Cryptocurrencies in Hong Kong's Recognized Token Indices: Analysis of Index Economics Industrialization

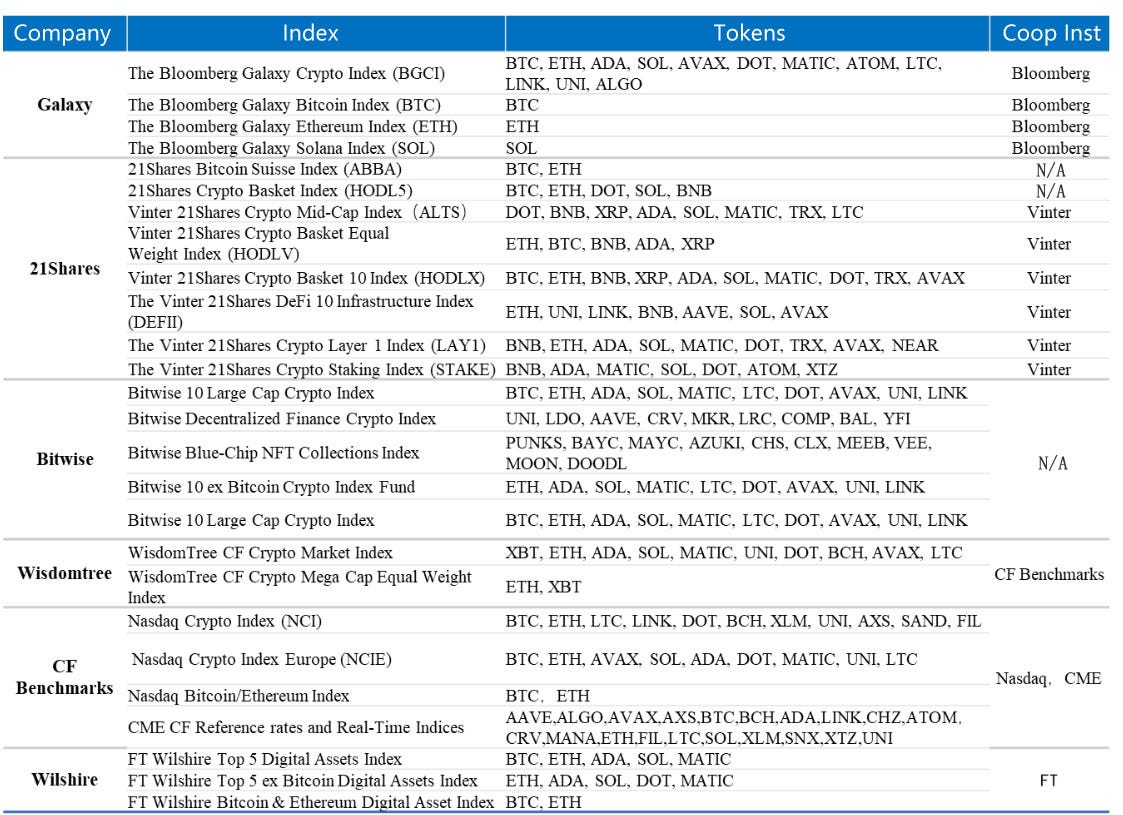

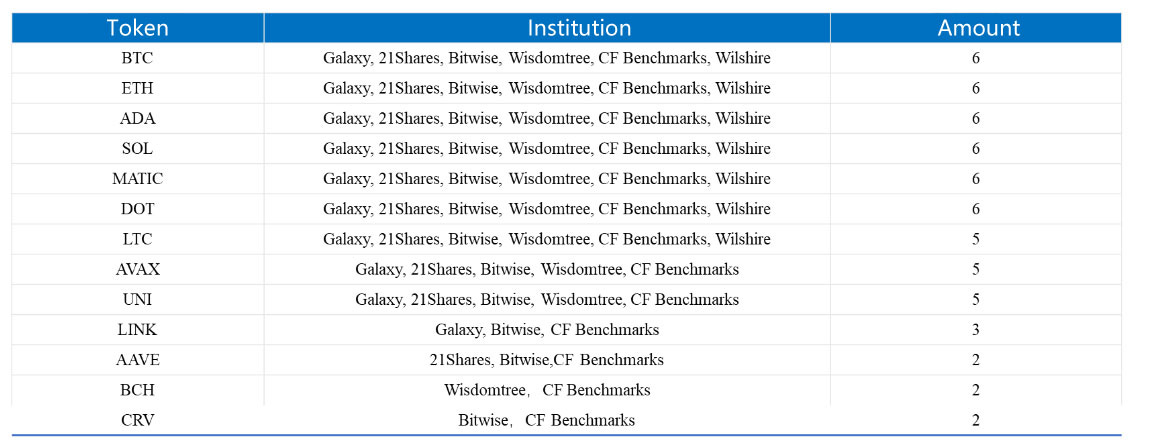

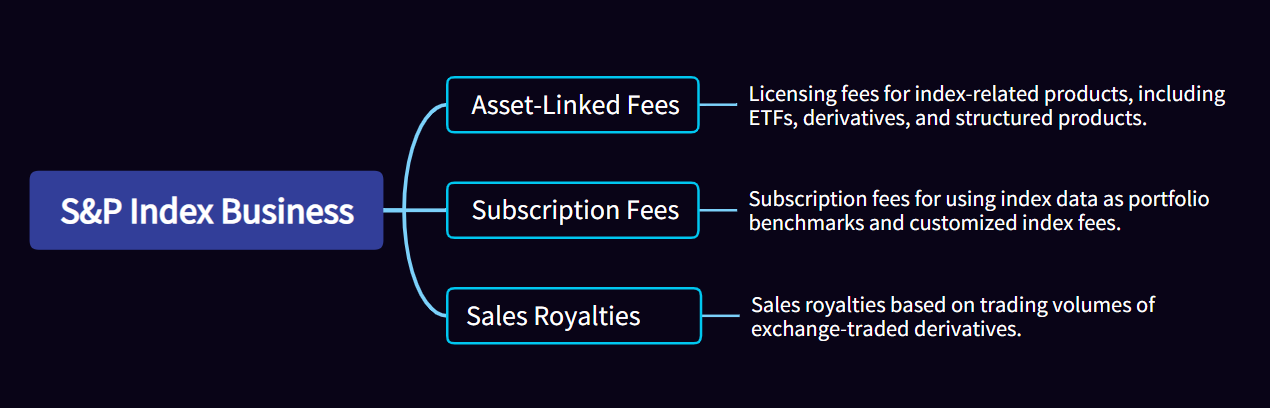

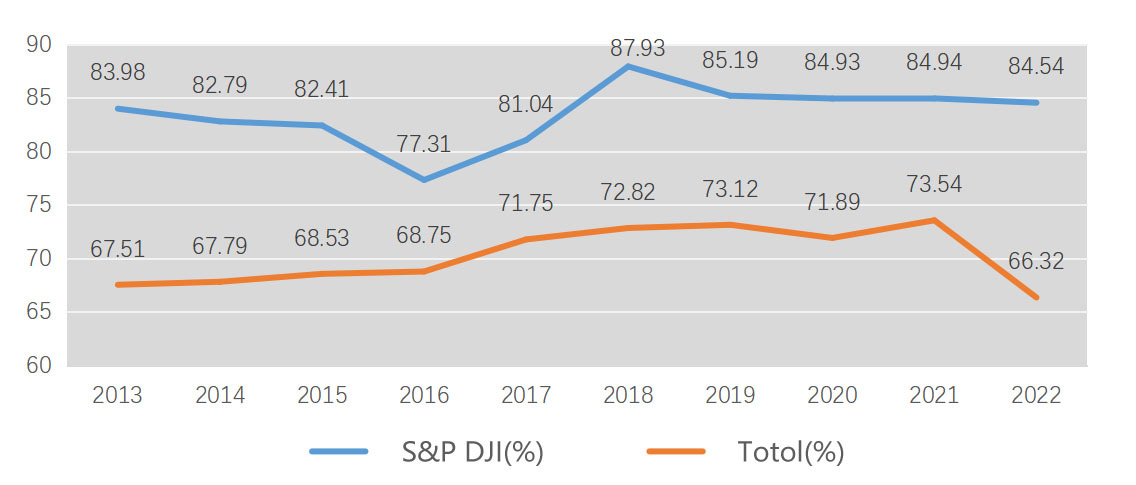

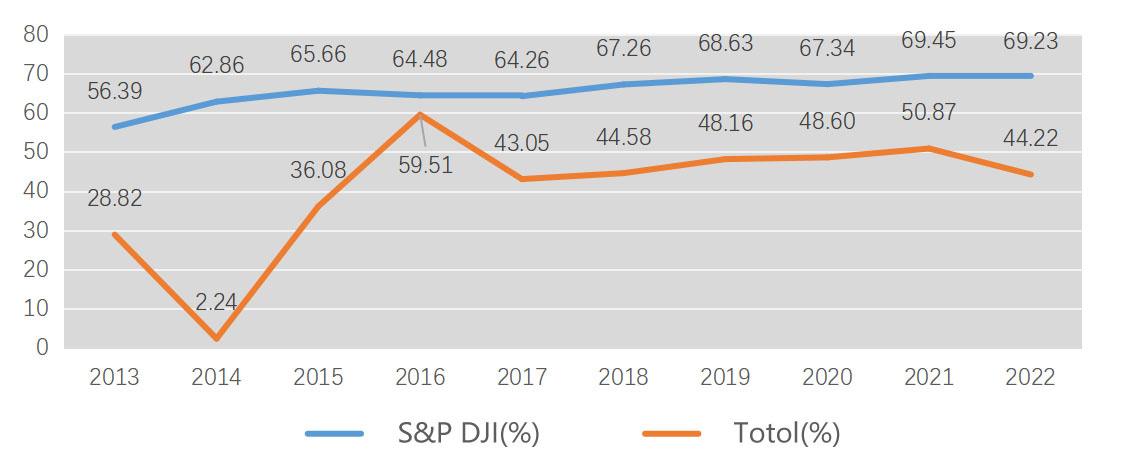

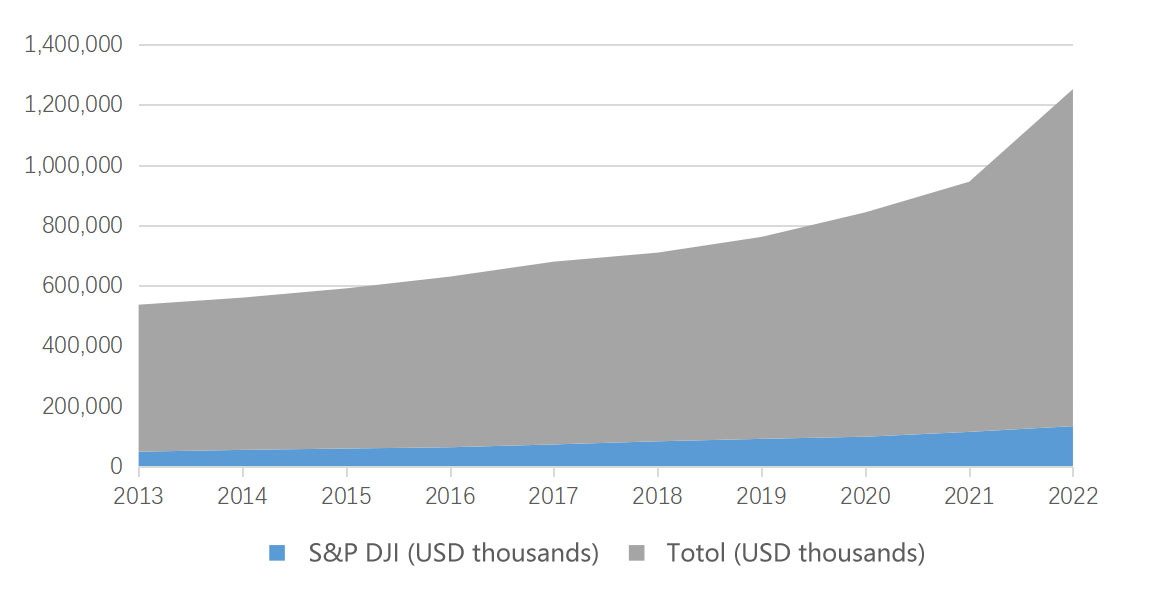

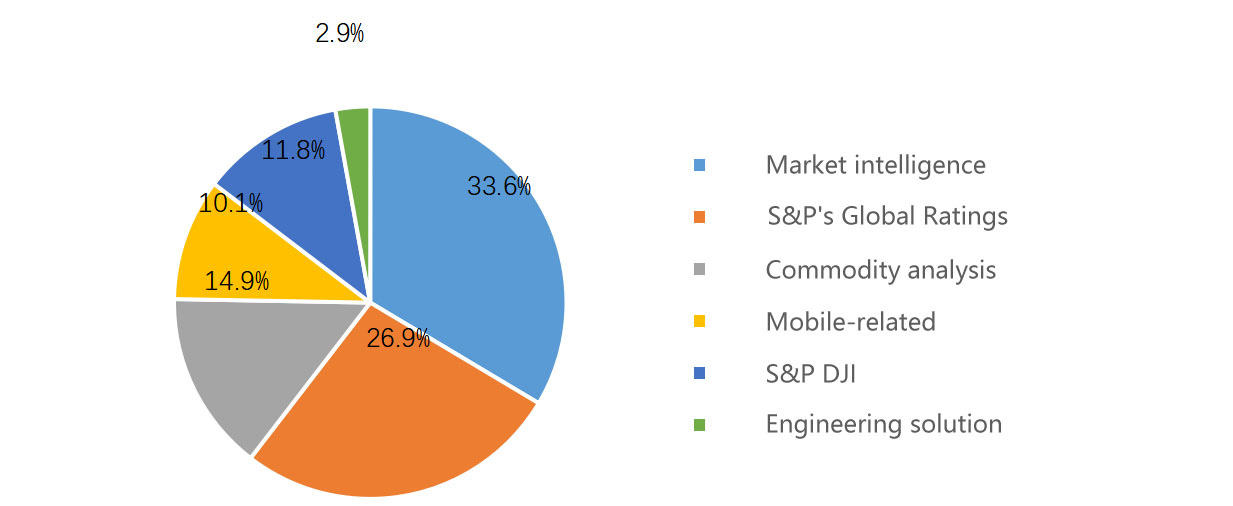

Author: William WuBlockchain authorized release 1. Interpretation of Hong Kong's Virtual Asset Index Policy Since the Hong Kong government released its Web 3.0 vision last year, both traditional institutions and Web 3.0 companies have been paying special attention to the market opportunities it presents. With the recent official finalization of regulatory documents by the Securities and Futures Commission (SFC) of Hong Kong regarding virtual asset trading, the future trends worth noting have become even clearer, and virtual asset indices are one of them. According to the policy document, virtual asset indices have significant strategic importance in Hong Kong's future market. The regulatory requirement states that virtual assets available for retail trading must be included in at least two virtual asset indices launched by at least two accepted index providers. This means that virtual asset indices will serve as the main arbiters for "retail trading class assets." To further clarify which virtual asset indices are qualified and to prevent conflicts of interest, the SFC explicitly points out the following: (1) Virtual asset indices issued by virtual asset issuers and exchanges are not qualified. (2) At least one index should comply with the "Financial Benchmark Principles" and be launched by a company with experience in issuing indices in traditional securities markets. Based on the above regulations, this effectively grants traditional financial companies a kind of "franchise" - virtual assets not included in the indices issued by traditional financial firms are not allowed to be traded with retail investors. So, considering the current virtual asset indices in the market, which virtual assets are potentially allowed to be traded with retail investors? According to the compiled market data, the main institutions currently providing recognized virtual asset indices accepted by the market are Galaxy, 