Coin Metrics’ State of the Network: Issue 214

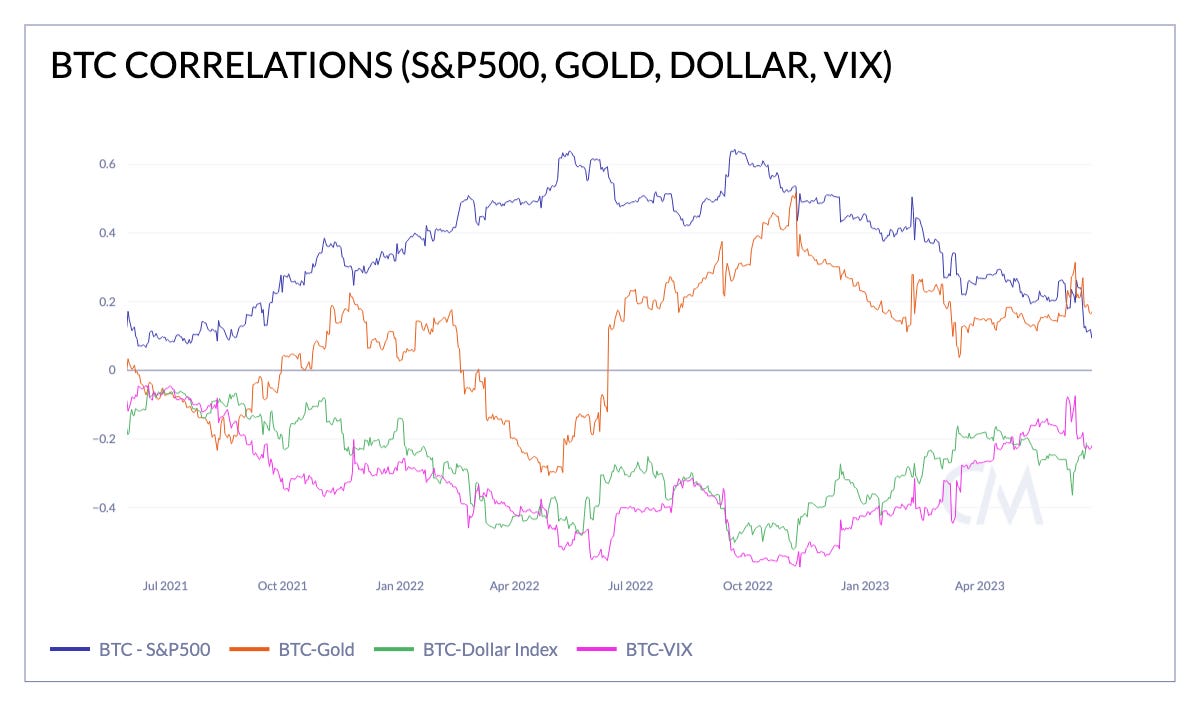

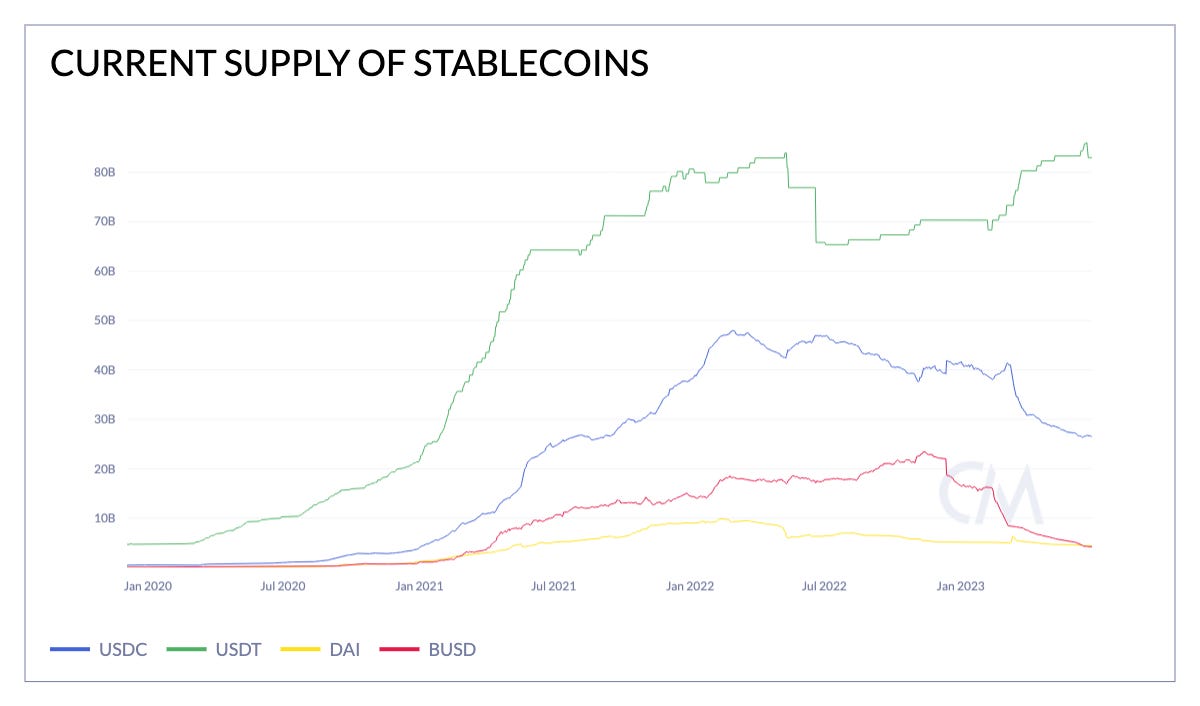

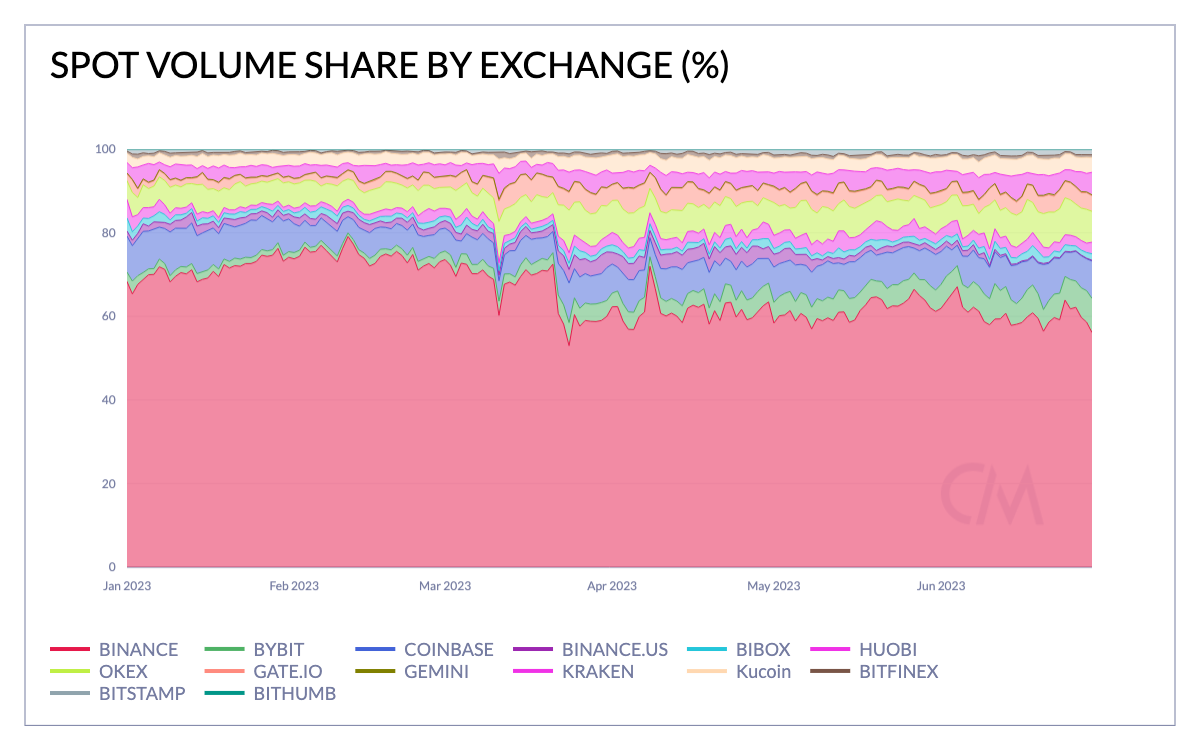

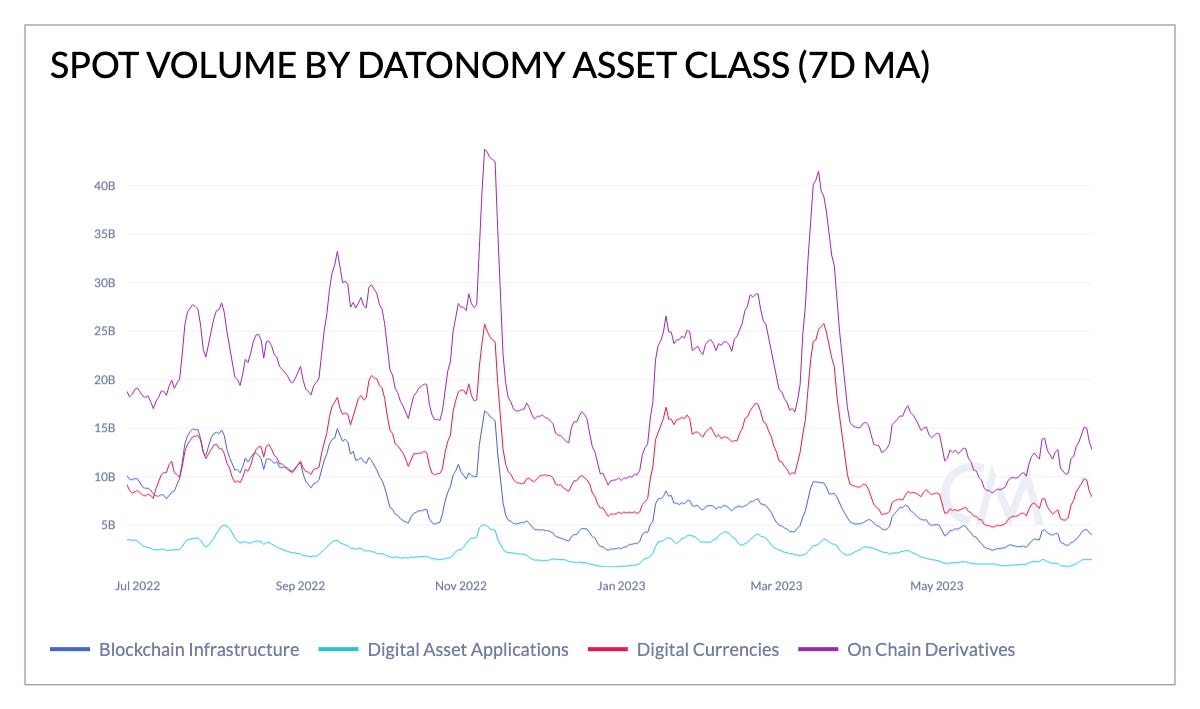

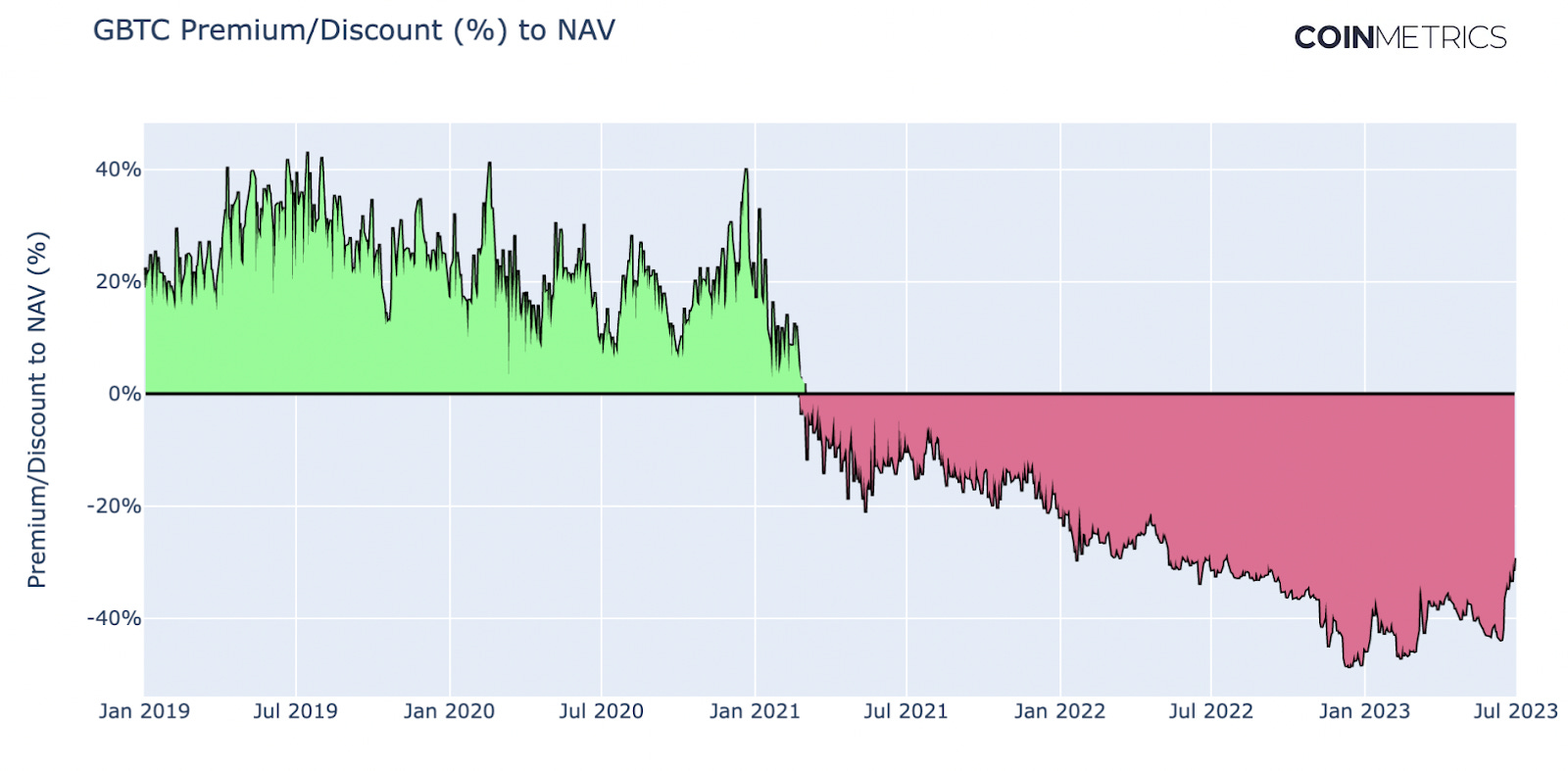

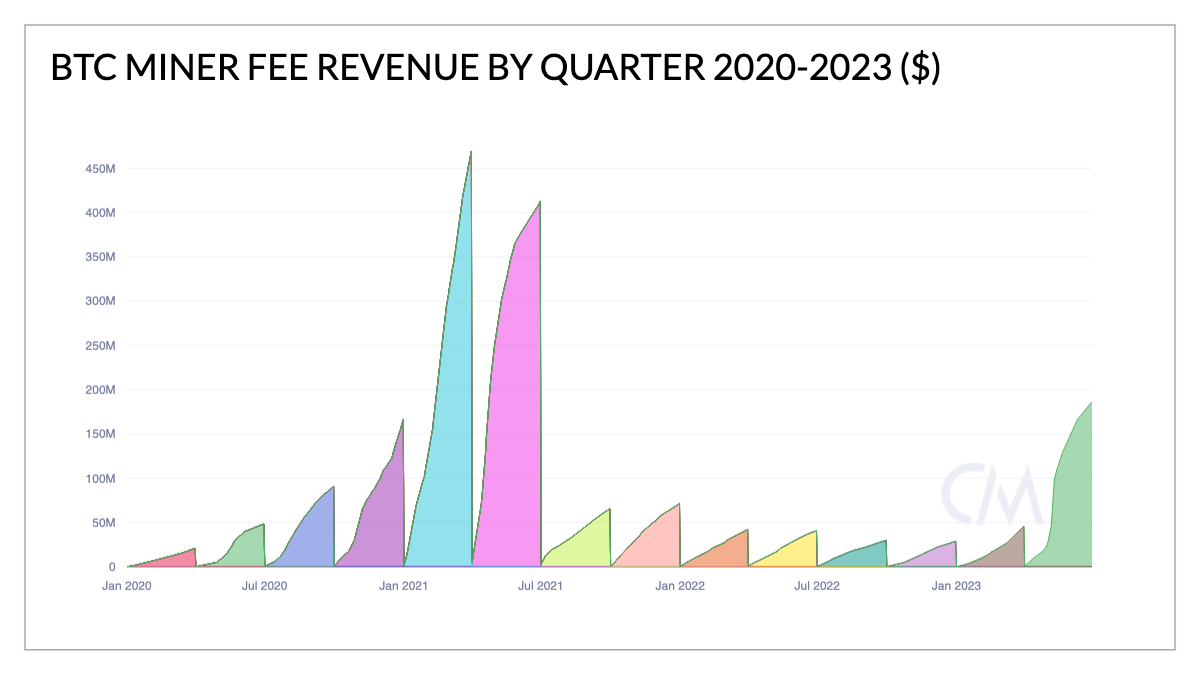

Get the best data-driven crypto insights and analysis every week: State of the Network’s Q2 2023 Wrap-UpBy: Tanay Ved & Kyle Waters In this special edition of State of the Network, we take a data-driven look at the most important events that impacted the digital assets industry from Q2 2023. Market Ebbs & FlowsIn a dynamic first half of 2023, digital asset markets started the year on a strong footing, with bitcoin (BTC) and ether (ETH) surging 83% and 55%, respectively, buoyed by a risk-on sentiment in January. On the other hand, Q2 exhibited a more subdued performance, with BTC and ETH posting gains of 7% and 4%. In light of increased regulatory scrutiny from the SEC and the Federal Reserve's ongoing battle against inflation, a spectrum of events over the quarter has influenced market sentiment, adding complexity to the evolving relationship between traditional and digital asset markets. Source: Coin Metrics Formula Builder Using Bitcoin as a proxy for the wider crypto-market, its 90-day correlation against equities in the S&P 500 index has fallen to 0.09—its lowest level since June 2021. This declining correlation signifies a shift between the tech-heavy S&P 500 and digital assets, diverging from the trend witnessed in 2022 when these markets were in closer alignment due to the Federal