Earnings+More - DraftKings gains ground

DraftKings gains groundDraftKings makes market share gains in May, overround analysis looks at what the bookies are doing in the off-season, plus recession rumblings +MoreGood morning. The latest edition of The Data Month looks at the market shares of the leading contenders in May and suggests DraftKings is taking share from those below it in the rankings.

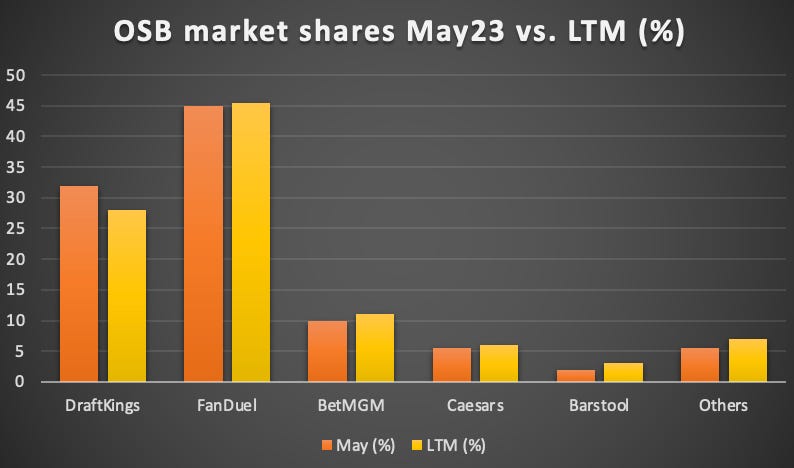

DraftKings’ gainsThe latest OSB data for May suggests DraftKings is taking share from those below it in the rankings. Stealing a march: A comparison between market shares for online sports betting in May compared with the last 12 months figures indicates DraftKings has made gains at the expense of operators below it in the rankings.

👑 DraftKings is stealing market share No. 1 in heaven: Recent data from Massachusetts and New York also suggests DraftKings is starting to eat into FanDuel’s market leadership.

