Research: How DWF Labs is Suspected of Involvement in Deploying and Manipulating Memecoins

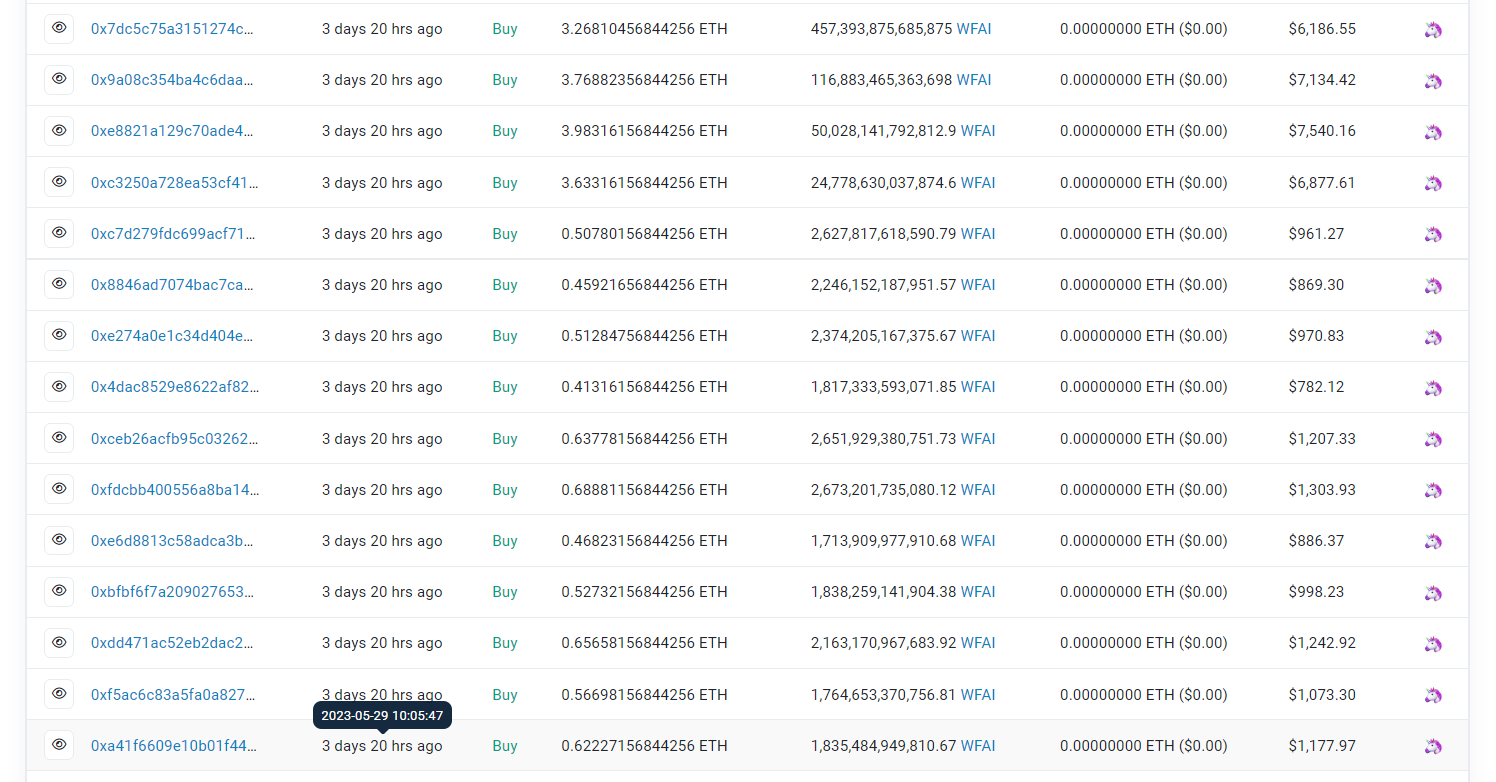

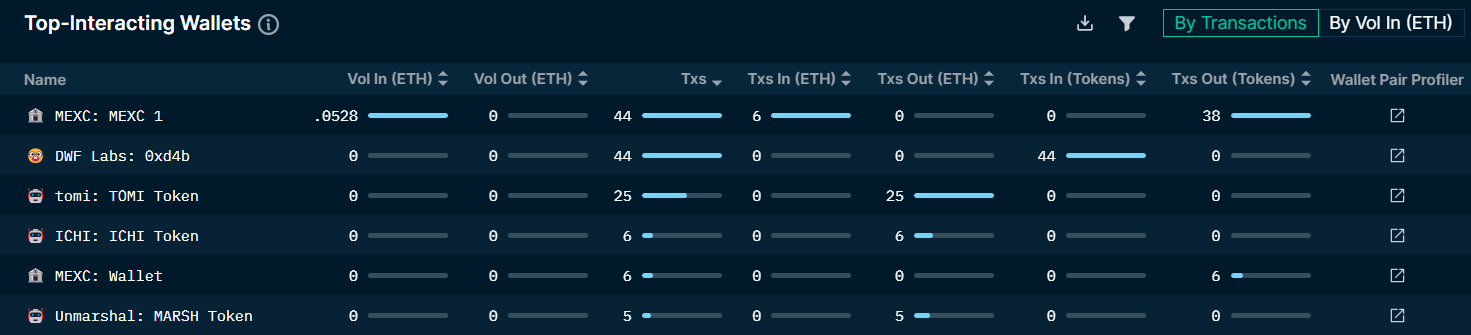

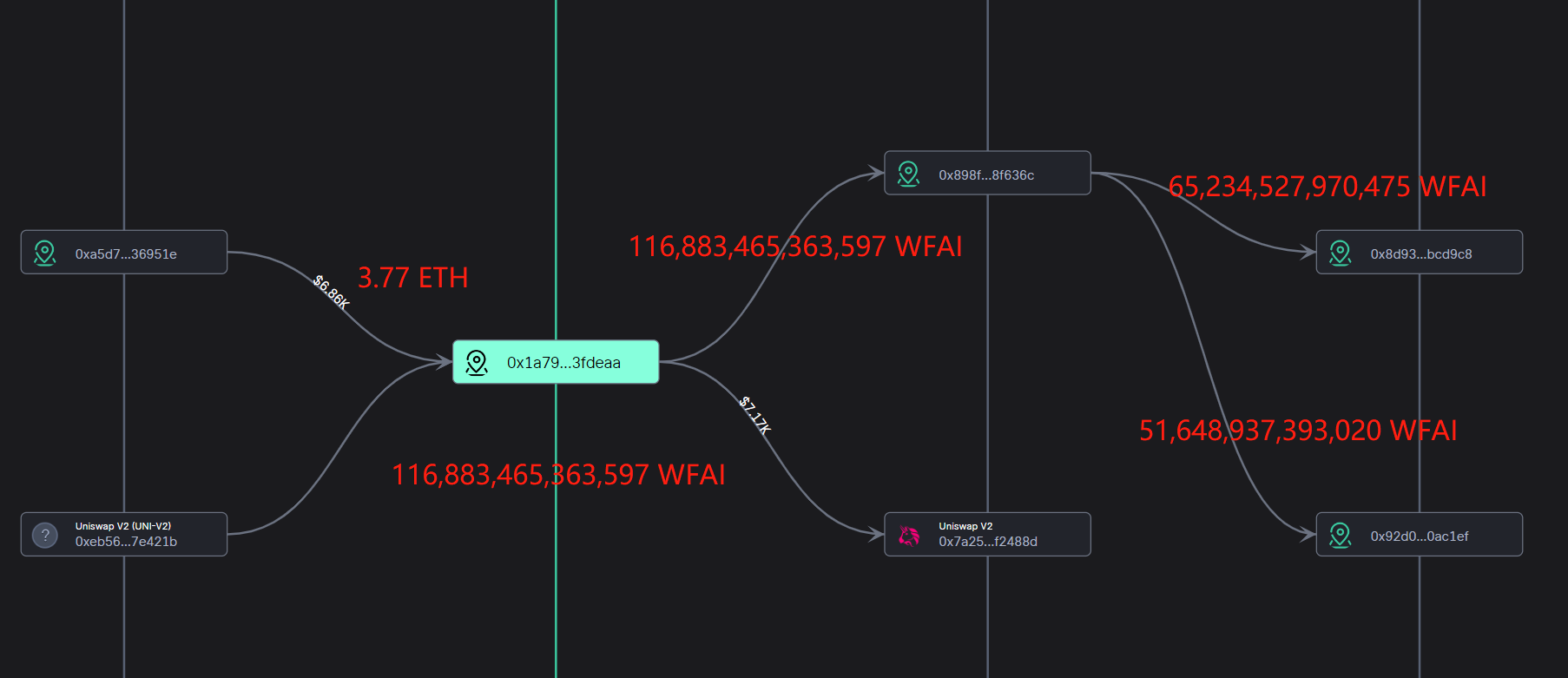

Auhor: @0xMavWisdom Twitter user @ChrisONCT first shared an analysis of DWF Labs' alleged insider trading with Memecoin WFAI (https://twitter.com/ChrisONCT/status/1663261546070278144?s=20). This article is a further study on his Twitter thread. According to the author's research, WFAI is very likely a memecoin that DWF Labs itself deployed and manipulated. (Note: Unless specifically marked, all times are in UTC; all data is up to 22:00 UTC+8 on June 2nd) WFAI, full name WaifuAI, is a Memecoin that uses anime female characters for promotion. It was created on May 25 by WaifuAI: Deployer (0xf2...09cb). The deployer's address is a new address, and the initial funds were transferred from Binance. WFAI has a total supply of 777,000,000,000,000 tokens. According to the tokenomics on the official website, 1% is airdropped to PEPE, LADYS, and SHIB holders, 2% is airdropped to those who have burned PEPE, LADYS, and SHIB, 2% is held in the multisig wallet wfai.eth for ecosystem construction, and 95% is used for liquidity provision and LP Token burning. (In reality, the so-called wfai.eth is actually WaifuAI: Deployer, and it has not owned or ever owned any WFAI.) On May 31st at 21:16 UTC+8, MEXC launched a vote for WFAI's listing and opened deposits. On June 1st at 23:00 UTC+8, MEXC officially launched WFAI trading. The initial liquidity was added on May 29th at 10:05:47. The project team's address (0xbb...83ea) added 738,150,000,000,000 WFAI (95% of the total supply) and 2 ETH as liquidity, and received 38,422,649.57 LP Tokens. On May 30th at 7:36, all LP Tokens were transferred to the burn address Null: 0x00...0000. At the same time when the liquidity was deployed at 10:05:47 on May 29th, 15 addresses simultaneously purchased varying