21Shares, CF Benchmarks, Bitwise, Wisdomtree, and Wilshire. Galaxy, in collaboration with Bloomberg, issues virtual asset indices. CF Benchmarks' indices have been widely used on CME and Nasdaq. Wilshire, as a veteran index issuer, currently collaborates with the Financial Times in issuing virtual asset indices. Therefore, the aforementioned three companies can be considered as "companies that comply with the 'Financial Benchmark Principles' and have experience in issuing indices in traditional securities markets." Upon compiling the data, it is found that, in compliance with the SFC requirements, there are currently 13 cryptocurrencies that can be considered as alternative options for retail trading. They are BTC, ETH, ADA, SOL, MATIC, DOT, LTC, AVAX, UNI, LINK, AAVE, BCH, and CRV. However, it does not necessarily mean that all of the above cryptocurrencies will be allowed for retail trading. Assets available for retail trading must meet three conditions: "Exchange due diligence review + qualified large-scale virtual assets + written approval from the SFC." For example, SOL and BCH, given their current operational conditions, may be excluded by the SFC. Table 1. The index distribution in virtual assets Source: Meta Lab Table 2. Alternative available for retail customers trading virtual assets Source: Meta Lab 1. Feasibility Assessment of Virtual Asset Index Business Until today, the development of virtual asset index business remains a new topic for the Web 3.0 industry. This is mainly because index businesses are typically established in compliant and mature markets, serving as market benchmarks and performance indicators. However, the virtual asset market has been in an early and chaotic stage for the past decade, with limited high-quality assets and a lack of asset management institutions, providing an unfavorable environment for index businesses to thrive. Consequently, despite the emergence of numerous start-ups in the virtual asset index space over the past five years, only a few have managed to survive. Now, with the regulatory compliance in the Hong Kong market, especially with the emphasis placed on indices by the regulatory authorities, the virtual asset index business is presented with new opportunities for development. 