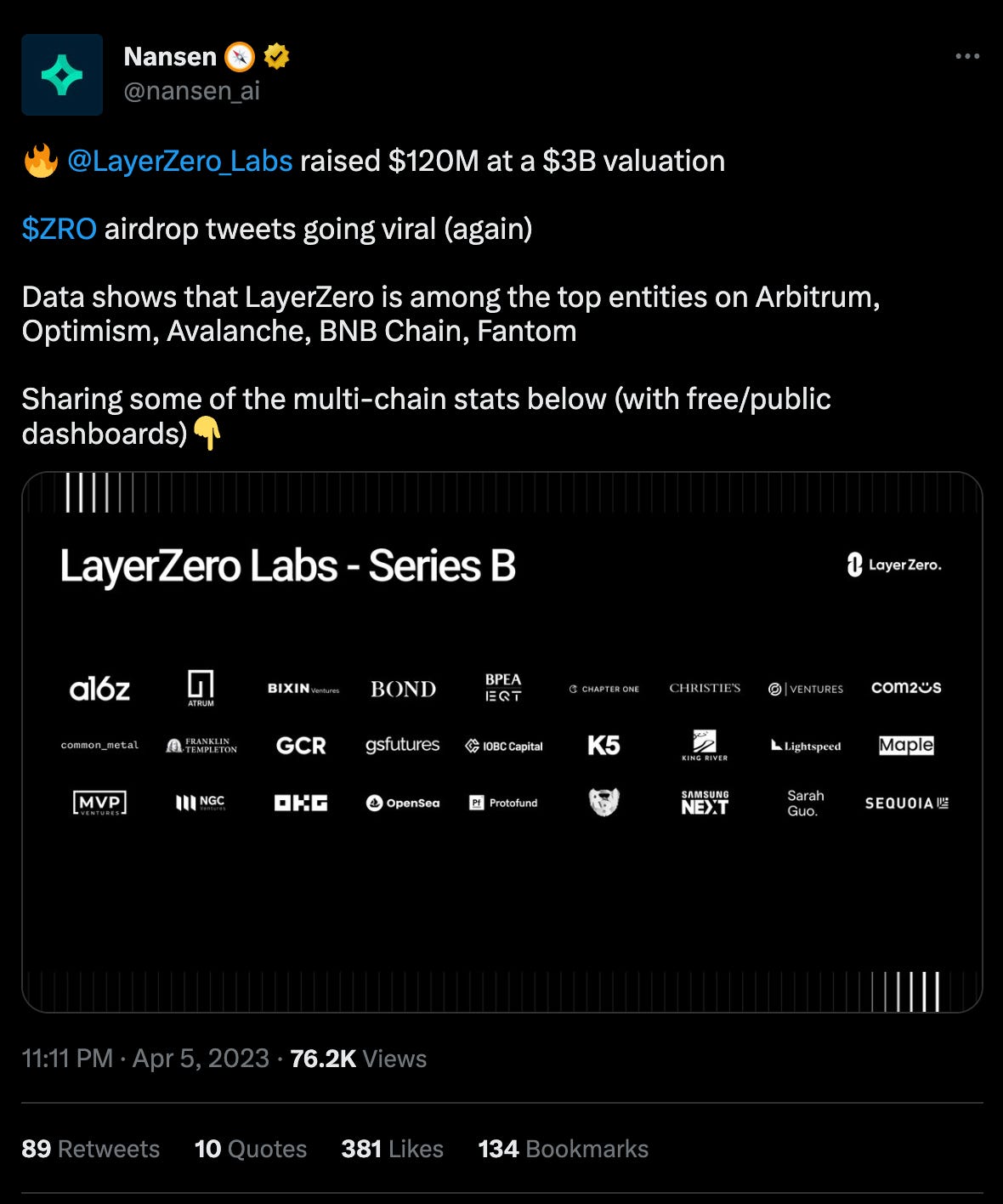

This Week In DeFi – April 7This week, LayerZero achieves a $3B valuation, PancakeSwap launches V3 on Ethereum and BNB Chain, S&P Global is hiring for DeFi and Unbound will issue a stablecoin against Uniswap LP tokens.To the DeFi community, This week, Blockchain interoperability protocol LayerZero raised $120 million in Series B funding, reaching a very significant total valuation of $3 billion. Investors in the round included a16z Crypto, Sequoia Capital, Circle Ventures, Samsung Next, OpenSea and Christie's. LayerZero plans to expand into the Asia-Pacific region and the gaming sector. The protocol's total value locked has crossed $7 billion, and transactional volume has hit more than $6 billion. LayerZero also supports NFT transfers through its Omnichain Non-Fungible Tokens (ONFT) standard. The Series B round brings LayerZero Labs' total funding to $263 million to date. https://twitter.com/nansen_ai/status/1643858899320311808 BNB Chain-based DEX PancakeSwap has introduced version 3 of its platform and expanded to the Ethereum network. The platform is based on Uniswap’s recently open-sourced v3 code, and is compatible with all tools built for the version 3 of Uniswap. PancakeSwap V3 is PancakeSwap had over $2.5 billion in total value locked as of Monday. PancakeSwap V3 offers the cheapest fees for on-chain trades among counterparts such as SushiSwap and Uniswap, and increased returns for liquidity providers. The exchange also plans to introduce a V3 "VIP" trading rewards program and a position manager feature in the future. https://twitter.com/DefiIgnas/status/1642940267442630657 S&P Global is seeking a director of DeFi to help develop and implement its strategies in decentralized markets. The successful candidate will report to the firm's chief DeFi officer, Chuck Mounts. S&P Global's hiring for the space highlights mainstream interest in cryptocurrencies and blockchain technology, with other traditional firms like Nasdaq and Boerse Stuttgart also exploring the space. The role requires a deep understanding of crypto finance and DeFi, and the salary range is between $107,100 to $212,975 depending on experience and qualifications. https://twitter.com/napgener/status/1642937706551427081

