Coin Metrics’ State of the Network: Issue 207

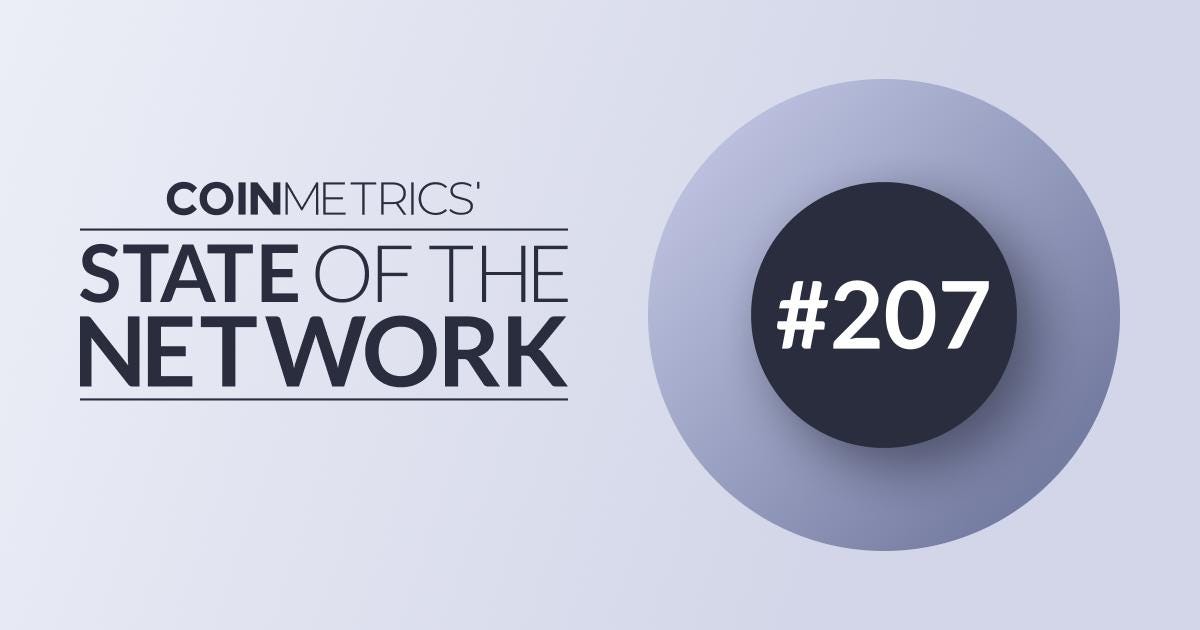

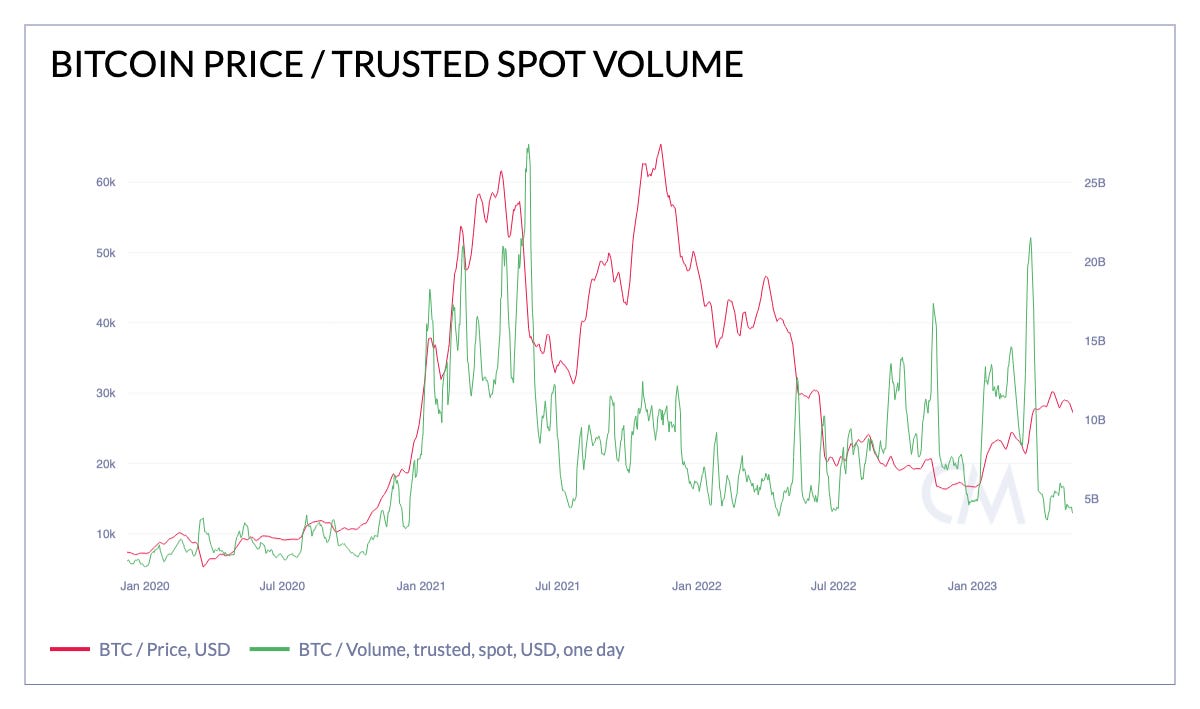

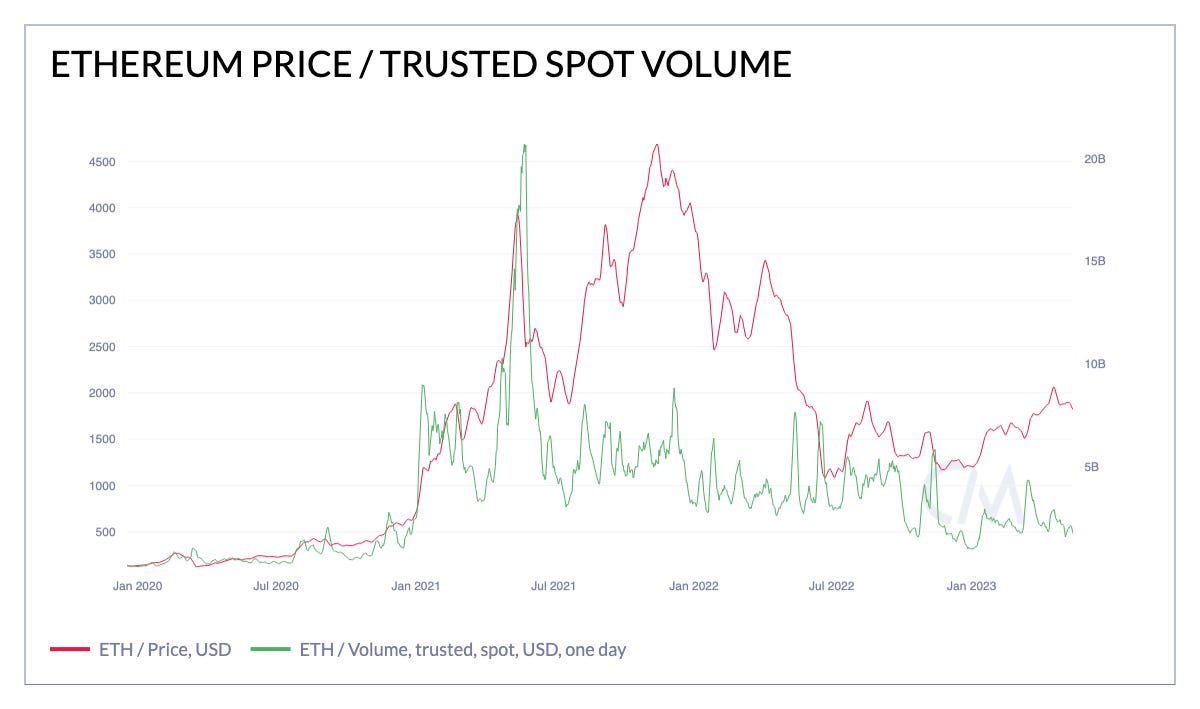

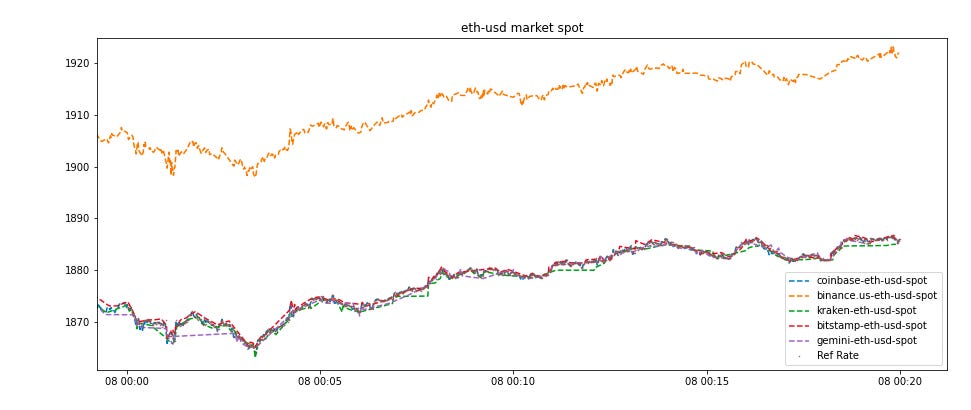

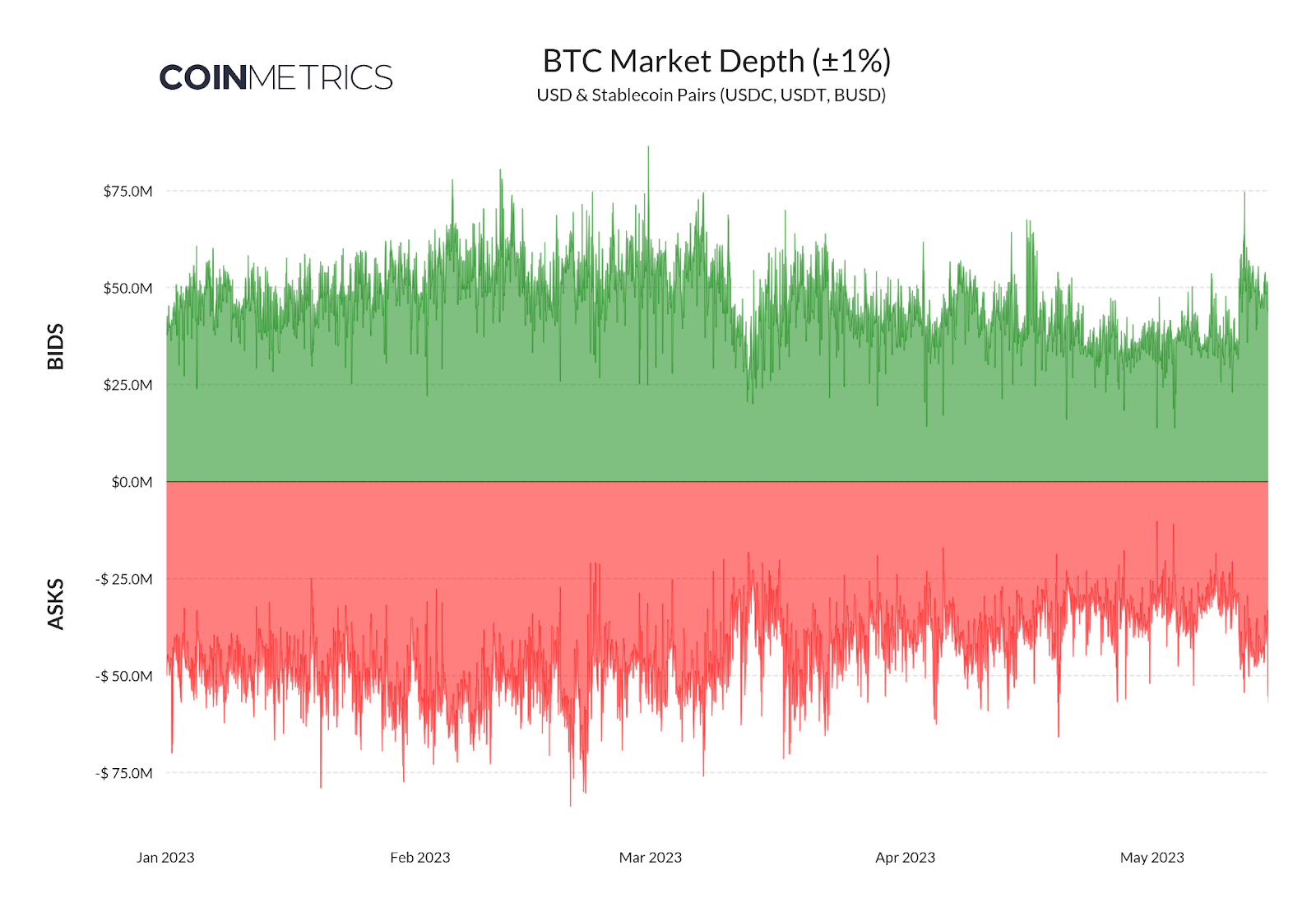

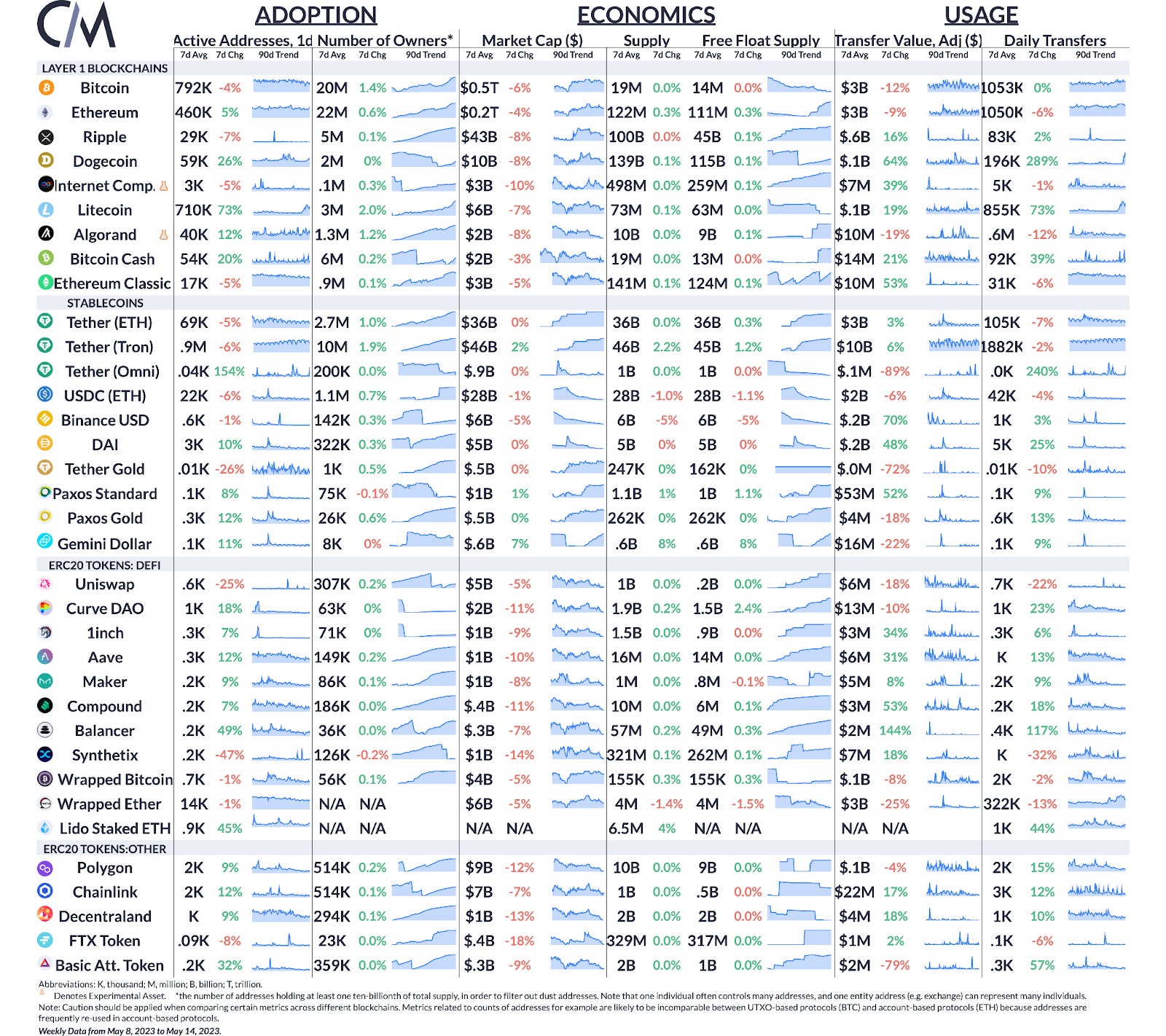

Coin Metrics’ State of the Network: Issue 207Reviewing the liquidity landscape of the digital assets marketGet the best data-drive crypto insights and analysis every week: Market Liquidity ReviewBy: Matías Andrade & Kyle Waters The current market environment for digital assets is characterized by complexity, owing to the presence of regulatory uncertainty, an onslaught of exogenous macro events, and continued shifts in the preferred exchange venues among traders. In this edition of State of the Network, we zoom in on essential trading volume and market data trends to contextualize the current market environment for digital asset participants. Trusted Spot VolumeCoin Metrics’ trusted spot volume (calculated through our trusted market framework) sheds light on the state of market conditions by aggregating spot volume at the highest quality markets. Looking at bitcoin (BTC), spot volume surged around the collapse of Silicon Valley Bank in March, but has since tapered in recent weeks, averaging just around $4B per day in the last week compared to $20B in March. Source: Coin Metrics Market Data Feed Meanwhile, spot trading volume of the second-largest