DeFi Rate - This Week In DeFi – March 31

This Week In DeFi – March 31This week, Polygon Labs and Consensys each launch zkEVM scaling networks, the Euler Finance hacker returns $100M+, and dYdX is moving to Cosmos.To the DeFi community, This week, Polygon Labs released its zero-knowledge-based rollup network, called Polygon zkEVM, providing a new scalability solution for Ethereum apps. The network has attracted over 50 projects from crypto, web3, and gaming spaces, including Uniswap and Aave, and is natively compatible with Ethereum apps. The mainnet is permissionless, and anyone can bridge assets and use them in zkEVM-native apps. The launch of Polygon's zkEVM follows over a year of development and two independent audits to ensure its security.  Today, Polygon Labs is announcing that Polygon zkEVM is fully open-source. Every single component is licensed with AGPL v3, including the zkProver, which is where all of the ZK magic happens 🪄

More: go.polygon.technology/zkevm-open-sou… Also joining the race is ConsenSys, which has launched a public testnet of its its own zkEVM scaling network called "Linea." ConsenSys has already processed over 350,000 transactions on its private testnet. Linea will natively integrate ConsenSys' MetaMask wallet and Truffle developer toolkit. The platform is the third zkEVM platform to come to market, following Matter Labs’ zkSync Era and Polygon Labs’ zkEVM above.  🔊 Thrilled to announce that ConsenSys zkEVM is now Linea✨: an innovative Layer 2 solution for Ethereum!

@LineaBuild empowers developers to build scalable dapps without constraints, pushing the boundaries of what's possible in web3 🚀

Linea @LineaBuild The Euler Finance hacker has returned 58,737 ETH in two instalments, bringing the total returned to 61,737 ETH out of the 96,000 ETH stolen. The hacker’s return of the funds was accompanied by a message apologising for his actions and taking note of the impact the hack had on the community. The protocol’s token price has increased by 43% on the news.  The Euler Hacker who stole 200M dollars just two weeks ago has now sent an apology to @eulerfinance via blockchain message… Decentralized exchange DYDX is transitioning to its own blockchain in the Cosmos ecosystem, from its current Ethereum Layer-2 network, StarkEx. The exchange is launching a private testnet of its Cosmos-based blockchain, which will be open to whitelisted third-parties acting as validators on the network. During the private testnet, DYDX will focus on creating validators, performing network upgrades, and testing out some of the exchange's main trading features. The exchange plans to roll out its public testnet in July, before a full launch in September. DYDX is also building an iOS app, an Android app, and a website.  MEV has been a significant issue for DEXs - we’re facing this head on with dYdX v4 ⚔️. We are researching and building novel mitigations for MEV into dYdX v4, uniquely enabled by app-chain technology.

