WuBlockchain - In-Depth Analysis of Airdrop Hunters

This article is jointly published by X-explore and WuBlockchain. Since Uniswap began using airdrop strategies to reward its early users in 2020, airdrops have sparked a huge craze in Web3. Influenced by this, numerous projects have seen a surge in people hunting for the next "free lunch" (looking for new airdrop projects). Now, nearly three years have passed since Uniswap's airdrop, and during this time many large projects have followed suit, using airdrops to reward users or attract attention. According to estimates from X-explore, over 20% of the airdrops in Arbitrum's airdrop in March this year were claimed by so-called "free riders" who use Sybil attacks. Therefore, we hope to answer the following two questions through a deep analysis of users who have successfully claimed multiple airdrops:

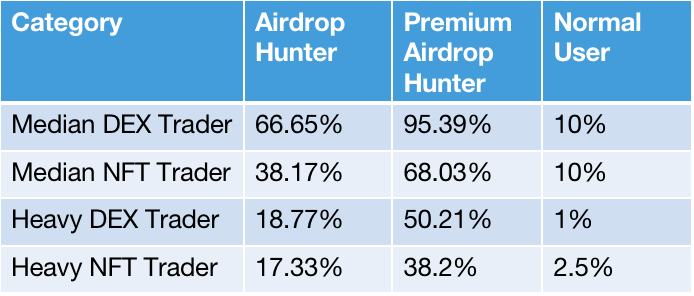

To answer the above questions, among the myriad of Ethereum and its layer 2 projects, we have carefully selected five projects with "over 100,000 airdrop claim addresses" and "total airdrop value exceeding $140 million". These are Uniswap, ENS, Optimism, Blur, and Arbitrum. We will delve into the users of these five projects in the following articles, with particular attention to the "expert" users who have received multiple airdrops from these projects. Note: The basis for calculating coin prices in this article is data from CoinMarketCap as of June 7, 2023. Most of the screenshots in the article are from June 14, 2023, so the prices may be slightly different, please forgive any confusion this may cause. Who are the Airdrop Hunters?We define addresses that have received at least three airdrops out of the five projects as Airdrop Hunters. Those that received three to four airdrops are classified as Standard Airdrop Hunters, while those that received all five airdrops are named Premium Airdrop Hunters. In this analysis, we found a total of 34,547 Standard Airdrop Hunter addresses, with an average airdrop income per address of $9,384 and a median airdrop income per address of $6,497. As for Premium Airdrop Hunters, we found a total of 932 addresses, with an average airdrop income per address of $18,935 and a median airdrop income per address of $14,288. Judging from the average and median income, the term "premium" is indeed fitting for the Premium Airdrop Hunters. 1. X-explore Address Tag AnalysisTo better reveal the characteristics of Airdrop Hunter addresses, we combined X-explore's proprietary on-chain label system and conducted an in-depth analysis of the above addresses in terms of behavior, assets, activity level, and trading profitability. We found that, whether they are Standard Airdrop Hunters or Premium Airdrop Hunters, their trading volumes on Decentralized Exchanges (DEX) and Non-Fungible Tokens (NFT) far exceed those of ordinary (normal) users.

