DeFi Rate - This Week In DeFi – May 19

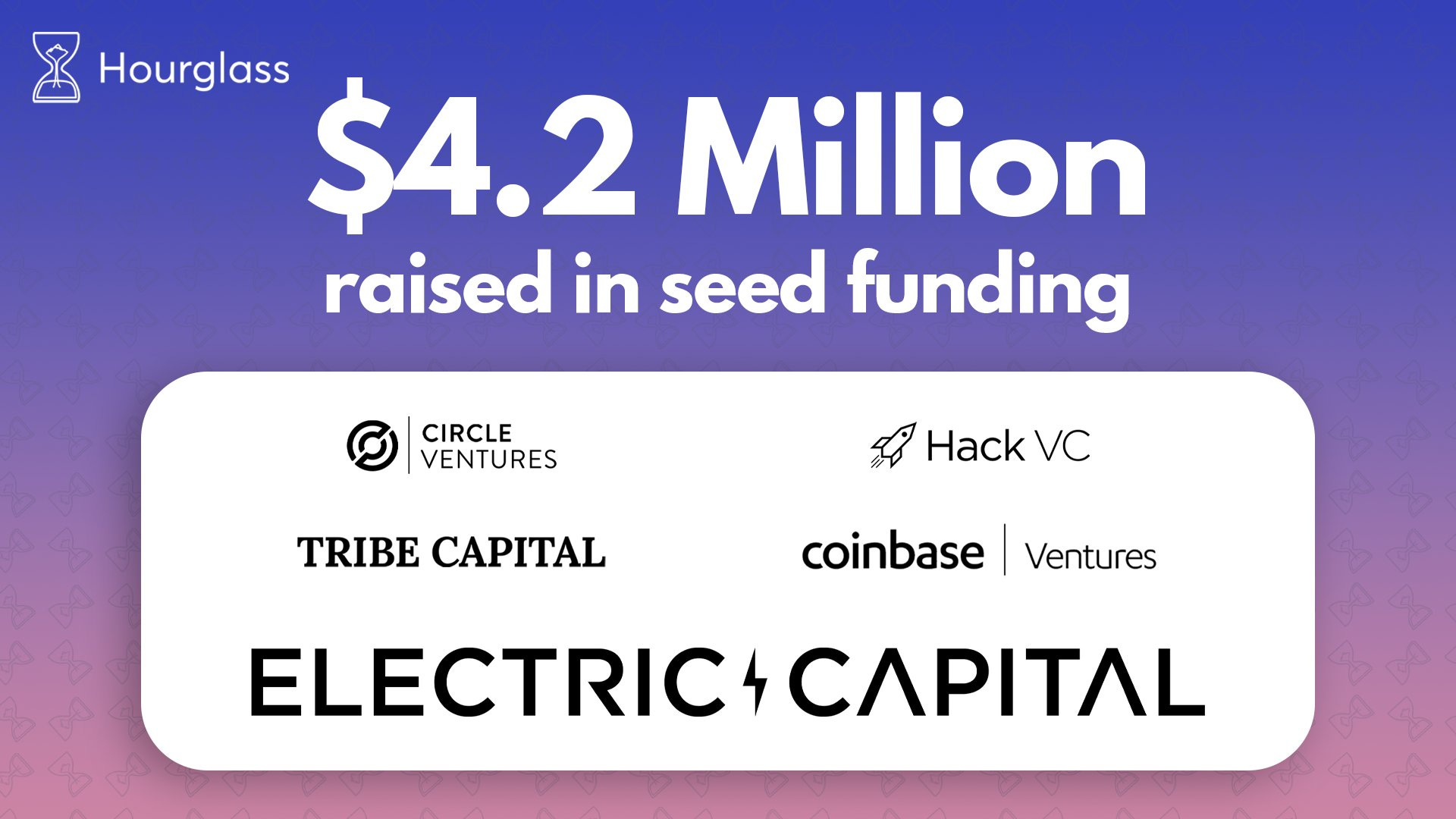

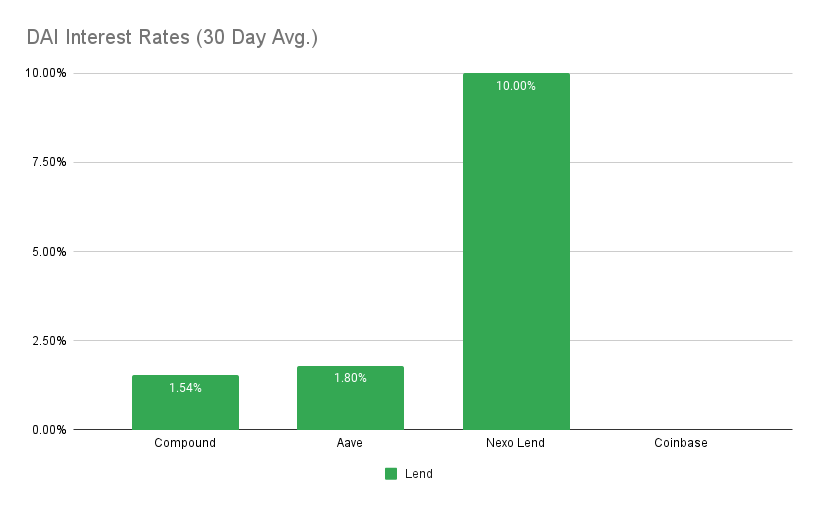

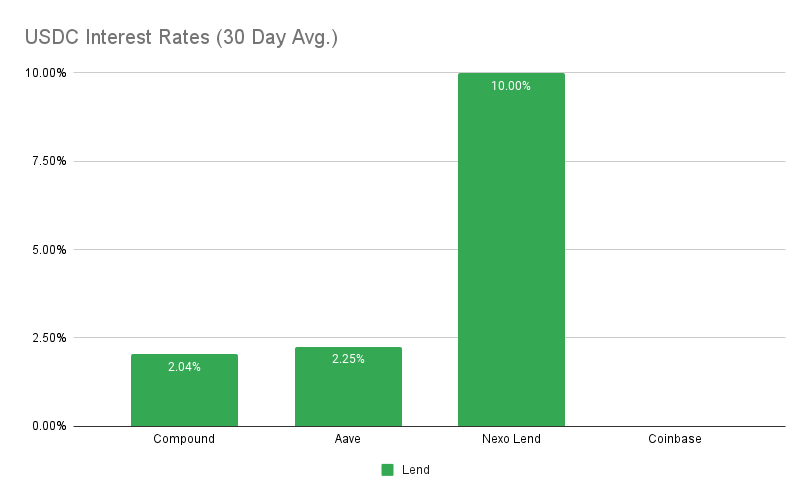

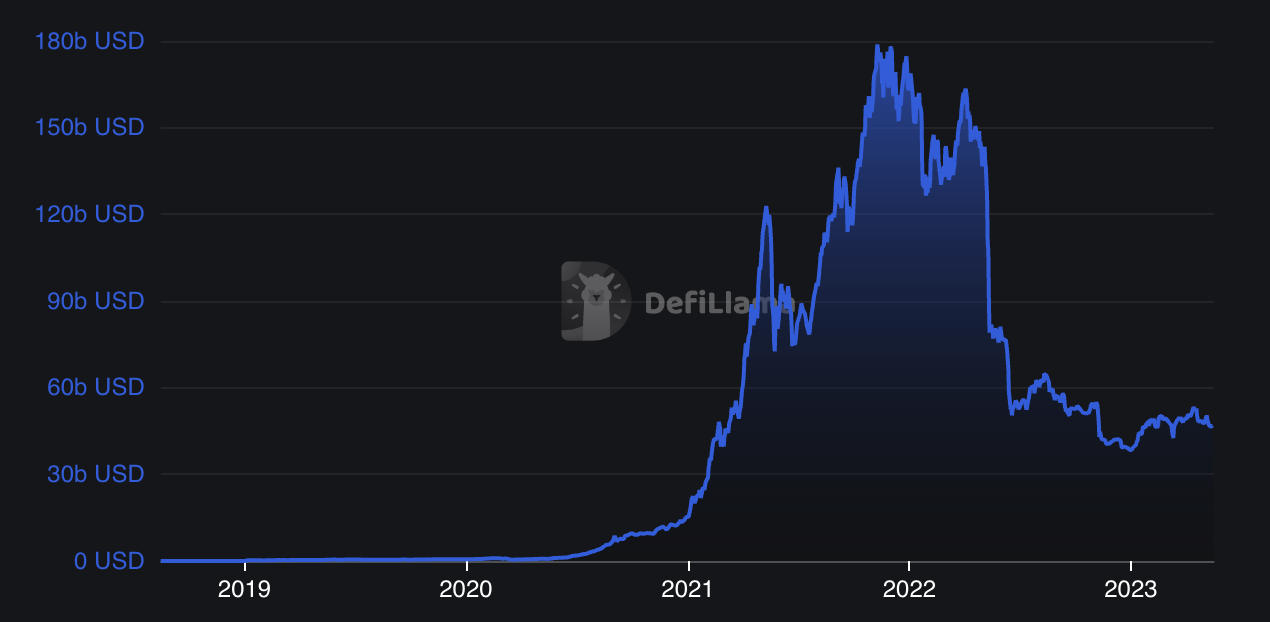

This Week In DeFi – May 19This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular altcoins.To the DeFi Community, This week, the memecoin frenzy has spread to the Dogecoin blockchain, as its daily transaction volume surged to a record high, temporarily surpassing both Bitcoin and Litecoin. Following in the footsteps of the recent BRC-20 token standard on Bitcoin, “DRC-20” tokens have been created on the Dogecoin chain, allowing developers to issue tokens that use dogecoin for network fees. Similarly, token-miniting has also made its way to the Bitcoin Layer-2 scaling solution, the Lightning Network. Infrastructure company Lightning Labs launches a new version of “Taproot Assets” – a protocol designed for issuing assets on Bitcoin and Lightning. The protocol is currently only on testnet, with a mainnet release “just around the corner.” https://twitter.com/takibi_coin/status/1657137317805432833 Uniswap continues to aggressively expand its V3 protocol to new chains, this time looking to launch on Polkadot and Coinbase’s rollup platform, Base. Uniswap V3 will launch on the Moonbeam parachain – a chain that is part of the polkadot ecosystem, following a governance vote that was overwhelmingly in favor of the expansion. Moonbeam is EVM-friendly, making it easy to deploy Ethereum-based smart contracts with minimal adjustments. The platform is currently is home to the majority of Polkadot’s DeFi activity. A governance proposal is currently underway to deploy Uniswap V3 on Base – an Ethereum scaling platform based on Optimism. https://twitter.com/Polkadot/status/1658820737384292352 Crypto startup Hourglass has launched the first marketplace for trading a new innovation known as Time-Bound Tokens (TBTs). TBTs tokenize a user's staked assets in a decentralized finance (DeFi) protocol based on their lock-up time period. The marketplace will allow users to trade their ownership of locked assets by transferring