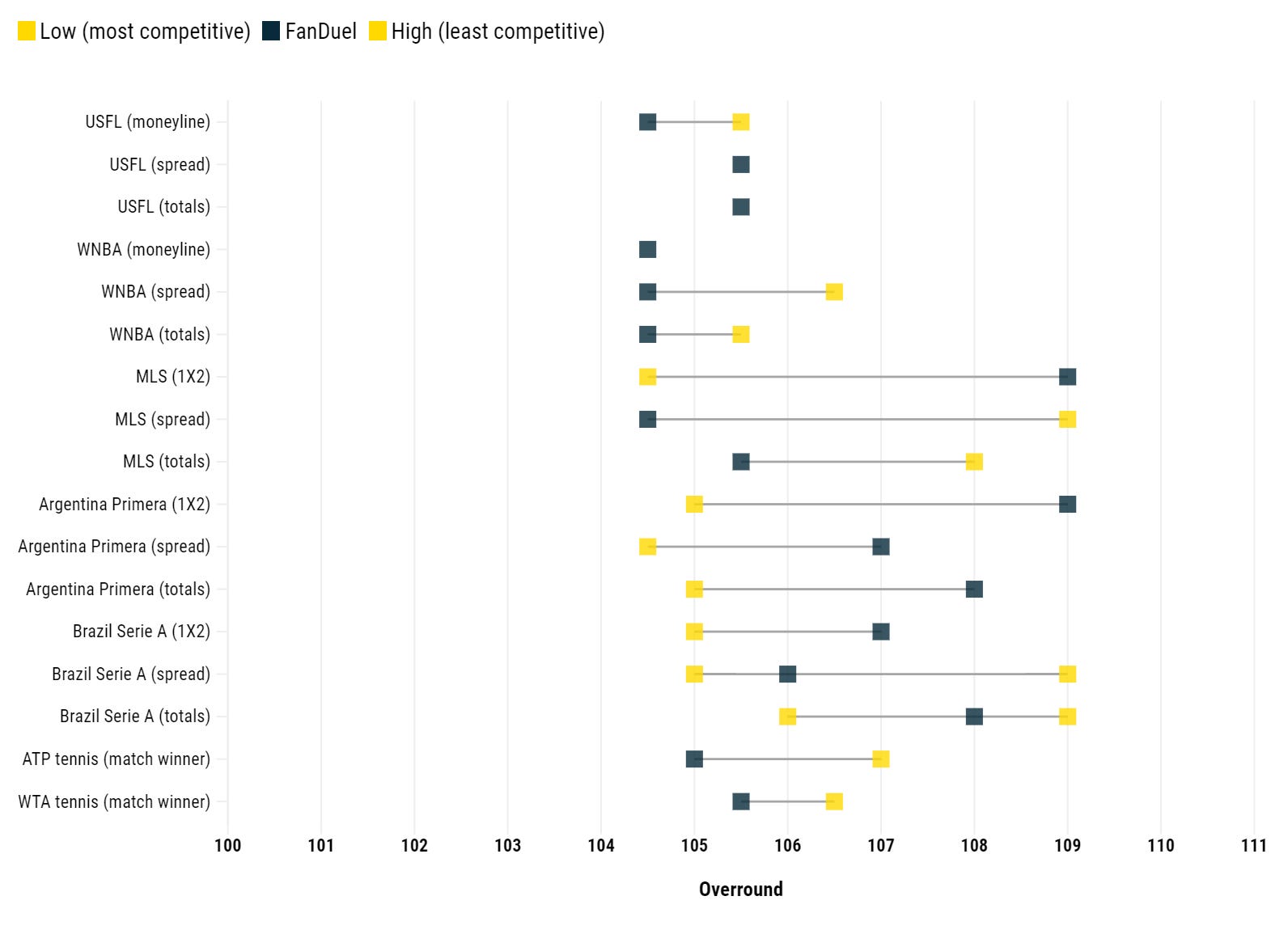

** SPONSOR’S MESSAGE ** Tried, tested and proven over a decade in the highly-regulated US market, and continuing to expand across Europe, Latin America, Asia and Africa. GeoComply harnesses the power of its market-leading geolocation technology to protect against fraud, including fake account creations, bonus abuse, account takeovers, stolen identities, money laundering, and more. Visit geocomply.com. Price pointsThere is a surprising amount of uniformity on pricing – and therefore margin/vig taken – on non-core competitions in the US sporting calendar, according to Propus Partners. Face in the crowd: Market leader FanDuel does not have stand out pricing or aggressively low margins on most events, according to data analysis from Propus Partners. Margin comparison