Reserve’s rate hike cycle. Often referred to as “digital gold,” BTC’s correlation to Gold has been higher during times of financial distress as market participants flock to “safe-haven” assets as alternative stores of value. The current 90-day correlation with the commodity is at 0.16, rising from 0.03 since March during amplified fears of the regional banking crisis. Additionally, BTC has continued to display an inverse relationship with the Dollar Index (DXY) and the volatility index (VIX), although weakening to -0.21 and -0.22 respectively. Source: Coin Metrics Reference Rates Q2 presented a mixed bag in digital asset performance, influenced by the interplay of market forces such as regulatory ambiguity, potential rate hikes amid signs of easing inflation and crucial crypto-native developments. Bitcoin's strength shines through, posting an 82% year-to-date return, surpassed only by Lido (LDO) and Bitcoin Cash (BCH) amongst assets with a market cap over $1B, rising 95% and 133% respectively. For liquid staking protocol Lido, these gains were largely driven by anticipation around Ethereum's Shapella upgrade at the beginning of the year while BCH was helped by its listing on EDX Markets, a new exchange launched by institutional giants such as Fidelity, Citadel, and Charles Schwab in June. In contrast, Solana (SOL), Polygon (MATIC), and Cardano (ADA) experienced 20% declines in June due to their alleged security status in the SEC's Coinbase lawsuit. Amidst a quarter full of regulatory headlines, XRP managed to achieve a 41% gain with the decision of the SEC vs Ripple case inching closer