Earnings+More - US iCasino supply: the $2bn opportunity

US iCasino supply: the $2bn opportunityThe US iCasino supplier sector examined, AI in gaming, recent analyst takes +MoreGood morning. Welcome to the latest Due Diligence, which this month focuses on the iCasino supply side. In a recent note, the team at JMP suggested that the bull case for suppliers in the US could be up to $2bn and gave a handy rundown of the landscape of a sub-sector likely to see huge change in the coming years.

I'm looking for a partner, someone who gets things fixed. Content is King‘Good games make money,” suggests the team at JMP. iDemand: The content creators within the iCasino sub-sector saw revenue gains that outstripped all other sub-sectors within the consumer discretionary space as suppliers continued to benefit from strong revenue growth in the US.

Young at heart: iCasino operations notched up growth of 36% in 2022 to reach over $5bn in revenue but, as the analysts suggest, the market remains in its infancy and the demand for more new content is evident.

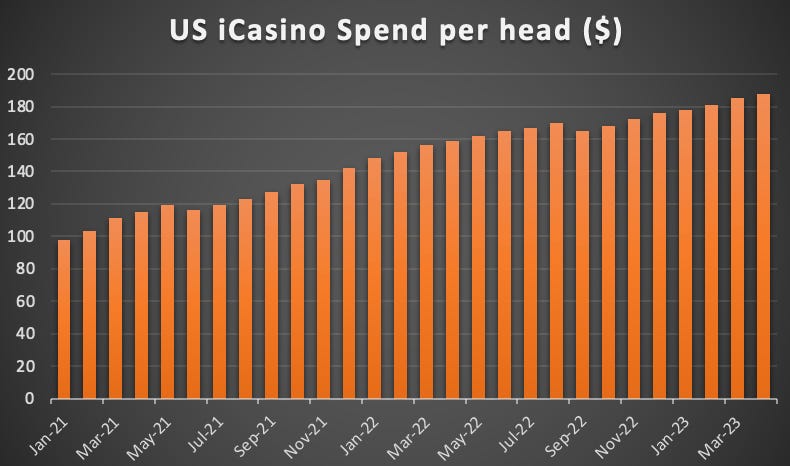

Where are we now: In 2022, US iCasino generated GGR of $5.4bn and has demonstrated a 15% CAGR since 2013. Notably, as consumer awareness has grown, spend per head has almost doubled to $188 in the last two years. 🎰 US iCasino spend per head Source: JMP The race to $2bn: Based on a high-single-digit margin, JMP detailed their Bull, Base and Bear estimates for the size of the supply potential.

** SPONSOR’S MESSAGE ** The Huddle Journal: During NBA Finals Huddle outperformed competitors with superior reactivation rates, proving their market strength, and validated that Huddle is market leader when it comes to pricing.

Explore more: https://huddle.tech/unveiling-huddles-remarkable-statistics-a-recap-of-the-thrilling-nba-finals/ Growth thru M&AMulti-ball: Against the backdrop of the desire for ever more content, it is not surprising that, as the JMP team points out, M&A within the supply space tends to be in the region of 20x EBITDA vs. the 8x EBITDA that companies generally trade at.

Where the wild things are: The report details many of the larger players in the iCasino space, from large land-based entities that have branched out into the online arena to the online endemic providers that dominate in slots and live-dealer.

The big suppliers

The content suppliers

Multiplication tables: The potential for multiple combinations of any of the above appear very high, given recent news around Aristocrat’s $1.2bn bid for NeoGames – which includes the iCasino supplier PariPlay – and IGT’s announcement that it was undertaking a strategic review, which includes the possibility of a sale of its digital division. Live and let liveLust for live: Live dealer is set to be a key battleground. JMP notes that as it stands Evolution almost has the market as a lock. “But it is evident that resources are being allocated to develop the technology for this product from other operators in the market.”

Clear intent: It's worth noting recent comments from MGM Resorts CEO Bill Hornbuckle on the subject of live dealer. Talking about areas for potential M&A during the Q1 earnings call, he signaled the company’s interest in the area.

Mind the generation gap: As part of its report, JMP conducted a survey of industry executives and among its takeaways is that the sector is worried about the younger generation not being interested in slots. AI comes to gamingThere are multiple touchpoints for how advances in AI will intersect with the gaming sector. Artificial energy: The gaming and betting sector is not immune from the fervor surrounding the latest advances in AI and it has prompted the team at Jefferies to put forward a number of predictions for where the technology will impact future operations.