1. Business Feasibility Analysis As mentioned earlier, due to the immaturity of the virtual asset market, many index start-ups in the past five years have struggled and only a few have survived. The surviving companies can be categorized into two main types: a) Companies that issue asset management products based on the compilation of virtual asset indices. Notable examples include Galaxy, which collaborated with Bloomberg to launch the Galaxy Crypto Index Funds, and 21Shares, which issued a considerable number of virtual asset ETPs. Currently, the majority of companies involved in index business follow this model. b) Companies that integrate virtual asset indices with news and information services. For instance, Wilshire, a well-established index provider, collaborated with Financial Times to publish the FT Wilshire Top 5 Digital Assets Index, which provides market information to readers of the Financial Times. Considering the trend of virtual assets gradually conforming to regulations and being integrated into traditional financial markets, it is expected that the market will not require a multitude of virtual asset indices in the future. The business models will gradually align with traditional market practices, making the index business in traditional securities markets a valuable reference. Taking S&P Global as an example, the company's index business (S&P Dow Jones Indices) currently accounts for approximately 11% of its total revenue. The specific sources of index revenue include asset-based fees, subscription fees, and licensing fees. From S&P's operational performance, the index business exhibits three main characteristics: Firstly, the index business enjoys high gross profit margins and operating profit margins. Taking S&P as an example, over the past decade, the index business of S&P has maintained an average gross profit margin of around 83% and an operating net profit margin of around 65%, surpassing the aggregate industry benchmarks of S&P. The main reason for this is that, excluding inflation factors, the costs of the index business are relatively fixed. As the number of clients increases, economies of scale are formed, leading to a decrease in cost ratios and keeping the profit margin at a high level. Figure 1. After nearly a decade standard &poor's gross margin Source: Wind, Meta Lab Figure 2. Standard & Poor's operating net