DeFi Rate - This Week In DeFi – April 14

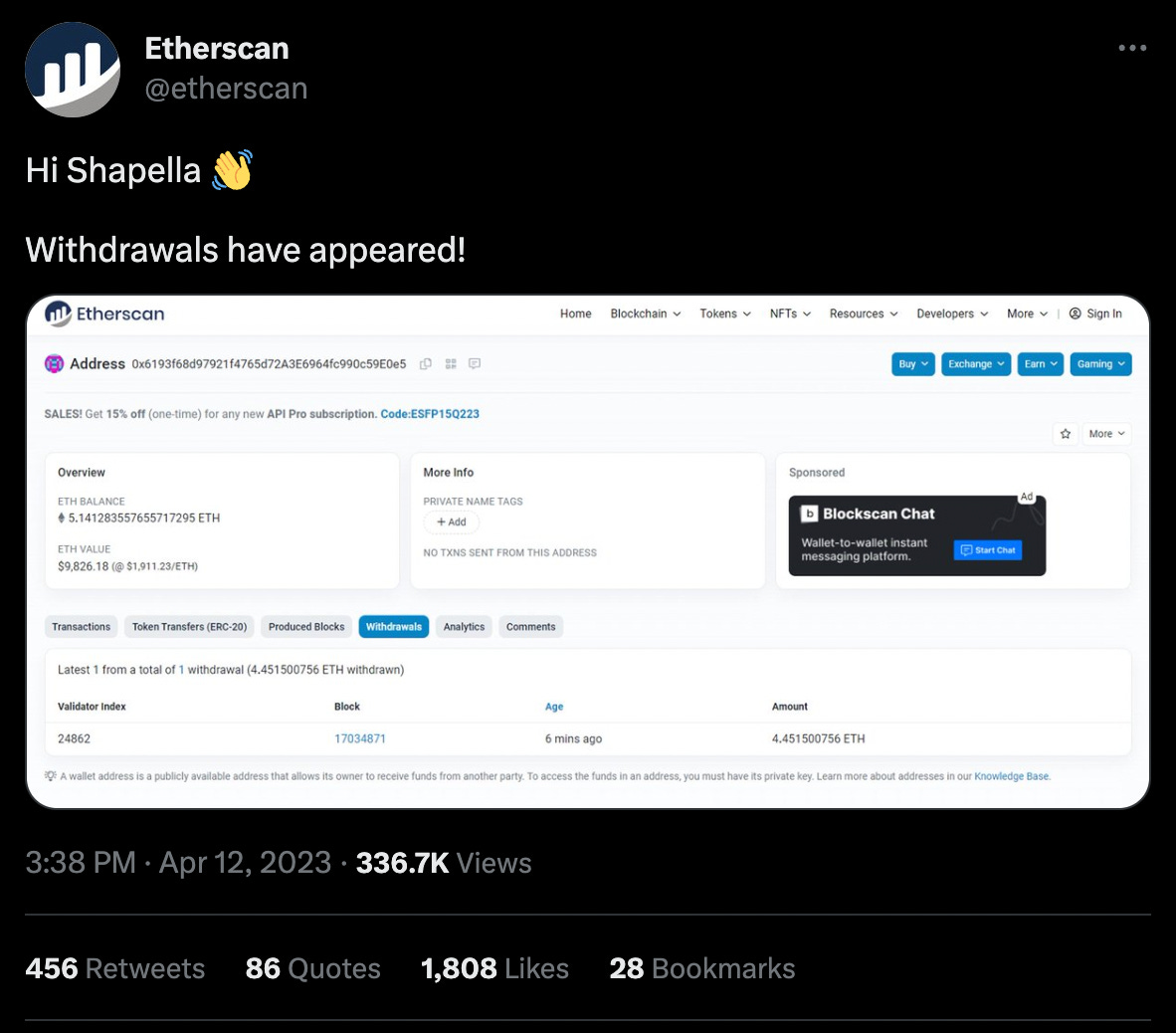

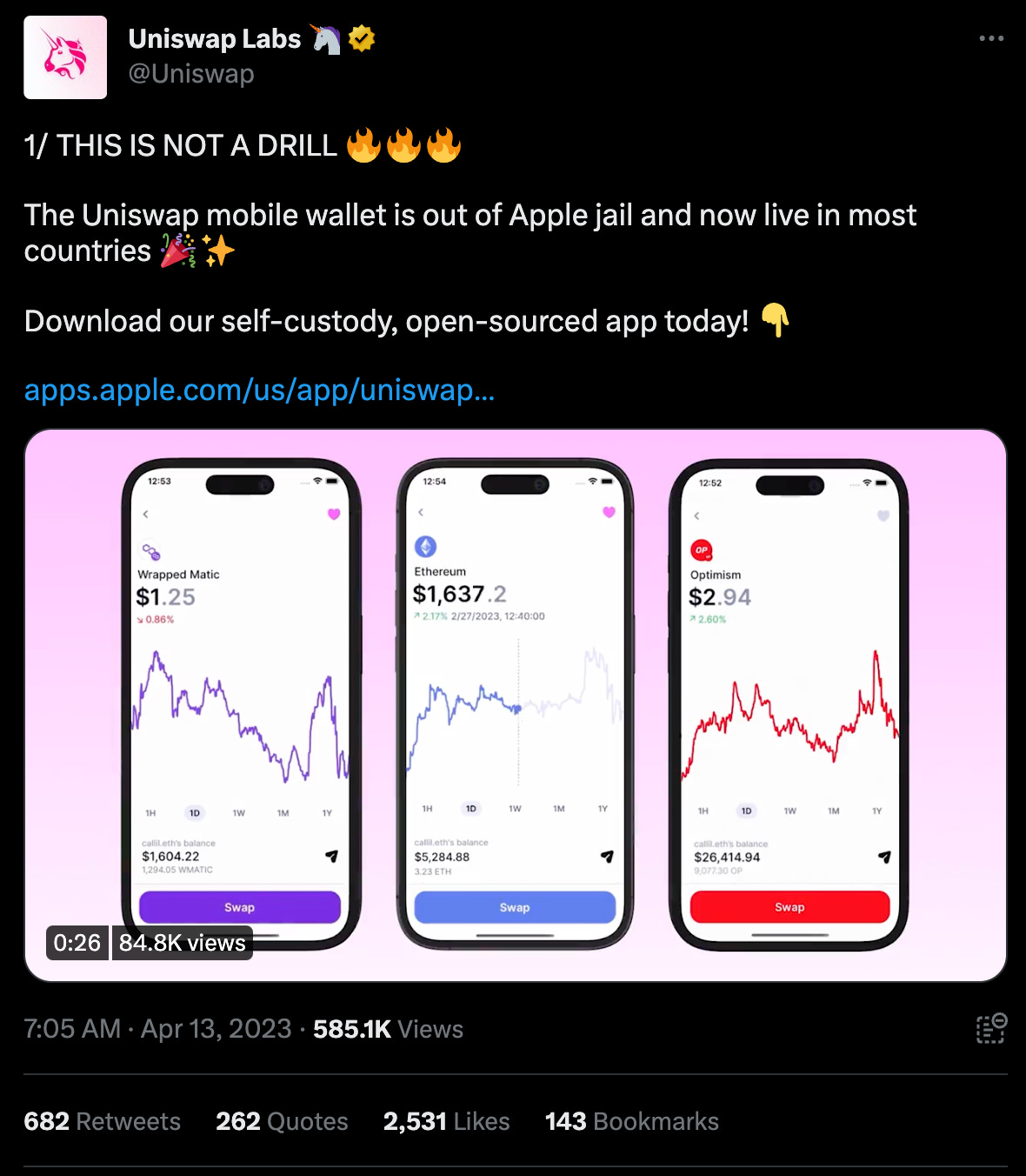

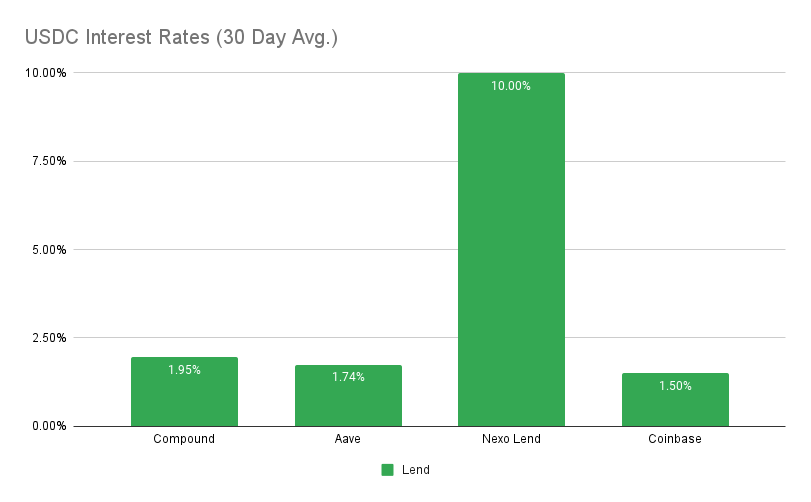

This Week In DeFi – April 14This week, Shapella goes live on Ethereum, Uniswap's iOS app is approved by Apple, Maple Finance opens a pool for US Treasuries, and SushiSwap suffers a $3.4M exploit.To the DeFi community, This week, Ethereum’s long-anticipated Shapella upgrade has gone live, enabling users to withdraw staked Ether. Despite many expecting increased selling pressure from the unstaking of coins, the price of Ether still managed to hit new highs for the year above $2,000. Over $1.71 billion in Ether is now waiting to be withdrawn following the upgrade, with more than 860,750 coins pending withdrawal. On-chain estimates also suggest that over 1.1 million Ether (worth $2 billion) in accrued validator rewards may be claimed following Shapella. Currently, 17.52 million ether is staked, accounting for 15.6% of the total Ether supply. https://twitter.com/etherscan/status/1646281789735047168 Uniswap has launched its iOS wallet on the Apple App Store after a delay, with features including digital asset trades, wallet activity tracking, and NFT data. Apple was slow in approving the app due to its updated app rules around digital assets, which state that apps can facilitate exchange transactions provided they have appropriate licensing and permissions in countries where cryptocurrency exchanges are allowed. Apple's policies on crypto have been criticized, with some saying they are holding back the adoption of blockchain-centric gaming. https://twitter.com/Uniswap/status/1646514969746501633 Maple Finance, a blockchain-based crypto lending protocol, is launching a lending pool that invests in US Treasury bonds. The protocol's native token, MPL, rallied 23% ahead of a community call in which CEO Sidney Powell announced the plans. The move comes as the platform recovers from a difficult year for crypto lending that saw insolvencies and losses for liquidity providers. Maple is also planning a community