Analyzing Historical Returns of BNB Launchpad and Comparing with ETH Staking Yield

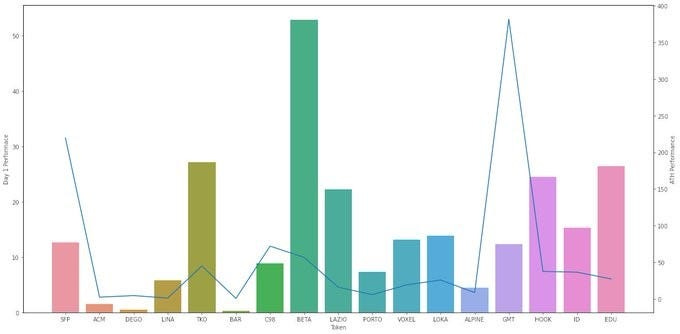

Source: https://twitter.com/NintendoDoomed/status/1658052950336614405 WuBlockchain is authorized by the author to translate and publish This article provides statistical data on BNB Launchpad performance from 2021 to the present. It evaluates the current profitability level of Launchpad compared to historical data and calculates the long-term returns of holding BNB for IEO, benchmarking against ETH staking rewards. The goal is to provide a comprehensive analysis of “BNB returns.” The graph above shows the historical data of Launchpad with the following indicators: ● D1 Gain: The price difference between the initial listing and the initial decentralized offering (IDO) in the first UTC+0:00. ● ATH Gain: The highest price compared to the IDO. ● BNB-based D1 ROI: The amount of BNB received by selling tokens acquired by investing 1 BNB on the first day. ● BNB-based ATH ROI: The amount of BNB received by selling tokens acquired by investing 1 BNB at the historical peak price. Evaluation of profitability Taking the median of all Launchpad projects since 2021, the median D1 Gain is 12.6x, ATH Gain is 25.7x, the BNB-based D1 ROI is 0.015, and the BNB-based ATH ROI is 0.031. Regarding the three tokens launched since HOOK, all indicators are at an above-average level. The median D1 Gain of 24.4x is 1.9x the historical median, ATH Gain is 1.4x the historical median, the BNB-based D1 ROI is 1.5x, and the BNB-based ATH ROI is 1.3x. In other words, these projects during the bear market are actually more profitable than most projects during the bull market. The current policies are also relatively friendly to arbitrage users. Compared to the inconsistent returns in the past, the BNB-based ROI of the three recent projects are around 2%. If the future Launchpad terms remain similar to these projects, users who engage in spot trading, shorting contracts through Venus, and participating in IEO can expect a relatively stable return. Why is there feedback that it’s “less exciting”? The reason is likely due to the lack of major breakthroughs. Products like SFP and GMT in 2021/2022 provided returns of hundreds of times, and holding onto them would yield significant profits. The time between the previous SFP and GMT was about one year, but after GMT, a year has passed without the emergence of projects with similar growth rates. It’s normal for an outstanding project to leave a stronger impression compared to three above-average projects. When you look at the chart below, the first thing that comes to mind is finding GMT. The so-called BNB-based ATH ROI of 0.46 for GMT means that by investing 1 BNB, you could sell it at the peak for 0.46 BNB. SFP, on the other hand, could yield 1.56 BNB from 1 BNB invested! It’s no wonder people have a lasting impression. In comparison, the current maximum return of 0.0X is somewhat underwhelming. However, it’s interesting to note that both SFP and GMT had relatively average D1 Gain, only 12x, which is half of the Hook/EDU projects. These three new projects have not been online for long and are operating in a bear market environment, where Ponzi-like patterns are less likely to thrive. Therefore, there should not be excessively high expectations for now. Long-term returns of holding BNB The annualized return of BNB Launchpad can be compared to ETH staking rewards. Over the past two and a half years, if tokens acquired on the first day were sold, the total BNB-based ROI would be 36%, with an annualized return of 14%. This appears slightly higher than the returns from ETH staking during the same period. However, there are also the earnings from BNB Launchpool to consider. If we include the earnings from staking and withdrawing in the Launchpool, the total BNB-based ROI would be 52%, with an annualized return of 21%. This is nearly double the returns from ETH staking during the same period. In the past year since the bear market, the overall project returns have been approximately 9.5%. Comparatively, the ETH staking APR benefiting from MEV income after the merge is around 6%. Therefore, even in a bear market, the BNB IEO returns have maintained a rate 1.5x higher than ETH staking. If a bull market arrives, ETH staking returns are expected to benefit from MEV income, while BNB Launchpad may experience both quantity and price increases. However, the current ETH staking rate is relatively low compared to other Layer 1 solutions, indicating potential for a 2–3x increase in staking. This may dilute the returns due to increased staking activity. The capital invested in IEO has been relatively stable around 10 million, and with the allure of “ATH ROI,” BNB is relatively resilient in a bull market. Additionally, both BNB and ETH are experiencing deflationary mechanisms through token burning, with BNB’s burning rate significantly faster. However, the returns from burning should directly reflect in the token price. BNB/ETH has historically shown an upward trend, and since 2021, BNB/ETH has mostly been fluctuating sideways. Therefore, comparing the returns from staking and Launchpad with those from ETH is reasonably justified. Summary Since the bear market, the overall comprehensive ROI of the three Launchpad projects have been in the upper-middle range of historical data, with indicators approximately 1.3~1.9x higher than the historical median. The stable BNB-based D1 ROI of around 2% makes it suitable for arbitrage. It has been a year since projects like SFP and GMT that achieved phenomenal returns, allowing for a maximum return of up to 1.5x the initial investment of 1 BNB. The market feedback may be more negative due to the absence of such projects. Comparing it to ETH staking, the long-term returns from holding BNB for IEO approximately 9.5%, which is 1.5x higher than ETH returns. During the previous bull market, BNB’s returns were approximately twice as high as ETH’s, and it is expected to be more resilient in future bull markets. However, this analysis is based on a single dimension. In the next bull market, the use cases of ETH and BNB could be the key factors determining their returns. Currently, ETH Layer 2 development is progressing well, and it is crucial to observe whether BNB Chain can continue its momentum. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Bitcoin developers discuss network congestion caused by BRC-20s.