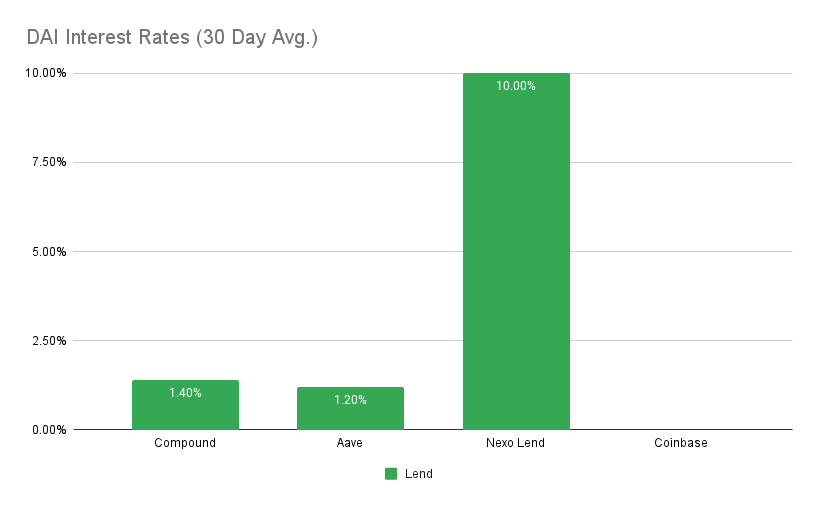

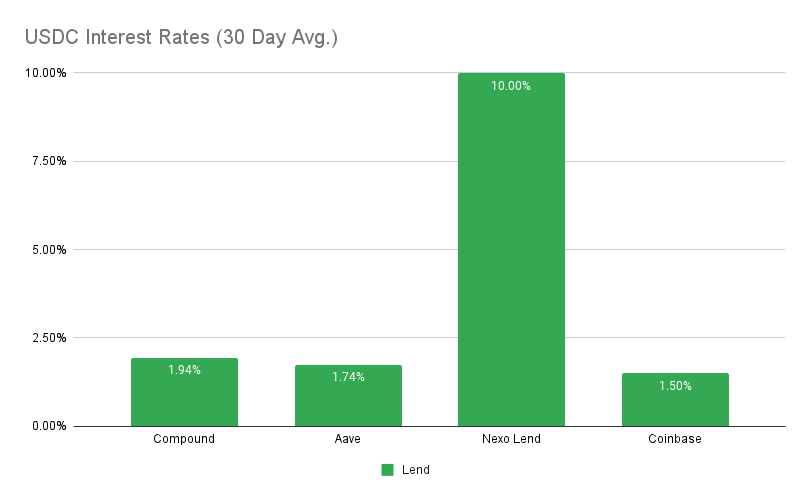

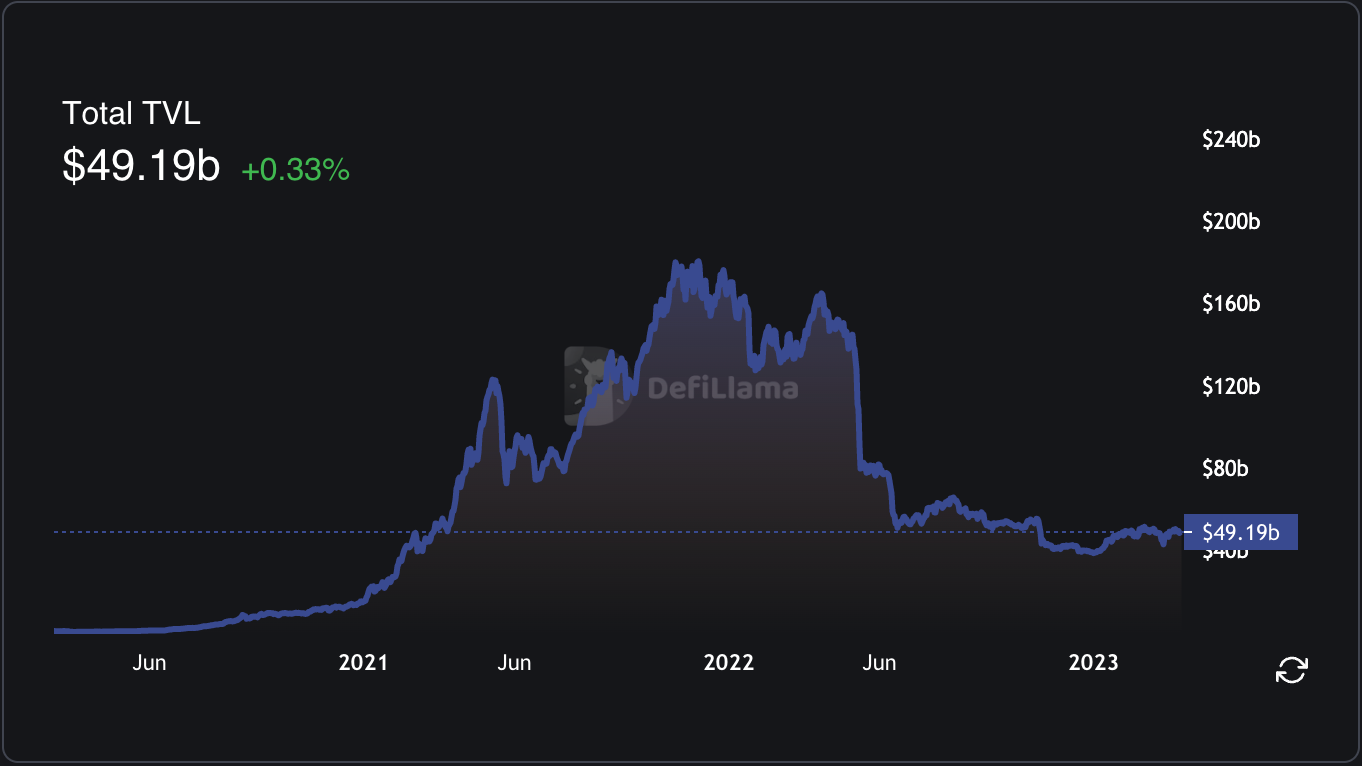

🧵 below and read more at: dydx.exchange/blog/dydx-v4-a… The zkEVM race is on, as three different zero-knowledge rollup platforms are presented to the Ethereum community: zkSync Era, Polygon zkEVM and Linea. These platforms are the next exciting development in scaling, with some key differences over regular rollup platforms, including instant withdrawals to mainnet (as opposed to a forced delay, as on Optimism or Arbitrum) and a reliance on trustless mechanisms rather than the honesty of incentivised actors. Will we have a “zkEVM season”? Also of high interest is the CFTC’s action against Binance, including its derivatives platform – a move that has resulted in a significant exodus from the industry’s leading exchange. This may lead to increased traction on decentralized derivatives alternatives such as DYDX, GMX and others, as traders look for new derivatives providers that are safer from regulatory action. The US regulator crackdown on crypto doesn’t appear to be ending any time soon, as Biden proposes boosting the SEC with $2.4 billion in additional funding – paired with an anti-crypto Gensler at the helm. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Compound at 1.4% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 1.9% APY Top StoriesBinance, CEO Zhao Sued by CFTC Over 'Willful Evasion' of U.S. Laws, Unregistered Crypto Derivatives ProductsUNICEF hatches plan for a prototype DAO, following its crypto fundSEC Chair Gensler welcomes Biden's $2.4 billion in funding, will use funds to fight 'misconduct' in cryptoEU Lawmakers Vote in Favor of Payment Limits on Anonymous Crypto WalletsStat