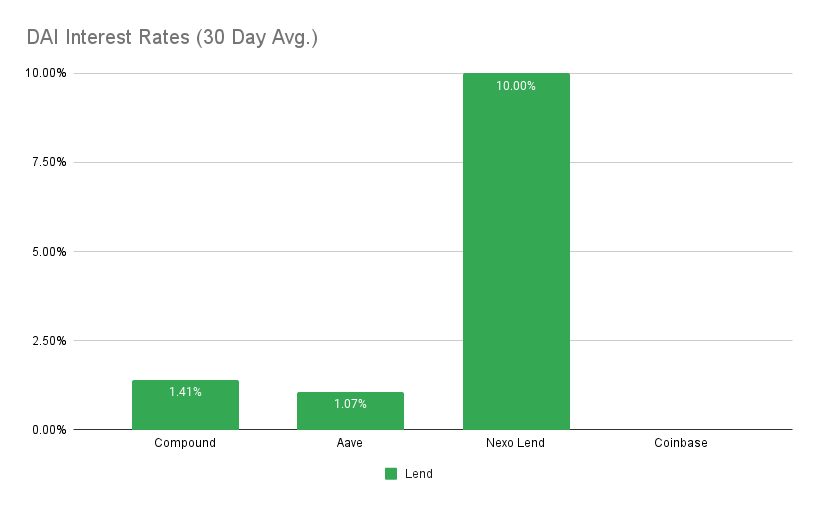

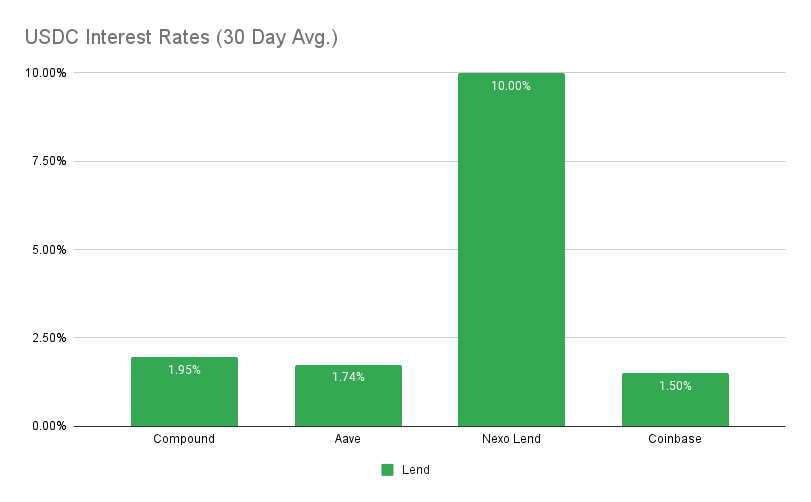

Unbound Finance will launch its Version 2 on Arbitrum One on April 11, allowing liquidity providers to use their LP tokens as collateral for loans on Uniswap and access higher returns. Unbound V2 is among the first protocols to offer collateralization of Uniswap V3 positions, making it easier for LPs to earn more from their capital. Unbound will allow Uniswap V3 LPs to borrow its stablecoin, UND, interest-free, secured against their concentrated liquidity positions. The new version of the platform also expands collateral support to LP tokens of volatile asset pools, such as WETH-DAI, and introduces price stability mechanisms to ensure UND's value remains stable. https://twitter.com/unboundfinance/status/1643141292904382466 DeFi development and platform launches continue to soar, as the sector appears to be thriving in terms of technical progress. zkEVM platforms are attracting value to their ecosystems, platforms are releasing new-and-improved versions of their protocols, and innovation is peaking. Uniswap’s V3 Business Source License (BSL) expired this month, leaving other protocols free to copy and improve upon the code of the popular decentralized exchange – most notably, PancakeSwap, which has decided to compete with Uniswap itself on Ethereum. Several other smaller projects are also forking the code and adding their own twists. Uniswap has beaten Coinbase in monthly trading volume for the second month in a row, highlighting a shift in interest and activity from centralized platforms to decentralized ones – a trend that could likely continue. DeFi has made it onto the US Treasury’s radar, as it releases a report noting money laundering in the sector – flagging it for a potential tightening of regulation. The biggest event to look out for next week is Ethereum’s Shapella upgrade on April 12, which will see more than 1 million staked ETH