after more than two years since it began. Stablecoin LandscapeSource: Coin Metrics Network Data The year has also created a significant stir around stablecoins, amplified by the impacts of Silicon Valley Bank’s collapse in March. USDT has been a beneficiary of increased pressure (often referred to as “Operation Choke Point 2.0”) applied to on-shore stablecoin issuers, with its current supply reaching an all-time high of $85B. In stark contrast, USDC’s current supply has fallen to $26B, revisiting levels last seen in September 2021. Alongside the de-pegging, negotiations on the $31.4 trillion debt ceiling prompted Circle to diversify reserves by investing in short-dated treasury bills. Tether also disclosed allocations to bitcoin and short-term treasuries. Following this trend, the composition of Dai generated by collateral has also gone through significant changes, with only 8.6% being generated by USDC vs over 50% a year ago. Despite the turbulence, stablecoins continue to be one of the most compelling use cases of public blockchains and the quarter saw new experiments announced, including German multinational SAP launching cross-border payments with USDC or EUROC. Exchanges & Altcoins Under ScrutinyIn June, the Securities and Exchange Commission (SEC) intensified regulatory scrutiny on digital asset markets, filing a lawsuit against Binance, the largest global crypto exchange. The allegations spanned from inadequate user fund segregation to unlicensed US operations and offering unregistered securities. Simultaneously, Coinbase faced an SEC suit for alleged securities-related