Tuesday, May 16, 2023

Editor: WuBlockchain The issue of high transaction fees and network congestion in the Bitcoin network caused by the popularity of Inscription and BRC-20 has been discussed in the Bitcoin developer

Global Crypto Mining News (May 8 to May 14)

Monday, May 15, 2023

1. On May 7th, Bitfarms mined 21000th BTC with renewable power, representing 1/1000 of all BTC to ever be mined. Bitfarms' mining operations began in Quebec, Canada, and are expanding to Washington

Asia's weekly TOP10 crypto news (May 8 to May 14)

Sunday, May 14, 2023

Author:Lily Editor:Colin Wu 1. South Korea's weekly summary 1.1 Kaiko: Bitcoin Kimchi Premium declines since 2021 link According to Kaiko, Bitcoin Kimchi Premium — the difference between the price

Weekly project updates: MakerDAO's "Endgame", Solana's mobile Saga public sale, Chiliz's mainnet launch, etc

Saturday, May 13, 2023

1. BTC's weekly summary a. Interlay founder Alexei Zamyatin proposes BRC-21 standard link On May 8, Alexei Zamyatin, the founder of Interlay, proposed the introduction of the BRC-21 standard to

WuBlockchain Weekly:Ethereum mainnet malfunctioned、ParaSpace turmoil、US CPI and Top10 News

Friday, May 12, 2023

Top10 News 1. Ethereum main network's beacon chain experiences half-hour problem link On May 12, the beacon chain of the Ethereum main network experienced a problem for about half an hour, and the

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