DeFi Rate - This Week In DeFi – May 26

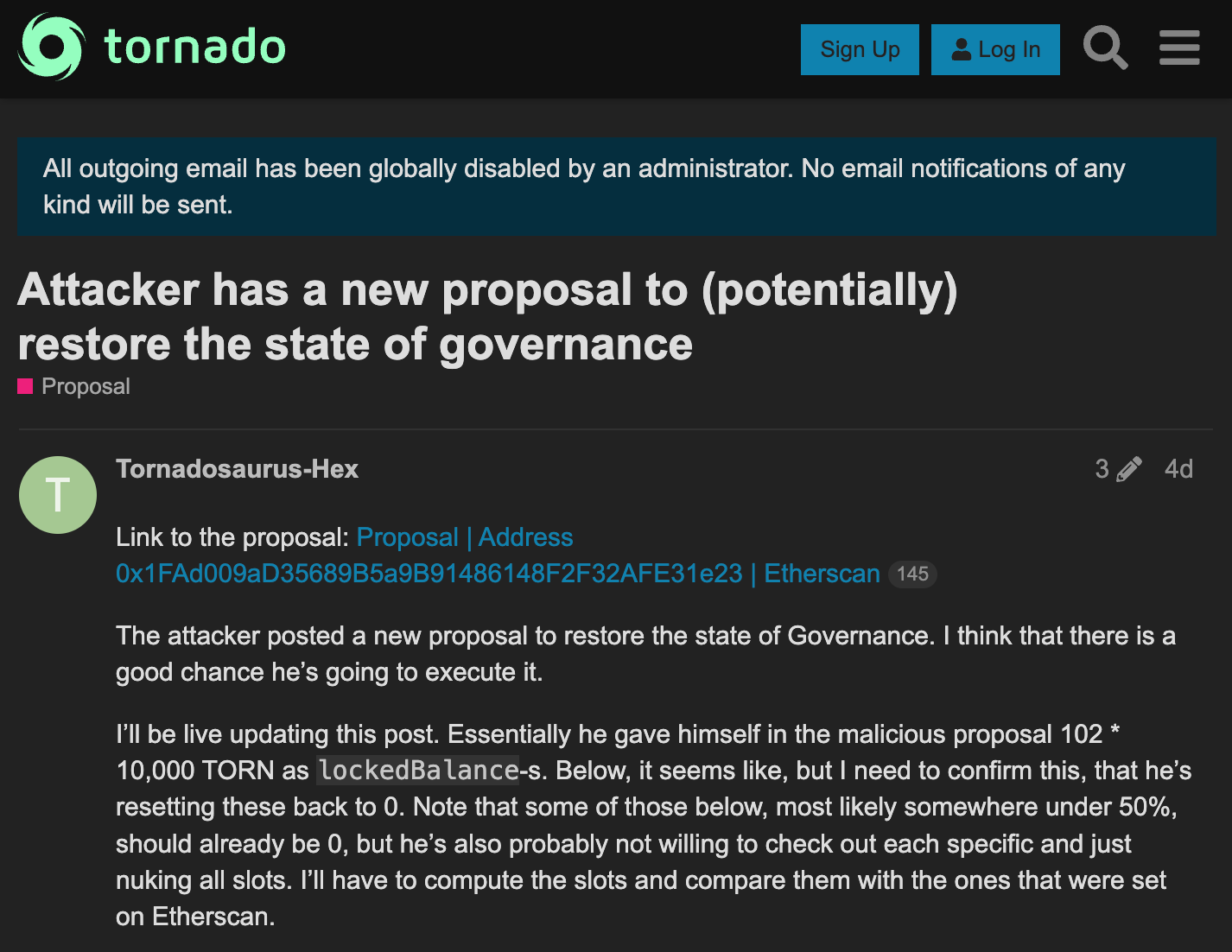

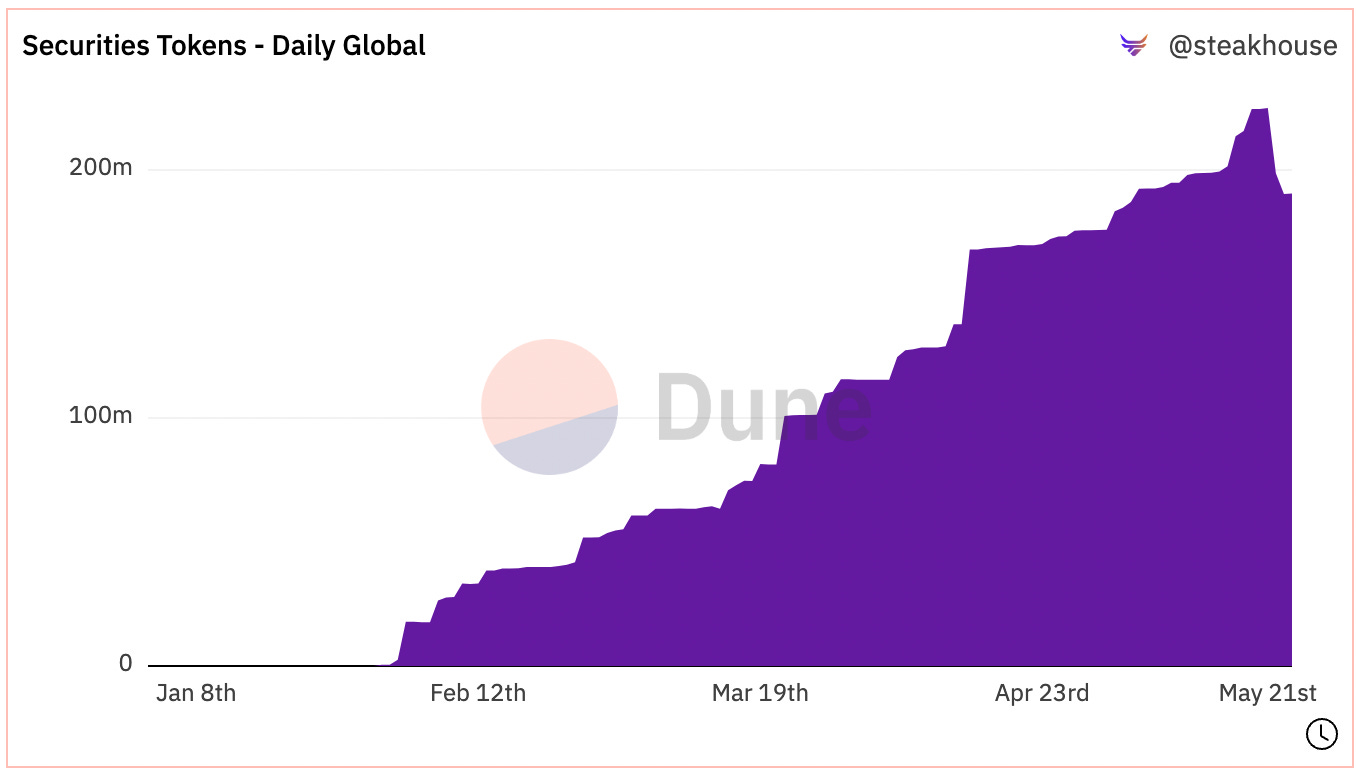

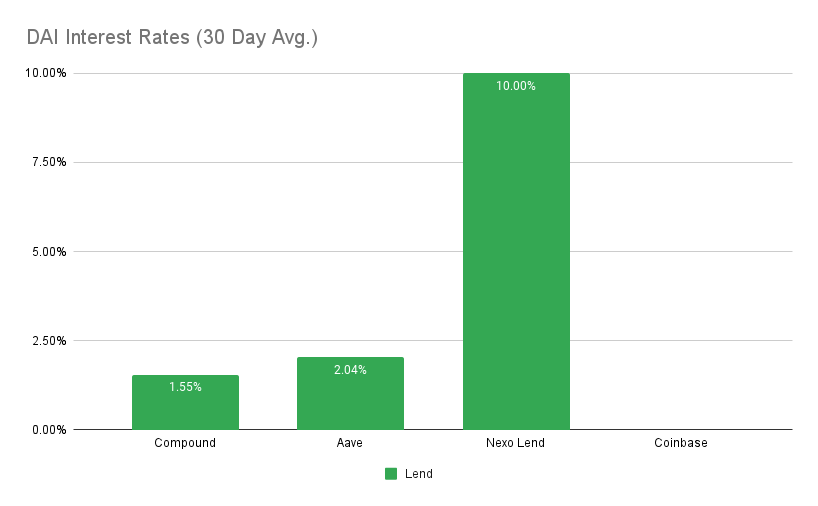

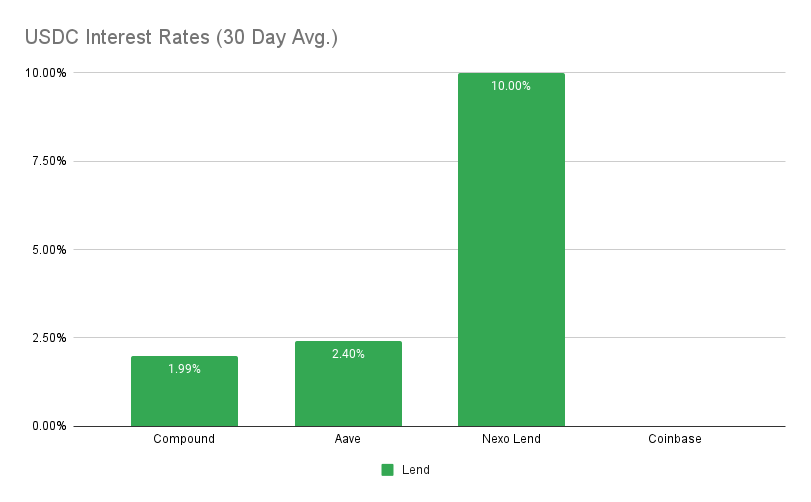

This Week In DeFi – May 26This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.To the DeFi Community, This week, cross-chain protocol Multichain has experienced a disruption to some of its cross-chain routes, with an explanation yet to be given by the development team. Reported issues with stuck transactions have been ongoing since May 21, and Multichain has promised to compensate affected users for the inconvenience. The continued silence from the team about the cause of the issue has prompted several key stakeholders to take action, with the Fantom Foundation withdrawing $2.4 million in liquidity of MULTI tokens from SushiSwap, while HashKey Group, moved $250,000 to a crypto exchange Gate.io, and Tron founder Justin Sun has pulled 470,000 USDD from the Multichain protocol. Unverified rumors on Twitter suggest that the core leadership team may have been arrested in China. Multichain is home to over $1.53 billion in liquidity. Coinbase's Base network, a Layer-2 scaling solution for Ethereum, has outlined a roadmap for the launch of its mainnet – although specific dates have not been provided. The network, which uses Optimistic Rollup technology, has already fulfilled two out of five criteria necessary for the launch. This included the successful performance of the Regolith hard fork, and an infrastructure review with the OP Labs team. The third criterion involves upgrading the network to Bedrock, a change that is scheduled for June 6 in Optimism's roadmap. The last two criteria include completing internal and external audits and demonstrating testnet stability. Base has garnered plenty of attention with speculation surrounding the apps that will