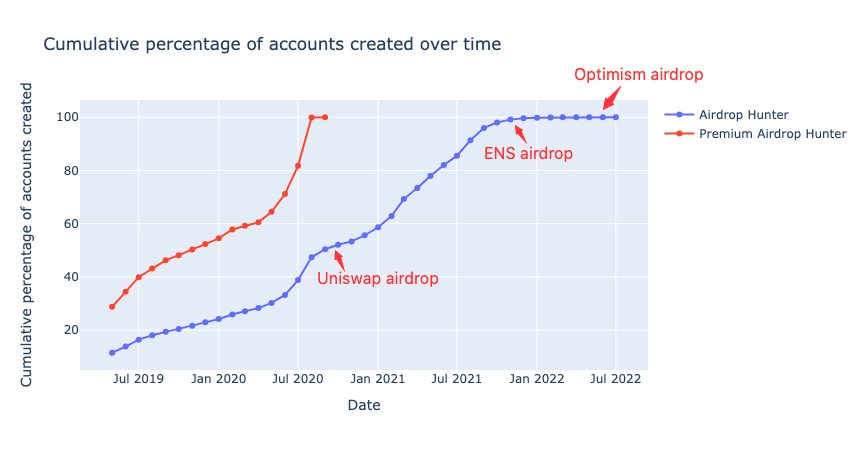

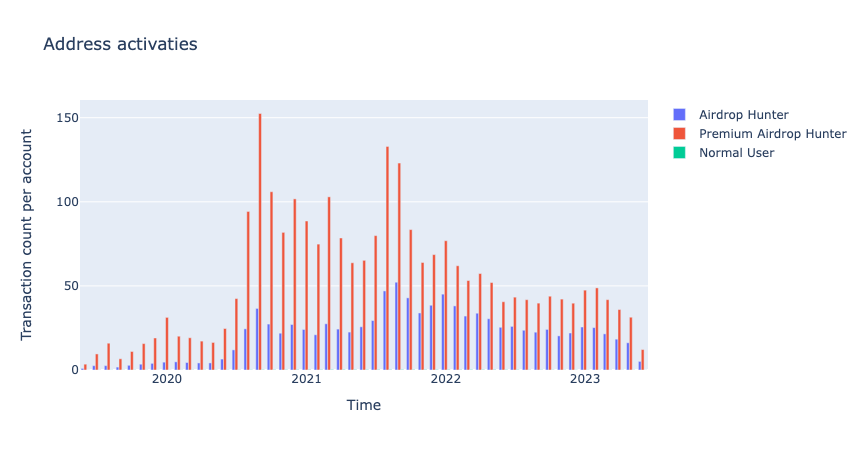

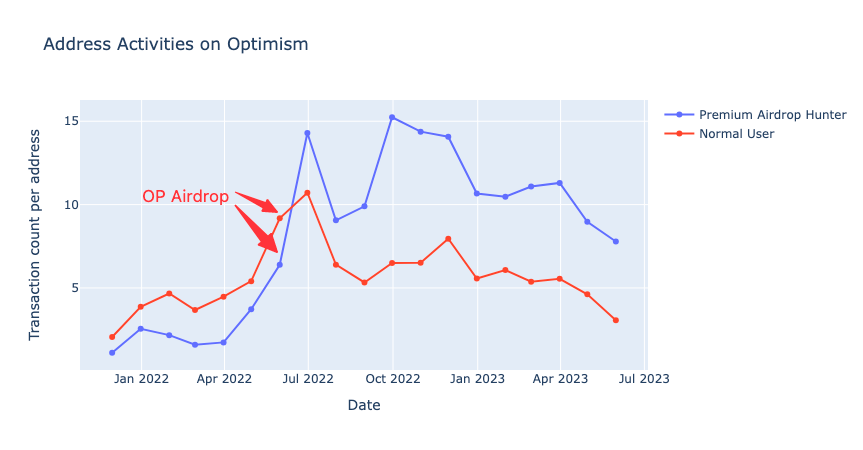

These data show that Airdrop Hunters are more active in the cryptocurrency market than ordinary users, demonstrating higher enthusiasm in trading digital assets, especially in DEX and NFT transactions. 2. Initial Active Time on EthereumCombining the airdrop time of on-chain projects and the initial active time of Airdrop Hunters on Ethereum, we find that most Airdrop Hunters are actually early users of Ethereum. At the time of Uniswap's airdrop (September 2020), more than half of the Airdrop Hunters had started to be active on Ethereum. The initial activity time distribution of the Premium Airdrop Hunters is also significantly earlier than that of the Standard Airdrop Hunters. 3. Activity Level on EthereumWe randomly sampled user accounts created before June 2021, selecting over 30,000 addresses, and compared their activity levels with those of Airdrop Hunters. As shown in the figure, Airdrop Hunters are active users on Ethereum, where Premium Airdrop Hunters make an average of over 50 transactions per month on Ethereum, and Standard Airdrop Hunters also make over 21 transactions per month. In comparison, the addresses we randomly sampled only average 0.16 transactions per month on Ethereum. These results further emphasize the enthusiasm and activity of Airdrop Hunters in on-chain activities. They significantly outperform ordinary users in terms of the number of transactions. 4. Behavior After the Project AirdropWe have been tracking the activity of airdrop recipients (including ordinary users and airdrop hunters) after airdrops from five projects. We found that after the project's airdrop, the activity levels of all users tend to decline, especially among ordinary users. Airdrop hunters are consistently more active than ordinary users at any given time. Optimism, however, is an exception: before the Optimism airdrop, the activity level of ordinary users on the OP chain actually surpassed premium airdrop hunters. Yet, after the Optimism airdrop, the activity level of ordinary users continued to decline. On the contrary, premium airdrop hunters saw an upward trend in their activity levels on the OP chain after receiving the airdrop, and even in the next month following the airdrop, their activity level surpassed that of ordinary users. Through our in-depth analysis, we found that this is mainly due to the OP airdrop rules considering the activity of the addresses on Ethereum. The results show that many previously inactive premium airdrop hunters started to take interest in OP after receiving the airdrop, and began actively interacting with different projects on the OP chain. 5. SummaryAfter sampling and analyzing the detailed on-chain behavior of many Airdrop Hunter addresses, we found that the above analysis is further corroborated. The on-chain activity characteristics of Airdrop Hunters can be summarized as follows:

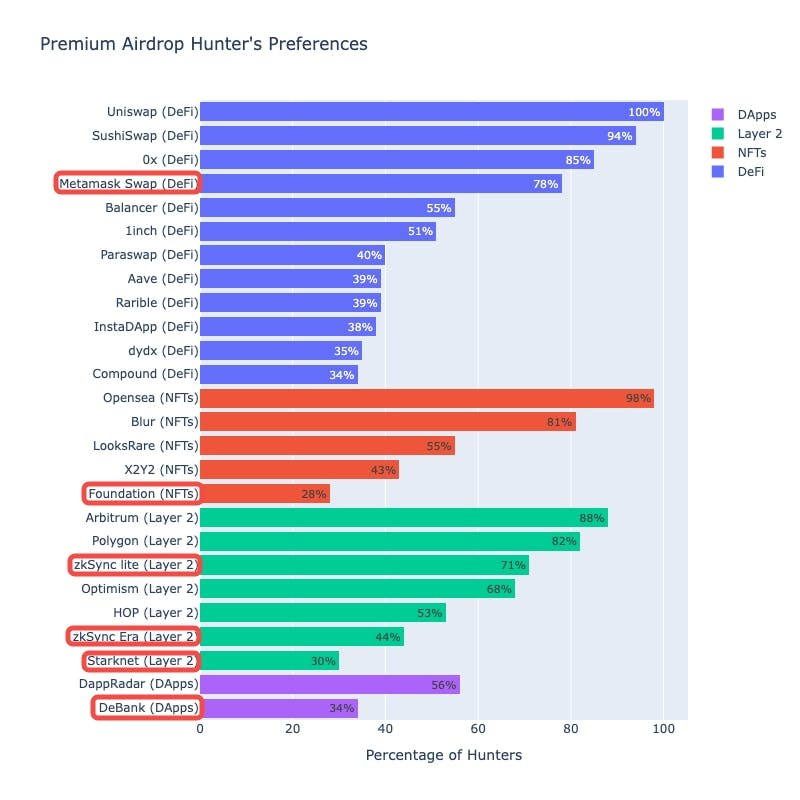

What is the 'Next Target' for Airdrop Hunters?After gaining some understanding of the Airdrop Hunter, we were curious about their "next target". What projects are they optimistic about? To answer this question, we studied the projects they participated in and their behavior patterns when interacting with the projects through on-chain data. While helping readers understand which on-chain projects are worth interacting with, it further reveals the methods Airdrop Hunters use to interact with these projects. It's worth mentioning that we have included these Airdrop Hunters in our monitoring system. In the future, X-explore will continue to follow the latest movement of these Airdrop Hunters to bring more valuable analysis to readers. We have divided the projects preferred by Airdrop Hunters into several tracks, each sorted by the participation rate of Premium Airdrop Hunters and selected projects with a participation rate of 25% or more. If a project has multiple smart contracts, we choose the one with the highest participation rate. Below are the track and project categories:

