Not Boring by Packy McCormick - Weekly Dose of Optimism #51

Weekly Dose of Optimism #51Are We Back?, Hard Things, Charm Industrial, Astranis, x.ai, RegfluencersHi friends 👋, Happy Friday and welcome back to our 51st Weekly Dose of Optimism. I texted Packy yesterday morning “damn, pretty slow week for the optimists huh?” and he replied with like 7 different links to stories that could all feasibly be included in this weekly roundup. Turns out we humans don’t take weeks off from accomplishing big things. Let’s get to it. The Weekly Dose is brought to you by…Composer You know Composer and we love Composer. But if we’re being honest, for a while the product was really only accessible for pretty sophisticated traders. Setting up Symphonies could be complicated and frankly I (Dan) had a hard time navigating the product. But Composer’s new Create with AI tool makes sophisticated Symphony building incredibly easy. I built a Symphony using the following prompt:

And Voila, I had a portfolio of assets allocated to satisfy my strategy. It’s doing pretty well, too. Composer AI is the best way to go from idea to execution. Beyond straight up using ChatGPT, this is the most practical use of AI in any product I use on a regular basis. (1) Inflation Eased to 3% in June, Slowest Pace in More Than Two Years Gwynn Guilford for WSJ

We’ve stayed away from too much commentary on the macro over the past couple of years, mainly because we know enough to know that we don’t know much about the macroeconomy let alone how to predict it. With that said, it looks like the J-Pow led Federal Reserve has done a pretty solid job of reigning in inflation without destroying the overall economy. Inflation has slowed to its slowest pace in more than two years, unemployment is low, and the S&P 500 has performed strongly so far in 2023. We are not saying we’re back. That’s about the most surefire to assure that we are indeed not back. But what we can say, with some degree of certainty, is that things seem to be moving in the direct direction and that, at least for now, what could have been a pretty messy economic situation looks to have been pretty solidly managed. A strong economy. Steadying interest rates. Reshoring manufacturing. Hotbed of AI. (2) Proof You Can Do Hard Things By Nat Eliason

We can do hard things. But should we do hard things? What’s the point? Nat Eliason reflected on this question in his recent essay and came to the conclusion that, yes, we should do hard things. Regardless of whatever that hard thing is, doing hard things is a good thing. The harder you push yourself to accomplish something, the more competent you will see yourself to be, and the more competent you you believe yourself to be, the more hard work you will take on, the more hard work you take on the less “hard” everything else in life will seem to be. Go out and do something hard this weekend. (Sorry, a bit hardo, I know.)

Speaking of hard things, Peter Reinhardt is trying to turn biomass into permanent carbon storage, in order to advance CO2 removal. We’ve briefly written about his company, Charm Industrial, a few times, mostly due to its connection to Frontier (the Advance Market Commitment from Stripe and others to glavanize the carbon removal industry.) But this profile from Barrett Brooks goes much deeper on Charm, its approach, and its founder. Reinhardt sold his first business, Segment, to Twilio for $3.2B in 2020. The deal likely made Reinhardt a few hundred million dollars. And with this newfound wealth (and time), Reinhardt went all-in on solving hard problems. He’s part of a growing class of ZIRP entrepreneurs that are investing bits-made wealth into atoms-focused challenges. (4) Astranis to bring satellite internet to 2 million people in the Philippines next year Michael Sheetz for CNBC

Astranis is bringing a dedicated satellite to the Philippines, unlocking internet access for an estimated 2M Philippinos. You likely haven’t heard of Astranis, but the best way to think of it is that it’s Starlink for the masses. It’s focused on connecting people who pay <$2/month for internet today and might make less in an entire year than Starlink charges for their premium satellite dish. Astranis works with telecoms to deliver connectivity, whereas Starlink is accessible by individual consumers like you and me. They serve different parts of the market, but at the end of the day both companies make the internet more accessible. More opportunity for more people, and more people contributing to humanity’s giant collective brain. (5) x.ai