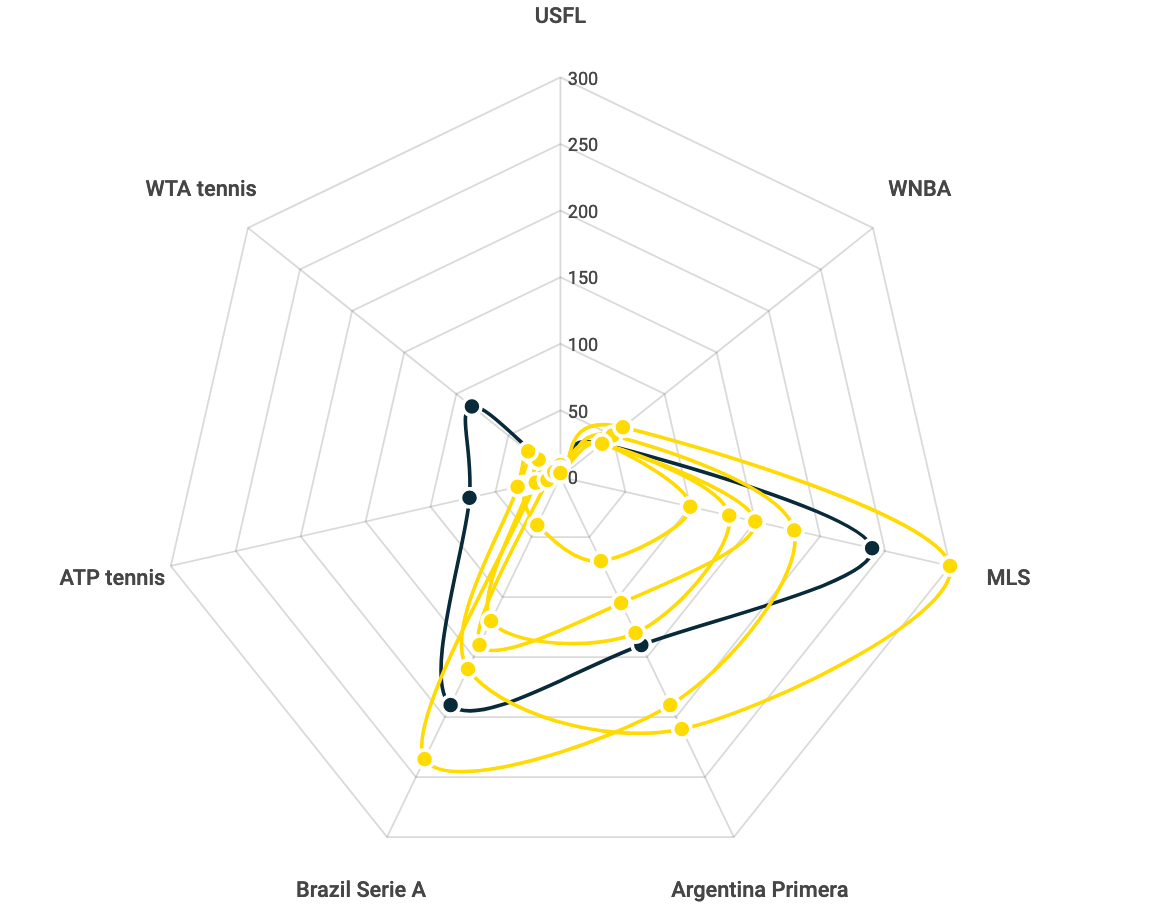

🥊 FanDuel vs. the rest on overrounds Markets per eventSample size: The chart below shows the total number of markets available for each event within the sample of competitions. Note, each bookmaker groups markets in different ways, so Propus has used a standardised approach for fair comparison.

🕷️ Where FanDuel sits in terms of number of markets FanDuel vs. the marketSelectively aggressive: Propus argues that the above data shows FanDuel (blue line) does not have a particularly aggressive pricing policy, from this sample anyway, and while market sets are strong, so are those of key competitors. It leads then to ask what else, from a product perspective, has led to the market-leading position?

Note: Data was taken across seven different competitions from six leading US sportsbooks from the week commencing June 12. All data was taken pre-match. Analysis in future editions will take deeper dives into price position by selection (i.e., how margin is weighted) and current bet builder/SGP product positions. ** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Recession watchThe resumption of student loan repayments could provide another headwind for the consumer. Bloody students: Student loan repayments in the US could add ~$6bn of further pressure on consumer spending, adding further uncertainty to the gaming sector backdrop and posing particular risk for digital operators, according to Wells Fargo.

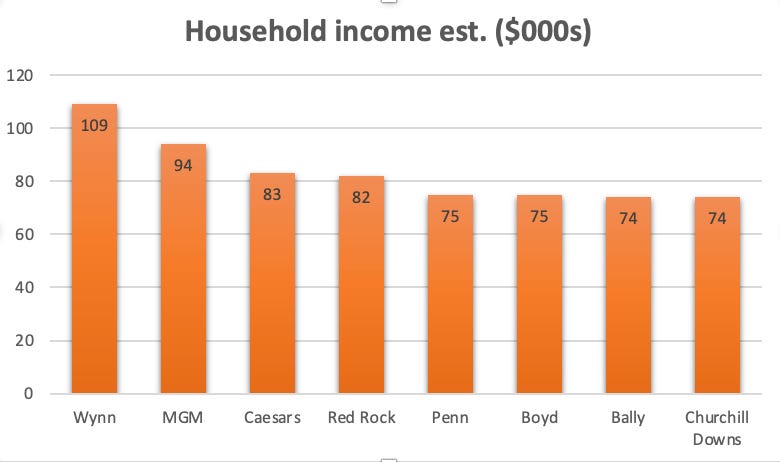

Penn push: Highlighted as being particularly vulnerable is Penn Entertainment, which has made much of its attempts to attract a younger demographic to its properties. Helped along by the Barstool acquisition, Penn has seen a steady increase in revenue from younger cohorts, up to over 18% vs. under 13% in 2019.