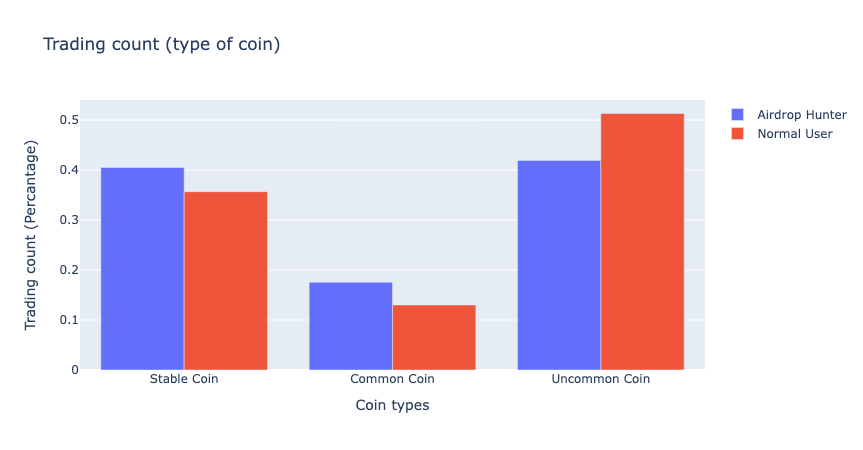

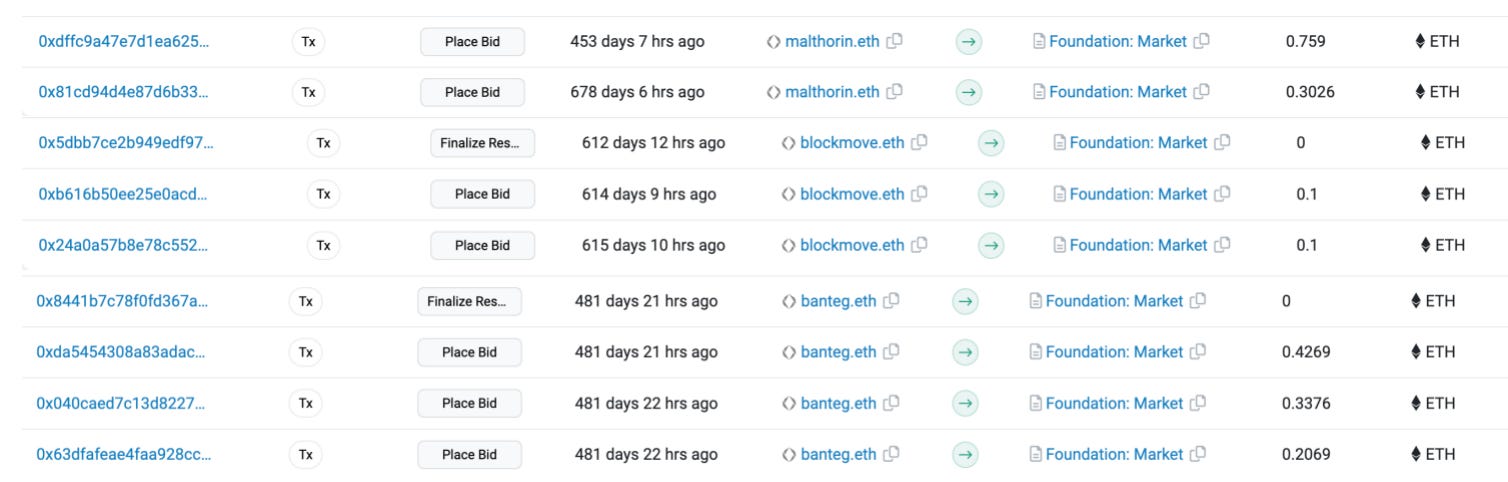

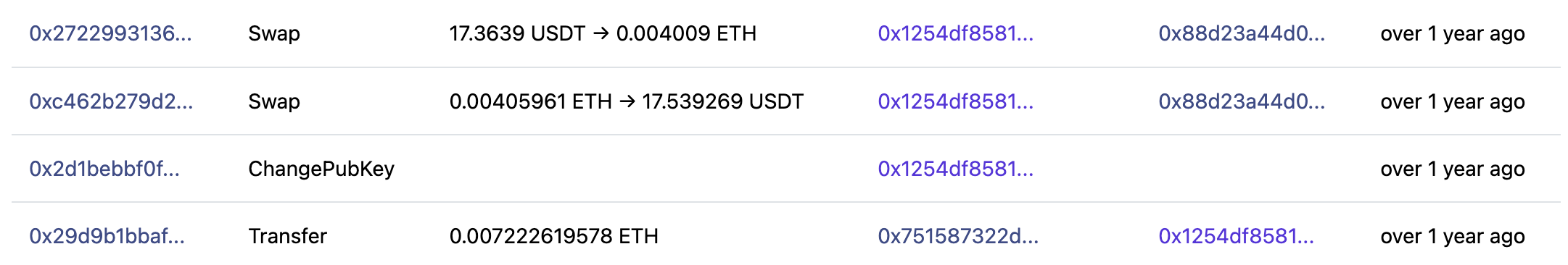

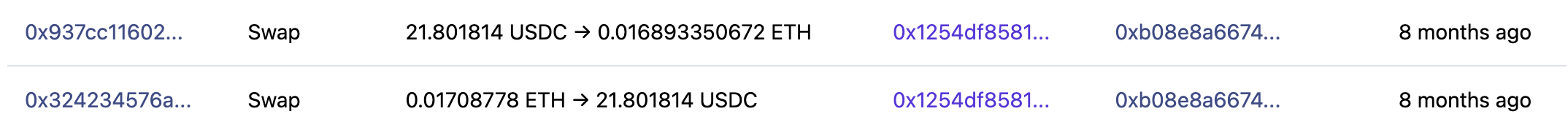

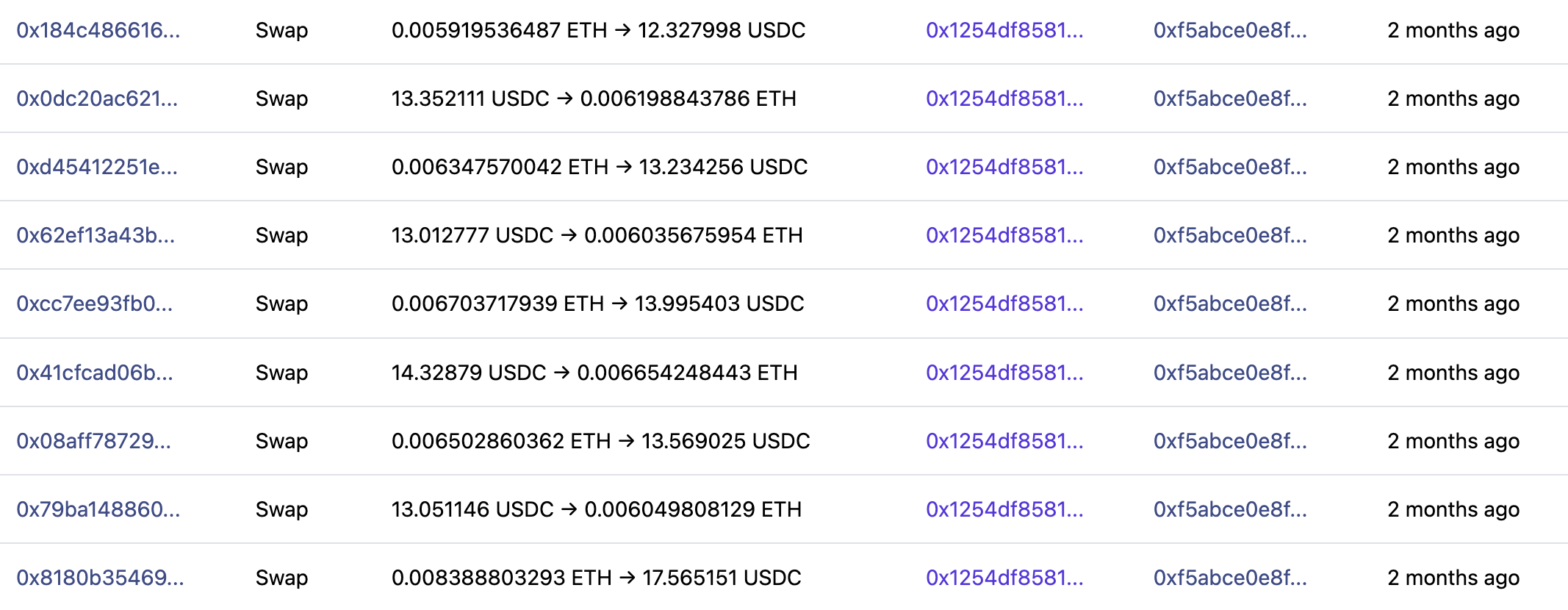

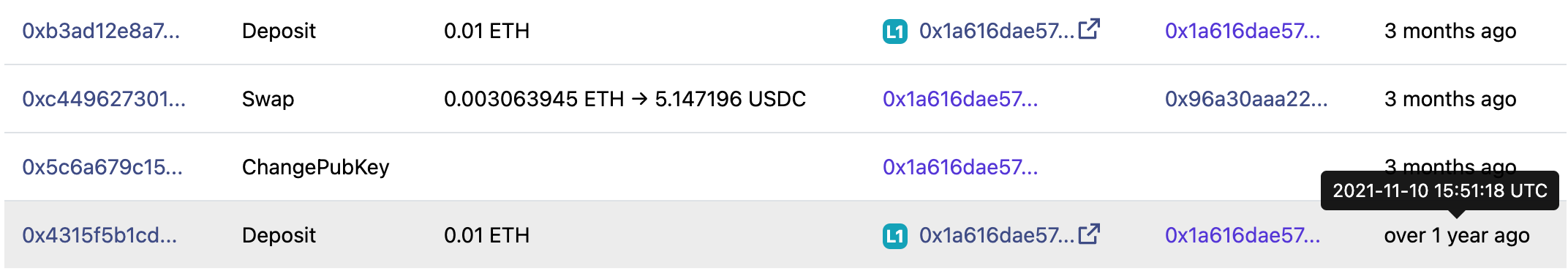

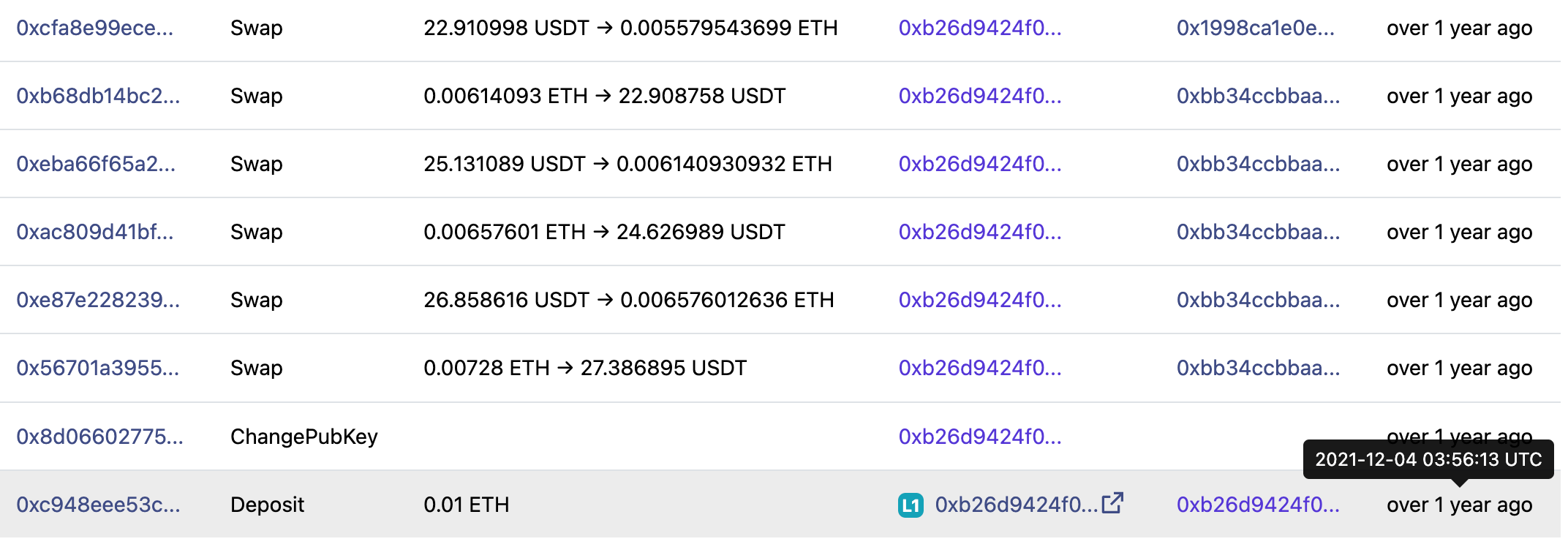

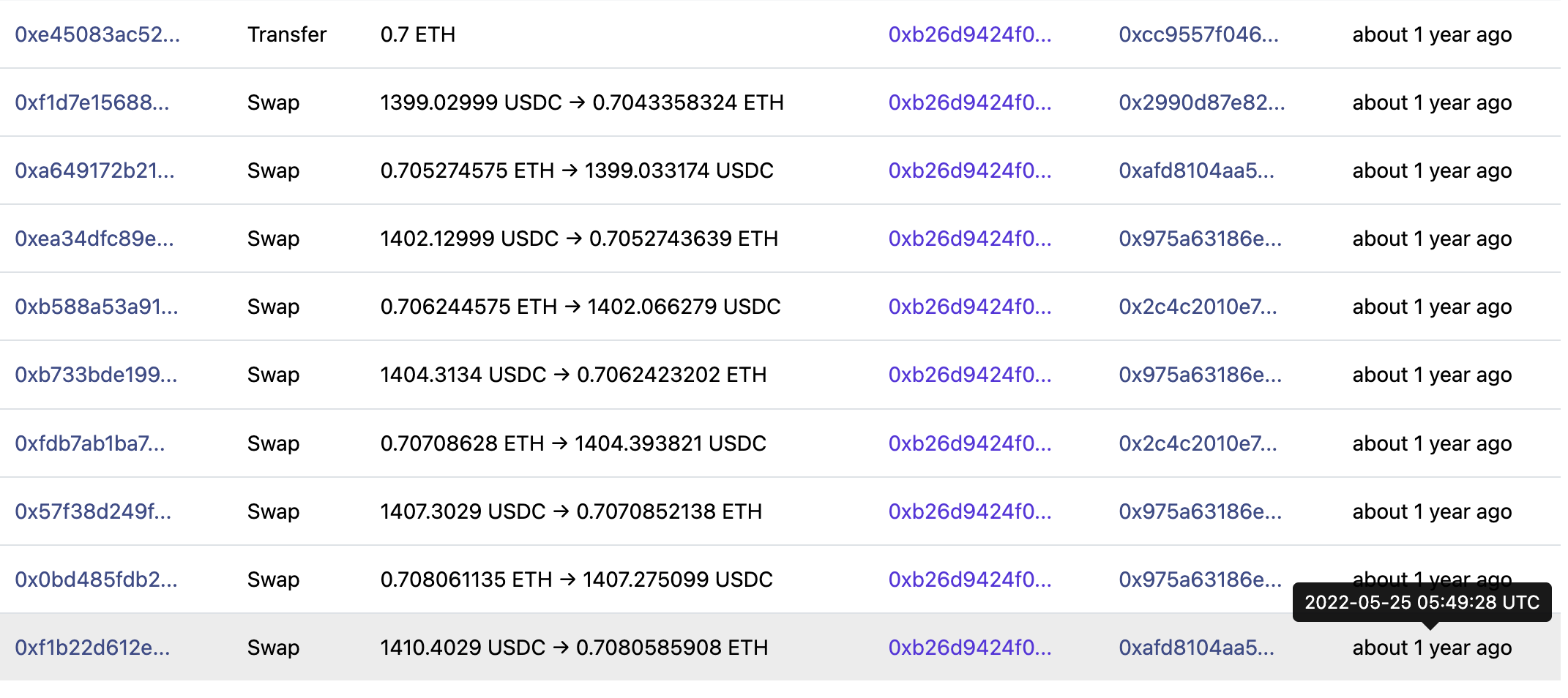

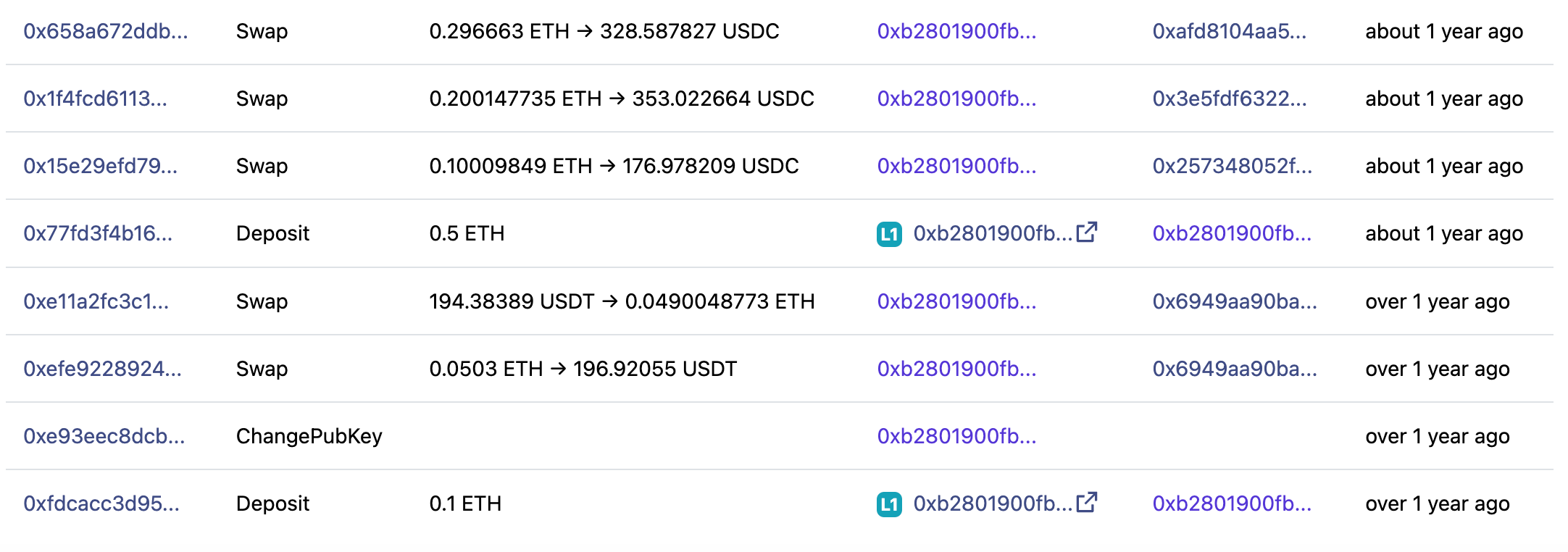

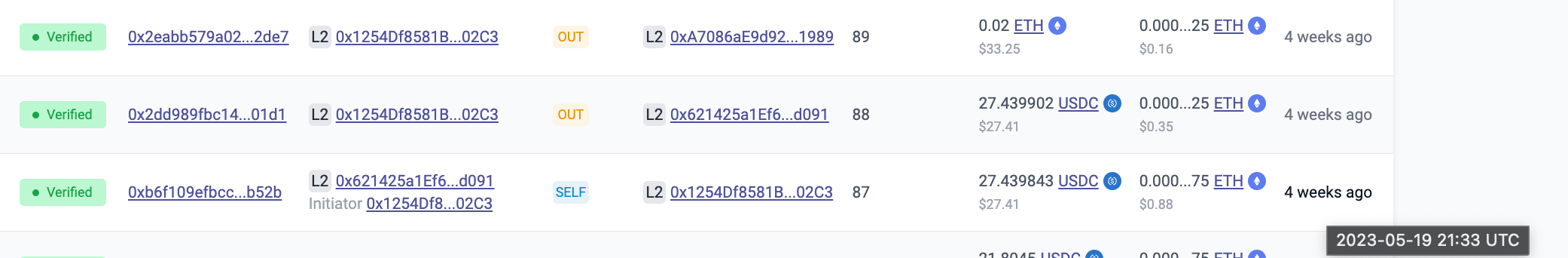

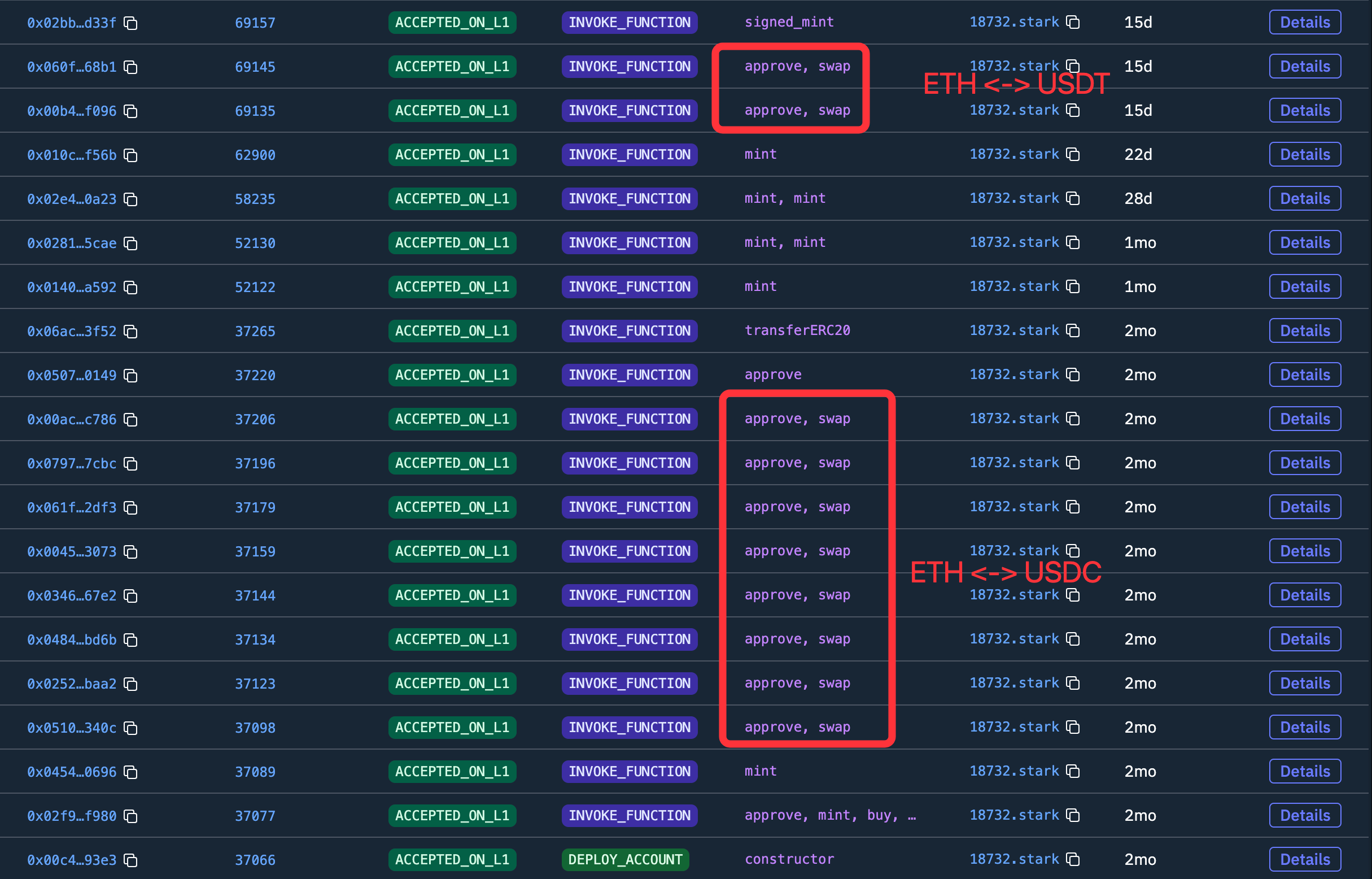

The projects highlighted in bold and encircled in red indicate that the project has not yet conducted an airdrop and has not yet issued tokens. We will delve into the behaviors of Airdrop Hunters on these projects. 1. DeFi Track: Metamask: Swap RouterAfter our analysis, the total trading volume of Airdrop Hunters on Metamask is $191,438,051, with a median trading volume of $1,255 per Airdrop Hunter. In addition, we removed Airdrop Hunters from all 1,811,782 Metamask Swap users and sampled the same number of other Metamask users from these 1,776,303 addresses. We found that their total trading volume on Metamask is $205,673,503, with a median trading volume of $474. Although the total trading volume difference is not substantial, the median indicates a more balanced trading volume among Airdrop Hunters, with most of them having a trading volume greater than $1,000. Below is the transaction pair information for both Airdrop Hunters and other users: We found that Airdrop Hunters have a very similar preference for trading pairs on Metamask Swap and Uniswap. Compared to ordinary users, Airdrop Hunters tend to trade stablecoins and more mainstream cryptocurrencies: USDC, USDT, WETH, DAI, WBTC, etc. These stablecoins and mainstream cryptocurrencies have higher liquidity and relatively stable prices, reducing the risk of trading. In addition, stablecoins and mainstream cryptocurrencies are also easier to transfer and trade across multiple platforms, enhancing the flexibility of funds. This indicates that while Airdrop Hunters are pursuing returns, they also pay attention to risk control and the flexible use of funds. 