Coin Metrics’ State of the Network: Issue 219

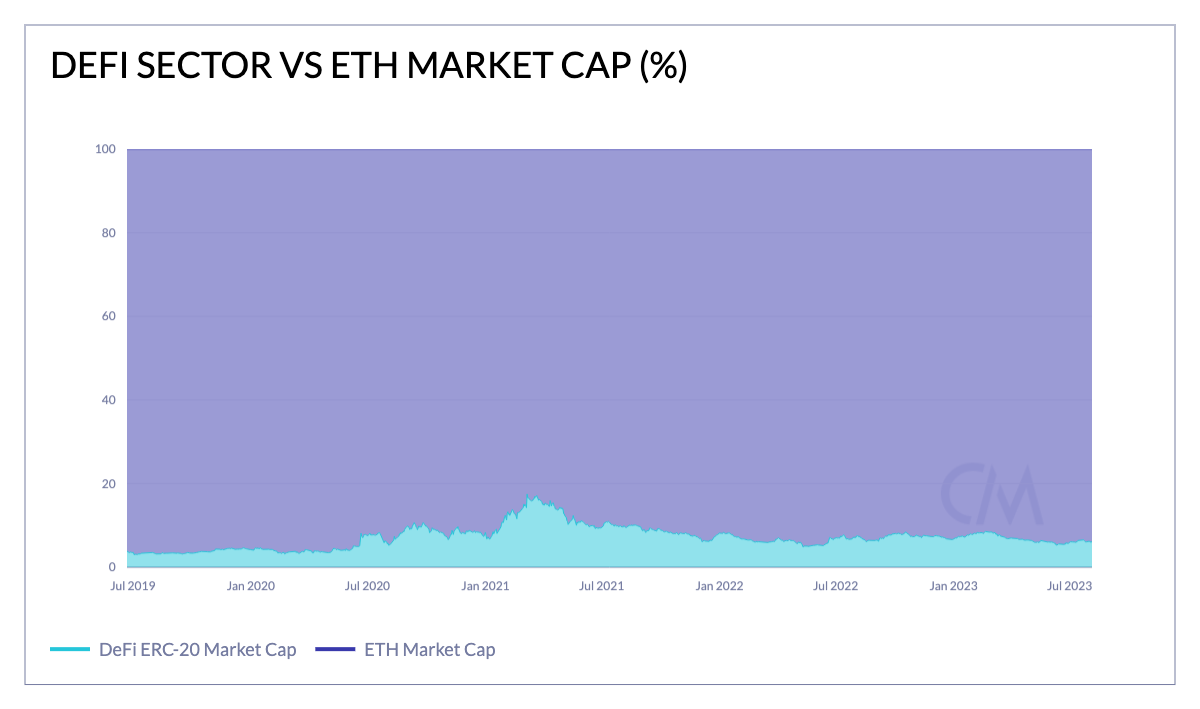

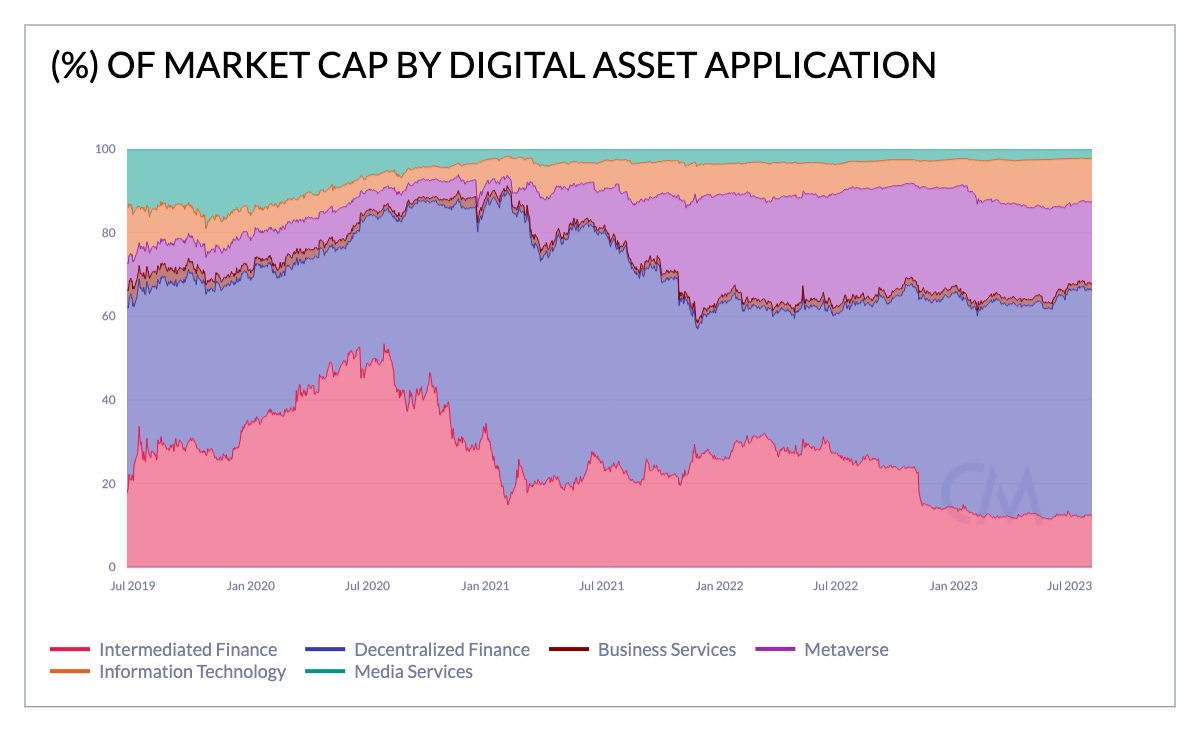

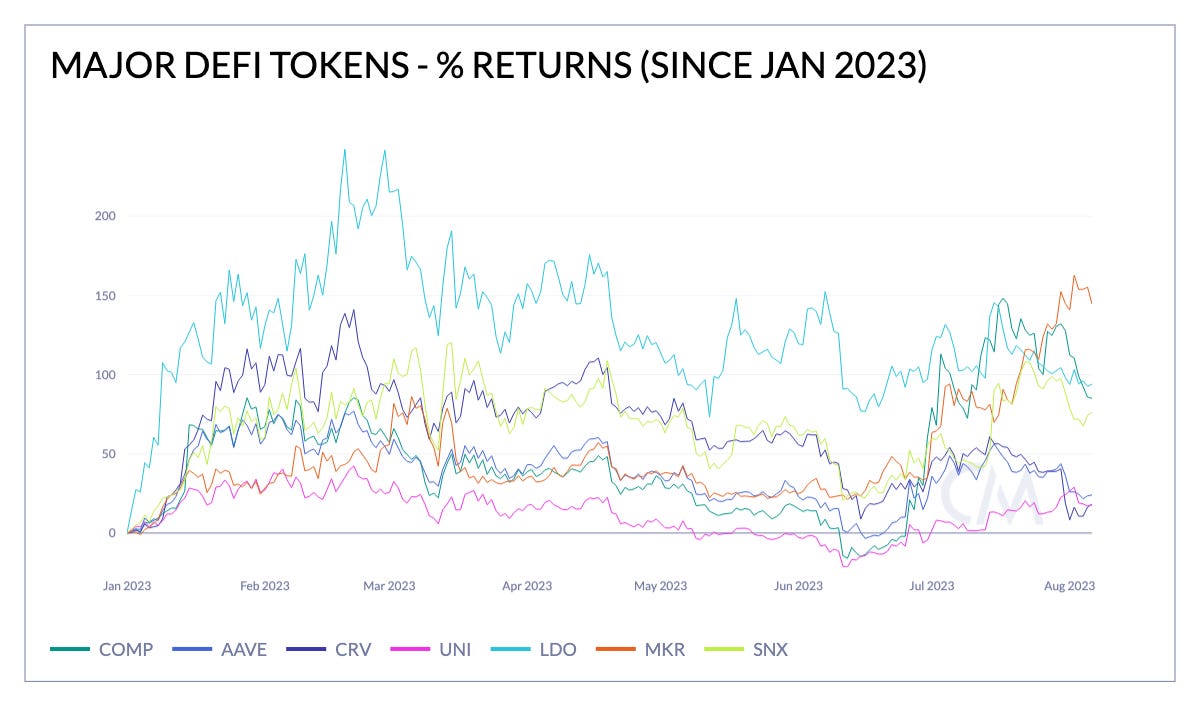

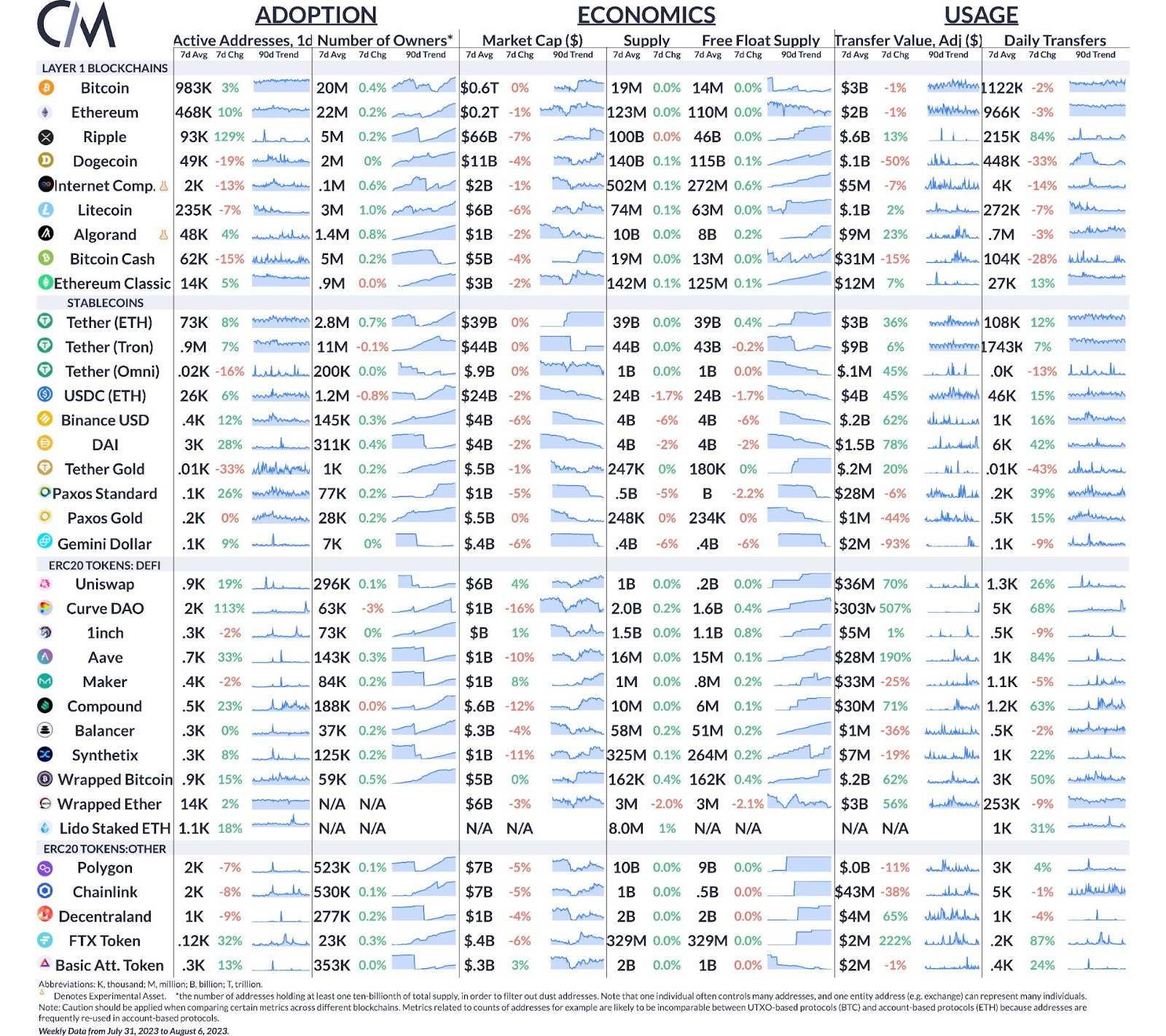

Get the best data-driven crypto insights and analysis every week: DeFi’s Double-Edged SwordUnpacking the Features & Risks of DeFi LendingBy: Tanay Ved, Lucas Nuzzi & The Coin Metrics Team Over the years, the digital asset ecosystem has spawned diverse use-cases. Among them, decentralized finance (DeFi) has emerged as a transformative force—enabling a host of financial innovation by building on conventional financial principles and harnessing the unique properties of blockchains. Although the sector still remains in its early innings, this intersection between finance and technology has materialized into an array of financial services, facilitating the issuance, lending, trading and management of crypto-assets, and even real-world assets. The Ethereum Network has served as a hotbed for these services. Within the larger scheme of things, however, DeFi remains a nascent sector, with the market