BoxTotal Value Locked: $49.2B (down 2.4% since last week) DeFi Market Cap: $49.5B (down 2.5%) DEX Weekly Volume: $9.55B (down 36%) Bonus Reads[Samuel Haig – The Defiant] – Staked ETH Withdrawals To Activate On April 12 [Brayden Lindrea – Cointelegraph] – Coinbase wants devs to build inflation-pegged ‘flatcoins’ on its new ‘Base’ network [Brandy Betz – CoinDesk] – Staking Protocol EigenLayer Raises $50M Amid Crypto Winter [Jeremy Nation – The Block] – MakerDAO 'Endgame Plan' ratified in new 'Constitution' This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – March 24

Friday, March 24, 2023

This week, Arbitrum's $ARB goes live, Celsius custody will return 72.5% of assets, Coinbase gets a warning from the SEC and DRPC launches decentralized RPCs for Ethereum.

This Week In DeFi – March 17

Friday, March 17, 2023

This week, USDC loses and regains its dollar peg, Arbitrum finally announces a token and airdrop, Ethereum sets a target date for withdrawals and Euler Finance is hacked for $200M.

This Week In DeFi – March 3

Friday, March 10, 2023

Coinbase unveils "Wallet-as-a-Service," MolochDAO builds a regulation-friendly mixer, Violet launches a "compliant" DEX and ENS announces sub-domains.

This Week In DeFi – March 3

Friday, March 3, 2023

This week, Marker looks to add MKR as collateral for DAI, Robinhood launches a non-custodial wallet, Ethereum devs release EntryPoint for account abstraction, and Redeem sends NFTs to phone numbers

This Week In DeFi – February 24

Friday, February 24, 2023

This week, Coinbase launches its own L2 network and lists Euro Coin, Mastercard enables USDC purchases via Immersve and BUSD meets the end of the road across multiple platforms.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