be built on the network. However, concerns have been raised about the network's centralization and its impact on user privacy. Privacy mixer Tornado Cash was hacked this week, in an exploit which gave majority control of its DAO to the attacker. A malicious governance upgrade approved on May 20 snuck in an extra function that gave the attacker 1.2 million votes, and as a result access to some protocol funds, including the treasury. A total of 483,000 TORN was taken from the protocol, with the majority being sold for Ether. 100,000 TORN remains in their control. Tornado Cash is still functional, with the attacker unable to access pooled funds on Ethereum – even sending 100 to the router themself. Interestingly, the attacker submitted their own proposal to Tornado Cash governance to revert all of their own malicious changes to the protocol. https://twitter.com/samczsun/status/1660012956632104960 The security tokenization trend is gaining momentum, as several firms have created ERC-20 tokens representing securities such as government bonds and exchange-traded funds (ETFs) on blockchain platforms. Companies like Matrixport, Backed Finance, Ondo, and Franklin Templeton have issued tokenized securities on platforms like Ethereum, Polygon, and Gnosis Chain. Ondo and MatrixDock dominate the market with offerings of short-term U.S. government bonds. Tokenized securities offer advantages such as lower fees, faster settlement, and integration with existing business models. Regulatory clarity and interoperability with decentralized finance (DeFi) platforms are seen as important factors for the continued growth of tokenized securities. The total market cap of tokenized securities across six major platforms recently reached over $220 million. Things are moving along in DeFi this week – with a mixture of battle-testing and innovation. Unfortunately Tornado Cash can’t