violations, and operating as an unregistered exchange, broker and clearing agency. Amidst these allegations, spot volume share of Binance-US compressed significantly, whereas Binance’s share of trading volumes experienced a decline of 20% in late March due to CFTC charges against the exchange. Source: Coin Metrics Formula Builder Notably, the SEC pinpointed 13 altcoins in its complaint against Coinbase, including Solana (SOL), Polygon (MATIC), and Cardano (ADA), contributing to a dip in these tokens' prices. This mounted additional pressure on markets with depleted volumes and deteriorating liquidity as a result of retreating market makers in May. Source: Coin Metrics datonomy™ Revival In Institutional InterestIn stark contrast to the narrative in early June, the second half saw a flurry of positive institutional interest. A cascade of ETF applications emerged, led by BlackRock—the largest asset manager with $9T in assets under management—followed by Fidelity. Prior applicants—including WisdomTree, Invesco, Valkyrie, and ARK Invest—also rejoined the race. Furthermore, the aforementioned EDX Markets also launched on June 20th, adding to a list of investment vehicles facilitating greater flows for the asset. In the wake of these developments, the Grayscale Bitcoin Trust (GBTC), which has been trading at a discount to its net asset value (NAV) since 2021, began narrowing the disparity to 29.2% as of June 29th, as hopes of its conversion to an ETF product accelerated. Sources: Coin Metrics, Grayscale Bitcoin Miners Rejoice in a Strong Fee MarketIn a quarter overshadowed by regulatory and