Research: Two Major Trends in the NFT Marketplace: Multi-function Aggregation and Multi-chain Competition

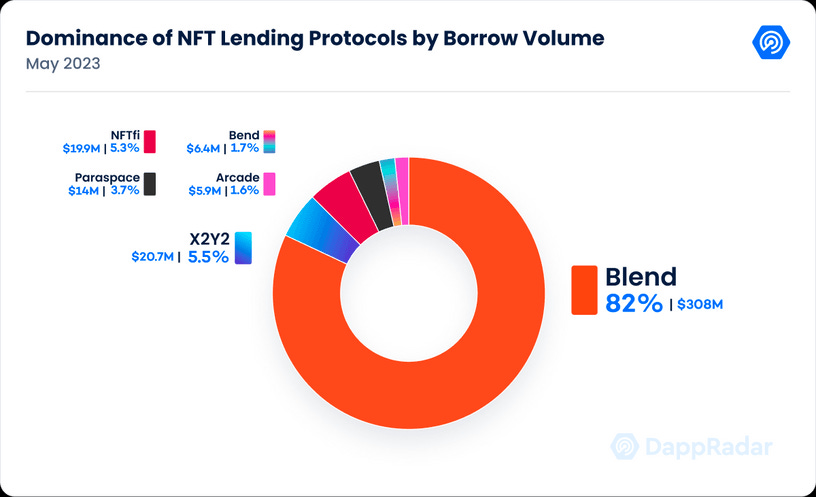

Author: @0xMavWisdom Last month, I took stock of the current situation in the NFT marketplace, including the fierce competition between top-tier platforms like Blur and OpenSea, the struggles faced by LooksRare and X2Y2 with their trading mining approaches, as well as some niche platforms that cater to specific audiences. After experiencing the May hype surrounding Bitcoin Ordinals and the explosive growth of Blend’s lending shares, the future competitive trends in the NFT marketplace have become more apparent. This article will focus on these trends. Trend 1: Multi-functional Aggregation NFT Marketplace Will Become Mainstream As an NFT marketplace, spot trading is the foundation, and providing users with a high-quality and comfortable trading experience is key to market competition. The NFT spot trading functionality has undergone at least two advancements, transitioning from a singular approach to a more diversified one. The first advancement is trade aggregation. Initially, the selling side dominated the trading process, with listings being the basis for trades, and buyer bids being less prominent. Users have gone from the process of selecting and purchasing from individual sellers on a single platform to a process where sellers aggregate listings across multiple markets for buyers to choose from on an aggregation platform. The second advancement is Bid Pool. Bid Pool has brought about a fundamental change in the trading model, where the buyer’s bid becomes a liquidity pool. The buyer relinquishes the decision-making power to the seller, who can choose to continue listing and wait or directly sell it to the buyer through the Bid Pool. Rarity/image differentiation is no longer the primary focus; instead, the significant reduction in trade waiting time takes precedence. Bid Pool was first introduced by Blur, and trade aggregation has also been popularized by Blur. Now, OpenSea/Pro has also integrated these two trade methods, making it difficult for newcomers to bypass them. Open APIs are the new open source, and both emerging and established NFT marketplaces will likely aggregate with each other. Drawing from the concept of liquidity pools in DeFi, there are many areas worth exploring in introducing depth to NFT trading, such as establishing pools based on NFT rarity characteristics. The path of NFT marketplaces is similar to that of centralized exchanges (CEX). Expansion is a powerful means of increasing market influence. After spot trading, leverage is almost inevitable. Currently, there are two paths: one leans towards on-chain DeFi lending, and the other resembles perpetual contracts. For NFT lending, X2Y2 and Blur are the two mainstream NFT marketplaces, with X2Y2 being one of the earliest to establish a lending market. However, unlike X2Y2fi, which has struggled to challenge the dominant lending market for a long time, Blur quickly eroded the existing lending market after introducing Blend. According to DappRadar, since its launch, Blend has accounted for 82% of the total lending volume across all NFT lending protocols in the 22 days since its launch. Moreover, its lending volume is gradually approaching the spot trading volume of Blur. Despite the boost from Blur’s influence, one cannot help but acknowledge that leverage is indeed a lucrative business to increase platform growth, especially during a bear market. Additionally, Binance, as a leading player in the crypto space, although its NFT marketplace has been relatively low-key since its launch, also introduced NFT lending functionality in late May, further validating this trend. (Source: https://dappradar.com/blog/blur-dominates-82-of-the-nft-lending-market) Futures are one of the important hot directions in the current NFT infrastructure entrepreneurship. In the past few months, notable NFT futures protocols such as NFTPerp, NFEX, and tribe3 have emerged. According to the revenue structure analysis of CEX, futures trading is the most significant form of trading contribution, surpassing spot trading. Contract trading offers high leverage and the opportunity to amplify the gambler’s psychology of individuals by betting small to win big. Volatility is the essence of contracts, and for NFT with fewer quantities and lower liquidity than fungible tokens (FT), they tend to exhibit higher volatility. The Blur Bid Pool not only enables instant NFT trading but also, when used in conjunction with futures tools, allows large holders to easily manipulate the floor price of NFT and profit from it. However, from a positive perspective, futures provide ordinary users with the opportunity to enter high-value NFT and serve as a good method for increasing user volume in the marketplace. Currently, there hasn’t been a native NFT marketplace that has launched or integrated a futures market. Additionally, based on the development experience of CEX, platforms like Bitget gradually added spot trading after establishing themselves in futures. Such a path may also be suitable for the NFT marketplace. It’s worth paying attention to whether NFT futures protocols will gradually add spot