amounts of WFAI, each with a value exceeding 0.4 ETH. It's not hard to guess that these 15 wallets are likely affiliated with the project team. (scroll to the last page: https://etherscan.io/dex?q=0x8a001303158670e284950565164933372807cd48#transactions) Looking up from the bottom: 1. New address: 0x15...c668 spent 0.622 ETH to purchase 1,835,484,949,810 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:59:11, this address transferred 1,835,484,949,600 WFAI to another new address: 0x75...1746b, and has held it ever since, accounting for about 0.23% of the total, which is currently the 23rd largest holder address. 2. New address: 0xe4...f7a6 spent 0.567 ETH to purchase 1,764,653,370,756 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:56:59, this address transferred 1,764,653,370,535 WFAI to another new address: 0x53...b40d, and has held it ever since, accounting for about 0.2271% of the total, which is currently the 25th largest holder address. 3. New address: 0xC7...1a87 spent 0.657 ETH to purchase 2,163,170,967,683 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:55:59, this address transferred 2,163,170,967,541 WFAI to another new address: 0x5d...11eA, and has held it ever since, accounting for about 0.2784% of the total, which is currently the 21st largest holder address. 4. New address: 0x34...ad66 spent 0.527 ETH to purchase 1,838,259,141,904 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:54:47, this address transferred 1,838,259,141,701 WFAI to another new address: 0x61...71bC, and has held it ever since, accounting for about 0.2366% of the total, which is currently the 22nd largest holder address. 5. New address: 0x2f...4a0B spent 0.468 ETH to purchase 1,713,909,977,910 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:53:47, this address transferred 1,713,909,977,800 WFAI to another new address: 0xC8...B21B, and has held it ever since, accounting for about 0.2206% of the total, which is currently the 