2. NFT Track: FoundationWe randomly sampled three Airdrop Hunters who have participated in Foundation and found that their interactions on Foundation are not frequent. Most of the interactions are placing bids for NFTs, although two of the Airdrop Hunters actually purchased NFTs. The airdrop rules of Blur can give us some insights. Some people, although they haven't purchased NFTs, could get considerable airdrop income just by swapping coins and placing bids. So when interacting with projects, we can try different functions of the project, which might lead to unexpected benefits. 3. Layer 2 Solution Track: zkSync lite, zkSync Era, StarknetzkSync (lite): We randomly selected 4 airdrop hunters who had bridged to zkSync lite. Next, we will use screenshots with explanations to guide you through these airdrop hunters' behavior patterns on zkSync. If you want to understand the complete behavior of airdrop hunters, please refer to the link we attached. Hunter 1's first transaction occurred on 2021-11-01, where he transferred in an amount from another address. It's worth noting that the interval between his two subsequent Swap transactions was only 15 seconds. He first swapped ETH for USDT, then swapped USDT back to ETH. This rapid and continuous trading behavior looks like an attempt to increase his activity level on the zkSync. I've omitted several cross-chain and address transfer operations in the middle. Hunter 1 performed a similar trading operation again 8 months ago, on October 20, 2022. This time, the stablecoin switched from USDT to USDC, with an interval of about 30 seconds. Two months ago, this address performed a series of similar trading operations (a total of 39 transactions), with each transaction spaced approximately 