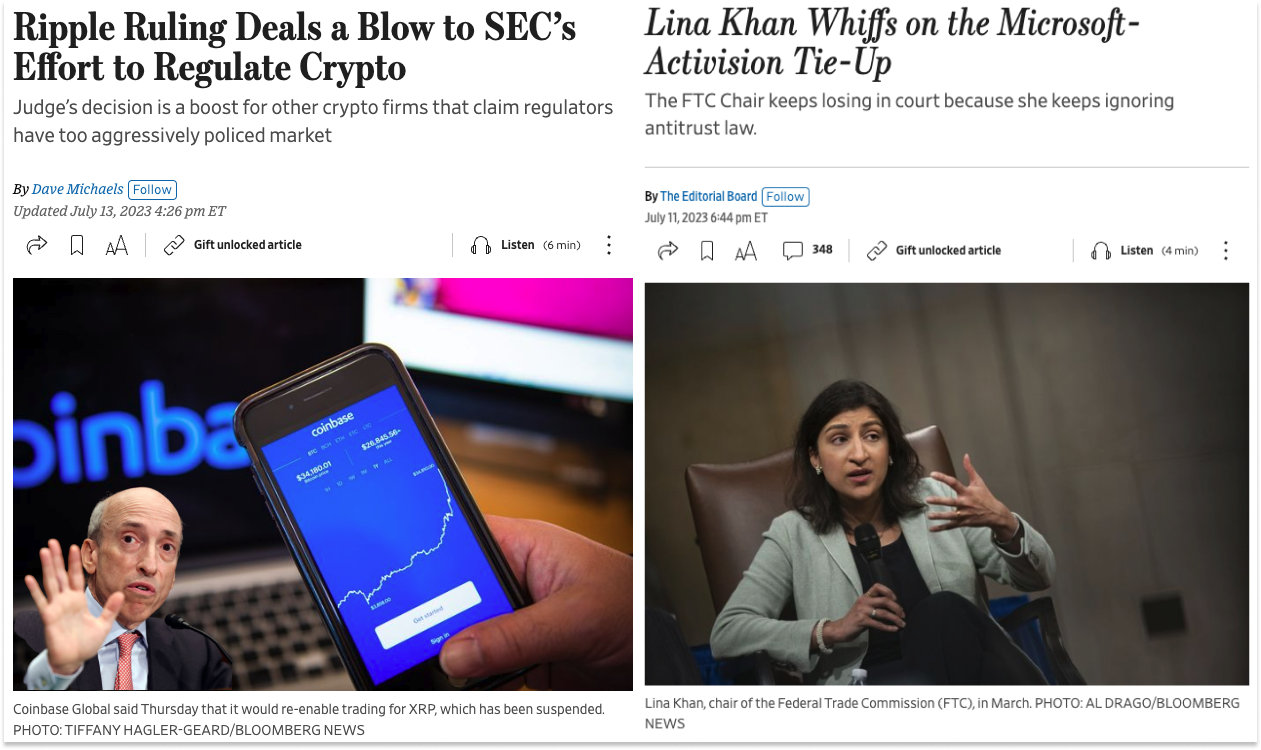

Speaking of bringing brains online… Packy here. I had a little bit of fun with Elon’s Twitter acquisition earlier this week in Praise Elon. I don’t think he’s doing a great job there. But I’m also pumped that he’s launching xAI with the goal to “Understand the Universe.” Details are sparse so far, but Chroma’s Anton Troynikov put together a short thread on what he thinks xAI is up to. The TL;DR is that they’re going to try to use AI to “solve math” in order to figure out if the universe is explicable, “i.e., is it even possible for human cognition to model and understand the universe at full fidelity.” That seems useful and wondrous and optimistic. We’re big fans of David Deutsch’s Principle of Optimism here: “All evil is caused by insufficient knowledge.” If Elon and the xAI team is successful, it will take a big bite out of our insufficient knowledge. Will they succeed? Who knows. But Elon has as good a shot as anyone. In the intro to Tuesday’s piece, I wrote that “Someone can be world-class at some things and not as good at other things,” and this feels like something he can be world-class at. Assembling an all-star team to solve really hard technical challenges is what he does at his best. Whether xAI ultimately understands the universe or not, this is the kind of challenge I’m excited to see well-resourced people address. Now Sam Altman just needs to goad him into working on fusion… (Bonus) The American System is Working Packy again. I gotta be honest. I’ve felt disheartened by America’s regulatory stance towards innovation for the last little while. Gary Gensler’s SEC has been regulating crypto through enforcement in a pretty transparent effort to kill the industry. Lina Khan’s FTC has been going hard after big tech companies and limiting exit options for startups in the process. Both Genlser and Khan seem more motivated by stardom than by actually protecting consumers. And they would have gotten away with it, too, if it weren’t for you meddling judges! This past week has been a nice reminder that while America has its issues, the system is actually pretty robust against bad actors. On Wednesday, U.S. District Judge Jacqueline Scott Corley ruled against the FTC in its attempt to block Microsoft’s acquisition of Activision. Ben Thompson has a good breakdown here, which he concluded with: “It is, I would grant, problematic to have a regulator that is too permissive; it’s worse, though, to have one that is so ideological that every opinion against it is embarrassing in the totality of its dismissiveness.” The Wall Street Journal Editorial Board was even more blunt about Khan: “Yet this is Ms. Khan’s method: Sue first based on dubious or long-repudiated antitrust legal theories, then scramble to find evidence to support the agency’s claims. A CEO with her record of failure would be out of a job.” If that approach sounds familiar, it’s because it’s