profit margin in the last decade Source: Wind, Meta Lab Second, index business revenue increment. Over the past decade, S&P's index revenue has grown from $490 million in 2013 to $1.34 billion in 2022. The main reason is that over the past decade, the global size of index funds and ETFs has grown from $1 trillion in 2008 to around $10 trillion by the end of 2022, along with the increase in index-linked fees. Figure 3. Revenue of S&P over the past decade ($10,000) Source: Wind, Meta Lab Finally, there is a limit to the scale of the index business's revenues. According to industry estimates, the index business in traditional securities markets is no more than $10 billion. In particular, even for index leaders such as S&P, the main source of revenue is not index. By 2022, market intelligence and ratings accounted for more than 60% of revenue, while indexes accounted for 11.8%. Figure 4. Business revenue composition of S&P in 2022 Source: Wind, Meta Lab 2. Assessment of the Future Development of Virtual Asset Index Business Looking at the historical development of traditional index businesses, market indices originated in the late 19th century (with the Dow Jones Industrial Average in 1884) primarily as financial indicators providing market information, and their profitability had always been a challenge. It was not until the 1960s that the business model of index business gradually became clear. In the 1970s, the emergence of ETFs and mutual fund products tracking indices marked the transition of indices from investment benchmarks to investment targets, making asset-linked fees possible. In 1993, the effective date of the U.S. SEC's "Final Rule Regarding Performance Presentation and Portfolio Manager Disclosure" required mutual funds to provide specific performance benchmarks to investors and mandated that funds compare their returns to appropriate securities market indices in chart form. This marked the formal recognition of indices as essential benchmarks for evaluating fund performance, and major asset management companies began paying subscription fees to index providers. It can be seen that the maturity of the profit models in traditional securities markets for indices is mainly attributed to the rise of index-related asset management products and regulatory requirements for providing