20 seconds apart. Hunter 2's behavior is relatively simple. They bridged from the mainnet on 2021-11-10 and made their first transaction three months ago (exchanging ETH for USDC). Then, this address had another transaction that bridged from the mainnet and has had no other transactions since. Hunter 3's behavior on zkSync lite is very similar to that of Hunter 1. They both bridge from the mainnet to zkSync at the end of 2021, then used zkSync's Swap feature to convert ETH to stablecoins, and then exchanged the stablecoins back to ETH (ETH <-> USDT). Moreover, they both carried out multiple transactions with time intervals of about 20 seconds. This may indicate that they are trying to increase their activity by frequently trading. Ignoring several scattered transactions in between, Hunter 3 performed a similar set of operations on 2022-05-25, with transaction time intervals of about 20 seconds. After bridged to zkSync lite, Hunter 4 made a few transactions and then bridged again after a while. This behavior pattern may mean that they are trying to maintain a certain level of activity on the zkSync and carry out fund transfers and allocations when needed. zkSync Era: In addition to zkSync lite, many airdrop hunters also choose to interact on the mainnet of zkSync Era through cross-chain transactions. Notably, within the first two days of the zkSync Era mainnet going live, a substantial number of airdrop hunters began interacting here, demonstrating their high interest and active participation in the zkSync Era project. Airdrop Hunter 1 exhibits almost the same behavioral pattern on both zkSync lite and zkSync Era. After the zkSync Era went live on March 24, 2023, Airdrop Hunter 1 immediately bridged to zkSync Era on the next day, showing a high level of interest and quick response to this new project. He then used the SyncSwap contract to perform token swap operations. Airdrop Hunter 1 undertook