vote on new tokenomics and utility for MPL later this year. The new pool will allow accredited investors and corporate treasuries outside the US to invest stablecoin holdings in Treasury bonds and earn yields. https://twitter.com/CoinDesk/status/1645823083805016068 Decentralized exchange SushiSwap plans to return funds to users who lost over $3.4 million in a weekend exploit due to a faulty smart contract. White-hat hackers have secured $51,000 worth of user assets, which will soon be claimable, and a claims process is being developed to make affected users whole. The protocol has recovered 300 ETH and is in talks with Lido about recovering an additional 700 ETH. The incident highlights the importance of maintaining stringent security practices when transacting on-chain, as even trusted protocols can suffer exploits or ship faulty code. https://twitter.com/SushiSwap/status/1646032261257781248 Ethereum staking withdrawals are finally enabled as the Shapella upgrade is implemented nice and smoothly – with no errors reported so far. The price of Ether has held up spectacularly, especially considering the amount of concern over the increase in newly-available ETH supply following the hard fork. Although much more ETH is due to become unlocked over the next week or so from staking services and platforms, it appears that the willingness of stakers to sell their coins may have been much overstated. Governments and regulations continue to act as a chokepoint on the DeFi industry as France becomes the latest country to look at antiquated rules for the sector. The country’s central bank is looking at forcing DeFi projects to incorporate or prove they “meet governance and security" norms” in order to operate, just a week before EU lawmakers vote on the looming Markets in Crypto-Assets Regulation (MiCA) regulation. The US SEC is also looking to clarify its powers and stance over DeFi exchanges, a move that could signal actions coming to such platforms in the near future. Lastly, Decentralized derivatives exchange dYdX has also suffered a loss of its Canadian customers, as