DeFi Rate - This Week In DeFi – May 12

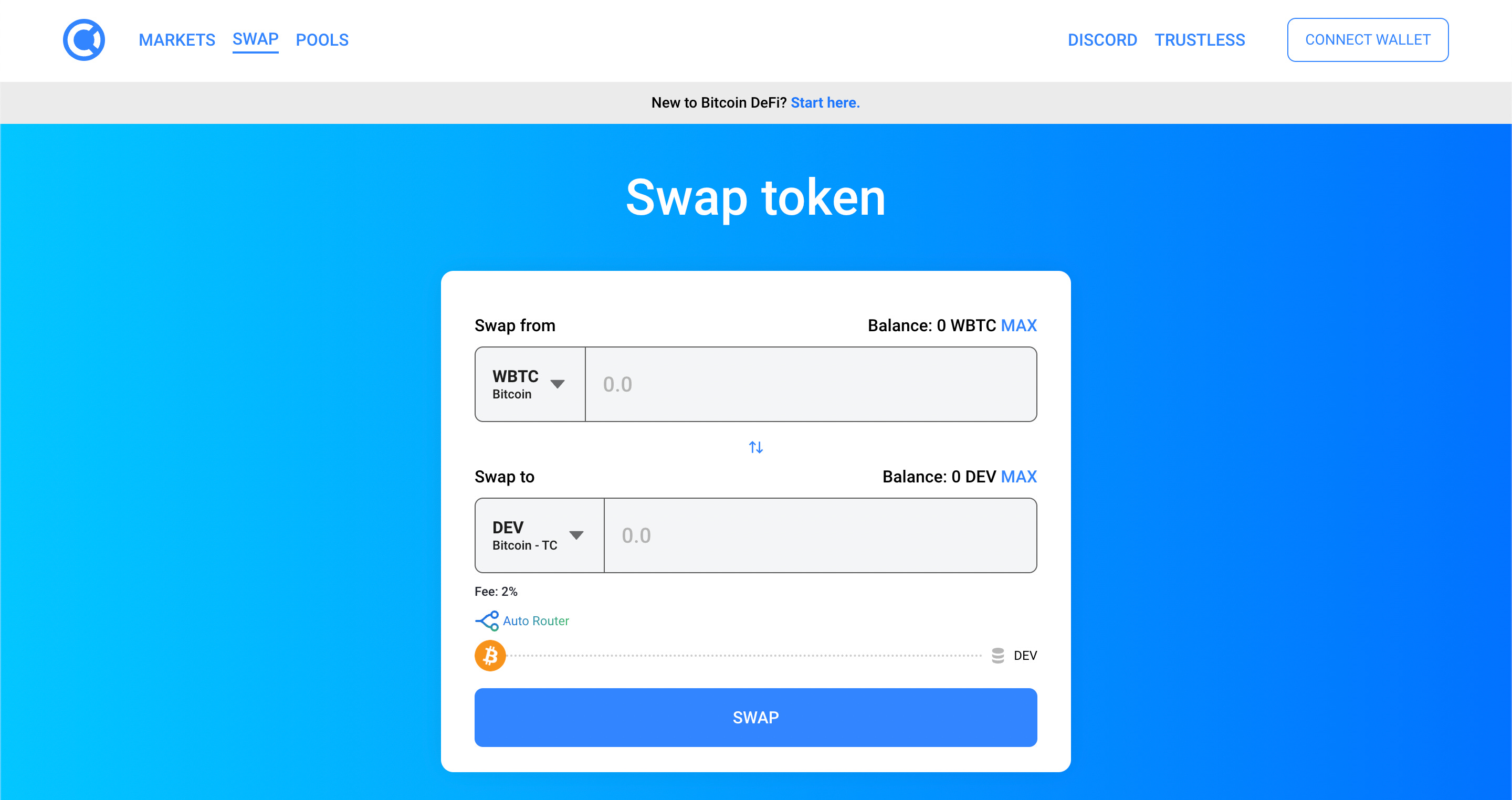

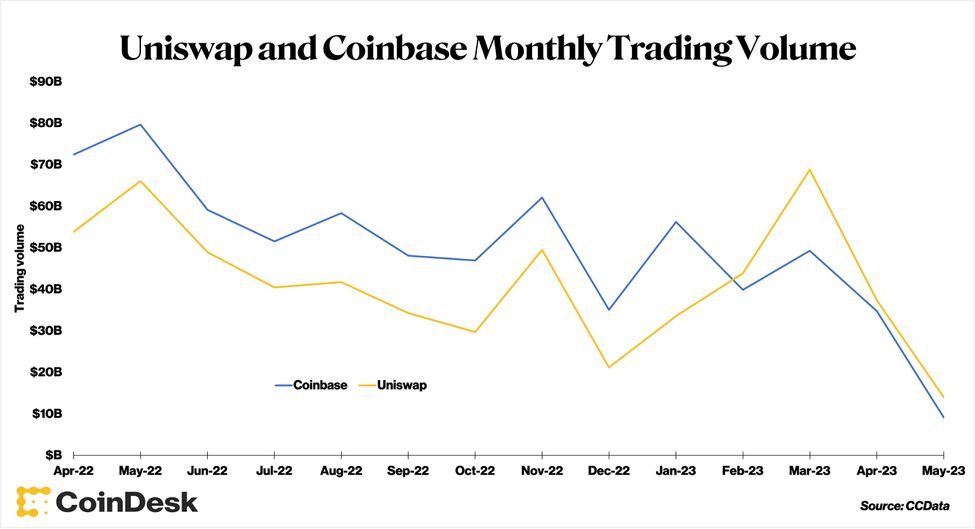

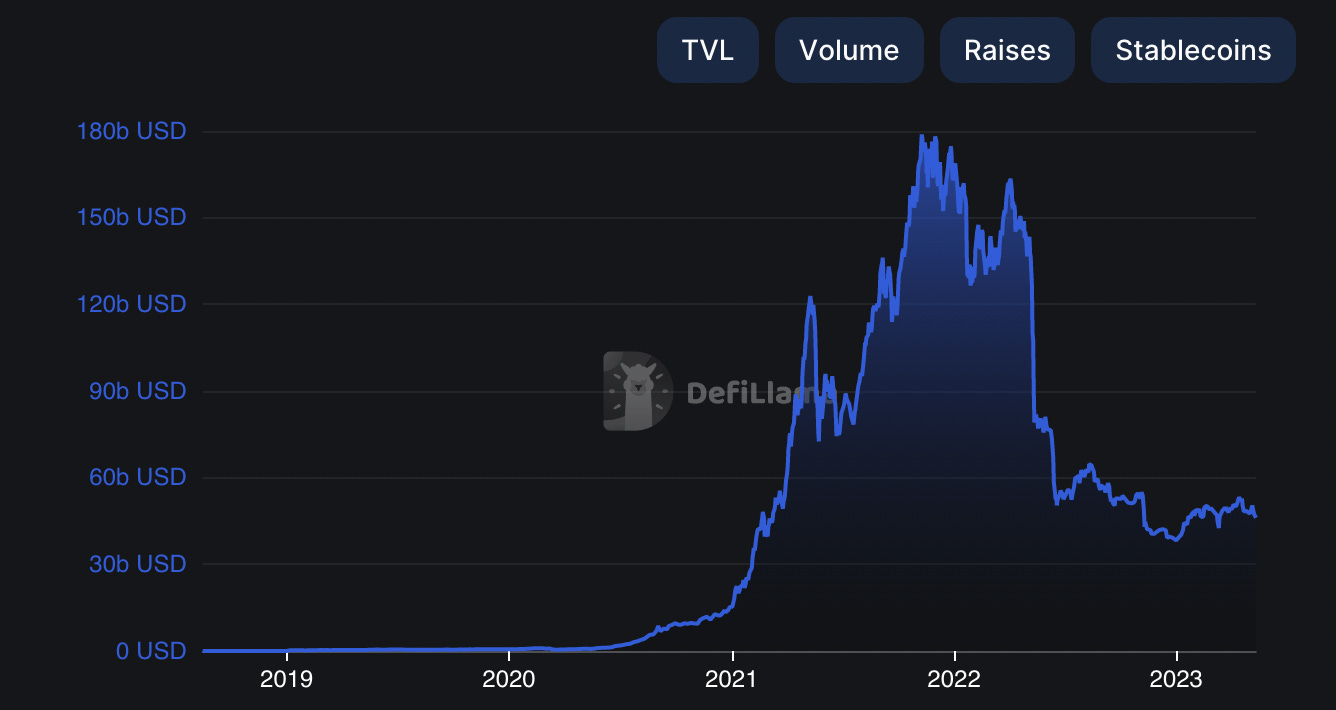

This Week In DeFi – May 12This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customersDevelopers have launched Trustless Market, a protocol that uses Uniswap's smart contracts on the Bitcoin network. Although most of the tokens issued on Bitcoin are meme coins, innovations like Trustless Market is a start to making Bitcoin a generalized platform. The protocol has attracted over 2,000 users and lets liquidity providers earn a 2% cut on all swaps conducted on the network. The meme tokens and Ordinals inscriptions have boosted Bitcoin fees, resulting in the second highest day ever in fee revenue for miners on the Bitcoin blockchain. https://twitter.com/punk3700/status/1654532887201579010 Uniswap has surpassed Coinbase in trading volume for the fourth consecutive month in April, handling $37 billion compared to Coinbase's $34 billion. Uniswap began to exceed Coinbase's volume in February, and the gap between them widened after the depeg of USDC and other stablecoins in March. Traders turned to on-chain trading venues during this period of uncertainty, according to Jacob Joseph, research analyst at CCData. https://twitter.com/CoinDesk/status/1656743338546982914 MakerDAO has launched Spark Protocol, a new lending platform aimed at improving DAI's capabilities. The protocol's debut offering, Spark Lend, allows users to borrow or supply Ether, stETH, DAI, and savings DAI at competitive rates. Savings DAI (sDAI) is a new yield-bearing token representing DAI deposited in Maker's DAI Saving Rate module. Spark Protocol is the first product of Maker's Endgame plan, which involves restructuring the DAO into multiple subDAOs, each with its own governing token. Spark is integrated with Maker's Peg Stability Module, which allows users to convert DAI or sDAI into USDC and vice versa. MakerDAO has also published