similar to the one Gensler has been taking to crypto at the SEC: enforce first, make rules later. And in another bit of great news for innovation, “U.S. District Judge Analisa Torres agreed with Ripple Labs’ argument that roughly half of its sales of XRP didn’t violate investor-protection laws.” The XRP tokens Ripple sold directly to institutional investors were securities, which Ripple should have registered, and the company faces penalties for not doing so. Importantly, however, the XRP tokens Ripple sold through exchanges were not securities offerings, implying that cryptocurrencies listed on exchanges aren’t necessarily securities, no matter how they were originally sold. I’m not a particularly big fan of Ripple, but I am a fan of the precedent the case sets for good projects in crypto. There’s a little more clarity. Plus, the XRP case — which a lawyer friend told me could not have had a worse set of facts for Ripple — should set the tone for upcoming SEC legal battles against crypto, including the big one against Coinbase. Lest we get too excited, the battles are still ongoing. The order in the Ripple case is “just a partial summary judgment from a single district court judge.” The Coinbase case is still to come. Khan will appeal the Microsoft/Activision decision. The FTC has ongoing investigations of all of the big tech companies, including a fresh one into OpenAI, and the SEC would like to continue to try to sue crypto out of existence. It’s too early for victory laps. That said, it’s great to see those checks and balances you learned about in 5th Grade Social Studies class in action. Regulation and enforcement are important and healthy. Celsius CEO Alex Mashinsky was arrested this week, and the crypto industry cheered. Real consumer protection, and real consequences for those who intentionally harm consumers, are great things. But abusing power to extrajudicially push through an ideological and celebrity-motivated agenda is not good, and it makes me very happy to see that, for now, it’s also ineffective. Two wannabe regfluencers overreached, and the American legal system slapped their hands. Entrepreneurs can build with a little more confidence in the system. God Bless America. That’s all for this week. We’ll be back in your inbox on Tuesday. Thanks for reading, Dan + Packy |

Older messages

Praise Elon

Tuesday, July 11, 2023

Elon is Killing Twitter to Save Us All

Weekly Dose of Optimism #50

Friday, July 7, 2023

Great Work, Hydrogen Demand, Texan Renewables, CEQA, USA

Weekly Dose of Optimism #49

Friday, June 30, 2023

AI Drugs, Obesity Drugs, Wagecession, and J-Pow's Protector, Idiots

How to Fix a Country in 12 Days

Tuesday, June 27, 2023

The I-95 Playbook for Building Things in America

Weekly Dose of Optimism #48

Friday, June 23, 2023

Two Biases, Compounding Optimism, Cultivated Meat, Social Reward Shrooms, I-95

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month