macroeconomic headlines, the Bitcoin network also witnessed crucial developments that brought welcomed changes, particularly for Bitcoin miners. After the rise of Ordinals and Inscriptions took the Bitcoin ecosystem by storm in Q1, the introduction of a new token standard on Bitcoin called BRC–20 brought a new wave of activity. Setting aside the ongoing philosophical debate among Bitcoiners, one significant outcome has been the resurgence of the Bitcoin fee market. Out of the total $2.4B miners earned in Q2, $184M came in the form of user transaction fees. This was an exceptional change to the recent trend of a tepid fee market. As depicted in the chart below, Bitcoin miners earned more in fees in Q2 2023 than the previous five quarters combined. Source: Coin Metrics Network Data Though the pace of fee payouts has slowed significantly in recent weeks as activity has waned, excitement abounds as the token standard does unlock experimental new use cases for Bitcoin’s core transaction types, and accelerates the push to scale Bitcoin with the Lightning Network. Though many hurdles remain, miners’ prospects brightened in the quarter, as a rising BTC price bolstered top-line revenues, while receding inflation pressures translated to lower industrial electricity rates in the US. Miners also notched a win with the blocking (for now) of the Biden administration’s proposed Digital Asset Mining Energy (DAME) tax in the US Debt Ceiling agreement. However, despite these victories, competition remains as fierce as ever, with Bitcoin’s hashrate breaking new highs during the quarter at 375 EH/s. Using