similar transaction behavior again seven days after the initial interaction (April 2, 2023) to increase activity. This timing seems very clever, raising questions as to whether he is trying to enhance activity levels in different weeks. Airdrop Hunter 1's last operation on zkSync Era took place a month ago (May 19, 2023), and this operation still involved using SyncSwap to complete the exchange operation between ETH and USDC. Airdrop Hunter 2 bridged to zkSync Era on the day the zkSync Era mainnet was launched, just like Airdrop Hunter 1, showing his high attention and activity to the project. His multiple transactions on zkSync Era were made through the Mute project. Unlike Airdrop Hunter 1, who exchanged between currencies, Airdrop Hunter 2 made an ETH to ETH exchange through a contract. This method can both pay lower fees, avoid the risk of price fluctuations, and leave active traces on zkSync. Airdrop Hunter 3 and Airdrop Hunter 1 bridged to zkSync Era on the same day (2023-03-25), and their operations on the chain are very similar to those of Airdrop Hunter 1. The only difference is that Airdrop Hunter 3 used the SpaceFi project to exchange between ETH and USDC. A week after the first interaction (2023-04-03), Airdrop Hunter 3 returned to zkSync Era again. This time, Airdrop Hunter 3 used SyncSwap instead of SpaceFi. While boosting his activity level, he also participated in multiple projects within the zkSync Era ecosystem. Airdrop Hunter 3 continued with transfers and other activities afterwards, and also participated in the iZUMi project, where he made transactions between ETH and ETH. Notably, there are multiple records of outbound transfers from this address on 2023-05-15. StarkNet: As there are fewer airdrop hunters bridged to Starknet, and the transaction behavior pattern of airdrop hunters is quite similar to zkSync, we choose a representative address for analysis and illustration.