performance benchmarks by the SEC. In the current field of virtual asset index business, institutional clients are still not mature, and the number of institutions is relatively small compared to index clients. Index products are relatively scarce, primarily focused on Bitcoin and Ethereum ETFs. Based on the above realities, the author believes that the future virtual asset index business in the Hong Kong region will have three main characteristics: (1) Currently engaged in virtual asset index business, one needs to be prepared for the non-profitability of this business for the next 3-5 years. The key to its profitability in the future lies in whether the virtual asset derivatives market will be lifted. If the derivatives market is opened to the public, the index will most likely serve as a reference price for derivatives, and royalties can be collected from exchanges or issuers. Alternatively, after the opening of the derivatives market, specialized asset management institutions in the virtual asset field may increase and issue more index-related products. (2) Virtual asset index business should be considered as an ancillary business rather than a core business. As mentioned earlier, companies with index businesses in history, their main business was not index-related, but rather rating and intelligence services. (3) Virtual asset index business is more suitable for traditional financial institutions rather than Web 3.0 start-up companies. The main reasons, in addition to the qualification requirements of the SFC mentioned earlier for index providers, lie in market competitiveness - corporate branding and reputation have a significant impact on the index business. For example, the market credibility and dissemination power of indices released by Bloomberg and start-up companies are self-evident. Of course, index business is a long-term-oriented business. As seen from the analysis of S&P earlier, although the index business faced profitability challenges in its early stages, once the virtual asset market further matures, scale advantages and high-profit margins at low costs are likely to appear under the first-mover conditions. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Weekly Project Updates: Optimism's Bedrock Upgrade, List of EIPs Confirmed for Cancun Upgrade, Curve Founder Accus…