novel data produced from our latest report The Signal & the Nonce, we see that the overall network’s efficiency continues to increase with the adoption of modern ASICs such as the S19 XP. As mining industry participants look to the second half of the year, they will continue to contend with a complex mixture of market variables. Ethereum’s “Shapella” Upgrade LaunchesApril marked a crucial milestone for the Ethereum network, with the successful launch of staked ETH withdrawals through the Shapella Upgrade. A highly anticipated event not only for stakeholders of the Ethereum ecosystem, but also participants of digital asset markets at large—signifying the completion of another major upgrade after The Merge. Participating as an Ethereum validator prior to this was a one-way street, allowing only deposits to the consensus layer. However, the enablement of withdrawals closed the loop, allowing users to regain access to their staked ETH, making the system to function in unison. Source: Coin Metrics Network Data The supply of ETH staked has continued its ascent, currently sitting at 25.7 million ETH in the consensus layer contract. Since the dawn of Shapella, total deposits have outpaced withdrawals by 4.15 million ETH after an initial surge of withdrawal activity, dispelling fears of a selloff. The demand for staking ETH—measured through the number of validators in the queue—has reached 92K validators with a 45-day wait time based on a rate limit on entry called the churn limit. Although operational and technical risks still remain, the gravity of the event on the crypto ecosystem