Who is Arkham? A free data analysis tool similar to Nansen, exploring tokenized business models

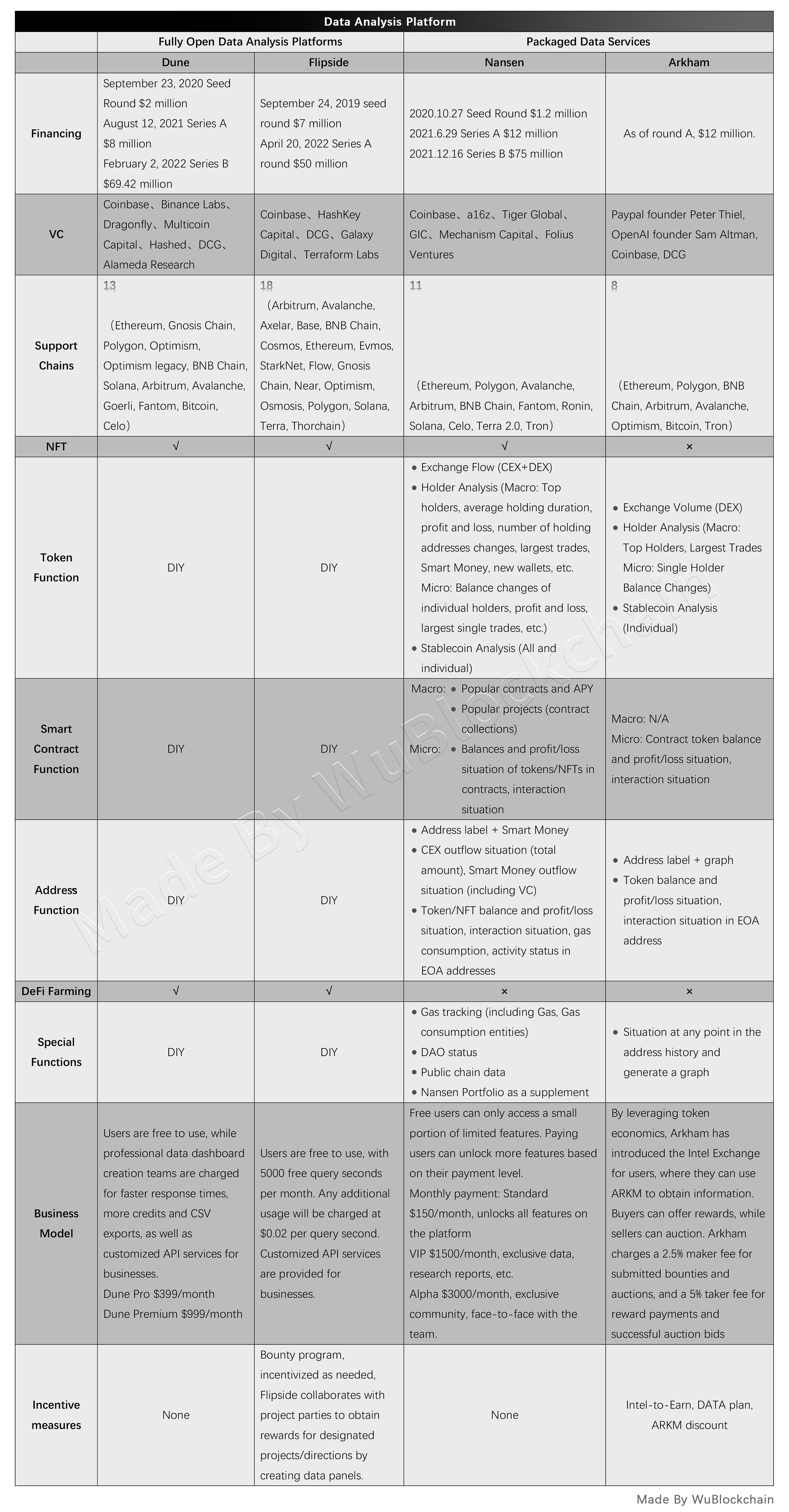

Author: defioasis Recently, Binance announced the launch of its 32nd Launchpad project, Arkham (ARKM). Unlike similar data analysis platforms such as Nansen or 0xScope that adopt a pay-for-advanced-features model, Arkham addresses the revenue problem through token economics while being a free public product. In the Crypto field, on-chain data can be considered a gold mine. Interpreting on-chain data can lead to numerous investment and arbitrage opportunities. Therefore, the use of data analysis platforms is mostly based on real demands, which results in a more authentic user base and higher quality in this competition. TL;DR Data analysis platforms can be broadly divided into two categories based on their level of openness. One category includes fully open data analysis platforms where users can define their own parameters, such as Dune Analytics, Flipside, and Footprint Analytics. The other category provides packaged data services where users perform queries under predetermined definitions, such as Nansen, 0xScope (Watchers), and Arkham. All six platforms have obtained financing, with Dune Analytics, Flipside, Nansen, and Arkham each securing over ten million dollars in cumulative funding. Coinbase is the most active investor in this space, having invested in the first three platforms. Looking at the number of supported public chains, data analysis platforms that require users to handle data construction support significantly more public chains than those offering pre-packaged services, as the latter place higher demands on the data organization and service capabilities of start-ups. Currently, Dune Analytics supports 13 public chains, Flipside supports 18, Footprint supports 27, Nansen supports 11, Watchers support 3, and Arkham supports 8. Ethereum, BNB Chain, and Arbitrum are widely supported public chains, but there is less support for zk-chain systems and Bitcoin. From a functionality perspective, Nansen is the most comprehensive among these three platforms. At the token level, it can show changes in Smart Money holdings over a certain period, inflows and outflows from both CEX and DEX exchanges, overall and individual inflows and outflows of stablecoins, the average holding duration of token holders, profit and loss, the situation with Smart Money, as well as individual holder balance changes and transaction statuses. At the smart contract level, it can clearly track the APY provided by popular contracts and LP trading pairs, as well as token/NFT interactions within the contracts. It has a well-developed tag system, making Smart Money a regular focus for the community. Compared to Nansen, both Watchers and Arkham are much younger. Watchers’ most distinctive feature is its data visualization graph, which reduces the time cost of on-chain research. Additionally, it supplements its tag system with related entity analysis, helping professional investors explore addresses closely related to, but not directly under, the tags. Arkham is the only platform among the three that does not support NFT data analysis and focuses more on individual address/entity situations. Therefore, global data is not commonly seen on Arkham. The functions available on Arkham can basically be found on Nansen, and like Watchers, it also introduces a data visualization graph. Besides being free, Arkham has a unique archive function, which provides an investment portfolio and graph of an address/entity at any two points in history. (As platforms like Dune, Flipside, and Footprint allow users to create suitable panels through SQL and creative initiative, they are not discussed here for now.) Before Arkham, it was generally believed that the direct demand for tokens from data analysis platforms was not high. Platforms providing data packaging services mainly follow a paid membership model, similar to Web2, offering only limited features for free users to trial. They offer differentiated features and services according to different levels of payment plans, but the high pricing often deters average investors. Nansen has three levels of