markets and compete for spot trading market share. LaunchPad is receiving increasing attention from more NFT marketplaces. For example, OpenSea places project launches on its UI homepage, occupying a significant space, and Element introduced equity pass cards EPG/EPS for NFT issuance. There are also dedicated trading markets like Mint Fun focused on LaunchPad. Historically, project launches have often been the responsibility of the project teams themselves. However, if marketplaces can utilize their influence and resources to guide these launches, they have the potential to create more high-quality projects and drive the overall development of the market. The future NFT trading market will be a multifunctional and aggregated one-stop marketplace that combines diversified spot trading (list orders + pools + rarity trading), leverage (lendiing + futures), and LaunchPad functionalities. Trend 2: Multi-chain narrative evolves into a multi-chain war In the past month, we have witnessed the impressive rise of Bitcoin Ordinals and BRC-20. According to CryptoSlam, the NFT trading volume of Bitcoin, including BRC-20, reached $189 million in the last 30 days, with the first ORDI of BRC-20 reaching $40 million. Bitcoin has officially surpassed Solana to become the second-largest NFT trading public blockchain, second only to Ethereum, accounting for nearly 50% of Ethereum’s NFT volume. Currently, besides the native mainstream market UniSat Marketplace, NFT marketplaces like Magic Eden, Element, and OKX NFT Marketplace have integrated Ordinals NFT or BRC-20, or both. Bitcoin NFT have become an undeniable part of the ecosystem. Due to the fact that Ordinals strictly follows the security and rules of the Bitcoin network without relying on any centralized authority, it possesses a natural advantage in terms of NFT storage. Therefore, many communities believe that Bitcoin NFT will be a key driver of the next NFT bull market and will give rise to NFT collections with extremely high net worth. It should be noted that in this article, Bitcoin NFT refer to the combination of Bitcoin Ordinals NFT and BRC-20. There is ongoing discussion regarding whether BRC-20 should be considered a typical NFT or not. This debate may give rise to differentiated characteristics in future NFT trading markets that focus on Bitcoin NFT. Polygon cannot be ignored either. With its almost negligible gas fees and fast transactions, it has become the preferred choice for Web2 companies entering the NFT space. For example, Starbucks launched the Odyssey stamp collection journey for loyal customers based on Polygon, and Platinum Group, a major ticket issuer for Formula 1 races, introduced NFT tickets based on the Polygon chain for global racing events. Currently, many NFT marketplaces are operating on multiple chains simultaneously. OpenSea supports 8 chains, including Ethereum, Polygon, Arbitrum, and Optimism. OKX NFT Marketplace supports 5 chains, including Ethereum, Polygon, Avalanche, BNB Chain, and Bitcoin. Element supports 7 chains, including Ethereum, BNB Chain, zkSync, and Bitcoin, among others. In the assessment of the current landscape, it is also mentioned that multi-chain will be an important narrative during the NFT bear market, as the multi-chain strategy is an inevitable result of competition. When the competitiveness of the main chain is limited or there is insufficient market growth on the main chain, platforms can expand to other chains, leveraging the experiences gained from the competition on the main chain. They can use strategies such as incentives, subsidies, and reputation to challenge other native platforms on those chains and capture market share. This strategy is particularly suitable for smaller marketplaces that are unable to compete effectively on the main chain. As more main chain marketplaces realize this, and expand to other chains, a war to acquire native users on those expansion chains will become inevitable. As the functionality of a single NFT marketplace continues to expand and the multi-chain process accelerates, it fundamentally represents a competition for market dominance and influence. However, there is still a long way to go to truly establish sustainable market pricing power. OpenSea, with its first-mover advantage, defined royalty income for project creators. Subsequent platforms like SudoSwap, X2Y2, and Blur launched zero royalty initiatives, which weakened OpenSea’s influence but failed to explore other sustainable income paths for project creators and artists. Blur introduced the Bid Pool, enabling instant NFT trading, but it ended up being a tool for market manipulation by NFT whales, leading to a situation where ordinary users felt powerless and had no choice but to endure and exacerbate the continuous loss of NFT users. On the other hand, it is important for multiple stakeholders, such as marketplaces, to participate in defining industry standards and regulations to inject new vitality into the market. For example, UniSat introduced the BRC-20 protocol to the Ordinals market, triggering the explosion of Bitcoin NFTs. The launch of the Metaplex protocol also helped bring together the fragmented Solana NFT community. Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