cannot be understated. ConclusionQ2 2023 has shaped up to be an enthralling quarter for the digital asset landscape, marked by contrasting themes of regulatory pressure, institutional interest, and technical evolution. These developments not only reflect growing mainstream acceptance of the asset class but also lay the foundation for increased flows into digital assets. Furthermore, global efforts from the likes of UK and Hong Kong to establish themselves as crypto hubs underscore the widening reach of the digital asset space. As we move forward into Q3, the resolutions of ongoing legal battles and decisions on ETF applications hold significant potential to steer the industry's course as we come closer to the Bitcoin halving in 2024. Coin Metrics Updates from Q2This quarter’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. |

Older messages

Coin Metrics’ State of the Network: Issue 213

Tuesday, June 27, 2023

Measuring bitcoin's dominance in the digital assets ecosystem

Coin Metrics’ State of the Network: Issue 212

Tuesday, June 20, 2023

The basics of hash functions and a toy model of Bitcoin Mining

Coin Metrics’ State of the Network: Issue 211

Tuesday, June 13, 2023

Estimating Bitcoin's energy consumption with greater confidence

Coin Metrics’ State of the Network: Issue 210

Monday, June 12, 2023

Token Unlocks & Free Float Supply Shocks in Digital Asset Markets

Coin Metrics’ State of the Network: Issue 209

Wednesday, May 31, 2023

Zooming out at digital asset market caps, returns, sector correlations & volatility

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