a five-part plan for its major “Endgame” update – which will ultimately end up with the launch of a new blockchain. https://twitter.com/MakerDAO/status/1655575088547127311 A US judge has granted permission for bankrupt crypto lender BlockFi to return $297m to customers with deposits held in its Wallet program, which did not pay interest on customer deposits and was kept separate from other funds. Unfortunately, the return of funds does not apply to users of BlockFi Interest Accounts, as funds in BIA accounts were used by BlockFi for its lending business and therefore are property of the bankruptcy estates. These funds will be used to repay all creditors. BlockFi filed for Chapter 11 bankruptcy protection in late November, with over 100,000 creditors owed an estimated $10bn. https://twitter.com/Croesus_BTC/status/1656712508693188608 Memecoins once again take center-stage this week, this time spilling over onto the Bitcoin blockchain – an interesting sight to see. Uniswap clone “Trustless Market” has helped to facilitate some of this trade, gaining momentum now with more than 2,000 unique users. DEX volume on Ethereum has soared by more than 60% from last week, as everyone tries to get in on the memecoin craze. Prices of these coins, on the other hand, have begun to crash, as the craze may have spread too thin across the thousands of new tokens created. Tether has disclosed both Bitcoin and gold holdings in its reserves this quarter, also claiming to have posted $1.48 billion in net profits in Q1. According to its attestation, Tether holds $2.44 billion in excess reserves. USD Coin issuer Circle has taken an interesting turn and is now refusing to hold US Treasury bonds maturing beyond June, due to concerns that the US may default on its debts. Times are becoming highly fascinating, as the traditional system begins to present repeated risks to crypto, rather than the other way around. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.6% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 2.1% APY Top StoriesMetaMask rolls out ETH purchases via PayPal to US usersTether Reports $1.48B Profit in Q1, Reveals Bitcoin, Gold ReservesMiCA can ‘serve as a model’ for US crypto regulation, SEC’s Peirce saysCircle refuses to hold longer-dated Treasurys on concern US government might defaultStat BoxTotal Value Locked: $46.11B (down 5.2% since last week) DeFi Market Cap: $44.80B (down 8.2%) DEX Weekly Volume: $12.41B (up 61%) Bonus Reads[Yogita Khatri – The Block] – Worldcoin's new app to migrate from Polygon to Optimism's ecosystem [Vishal Chawla – The Block] – Ethereum's staking rewards rate hits post-Merge record high, fueled by memecoin frenzy [Margaux Nijkerk – CoinDesk] – Meet ‘Dencun.’ Ethereum Developers Are Already Planning Next Hard Fork [Samuel Haig – The Defiant] – Chronos DEX Attracts $230M With Modified ve(3,3) Tokenomics This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – May 5

Friday, May 5, 2023

This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.

This Week In DeFi – April 28

Friday, April 28, 2023

This week, Binance launches a liquid staking token, Ethereum DEX unique users near 2-year highs, users seek an airdrop for LayerZero and Solana wallet Phantom expands to Ethereum & Polygon.

This Week In DeFi – April 21

Friday, April 21, 2023

This week, net ETH staking briefly turns positive, PancakeSwap looks to go deflationary, Agility quintuples its TVL, and a16z launches an OP client.

This Week In DeFi – April 14

Wednesday, April 19, 2023

This week, Shapella goes live on Ethereum, Uniswap's iOS app is approved by Apple, Maple Finance opens a pool for US Treasuries, and SushiSwap suffers a $3.4M exploit.

This Week In DeFi – April 7

Friday, April 7, 2023

This week, LayerZero achieves a $3B valuation, PancakeSwap launches V3 on Ethereum and BNB Chain, S&P Global is hiring for DeFi and Unbound will issue a stablecoin against Uniswap LP tokens.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