payment gradients, (paid monthly) which are $150, $1500, and $3000 per month. Watchers provides more features to free users compared to Nansen, with prices of $198 and $2000 per month, and also offers customized payment plans. On the other hand, DIY data platforms are trapped in the plight of only being able to offer public products. Data analysts often find themselves giving away their expertise for free, especially independent data analysts who have the ability but lack the motivation. The business models of Dune, Flipside, and Footprint are quite similar at present, allowing users to use their services for free. They charge fees from creators or data teams with further needs to improve response speed and provide better CSV and API services. Arkham, by integrating token economics, presents an alternative path for business exploration. The key is to create token consumption scenarios and demand based on the core functionality of data analysis. To this end, Arkham has introduced the Intel Exchange. The Intel Exchange serves as a crucial platform connecting on-chain data analysts with regular users, and its daily usage scenario resembles how on-chain detective ZachXBT assists regular users in identifying scams and recovering defrauded funds through on-chain data analysis on Twitter. However, while ZachXBT offers free help based on good moral principles without expecting anything in return, it is almost impossible to find a second person doing such work for free. Arkham provides a channel for experts with excellent on-chain analysis skills to monetize their knowledge. Whether it is a security issue or an investment question, any intelligence that can find answers through on-chain information can be used for trades. Once the platform is established, the introduction of ARKM becomes a logical step: any user can pay for valuable information from data analysts using ARKM. Buyers can offer rewards, and sellers can auction. Arkham extracts certain fees from both parties of the transaction to maintain the platform’s long-term operation — Arkham charges a 2.5% maker fee for listing and auction payments, and a 5% taker fee for reward payments and successful auction bids. In addition, after logging into Binance IEO in Arkham, the founder of Dune Analytics recently reiterated Dune’s stance of not issuing tokens and launched a rather ironic NFT. Reference: https://www.arkhamintelligence.com/careers-details/data-scientist Follow us Wu Blockchain is free today. But if you enjoyed this post, you can tell Wu Blockchain that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

Opinion: Mirror, once the most promising decentralized content platform, why it failed?

Sunday, July 16, 2023

Author:Shawn Source: https://shawn.mirror.xyz/o0TQHboHKVWfBaxNknBH4OjtXOgUwuBFPzchJWmodho Editor's Note: Mirror was founded in 2020 and is not only a blockchain-powered content creation platform

Chief Economist of Bank of China (Hong Kong) Talks about the Development of Cryptocurrency Industry in Hong Kong

Sunday, July 16, 2023

The 11th “Huarui Financial Technology Salon” series event, jointly hosted by Shanghai Huarui Bank, International Monetary Institute (IMI) of Renmin University of China, and the Fintech Research

WuBlockchain Weekly: Court Rules XRP Itself Not a Security, US June CPI Up 3% YoY and Top10 News

Sunday, July 16, 2023

1. US Judge's Ruling on XRP Complex, Controversy Continues over Whether It Is a Security link On July 14th, the Southern District of New York court ruled on the SEC's lawsuit against Ripple and

Weekly Project Updates: Multichain Team Forced to Cease Operations, Starknet v0.12.0 Mainnet Goes Live, etc

Sunday, July 16, 2023

1. Multichain Incident Report link On July 14th, Multichain released an incident report via their official Twitter account. According to the report, on May 21, 2023, Multichain CEO Jun Zhao was taken

Asia's weekly TOP10 crypto news (July 10 to July 16)

Sunday, July 16, 2023

Author:Crescent Editor:Colin Wu 1. Bappebti to Launch Cryptocurrency Exchange in Indonesia link On July 14th, according to Indonesian media reports, the Futures and Commodity Trading Regulatory Agency

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