seem to catch a break, however hopefully the attacker will return control of the protocol and give us a valuable lesson for governance improvements. Things are yet to be resolved with Multichain, however it is fortunate that the protocol is just seeing some roadblocks, rather than any loss of funds. New Layer-2 progress and security tokens are providing some new excitement, as transactions become cheaper (and quicker), along with some new financial instruments to play with on-chain. Subject to restrictions via regulation, tokenized securities have been in the works for a long time in DeFi – and we’re finally seeing some real adoption and use of these tools. We also have a potential larger-scale adoption of stablecoins according to leaked EU plans, with a possible lowering of barriers for banks to start incorporating stablecoin usage into their everyday business. DeFi is slowly, but surely, integrating more tightly with traditional finance and we hope this trend will continue. Our usual CeFi stories also continue to develop, as DCG misses its deadline for payment of a huge $630 million owed to Gemini – which will now move to a period of forebearance to enable DCG to fulfil its obligations without going under. Hopefully, the payment can be resolved so that affected users can see the return of some (if not most) of their funds. Celsius assets may have a new owner, as the Farenheit consortium’s bid wins at auction. These assets, once worth over $2 billion could soon be in new hands and see some eventual resolutions. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.0% APY MakerDAO Updates DAI Savings Rate: 1.00% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Aave at 2.4% APY Top StoriesDCG misses $630 million payment due earlier this month, says GeminiEU Banks Could Access Stablecoins More Easily Under Leaked PlansFahrenheit Wins Bid to Acquire Assets