be enabled for withdrawals. A sell-off event, or a non-event? Let’s see… Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.0% APY Top StoriesStablecoin Tether's Market Capitalization Nears Record High of $83BU.S. Treasury Warns DeFi Is Used by North Korea, Scammers to Launder Dirty MoneyUniswap volume beats Coinbase and registers its best month since 2022Bitstamp launches new lending product across crypto-friendly marketsStat BoxTotal Value Locked: $50.65B (up 3.0% since last week) DeFi Market Cap: $51.7B (up 4.4%) DEX Weekly Volume: $7.68B (down 20%) Bonus Reads[Ryan Weeks – The Block] – Arbitrum to break up $1 billion proposal after backlash [Vishal Chawla – The Block] – Euler hacker returns $31 million, marking end to ‘recoverable funds’ in DeFi exploit [Sage D. Young – CoinDesk] – Lido Stakers Can Expect Ether Withdrawals 'No Sooner Than Early May' [Brayden Lindrea – Cointelegraph] – Coinbase supports new court action to remove Tornado Cash ban This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – March 31

Friday, March 31, 2023

This week, Polygon Labs and Consensys each launch zkEVM scaling networks, the Euler Finance hacker returns $100M+, and dYdX is moving to Cosmos.

This Week In DeFi – March 24

Friday, March 24, 2023

This week, Arbitrum's $ARB goes live, Celsius custody will return 72.5% of assets, Coinbase gets a warning from the SEC and DRPC launches decentralized RPCs for Ethereum.

This Week In DeFi – March 17

Friday, March 17, 2023

This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.

This Week In DeFi – March 3

Friday, March 10, 2023

Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.

This Week In DeFi – March 3

Friday, March 3, 2023

This week, Marker looks to add MKR as collateral for DAI, Robinhood launches a non-custodial wallet, Ethereum devs release EntryPoint for account abstraction, and Redeem sends NFTs to phone numbers

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