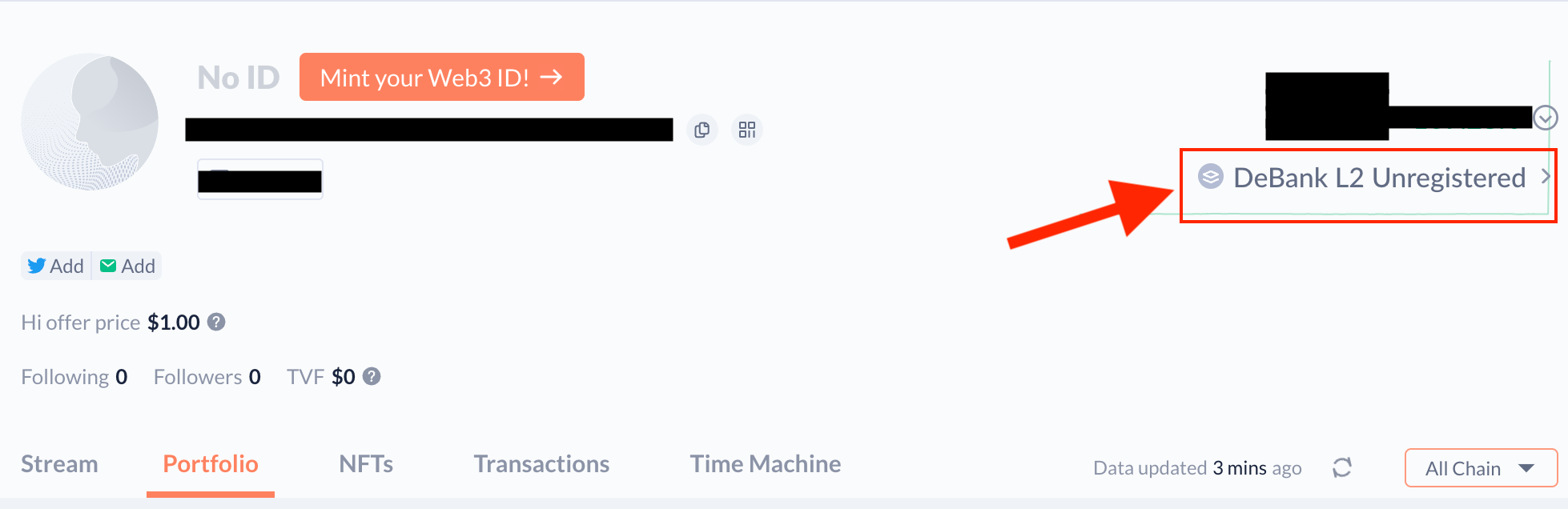

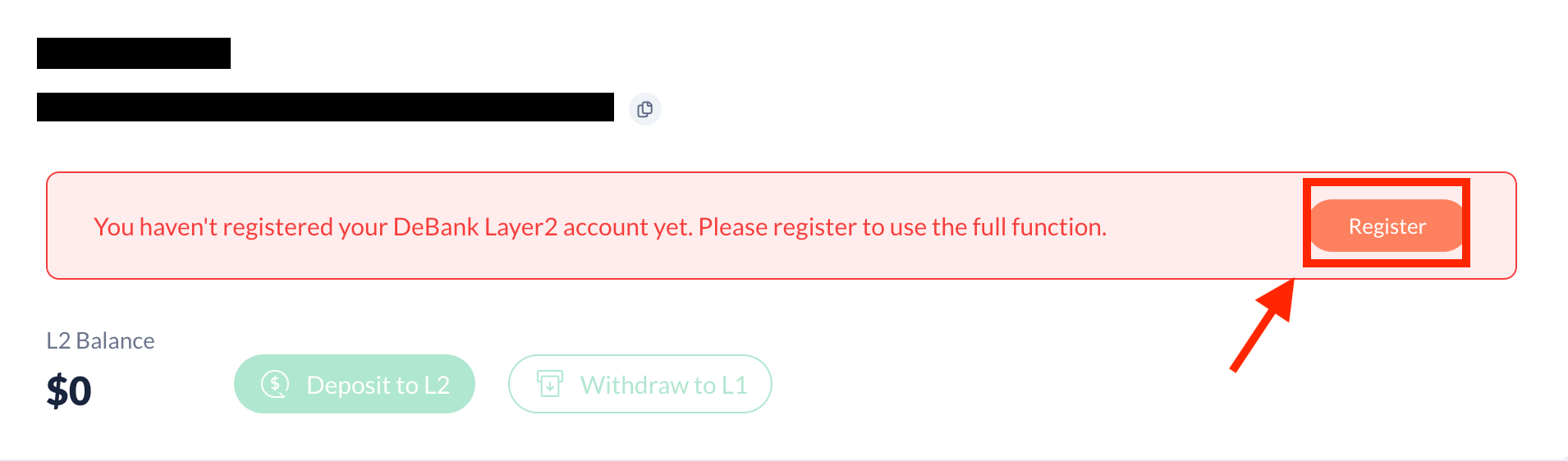

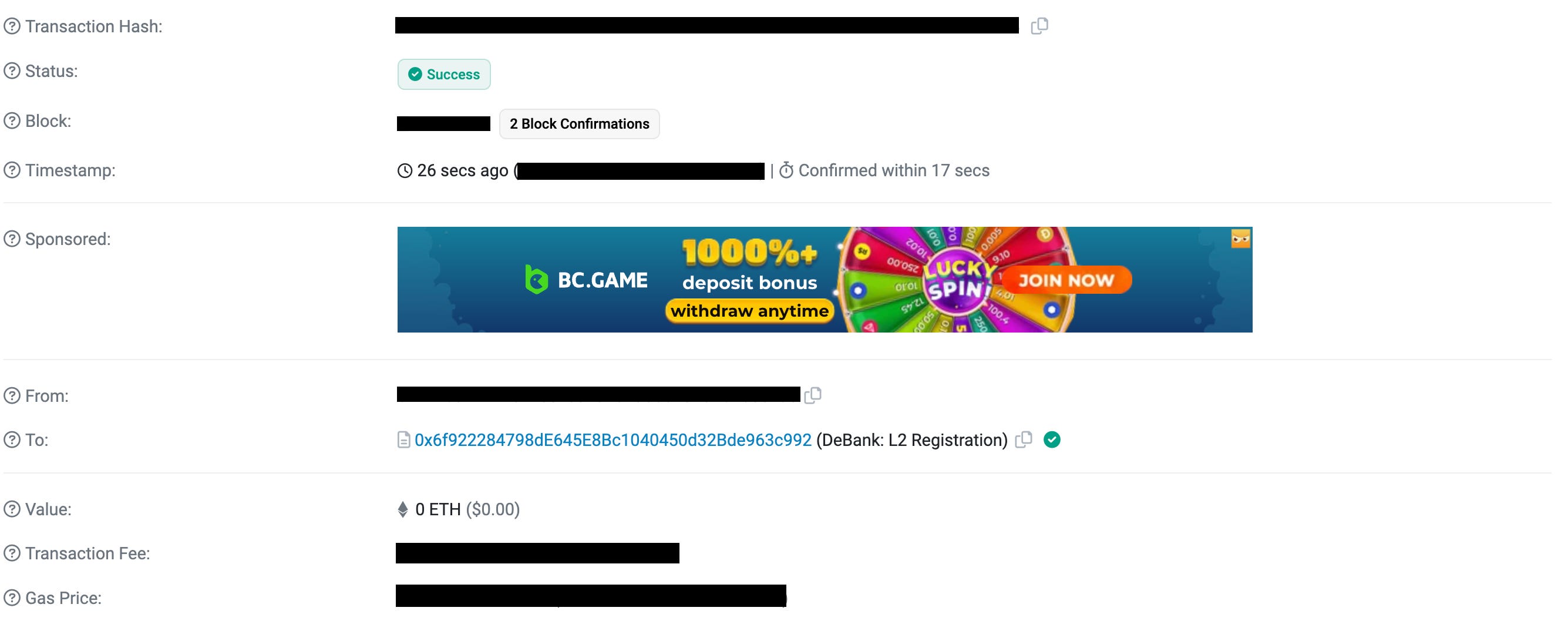

4. Dapp Track: DeBankDeBank is a decentralized finance (DeFi) data analysis and asset management platform that provides users with a comprehensive view of their investments and debts across different DeFi projects. It offers real-time project data, transaction records, and risk assessments to help users make informed investment decisions. Recently, DeBank has been expanding its DeFi services, including swap functions. The community is eagerly anticipating DeBank's airdrop. However, unlike the community members who follow tutorials to utilize DeBank primarily for airdrops, most airdrop hunters have merely registered with DeBank. They did not utilize DeBank's Swap function as suggested in the airdrop tutorial. Below, we illustrate how airdrop hunters interact with DeBank: From the behavior of these premium airdrop hunters, it seems more like they have registered with DeBank to enable its analytics feature, rather than use DeBank's Swap function to increase their chances of potential airdrop. 5. SummaryUpon a deep analysis of the projects chosen by airdrop hunters on-chain, we've identified key driving factors for their selection:

Through the in-depth analysis of X-explore, we found that although airdrop hunters on Arbitrum and Optimism display quality behavioral patterns, on zkSync and Starknet, they seem to inflate the volume and activity levels artificially. This is closely related to the integrity of the ecosystem on the chain. Optimism and Arbitrum had some development and settling time before the airdrop announcement, while zkSync's airdrop call was continuous before the Era mainnet launch. These findings force us to rethink: What is the real significance of an airdrop? How can we identify truly valuable users when formulating airdrop rules, instead of those who only exploit airdrops and engage in meaningless interactions? These are questions that project teams need to delve into. Insights from Airdrop Hunters

Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Global Crypto Mining News (Jun 19 to Jun 25)

Monday, June 26, 2023

1. Arkon Energy, a bitcoin mining startup that uses renewable power, has secured $26 million in new funding to enter the US Arkon Energy plans to expand by acquiring an energy-based data center in Ohio

Asia's weekly TOP10 crypto news (Jun 19 to Jun 25)

Sunday, June 25, 2023

Author:Crescent Editor:Colin Wu 1. President Tokayev of Kazakhstan Attends Binance Kazakhstan Signing Ceremony link On the 22nd of June, CZ showcased a signed photograph with Bagdat Mussin, the

Weekly Project Updates: Ethereum Staking Surpasses 20 Million Tokens, Optimism's 3rd RPGF Round, etc

Saturday, June 24, 2023

1. ETH's Weekly Summary a. ETHShanghai 2023 Summit and Hackathon to Be Held from June 25th to July 7th link On June 20th, according to an official tweet from ETHShanghai, the ETHShanghai 2023

WuBlockchain Weekly: Powell Believes Payment Stablecoins Should Be Treated as Currency and Top10 News

Friday, June 23, 2023

1. Powell Believes Payment Stablecoins Should Be Treated as Currency a. Federal Reserve Chairman Powell: Cryptocurrencies like Bitcoin Seem to Have 'Staying Power' link On June 22nd, during the

Cobo: In-depth insights into custody requirements and tailored solutions for Hong Kong virtual asset exchanges and…

Tuesday, June 20, 2023

Eugene Wong, Cobo Global Original article here Hong Kong has made remarkable strides in establishing a legal and regulatory framework of virtual asset operations over the past year. In October 2022,

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