of Insolvent Crypto Lender CelsiusLedger CEO: Government subpoena to access user funds is the 'only concern'Stat BoxTotal Value Locked: $46.65B (up 0.9% since last week) DeFi Market Cap: $46.26B (down 0.6%) DEX Weekly Volume: $7.39B (up 7.6%) Bonus Reads[Shaurya Malwa – CoinDesk] – BNB Chain Expected to Undergo ‘Luban’ Upgrade in June. Here’s all You Need to Know [Vishal Chawla – The Block] – Synthetix founder wants to buyback and burn millions of SNX tokens [Ezra Regeurra – Cointelegraph] – Circle launches euro-based stablecoin on Avalanche blockchain [Yogita Khatri – The Block] – Binance enters NFT lending space, starting with ETH loans This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – May 19

Friday, May 19, 2023

This week, memecoins move to the Dogecoin chain, Uniswap expands to Polkadot, Hourglass launches trading for "time-bound tokens" and Ribbon Finance launches options trading for popular

This Week In DeFi – May 12

Friday, May 12, 2023

This week, a Uniswap clone launches on Bitcoin, trading volume on Uniswap itself exceeds that of Coinbase yet again, MakerDAO launches a new lending platform, and BlockFi can return $300M to customers

This Week In DeFi – May 5

Friday, May 5, 2023

This week, Curve launches its crvUSD stablecoin, the Sui mainnet goes live, Ethereum gas fees reach 1-year highs, and Coinbase discontinues its borrow program.

This Week In DeFi – April 28

Friday, April 28, 2023

This week, Binance launches a liquid staking token, Ethereum DEX unique users near 2-year highs, users seek an airdrop for LayerZero and Solana wallet Phantom expands to Ethereum & Polygon.

This Week In DeFi – April 21

Friday, April 21, 2023

This week, net ETH staking briefly turns positive, PancakeSwap looks to go deflationary, Agility quintuples its TVL, and a16z launches an OP client.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