26th largest holder address. Also, on June 1st at 7:13:11, 0.0028 ETH was transferred to this new address: 0xC8...B21B. 6. New address: 0x57...99c6 spent 0.689 ETH to purchase 2,673,201,735,080 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:52:35, this address transferred 2,673,201,734,830 WFAI to another new address: 0xDB...f16A, and has held it ever since, accounting for about 0.344% of the total, which is currently the 17th largest holder address. 7. New address: 0xa5...951e spent 0.638 ETH to purchase 2,651,929,380,751 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:50:35, this address transferred 2,651,929,380,540 WFAI to another new address: 0x71...2d91, and has held it ever since, accounting for about 0.3413% of the total, which is currently the 18th largest holder address. Also, on June 1st at 7:04:47, 0.0033 ETH was transferred to this new address: 0x71...2d91. 8. New address: 0xC0...d808 spent 0.6413 ETH to purchase 1,817,333,593,071 WFAI, with the initial funds transferred from Binance. Subsequently, at 13:49:23, this address transferred 1,817,333,592,910 WFAI to another new address: 0xba...9820, and has held it ever since, accounting for about 0.2339% of the total, which is currently the 24th largest holder address. Also, on June 1st at 7:04:23, 0.0033 ETH was transferred to this new address: 0xba...9820. 9. New address: 0x5b...7f38 spent 0.513 ETH to purchase 2,374,205,167,375 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:47:59, this address transferred 2,374,205,167,153 WFAI to another new address: 0x83...8aBa, and has held it ever since, accounting for about 0.3056% of the total, which is currently the 19th largest holder address. Also, on June 1st at 7:03:47, 0.0033 ETH was transferred to this new address: 0x83...8aBa. 10. New address: 0xb3...1ed0 spent 0.459 ETH to purchase 2,246,152,187,951 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:43:59, this address transferred 2,246,152,187,731 WFAI