cryptoasset ether (ETH) has also trended downward, to $2B per day over the last week. This compares to $17B per day just two years ago in 2021. However, trusted ETH spot volume has moved higher since the beginning of this year. Source: Coin Metrics Market Data Feed Market Makers Scale Back, For NowAs pivotal mechanisms in the financial ecosystem, market-making firms have been instrumental in ensuring liquidity and price stability in the volatile crypto markets. However, some firms' recent indications to pull back from the U.S. market, spurred by rising regulatory scrutiny, signifies a noteworthy shift in their strategic approaches. Adding a complex layer to this narrative is the CFTC's recent lawsuit against Binance Holdings Ltd., one of the largest crypto exchanges globally. Despite some recent declines, Binance still maintains the lion’s share of spot trading volume globally. Source: Coin Metrics Market Data Feed While the regulator did not implicate trading firms in any wrongdoing, a citation in the lawsuit elucidates the convoluted dynamics among regulatory bodies, crypto exchanges, and market makers. The retreat of significant market makers from the U.S. crypto market emphasizes the profound impact of regulatory scrutiny on these entities' strategic maneuvers. In the nascent and rapidly evolving cryptocurrency industry, regulatory clarity is paramount for fostering a stable and compliant market ecosystem. The strategic decisions of some market makers to retract from the U.S. crypto market are reflective of an industry-wide trend grappling with regulatory ambiguities. One of the consequences of retrenching market makers has been particularly visible on Binance US, which saw a substantial deviation in the prices compared with other venues. The chart below highlights the difference particularly clearly, showing ETH trading around $35 over the consensus prices on Coinbase, Kraken and other exchanges, which were tracking their own price. This difference is partially due to arbitrageurs weighing the regulatory uncertainty against the profit from arbitrage, as well as the frictions caused by alleged limitations in USD withdrawals. Source: Coin Metrics Market Data Feed Bitcoin VolatilityThe volatility of Bitcoin has been considerably less dramatic relative to the activities seen in the previous year. Nonetheless, since March, there has been a noticeable increase in volatility coinciding with the bullish price action and increasing price of BTC and ETH, primarily attributed to the withdrawal of market makers, leading to a decline in liquidity provision. By employing our Reference Rate data, we have computed a 30-day realized volatility metric for BTC, which is illustrated in the chart below. Source: Coin Metrics Market Data Feed Order Book DepthA liquid market order book (the collection of outstanding bids and asks for a market) is a necessary component of a mature financial asset. The