The Pomp Letter - The State of Crypto Market Structure

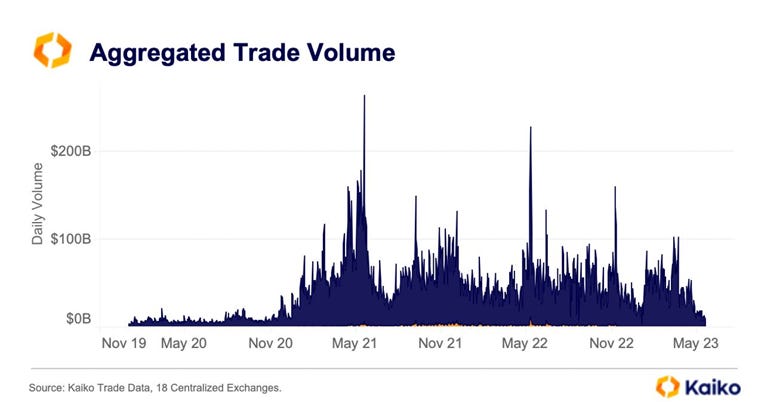

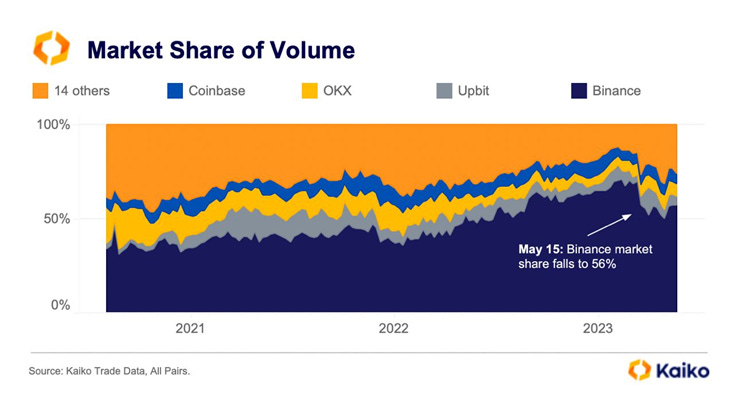

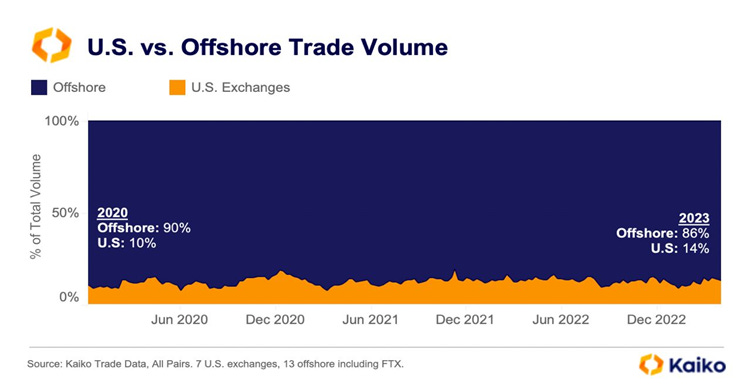

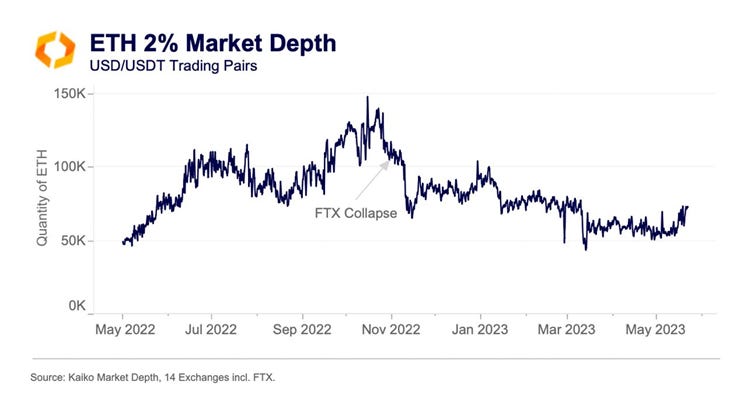

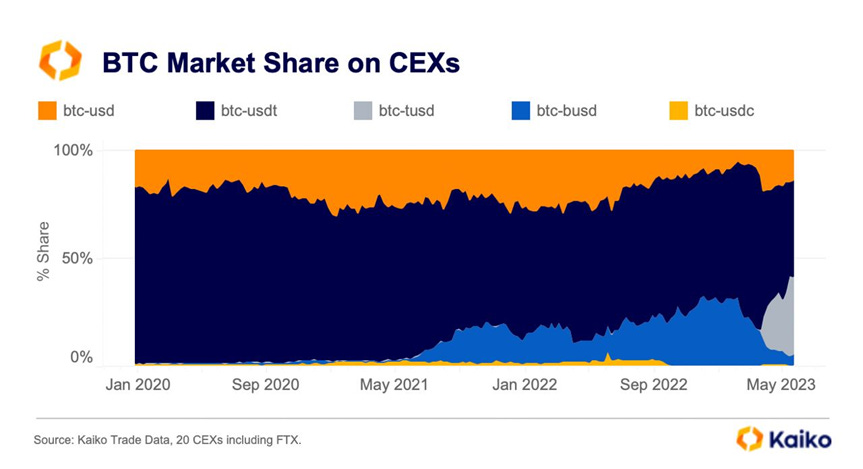

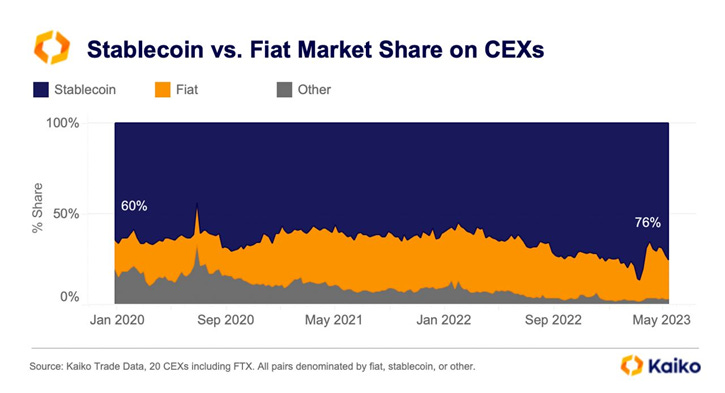

To investors, Today is a guest post from Will Clemente, co-founder of Reflexivity Research, on the current state of crypto market structure. You can subscribe to Reflexivity’s research by clicking here. After a major first quarter we have seen a continued decline in trading volume across the board for major digital assets across all major centralized exchanges. Throughout the month of May, aggregated trading volumes declined from $23bn to $9bn to their lowest levels since 2020. This represents continued apathy and decline in speculative interest in crypto markets. Looking at the makeup of overall trading volume by exchange, Binance’s market share has fallen to 56% despite a slight rebound over the last week. This is a 15% percent decline from its peak at the start of 2023. The biggest beneficiaries of this dynamic fall under the “other” category, which includes exchanges such as Huobi, Kraken, and Kucoin. Offshore exchanges remain the dominant venues across the entire crypto landscape, making up a whopping 86% of all trading volume; this dynamic is likely to only accelerate with regulatory uncertainty in the United States. Even Coinbase, which historically has been recognized as the publicly traded highly regulatory compliant alternative option to other venues in crypto, announced the launch of its own offshore derivatives venue called Coinbase international exchange. Harsh regulatory efforts and posturing from government officials in the US with the intention of establishing control over the industry are only going to have the opposite effect and drive talent/capital/innovation off-shore and on-chain; ultimately giving the government less control than what it would have if it encouraged activity to take place in the US; allowing it to at least retain some degree of oversight. For the foreseeable future it’s unclear why the dominance of trading volume in offshore venues won’t continue. While USD denominated market depth has remained relatively stable, liquidity for both Bitcoin and Ethereum measured by coin denominated 2% market depth (coin denominated depth of bids and asks within 2% of current trading price) has remains roughly flat on the month; again, illustrating a period of apathy for the crypto market. This downtrend in liquidity that we’ve been tracking for the last few months was reflected in an announcement from Jane Street and Jump, in a statement from the two market makers, that