these TBTs. Hourglass's launch coincides with Lido's Version 2 deployment, where it will tokenize Lido's withdrawal queue, providing users with liquidity while they wait. TBTs represent staked assets committed for a specific period and can be traded at a discount based on the lock-up duration. Hourglass raised $4.2 million in a seed round led by Electric Capital, with participation from Coinbase Ventures, Circle Ventures, Tribe Capital, hack.vc, and other angel investors. https://twitter.com/hourglasshq/status/1658502424691359745 Ribbon Finance's decentralized exchange Aevo has introduced options trading for popular altcoins such as LDO, PEPE, SUI, ARB, LTC, APT, and more. Previously, these options were only available through over-the-counter desks. Users can select the strike price and duration of the options and receive instant quotes from market makers Galaxy, GSR, and OrBit Markets. Market makers are required to post collateral, approximately 30% of the notional trade size, in the form of the stablecoin USDC. Currently, Aevo users can only buy options, but the platform plans to enable writing options with customized margins and counterparties in the future. https://twitter.com/aevoxyz/status/1658065977890996225 Collapsed CeFi giants are finally starting to wrap up their journeys this week, as Voyager, BlockFi and Celsius see progress with their bankruptcy proceedings. Voyager’s liquidation of its assets may begin as early as today, and affected customers may see some of their funds returned as early as June 1. Users will be able to initially recover around 36% of their claims, with the possibility of more as the company resolves issues with FTX. BlockFi is a step behind, seeking to liquidate its lending business after it failed to find a buyer. The company has already asked bankruptcy court for permission to begin the liquidation process. Lastly we have Celsius, which is currently in the middle of an auction for its assets. In the lead is a consortium called Fahrenheit LLC, which includes blockchain VC firm Arrington Capital. The auction is expected to conclude within a week. The moves conclude a trying time for crypto and all of those effected, however it is good to see customers finally being returned at least a portion of their funds. Remember everyone: “Not your keys, not your coins!” Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 1.8% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 2.3% APY Top StoriesEU Approves Landmark Crypto Licensing RegimeVoyager liquidation could start Friday, customers could see cash and crypto starting June 1BlockFi looks to liquidate lending business after unsuccessful sales attemptCelsius bankruptcy auction nears end, with Fahrenheit in the leadStat BoxTotal Value Locked: $46.25B (up 0.3% since last week) DeFi Market Cap: $46.56B (up 3.9%) DEX Weekly Volume: $6.87B (down 45%) Bonus Reads[Shaurya Malwa – CoinDesk] – Origin Protocol Enters Competitive Ether Yield Market With OETH Offering [Liam J. Kelly – Decrypt] – DeFi Token Synthetix Soars 10% as Community Mulls PEPE Market Launch [Jamie Crawley – CoinDesk] – Ledger Continues to Defend Recovery System, Says It's Always 'Technically' Possible to Extract Users' Keys [Yogita Khatri – The Block] – Tether to invest up to 15% of its profits in bitcoin This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – May 12

Friday, May 12, 2023

This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customers

This Week In DeFi – May 5

Friday, May 5, 2023

This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.

This Week In DeFi – April 28

Friday, April 28, 2023

This week, Binance launches a liquid staking token, Ethereum DEX unique users near 2-year highs, users seek an airdrop for LayerZero and Solana wallet Phantom expands to Ethereum & Polygon.

This Week In DeFi – April 21

Friday, April 21, 2023

This week, net ETH staking briefly turns positive, PancakeSwap looks to go deflationary, Agility quintuples its TVL, and a16z launches an OP client.

This Week In DeFi – April 14

Wednesday, April 19, 2023

This week, Shapella goes live on Ethereum, Uniswap's iOS app is approved by Apple, Maple Finance opens a pool for US Treasuries, and SushiSwap suffers a $3.4M exploit.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