ability to quickly enter and exit large positions with a small degree of price impact, or slippage, is a desirable feature for institutional market participants. Coin Metrics has been collecting order book snapshots for major crypto assets since 2019, and recently launched new liquidity metrics to further enhance institutions’ view of the crypto markets. The following chart shows the depth of BTC order books for bids and asks within 1% of the mid-market price for a collection of markets which Coin Metrics tracks (see availability here). One of the first clear trends is a slight contraction over the course of the year, though with a clear rebound in the last few weeks. Source: Coin Metrics Market Data Feed, Liquidity Metrics Also evident is the collapse of Silicon Valley Bank in March of this year, which sent crypto markets through a wild ride of uncertainty including the depegging of the USDC stablecoin. Just before the FDIC, Federal Reserve, and US Treasury issued a joint statement assuring the soundness of deposits at the bank, crypto liquidity retracted markedly, with BTC liquidity within 1% of mid-price dipping below $30M on both sides of the order book. The banking crisis also impacted crypto asset liquidity by impairing real-time payment systems used to move funds around. First, the closure of crypto-friendly Silvergate Bank in early March meant the end of the Silvergate Exchange Network (SEN), which offered crypto exchanges instant settlement services. Before Silvergate’s closure, SEN facilitated $1.3B of volume per day in the fourth quarter of 2022. Then, the closure of Signature Bank in March ended institutional crypto customers’ access to Signet—a money transfer system that served as a vital linkage for traditional banking infrastructure and crypto-market participants. Greater frictions between crypto exchanges and traditional banking infrastructure remains a headwind for market liquidity. However, despite these challenges bid/ask liquidity has remained relatively stable, with 1% depth holding steady near $45–$50M even as major market makers exit the ecosystem. ConclusionIn reviewing the liquidity landscape of the digital assets market, a number of pertinent factors emerge. First, the presence of regulatory uncertainty looms, casting a shadow of unpredictability and potential impediments to sustained liquidity. Moreover, the decrease in market makers, a critical component of vibrant trading activity, has raised concerns about the overall robustness of the market in the short term. The repercussions of this decline in market makers may potentially manifest in larger price aberrations between markets for the same underlying asset, as participants fail to fully capitalize on arbitrage opportunities. Furthermore, the struggle of exchanges to maintain banking relationships has raised apprehensions about the potential for a decline in order book market depth. As the industry grapples with these challenges, it becomes increasingly imperative to foster an environment that addresses regulatory concerns, incentivizes market maker participation, and ensures the stability of exchange-banking relationships—especially in the U.S. Thankfully, market structure experts continue to help lay the pipings so that digital assets can fortify their position in the global financial landscape. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Rising fee pressure on BTC have driven an increase in LTC use, which saw an increase in active addresses of over 70%, lending more evidence to the spillway theory as users find alternatives to send value on-chain on low-fee chains. However, much of the activity came as the long-time Bitcoin fork introduced the LTC-20 token standard, after BRC-20 tokens took off on Bitcoin. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 206

Tuesday, May 9, 2023

Fee Market Mania Hits Bitcoin & Ethereum

Coin Metrics’ State of the Network: Issue 205

Tuesday, May 2, 2023

A data-driven update on MakerDAO & Dai

Coin Metrics’ State of the Network: Issue 204

Tuesday, April 25, 2023

Breaking down blockchain addresses

Coin Metrics’ State of the Network: Issue 203

Wednesday, April 19, 2023

Review of Ethereum's 'Shapella' Upgrade

Coin Metrics’ State of the Network: Issue 202

Tuesday, April 11, 2023

A preview of Ethereum's upcoming Shanghai/Capella upgrade

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