to another new address: 0x84...7FCA, and has held it ever since, accounting for about 0.2891% of the total, which is currently the 20th largest holder address. Also, on June 1st at 7:03:11, 0.0034 ETH was transferred to this new address: 0x84...7FCA. 11. New address: 0x18...c4cB spent 0.508 ETH to purchase 2,627,817,618,590 WFAI, with the initial funds transferred from Huobi. Subsequently, at 13:13:35, this address transferred 2,627,817,618,520 WFAI to another new address: 0x73...8549; and on June 1st at 6:18:11, 0.0038 ETH was transferred to this new address: 0x73...8549. At 6:47:35, this new address: 0x73...8549 suddenly transferred 2,627,817,618,310 WFAI to MEXC deposit address: 0x6B...77b8. This MEXC deposit address: 0x6B...77b8 is quite interesting. According to Arkham data, this address has had a close relationship with DWF Labs for two months or even longer. It can be seen that this address has been used as DWF Labs' MEXC deposit address for an extended period. Nansen data also shows that DWF Labs: 0xD4...8342 is the most closely associated address label entity with this MEXC deposit address: 0x6B...77b8. (https://platform.arkhamintelligence.com/explorer/address/0x6B7cD4BE7217626f7d4113ADa9e8e19D81F177b8) (https://pro.nansen.ai/wallet-profiler/counterparties?address=0x6B7cD4BE7217626f7d4113ADa9e8e19D81F177b8) The early entrance to the project, the consistent timing, and almost identical operation logic strongly suggest that they are controlled by the same entity. One of the addresses used DWF Labs' MEXC deposit address when selling, which basically confirms that the entity behind this is DWF Labs, the project team and promoter for Memecoin WFAI. Those addresses that have transferred small amounts of ETH but have not taken any further action are most likely waiting for the right time to transfer the held WFAI to the exchange for sale, similar to the 11th transaction. However, this is not the end; the aforementioned 11 addresses are just the tip of the iceberg. 