In reel time: The team suggests a further application on the slot floor where they say the machines will be designed to make decisions about individual customers in real time.

Appliance of science: What Jefferies fails to mention in the report is the abundant AI applications being discussed in terms of sports betting. Data supplier Sportradar, for instance, has been busy deploying AI across various aspects of their businesses from its Managed Trading Services division through to sports-data collection and sports integrity. ** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. Entain revoltEminence Capital’s complaints on strategy hit a nerve. Strategic misdirection: The complaint from the 2% shareholder over the STS acquisition announced last week is “likely to catalyze closer scrutiny of Entain’s strategy and capital allocation,” said the team at Jefferies.

Straw in the wind: Eminence said in its letter that until now it had been supportive of the company’s M&A strategy, but with the crucial caveat that deals should be financed with the lowest possible sources of investment.

Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery: The specific charge relates to the multiple of the STS acquisition, which was completed at ~12x EBITDA. This compares with Entain’s own current EBITDA multiple of 7%.

Analyst takesBetMGM: Following a meeting with management, Deutsche Bank analysts said while the JV has been very successful, notably in “healthily profitable” iCasino, the structure with Entain “needs to be reconciled”, which is “something both sides continue to contemplate”.

Genius Sports: With two years remaining on its NFL agreement, JMP said Genius is “confident” that, with its Second Spectrum offering bringing “value-enhancing” elements, it will be “increasingly difficult” for the league to look to another data provider. Aristocrat: Macquarie said in late May that the move for NeoGames will be a knockout bid and will easily achieve the needed 67% approval from shareholders. ** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand? Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

M&A extra: Entain buys STS

Tuesday, June 20, 2023

Entain raises £600m to fund Polish bookmaker buyout, OpenBet buys Neccton, IGT slots consortium emerges +More

Activists pile pressure on 888

Tuesday, June 20, 2023

Activist investor ups 888 stake, Betsson acquires betFIRST, Entain's share drop, sector watch – sports streaming +More

DraftKings ignites PointsBet bidding battle

Tuesday, June 20, 2023

Fanatics bid faces competition, New York data, Entain shareholder revolt, Gambling Files ep 100, startup focus is ClearStake +More

Regtech roll-up gets a push

Tuesday, June 13, 2023

The potential for M&A in the gambling regtech space, recent transactions, M&A chatter +More

Exclusive: FS seeking to install Alexander as 888 CEO

Monday, June 12, 2023

Investor group's plans to grab control, BetMGM future discussed, IGT's sales options, startup focus – First Pitch Canada +More

You Might Also Like

+300% more shares (1 change)

Wednesday, March 19, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

What’s Ola Hiding?

Wednesday, March 19, 2025

+ Even big companies such as Hindustan Aeronautics Limited (HAL) are falling for cyber fraud. Meanwhile, Mumbai airport plans tariff hikes that could make flying out of the city more expensive.

Join Jason Lemkin and Sam Blond for Workshop Wednesday!

Tuesday, March 18, 2025

LIVE Wednesday, March 18th at 10AM To view this email as a web page, click here workshop wednesday Live TODAY Hey SaaStr Fans, SaaStr Workshop Wednesdays is back again tomorrow and we've got an

😬Weeping and gnashing of teeth

Tuesday, March 18, 2025

Our paid ads team tests a Reddit strategy View in browser Masters In Marketing In a seismic time for SEO marketing, an unlikely winner emerged last year: Reddit. And while nobody seems happy about that

🤯 Get your business up and running faster with AI

Tuesday, March 18, 2025

Discover the AI tools you should start using. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Only 3 spots!

Tuesday, March 18, 2025

Agency owners have been asking for this for a long time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$164,449 In 15 Days (His side-income SECRET)

Tuesday, March 18, 2025

5-step action-plan to build a brand-new "side-income" View in browser ClickBank Hi there, This Friday (21st March) a top ClickBank client is running an online Strategy Lab where he'll

Canadian Ecom Seller? A New Course Just for You

Tuesday, March 18, 2025

How independent agencies are staying ahead of the curve

Tuesday, March 18, 2025

Elevating growth amid surging demand for digital media

It's time to bet on emerging platforms

Tuesday, March 18, 2025

Tips to keep your brand adaptable and embrace change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