🎓 Income disparity: customers on the Strip earn more Data pointsUK large licensees: Looking at the most recent data from the UK Gambling Commission, the team at Regulus points out there are shifts taking place in market share dynamics rather than a sagging overall market.

Tail on the donkey: The team argues that comparing this data with the recent earnings commentary from the listed players, it is fair to suggest that Entain and William Hill/888 “lost material share”.

The growth in gaming was more lackluster at ~0.3% QoQ and down 4.8% YoY, a market situation that Regulus ascribes to dampened levels of recycling from betting, the effect of extra RG measures and, again, the long tail taking meaningful market share.

Domination game: Last week, E+M reported how FanDuel, DraftKings and BetMGM continued to dominate in OSB in New Jersey, Pennsylvania and Michigan in May, with joint market shares of between 81% and 90%.

** SPONSOR’S MESSAGE ** Existing sports-betting technology and services can be built better for operators. At Metric we’re changing the game by doing things differently, so our customers can too. Inspired to solve the problems and surpass the limitations of existing systems, we’ve employed modern technology and processes to build a ground-breaking sportsbook solution that can handle the needs of any modern operator – whatever they are. Contact us to find out more. Calendar

An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

PointsBet bidders were in ‘merger talks’

Monday, June 26, 2023

DraftKings/Fanatics report, Genius EPL extension, another New York entrant, startup focus – Split the Pot +More

OSB dominance comes in threes

Friday, June 23, 2023

Big states May data examined, Bally's Rhode island opportunity, Better Collective's impressive 2023 shares performance +More

US iCasino supply: the $2bn opportunity

Tuesday, June 20, 2023

The US iCasino supplier sector examined, AI in gaming, recent analyst takes +More

M&A extra: Entain buys STS

Tuesday, June 20, 2023

Entain raises £600m to fund Polish bookmaker buyout, OpenBet buys Neccton, IGT slots consortium emerges +More

Activists pile pressure on 888

Tuesday, June 20, 2023

Activist investor ups 888 stake, Betsson acquires betFIRST, Entain's share drop, sector watch – sports streaming +More

You Might Also Like

Join Jason Lemkin and Sam Blond for Workshop Wednesday!

Tuesday, March 18, 2025

LIVE Wednesday, March 18th at 10AM To view this email as a web page, click here workshop wednesday Live TODAY Hey SaaStr Fans, SaaStr Workshop Wednesdays is back again tomorrow and we've got an

😬Weeping and gnashing of teeth

Tuesday, March 18, 2025

Our paid ads team tests a Reddit strategy View in browser Masters In Marketing In a seismic time for SEO marketing, an unlikely winner emerged last year: Reddit. And while nobody seems happy about that

🤯 Get your business up and running faster with AI

Tuesday, March 18, 2025

Discover the AI tools you should start using. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Only 3 spots!

Tuesday, March 18, 2025

Agency owners have been asking for this for a long time ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

$164,449 In 15 Days (His side-income SECRET)

Tuesday, March 18, 2025

5-step action-plan to build a brand-new "side-income" View in browser ClickBank Hi there, This Friday (21st March) a top ClickBank client is running an online Strategy Lab where he'll

Canadian Ecom Seller? A New Course Just for You

Tuesday, March 18, 2025

How independent agencies are staying ahead of the curve

Tuesday, March 18, 2025

Elevating growth amid surging demand for digital media

It's time to bet on emerging platforms

Tuesday, March 18, 2025

Tips to keep your brand adaptable and embrace change ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Elon vs. Sora

Tuesday, March 18, 2025

Google's Veo 2 is in the race too!

The secret to CTAs that convert

Tuesday, March 18, 2025

Your call-to-action (CTA) is the final push that turns visitors into customers. But if it's weak, unclear, or generic, you're leaving money on the table. The best CTAs don't just say “Buy