Monday, June 12, 2023

1. ETH's Weekly Summary a. Arbitrum Pays $9 Million in Gas Fees to Ethereum in May link According to Token Terminal data, in May, Arbitrum paid approximately $9 million in supplier fees to Ethereum

CEX Data Report in May: Spot volume declines to the lowest in last 2 years

Monday, June 12, 2023

Data compiled by the WuBlockchain shows that: Spot trading volume on major exchanges fell 28% in May compared to the previous month. The top three changes were Bitget at 7%, Huobi at -7% and Bybit at -

Asia's weekly TOP10 crypto news (Jun 5 to Jun 11)

Monday, June 12, 2023

Author:Crescent Editor:Colin Wu 1. Hong Kong's weekly summary 1.1 Hong Kong Legislator: Welcomes Coinbase and Other Exchanges to Apply for Licenses link On June 10th, member of the Hong Kong

Global Crypto Mining News (May 29 to June 4)

Monday, June 5, 2023

1. Bitmain introduces the Z15Pro with 840 KSol hashrate, 2650 W power consumption and 3.15 KSol/J energy efficiency ratio for EquiHash/Zcash mining, priced at US$2999 a unit; double the hashrate and a

Asia's weekly TOP10 crypto news (May 29 to June 4)

Sunday, June 4, 2023

Author:Crescent Editor:Colin Wu 1. Japan's Weekly Summary 1.1 MUFG, Japan's Largest Bank, to Issue Local Bank-backed Stablecoins on Multiple Public Blockchains link On June 3rd, according to

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