12. New address: 0x19...3EeA spent 3.63 ETH to purchase 24,778,630,037,874 WFAI, with the initial funds transferred from Binance. Subsequently, at 10:39:11, this address transferred 24,778,630,037,351 WFAI to another new address: 0xd7...A50d, and has held it ever since, accounting for about 3.189% of the total, which is currently the 11th largest holder address. 13. New address: 0x92...dED1 spent 3.98 ETH to purchase 50,028,141,792,812 WFAI, with the initial funds transferred from Binance. Subsequently, at 10:34:47, this address transferred 50,028,141,792,201 WFAI to another new address: 0x94...B04E, and has held it ever since, accounting for about 6.4386% of the total, which is currently the 8th largest holder address. 14. New address: 0x1a...DeaA spent 3.77 ETH to purchase 116,883,465,363,697 WFAI, with the initial funds transferred from Huobi. Subsequently, at 10:31:35, this address transferred 116,883,465,363,597 WFAI to another new address: 0x89...636c. At 12:27, it transferred 65,234,527,970,475 WFAI to a new address: 0x8d...D9c8 and 51,648,937,393,020 WFAI to a new address: 0x92...C1EF. These two transfers addresses for 8.3957% and 6.6472% of the total WFAI supply, respectively, and both have been held since then. These two addresses are currently the 4th and 7th largest holder addresses, respectively. 15. New address: 0xD0...7a21 spent 3.27 ETH to purchase 457,393,875,685,875 WFAI, with the initial funds transferred from Huobi. Subsequently, between 10:29 and 12:58, this address transferred its holdings to four new addresses as follows: (1) 123,546,654,876,145 WFAI transferred to the new address: 0x7c...59BA, (2) 180,645,672,875,629 WFAI transferred to the new address: 0xB1...6bf7, (3) 91,654,734,835,876 WFAI transferred to the new address: 0xbC...5b1b, (4) 61,546,813,098,103 WFAI transferred to the new address: 0x88...bC74. Subsequently, (1) new address: 0x7c...59BA transferred between 11:57-11:58:

(2) New address: 0xB1...6bf7 transferred between 12:07-12:08:

(3) New address: 0xbC...5b1b transferred between 12:14-12:16:

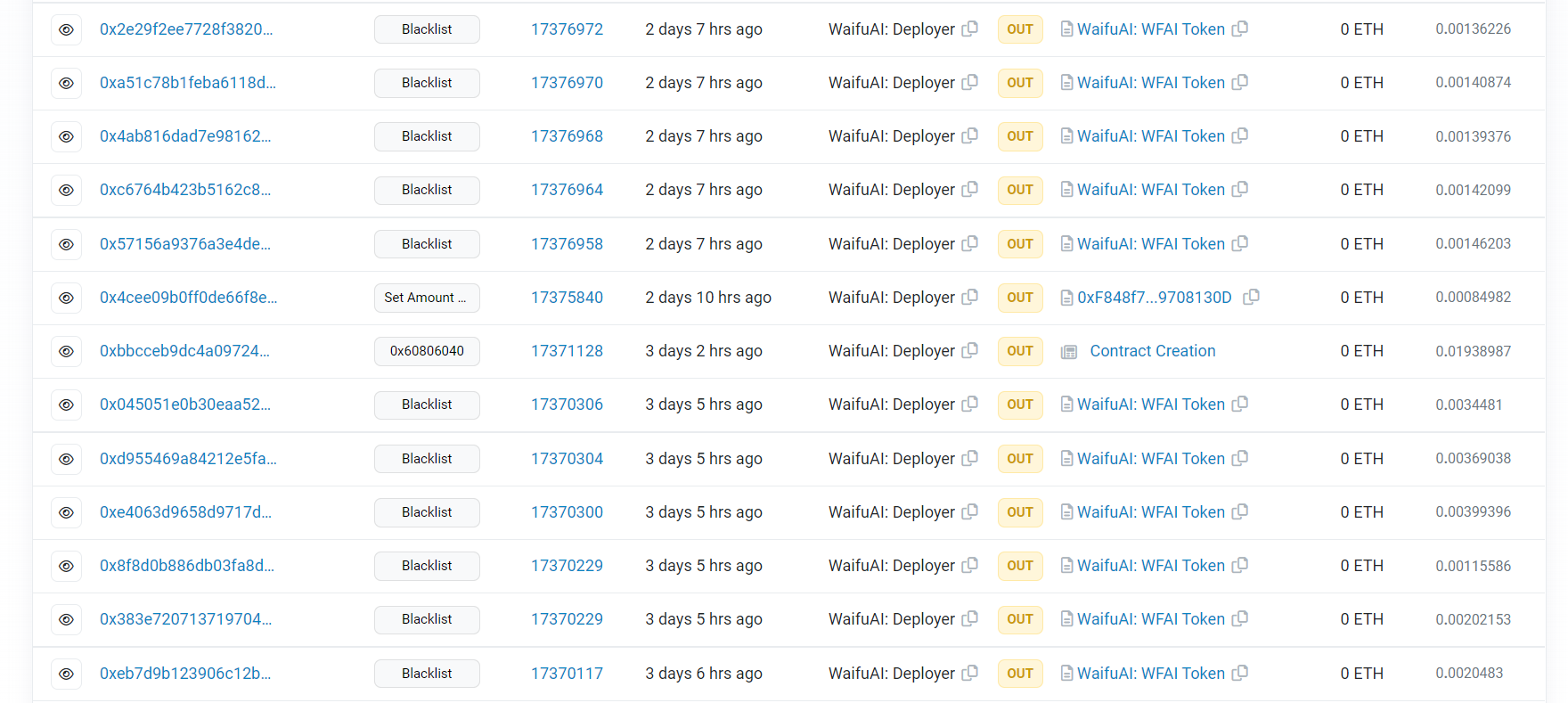

(4) New address: 0x88...bC74 has held its 61,546,813,098,103 WFAI ever since, accounting for about 7.9211% of the total, which is currently the 5th largest holder address. In summary, in these earliest 15 precise transactions, the project party purchased a total of 672,790,230,971,148 WAFI tokens with 20.71 ETH, accounting for 86.6% of the total. In other words, the so-called allocation of 95% to LP is just another way to buy back tokens at a low price for themselves. Excluding the 11th transaction that has already been transferred to MEXC (and most likely has been sold): 2,627,817,618,310 WFAI, the project party currently holds 670,162,413,352,838 WFAI tokens, accounting for 86.25% of the total. These tokens are distributed across 21 addresses, occupying the top 25 largest holder addresses. Continuing: In the 11th transaction, the process from the new address: 0x18...c4cB → new address: 0x73...8549 → MEXC revealed a clue, transferring into DWF Labs' MEXC deposit address, which basically confirms that the so-called WAFI project team is DWF Labs. According to the time of transfer to the exchange, it can be estimated that this 11th transaction generated a profit of around $160,000 (about 85 ETH), which is far beyond the purchase cost of these 15 transactions. In addition, following this DWF Labs' MEXC deposit address, I also discovered another large WAFI transaction apart from these 15 transactions. Its basic logic is the same as the above addresses, starting from a new address, then going through several transfers to this destination. Tracing back on the blockchain, the cost of this transaction was 0.567 ETH to purchase 907,198,513,620 WAFI and then transferred 907,198,513,597 WAFI to DWF Labs' MEXC deposit address after going through intermediary addresses. Therefore, the actual 3,535,016,131,907 WAFI belonging to the project team entered MEXC on June 1st at 15:03. It can be estimated that DWF Labs generated a total profit of about $226,000, which is approximately equivalent to 120 ETH, with a profit margin of almost 5-6 times. (https://etherscan.io/address/0x6b7cd4be7217626f7d4113ada9e8e19d81f177b8#tokentxns) In addition, an interesting point is worth mentioning. After Twitter user @ChrisONCT posted the analysis thread, WFAI announced on its official Twitter account at 15:18 PM UTC+8 on May 31st that they would blacklist 15 large holders occupying 83% of the total supply in their addresses. On-chain data shows that WaifuAI: Deployer (0xf2...09cb) indeed blacklisted 18 addresses, from May 30th 6:49 to May 31st 6:07 (i.e., May 30th 14:49 to May 31st 14:07 UTC+8). However, as we can see from the above tracking, the 11th