it shuts down access to its protocol for the country. Thankfully, other progress continues in the sector, including a breakthrough for Uniswap’s iOS app, a $30 million raise for a new Layer-1 chain by Sei Labs, a $100 million Web3 fund by BitGet exchange, and zkSync reaching $200 million in total value locked (TVL). Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 1.9% APY Top StoriesSEC poised to increase its scrutiny of decentralized finance exchangesDeFi Could Be Forced to Incorporate and Certify, French Central Bank SaysCrypto Exchange Bitget Starts $100M Asia-Focused Web3 FundzkSync Era Crosses $200M In TVL While Polygon zkEVM TrailsStat BoxTotal Value Locked: $52.51B (up 3.7% since last week) DeFi Market Cap: $53.28B (up 3.1%) DEX Weekly Volume: $6.17B (down 20%) Bonus Reads[Brandy Betz – CoinDesk] – Sei Labs Raises $30M for Trading-Focused Layer 1 Blockchain [Nivesh Rustgi – Decrypt] – Ren Transfers Assets to FTX Debtors' Cold Wallets [Nivesh Rustgi – Decrypt] – Older Version of DeFi Yield Aggregator Yearn Finance Exploited for $11.6M [Michael McSweeney – The Block] – dYdX to end support for Canadian users, cites regulatory environment This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – April 7

Friday, April 7, 2023

This week, LayerZero achieves a $3B valuation, PancakeSwap launches V3 on Ethereum and BNB Chain, S&P Global is hiring for DeFi and Unbound will issue a stablecoin against Uniswap LP tokens.

This Week In DeFi – March 31

Friday, March 31, 2023

This week, Polygon Labs and Consensys each launch zkEVM scaling networks, the Euler Finance hacker returns $100M+, and dYdX is moving to Cosmos.

This Week In DeFi – March 24

Friday, March 24, 2023

This week, Arbitrum's $ARB goes live, Celsius custody will return 72.5% of assets, Coinbase gets a warning from the SEC and DRPC launches decentralized RPCs for Ethereum.

This Week In DeFi – March 17

Friday, March 17, 2023

This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.

This Week In DeFi – March 3

Friday, March 10, 2023

Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