WuBlockchain Weekly: Federal Reserve Announces Pause in Interest Rate Hikes, Judge Rejects Freezing Binance Assets…

Tuesday, June 20, 2023

1. US Macro Economic Information a. Federal Reserve Announces Pause in Interest Rate Hikes link On June 15th, the Federal Reserve announced a pause in interest rate hikes for the month of June, marking

Weekly Project Updates: Uniswap Releases v4 Code Draft, Polygon Announces Launch of Polygon 2.0, etc

Tuesday, June 20, 2023

1. ETH's Weekly Summary a. Ethereum Foundation Announces Q1 2023 Donation Projects and Allocation Details link On June 15th, the Ethereum Foundation announced the recipients and allocation of funds

Asia's weekly TOP10 crypto news (Jun 12 to Jun 18)

Tuesday, June 20, 2023

Author:Crescent Editor:Colin Wu 1. Mainland of China's Weekly Summary 1.1 Shanghai Science and Technology Commission's Action Plan for Metaverse-related Technology Research link On June 14th,

Global Crypto Mining News (Jun 12 to Jun 18)

Tuesday, June 20, 2023

1. According to Bitcoin miner and hosting provider Blockstream CEO Adam Back, the crypto industry will eventually find a way around, even in the face of regulatory pressure. Once an exchange shuts down

Policy Rollout: Decoding the 'Transitional Arrangements' for Hong Kong Cryptocurrency Platforms

Tuesday, June 13, 2023

Author: Lawyer Gilbert Ng and Chris Lee WuBlockchain is authorized by the author to translate and publish. Gilbert Ng, founder of consultancy firm Mura and practicing lawyer in the High Court of the

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