they would be scaling back their crypto operations in the US. Jane Street went a step further stating that the firm would be scaling back its crypto operations globally due to regulatory uncertainty that has made it difficult for the firm to operate in a compliant fashion. This decline in liquidity makes it more difficult more entities operating in digital asset markets to execute larger trades without incurring slippage (price impact). In other words, declining liquidity in the market translates to higher volatility. In terms of trading pairs, TUSD has taken up an increasing amount of activity on centralized exchange, now 36% percent of all Bitcoin trading volume while Binance and Paxos’ BUSD pair has declined from 32% to 5% amidst regulatory uncertainty and the removal of zero-fee trading. Stablecoins remain the dominant pair of choice for centralized exchange market participants, with stablecoins making up 82% percent of overall trading volumes, relative to fiat, for Bitcoin specifically and 76% percent of centralized exchange crypto trading volumes overall. Of these stablecoins, Tether remains king with a whopping 76% of overall stablecoin market share on centralized exchanges. That is it for today’s analysis. Hope everyone has a great day. This was a guest post from Will Clemente, co-founder of Reflexivity Research, on the current state of crypto market structure. You can subscribe to Reflexivity’s research by clicking here. -Pomp |

Older messages

The AI Hype Cycle Learned From Bitcoin Hype Cycle

Tuesday, May 30, 2023

Listen now (4 min) | To investors, Artificial intelligence is now being talked about by the media as much as bitcoin was discussed during the all-time high run of 2021. This is noteworthy because the

Introducing the Bay Area Times

Monday, May 22, 2023

Listen now (2 min) | To investors, Today, we are publicly announcing the Bay Area Times — a new product that uses data and visuals to analyze what is happening across business, finance, and technology

Is Bitcoin The Largest Insurance Company In The World?

Friday, May 19, 2023

Listen now (5 min) | To investors, The concept of an insurance policy is straightforward. A contract is created between a policyholder and an insurer. The contract states that the insurer is legally

Podcast app setup

Wednesday, May 17, 2023

Open this on your phone and click the button below: Add to podcast app

The UK Attacks Bitcoin But Actually Ends Up Promoting It

Wednesday, May 17, 2023

Listen now (3 min) | Note: You all should have received my latest book summary (Excellent Advice for Living by Kevin Kelly) in your inbox this morning. It is under our new book brand — The Bookrat. If

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these