transaction occurred on June 1st, and almost all subsequent transfers took place on June 1st. This so-called blacklist is more likely to be just a marketing strategy aimed at boosting community confidence. After all, regardless of whether the blacklist is effective, the project team/DWF Labs has already recovered their costs and made multiple profits from these trades. (https://etherscan.io/txs?a=0xf2ac64054a5ff3997b0c604092f6bbc9193b09cb) In addition, DWF Labs' related addresses are also involved. DWF Labs address (0xD4...8342) spent approximately 20 ETH to purchase 624,922,265,863 WFAI on May 30th 10:34-46 UTC and has held them until now, ranking as the 48th largest holder (which would be even higher if the blacklisted supply and holders were excluded). However, their current value is only about 7.5 ETH. Nonetheless, it doesn't matter much, because the costs have been covered, and profits have been made several times over. Furthermore, as most of the supply is held by DWF Labs, they have the power to dump or pump the market in the future according to their will. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

WuBlockchain Weekly: Binance Initiates Workforce Reduction, CNHC Team Unreachable, BKEX Suspends Withdrawals and T…

Friday, June 2, 2023

1. The White House and Republicans Reach a Tentative Agreement on Debt Ceiling Principle link On May 28th, according to CNN, the White House and House Republicans have reached a tentative agreement on

VC monthly report: The financing amount in May reached its lowest point since January this year, with Worldcoin ta…

Friday, June 2, 2023

Author: WuBlockchain According to statistics from RootData, there were a total of 93 publicly announced investment projects in May. This represents a 13% decrease compared to the previous month (107

Analyzing the LSDfi project by Lybra Finance: the interest-bearing stablecoin built on LSD

Thursday, June 1, 2023

Author: @0xMavWisdom Note: This text is for informational purposes only and is not associated with any financial interests or endorsements of the mentioned project. With the continuous increase in ETH

Analyzing Abyss World: Sui Ecology 3A Game, with 120,000 Steam Wishlists, Can It Carry the New Hope of Blockchain …

Thursday, June 1, 2023

Author:@0xMavWisdom The content of this article is for informational purposes only and does not endorse or promote any business or investment activities. Readers are advised to strictly comply with

Dilation Effect Research: Contract Approval Risks in the Main Wallets of Binance, KuCoin, and Jump

Wednesday, May 31, 2023

This article is jointly published by Dilation Effect and WuBlockchain. Original Article Link: https://twitter.com/dilationeffect/status/1663136716662915073 Mainstream exchanges and institutions

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