capitalization of DeFi ERC-20 tokens accounting for around 6% ($14 billion) of the total ETH market capitalization (~$220 billion), and 17% at its peak in 2021. Source: Coin Metrics Formula Builder Despite this, it forms the largest sector amongst digital asset applications, representing greater than 50% of the asset class (datonomy universe). This can be attributed to DeFi's ability to provide open, permissionless, and programmable access to financial services, underpinned by the transparency and auditability of blockchains. This sets DeFi apart from its traditional counterpart, where the core innovation lies in smart contracts that facilitate a host of financial services, effectively eliminating the need for intermediaries or counterparties. Source: datonomy Furthermore, DeFi protocols are often referred to as ‘money-legos’ due to their composable nature. These apps can be used in conjunction with one another, allowing users to stack financial strategies like building blocks. For example, a user can lend ETH on Aave to earn interest, borrow a stablecoin like Dai and then provide the stablecoin as liquidity on Uniswap to earn trading fees—unlocking greater capital efficiency and interoperability. Source: Coin Metrics Formula Builder However, with this increased innovation and access to information, the surface area for risks has also expanded. While greater transparency, composability and self-custody form the core foundation of DeFi, they also push complexity back towards its users and stakeholders. Therefore, the very properties that make DeFi unique, can be a double-edged sword. Hence, contextualizing the health of DeFi protocols through a holistic view of assets and liabilities becomes crucial for informing effective risk management. In our new special insights report, we zoom into DeFi lending markets to illuminate their unique features and risks, particularly through the lens of recent exploits on Aave and Curve Finance—using a balance sheet-like methodology. User Research OpportunityWant to shape the future of cryptoasset data analytics? Join our User Research study to share your thoughts on our newest ideas and provide valuable feedback. Upon completion, participants will be eligible for 1 of 5 exclusive API keys, typically only available to institutions, for access to our professional data sets. Network Data InsightsSummary MetricsActive addresses on Ethereum rose 10% over the week, but remained under 500K per day on average. Activity on Ripple rose, with active addresses and transfers spiking. DeFi tokens remained active as well, including CRV, AAVE, UNI, and COMP. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 218

Tuesday, August 1, 2023

Decoding the Digital Dollar: Unraveling the Risks of Stablecoins

Coin Metrics’ State of the Network: Issue 217

Tuesday, July 25, 2023

Can On-Chain metrics help determine which Cryptocurrencies are Securities?

Coin Metrics’ State of the Network: Issue 216

Tuesday, July 18, 2023

A data-driven look at digital asset markets after a milestone ruling in SEC v. Ripple

Coin Metrics’ State of the Network: Issue 215

Tuesday, July 11, 2023

A closer look at the latest trends across Grayscale's Trusts

Coin Metrics’ State of the Network: Issue 214

Wednesday, July 5, 2023

A data-driven overview of the events from Q2, 2023

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